Crypto market sees $500 million in liquidation as Bitcoin hit record highs amid dovish Fed minutes

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

- Ethereum Price Forecast: ETH faces heavy distribution as price slips below average cost basis of investors

Bitcoin reached a new all-time high of $111,999 on Wednesday amid dovish Fed minutes, fueling wider market optimism.

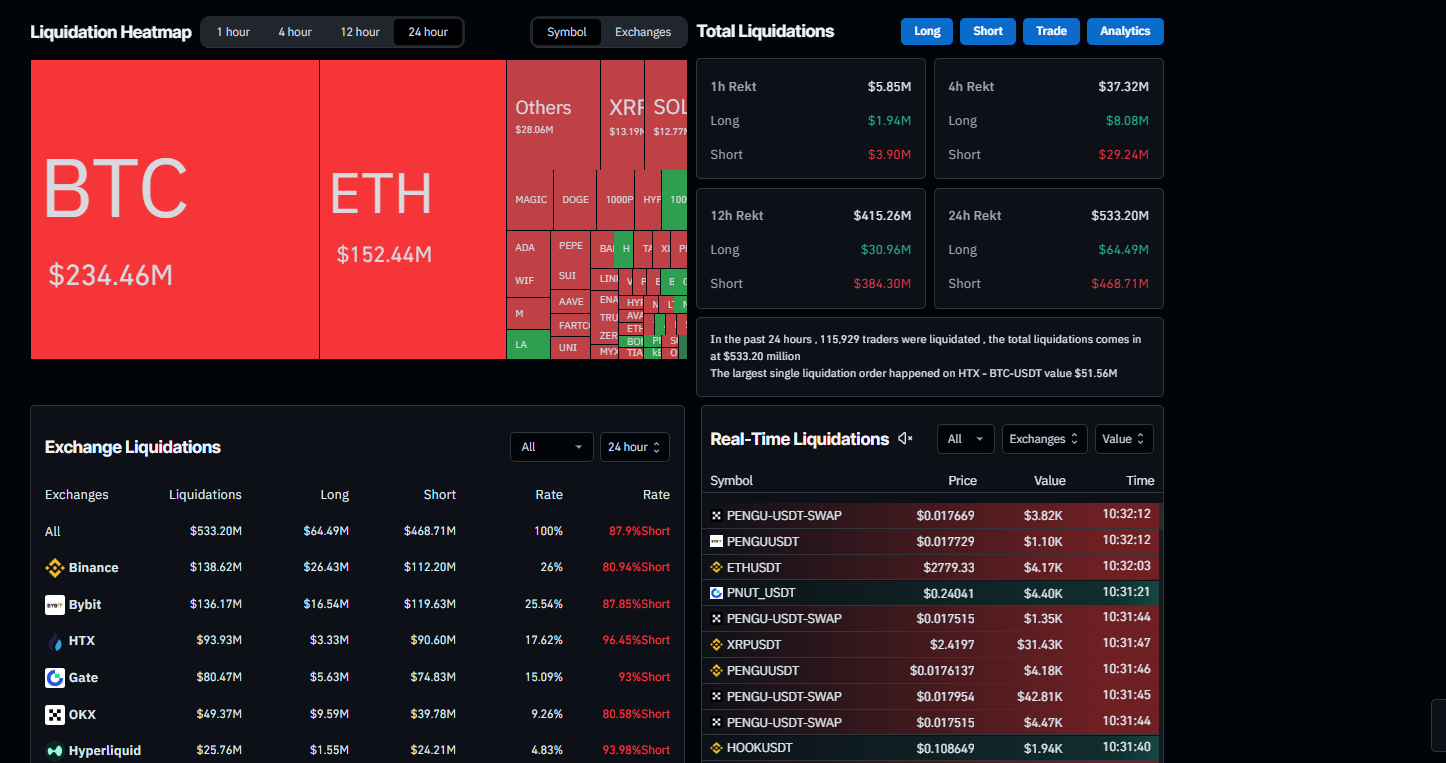

CoinGlass data shows that over $500 million in leveraged positions were liquidated across crypto markets in the past 24 hours.

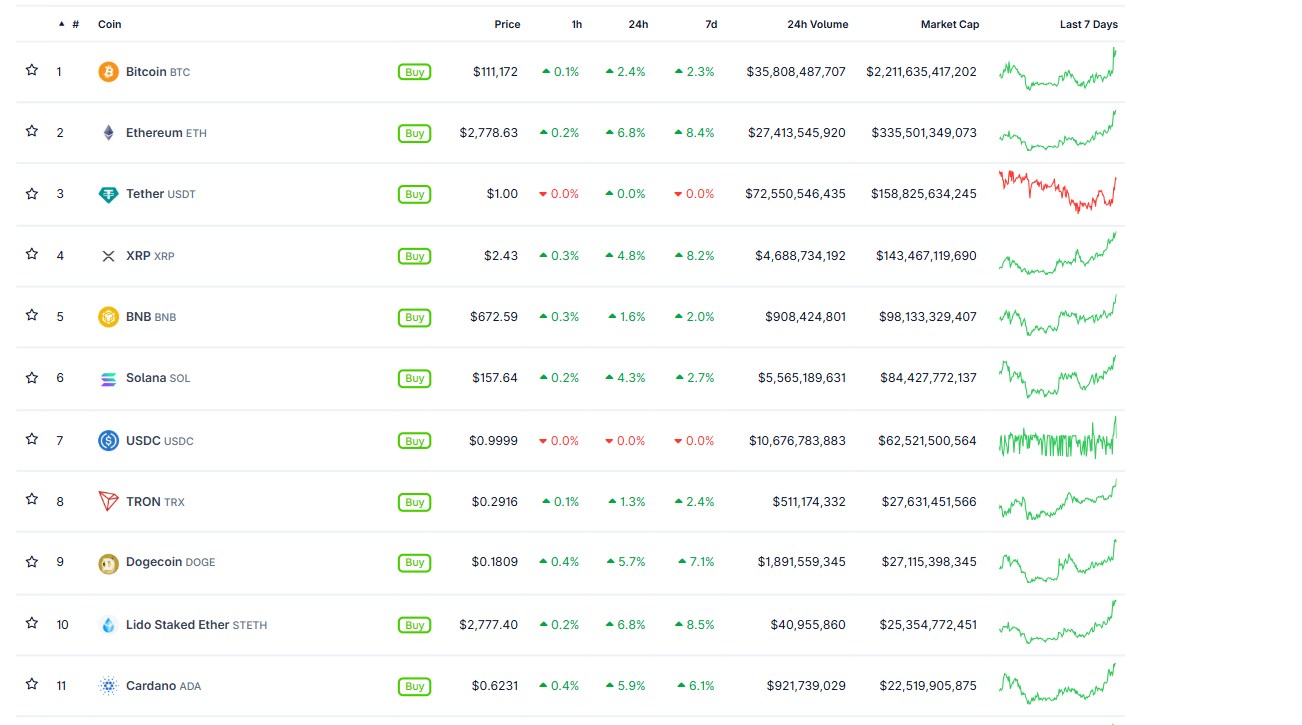

Major cryptos such as ETH, SOL, XRP and ADA followed this price surge.

The crypto market continues to trade in the green on Thursday, following the previous day's surge as Bitcoin (BTC) reached a new all-time high of $111,999. The renewed investor optimism follows dovish signals from the Federal Reserve's (Fed) minutes released on Wednesday, with major altcoins, including Ethereum (ETH), Solana (SOL), Ripple (XRP), and Cardano (ADA), following the footsteps of BTC. The rally triggered over $500 million in liquidations across leveraged positions in the past 24 hours, according to CoinGlass data.

Fed’s dovish minutes acted as a catalyst for riskier assets

Bitcoin and major altcoins saw a massive rally during the late American session on Wednesday, with BTC reaching a new all-time high of $111,999. Major altcoins, such as ETH, SOL, XRP and ADA, followed BTC’s lead and trade in the green, as shown in the CoinGecko chart below.

This rally was fueled by the Fed’s dovish minutes during the American trading session. The Federal Open Market Committee (FOMC) meeting minutes included a few officials who expressed the view that interest rates might decrease as early as July. At the same time, the majority of policymakers continued to have concerns regarding the inflationary pressures anticipated from US President Donald Trump's implementation of import taxes aimed at altering global trade.

The short-term dovish stance in the meeting minutes has triggered a risk-on sentiment, which supports the price rally in cryptos. According to the CoinGlass Liquidation Map chart, a total of 115,929 traders were liquidated in the last 24 hours, resulting in a total liquidation value of $533.20 million, with 87.9% of the positions being short. The largest single liquidation order occurred on Huobi (HTX) exchange, involving BTC/USDT, valued at $51.56 million. Bitcoin saw over $234.46 million in liquidation, while Ethereum saw $152.44 million.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.