Bitcoin Price Forecast: BTC ends Q2 with 30% gains, eyeing fresh record high as ETF inflows surge

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

Bitcoin price hovers around $108,000 on Monday after rallying 7.32% over the past week.

BTC wraps up Q2 with a strong 30% quarterly gain, close to its record high.

US-listed spot BTC ETFs recorded $2.22 billion inflows last week, the highest level since late May.

Bitcoin (BTC) is hovering around $108,000 at the time of writing on Monday after gaining more than 7% last week. Bitcoin concludes a strong second quarter, with gains exceeding 30%. The bullish sentiment is further supported by robust institutional interest, as US-listed spot Bitcoin Exchange Traded Funds (ETFs) recorded $2.22 billion in weekly inflows, the highest since May.

As the largest cryptocurrency by market capitalization inches closer to its all-time high with investors keeping a close watch, it may break new ground soon.

Bitcoin’s Q2 return of more than 30%

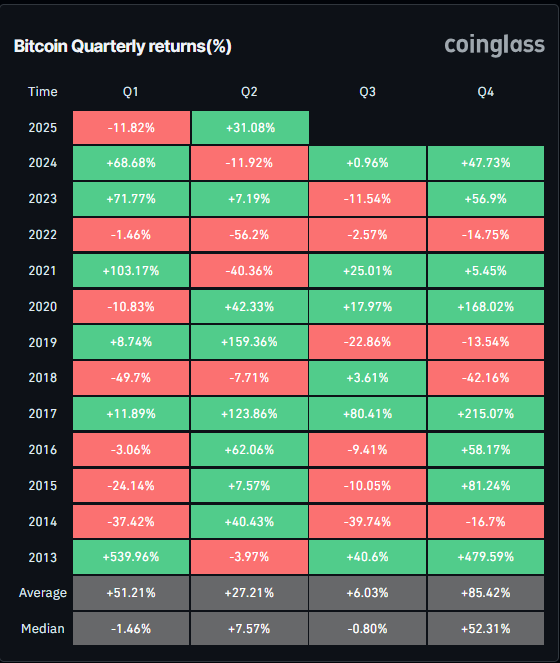

BTC’s Q2 returns were positive, at 31.08%, marking the best second quarter since 2020 and surpassing the average returns.

BTC Quarterly returns (%) chart. Source: Coinglass

Corporate and institutional demand continues to strengthen

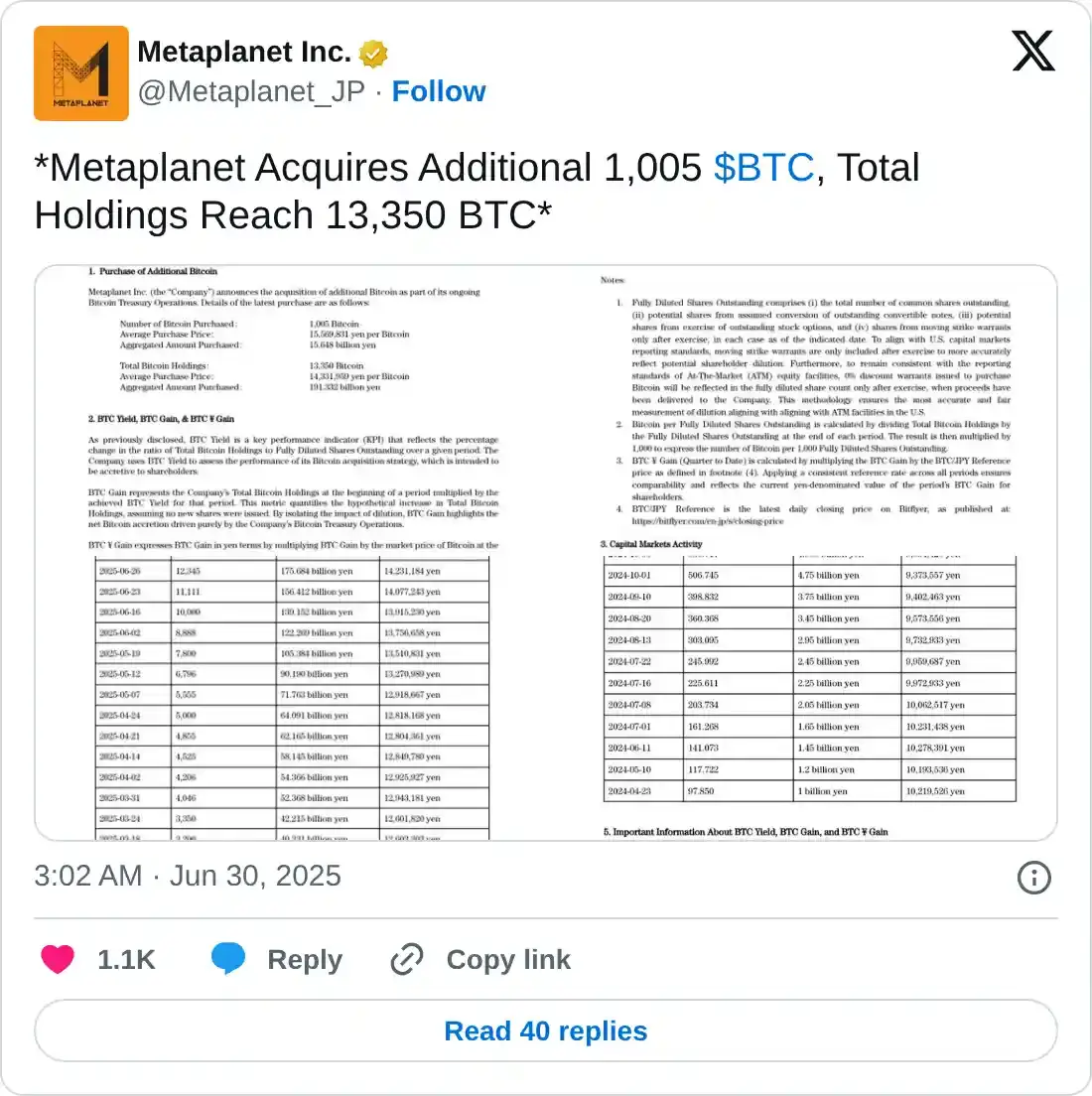

Bitcoin demand starts the week on a positive note. Japanese investment firm Metaplanet announced on Monday that it has purchased an additional 1,005 BTC, bringing the total holding to 13,350 BTC. On the same day, the firm also announced that it is issuing $208 million in 0% interest-rate ordinary bonds to enhance its Bitcoin acquisition strategy further.

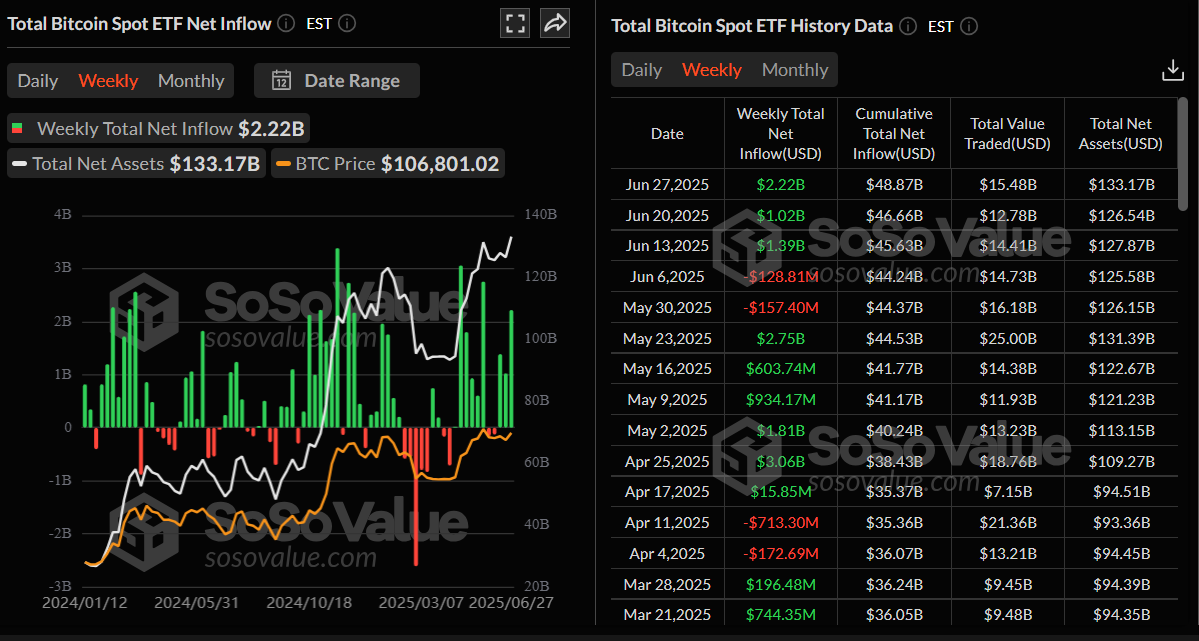

Apart from the corporate demand, institutional demand also remained robust. According to SoSoValue data, the spot BTC ETFs recorded a weekly inflow of $2.22 billion last week, the highest level since late May. If the inflow continues and intensifies, BTC could reach or even surpass its all-time highs.

Total Bitcoin spot ETF net inflow weekly chart. Source: SoSoValue

What is there for Bitcoin in July?

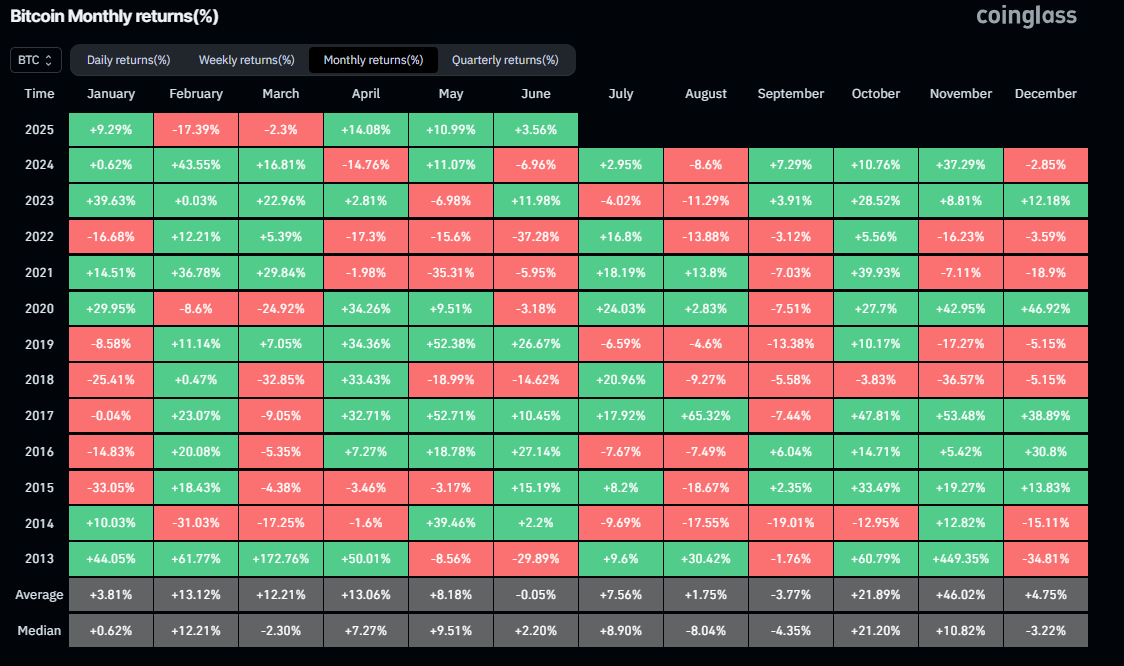

Bitcoin reached a new all-time high of $111,980 in May and stabilized above $107,000 in June, marking a 3.56% return for the month. According to Bitcoin’s historical data, BTC generally yielded a positive return for traders in July, with an average gain of 7.56%. If the ETFs’ demand continues to strengthen and tariffs and geopolitical uncertainty ease, traders could see positive returns in July.

Bitcoin historical monthly returns chart. Source: Coinglass

Bitcoin Price Forecast: BTC is a few inches from its record highs

Bitcoin price rose sharply by 7.32% last week, closing above $108,000. At the time of writing on Monday, it hovers at around $107,600.

If BTC continues its ongoing rally, it could extend toward the May 22 all-time high at $111,980. A successful close above this level could extend additional gains to set a new all-time high at $120,000.

The Relative Strength Index (RSI) on the daily chart reads 56, above its neutral level of 50, indicating bullish momentum. The Moving Average Convergence Divergence (MACD) on the daily chart also displayed a bullish crossover on Thursday, providing a buy signal and indicating an upward trend.

BTC/USDT daily chart

However, if BTC faces a correction, it could extend the decline to find support around the 50-day Exponential Moving Average (EMA) at $104,126.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.