Crypto Today: VanEck ETF filing drives BTC to $100k as Stellar (XLM) tracks XRP price rally

- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Senate to vote on Trump’s pro-Bitcoin Fed pick as BTC hits four-week high

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- Gold slumps below $5,100 as US Dollar gains

- WTI Price Forecast: Retreats from seven-month top, still well bid near $71.00 mark

- WTI climbs back closer to $72.00 as closure of Strait of Hormuz fuels supply concerns

Cryptocurrencies aggregate market capitalization reached $3.5 trillion on Wednesday, rising by $152 billion within the daily timeframe

This 4.8% increase is the highest single-day crypto market gains since in 35 days dating back to December 11.

Bitcoin price rose as high as $100,600, rising 3.3% on the day.

BTC’s 3% gains trails the broader crypto sector gains of 5%, signalling that investors are currently leaning into the altcoin market.

Bitcoin Market Updates: BTC retakes $100,000 but downside risks remain active

Bitcoin price rose 3.6% on Wednesday, trading as high as $100,681 on Binance.

Despite the 3.6% price gains, BTC on-chain transactions plunged 37% from last week’s peak, signalling downside risks ahead.

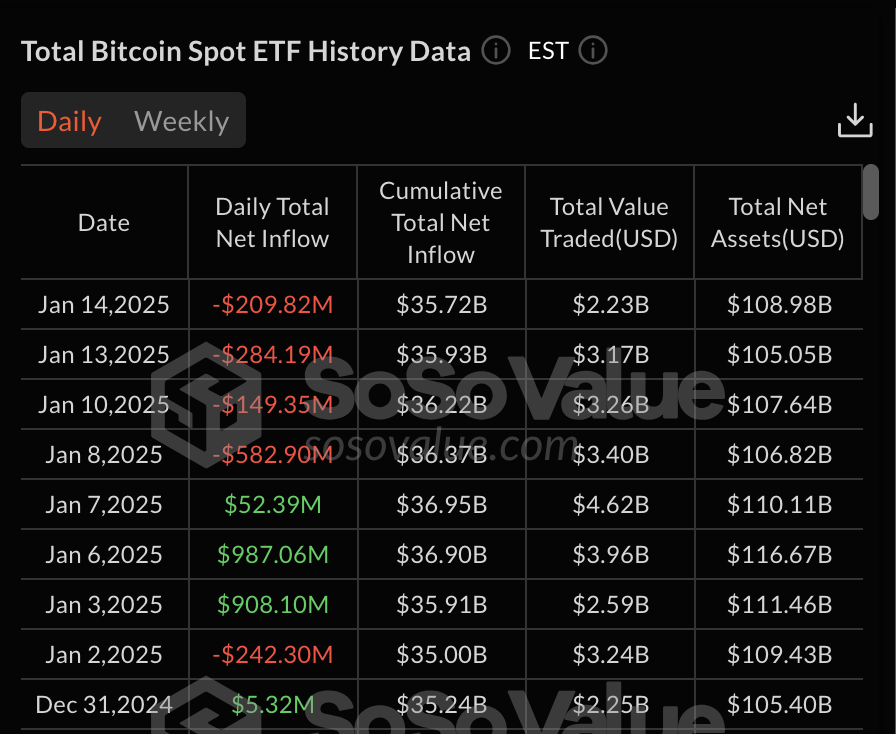

Bitcoin ETFs Performance, January 15 2025 | Source: SosoValue

Bitcoin ETFs recorded over $209 million outflows on Wednesday, which also dampened the bullish momentum.

Altcoin market updates: Stellar (XLM) mirrors XRP rally as traders intensify Trump bets

The global altcoin market rose by 8.61% on Wednesday, more than double Bitcoin’s 3.6% price gains which was notably subdued on the day by ETF outflows and low retail participation..

Solana Price surges 9% as SOL bulls reclaim momentum

Solana (SOL) posted an impressive 9% gain on Thursday, climbing to $205. The bullish momentum appears driven by strong on-chain activity and the rapid integration of AI-based projects into its ecosystem, boosting user adoption.

Stellar (XLM) mirrors XRP rally amid optimism surrounding Trump Crypto policy

Stellar (XLM) and Ripple (XRP) continued their upward trajectory, with XLM gaining 14% and XRP rising 12% on Wednesday. The intertwined fortunes of these two tokens stem from their shared origins. Stellar and XRP were both co-founded by Jed McCaleb.

XRP and XLM also share similarity in utility factors, as both projects aim to revolutionize cross-border payments and financial inclusion through decentralized networks.

XLM’s close price correlation with XRP ensures that positive developments surrounding Ripple often lift Stellar as well.

Market speculation around policy shifts and renewed interest in blockchain solutions for traditional finance under Trump has seen both assets emerge among the top gainers within the altcoin market on Wednesday.

If momentum persists, analysts predict XLM price could soon target $0.60, while XRP eyes a retest of $3 in the coming days.

Polygon (POL) Jumps 5% Amid Surge in Layer-2 Adoption

Polygon (MATIC) recorded 5% gain on Wednesday, trading at $0.48 as the Layer-2 network benefitted from growing demand for scalability solutions. Supported by strong fundamentals, MATIC could test the $0.50 mark before hitting a major sell-wall.

Chart of the day: Layer-2s emerge standout sector as market activity heightens

With Donald Trump’s inauguration less than a week away, trading activity has heightened across the crypto market, sparking congestion on Ethereum and other Layer-1 blockchains.

When transaction fees surge on the core Layer 1 networks like Ethereum, traders often turned to Layer-2 protocols, which provide scalable and cost-efficient solutions.

This rare market dynamic has reared its head over the past week.

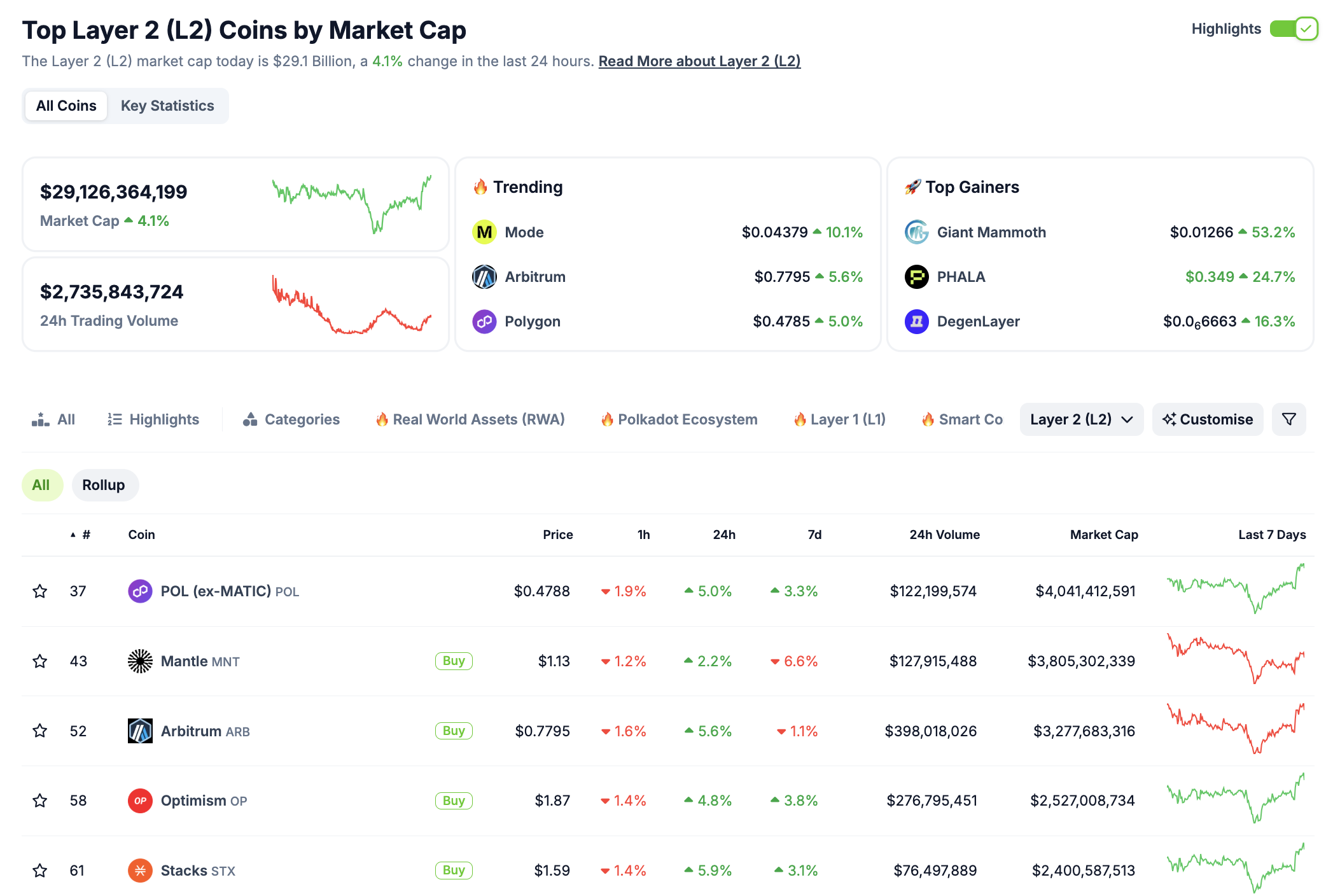

Layer-2 Sector Performance, January, 15 2025 | Source: Coingecko

Layer-2 Sector Performance, January, 15 2025 | Source: Coingecko

Data from CoinGecko highlights that the Layer-2 sector's aggregate market capitalization rose by 4.1% on Wednesday, reaching $29.1 billion.

Trading volumes remained substantial, with $2.7 billion exchanged within 24 hours, emphasizing sustained demand for these Layer-2 scaling solution projects.

Notable performers included Mode, which surged 10.1% as developer adoption strengthened its position in the ecosystem.

Arbitrum gained 5.6%, supported by growing DeFi integration, while Optimism also posted gains of 4.8%,

Meanwhile, tokens like Mantle experienced modest growth at 2.2% on the day, despite a 6.6% weekly decline, indicating mixed sentiment. POL (ex-MATIC) showed resilience with a 5% daily increase, signaling investor confidence in its recent rebranding efforts.

The Layer-2 ecosystem’s strong performance emphasized its critical role in managing blockchain congestion during volatile periods.

As Ethereum gas fees remain elevated, these protocols are positioned for sustained growth, offering traders and institutions reliable solutions for high-frequency transactions to maximize gains amid rising market activity.

Crypto News Updates:

VanEck Submits Onchain Economy ETF Application to SEC

Investment manager VanEck has filed an application with the U.S. Securities and Exchange Commission (SEC) to launch an Onchain Economy ETF.

This proposed exchange-traded fund aims to invest in companies operating within the cryptocurrency industry, including software developers, mining firms, exchanges, infrastructure providers, payment companies, and other related businesses.

The filing indicates that the fund will focus on "Digital Transformation Companies," encompassing a broad spectrum of entities contributing to the digital asset ecosystem.

Jamie Dimon criticizes Bitcoin as preferred currency for criminals

Jamie Dimon, CEO of JPMorgan Chase, has reiterated his criticism of Bitcoin, expressing doubts about its value and labeling it as the preferred currency for criminals involved in activities like sex trafficking, money laundering, and ransomware.

Despite his skepticism towards Bitcoin, Dimon acknowledged the legitimacy of blockchain technology and the use of stablecoins, highlighting that JPMorgan is already utilizing blockchain for transferring money and data

Text ccammers steal $2 million in Cryptocurrency, says NY Attorney General

The New York Attorney General's office has revealed that scammers stole over $2 million in cryptocurrency by deceiving individuals seeking remote job opportunities.

Victims were contacted via unsolicited text messages promising well-paying jobs reviewing products online.

To start earning, they were instructed to open cryptocurrency accounts and maintain specific balances, but the funds were diverted into the scammers' digital wallets. Seven victims from New York, Virginia, and Florida were identified in the lawsuit.

BitMEX Fined $100 million for Anti-Money laundering violations

Cryptocurrency exchange BitMEX has been fined $100 million by a U.S. judge for willfully violating anti-money laundering laws. The company pleaded guilty to charges of violating the Bank Secrecy Act from 2015 to 2020 by failing to implement adequate anti-money laundering measures and customer verification processes.

This penalty includes two years of probation and adds to prior settlements amounting to approximately $110 million in related cases. BitMEX has stated that it has since enhanced its compliance measures to adhere to regulatory standards.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.