Bitcoin Price Forecast: BTC faces setback from Microsoft’s rejection

- Gold rises to near $5,150 as Trump’s tariffs boost haven demand, US-Iran talks eyed

- Top 3 Price Prediction: BTC breakdown hints at deeper correction as ETH and XRP extend losses

- Gold drifts higher to $5,000 on heightened US-Iran tensions

- Gold climbs above $5,200 on geopolitical tensions, trade uncertainty

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Top 3 Price Prediction: BTC, ETH and XRP remain range-bound as breakdown risks rise

Bitcoin price hovers around $98,400 on Wednesday after declining 4.47% since Monday.

Microsoft shareholders rejected the proposal to add Bitcoin to the company’s balance sheet on Tuesday.

Rising institutional inflows, Ray Dalio’s endorsement of BTC, and Mara Digital and Riot Platforms’ increased Bitcoin holdings provide some support.

Bitcoin’s (BTC) price recovers slightly, trading around $98,400 on Wednesday, after declining 4.47% so far this week. Investor indecisiveness is evident in Bitcoin as mixed signals emerge. Microsoft’s shareholders rejected a proposal to add Bitcoin to the company’s balance sheet on Tuesday, while rising institutional inflows, Ray Dalio’s endorsement of BTC, and increased Bitcoin holdings by Mara Digital and Riot Platforms offer signs of optimism.

Bitcoin faces setback from Microsoft shareholders

Bitcoin has been largely on the back foot this week, declining 4.5% until Tuesday and reaching a low of $94,150 on Monday.

According to a research report from K33, the recent surge beyond 100K induced traders “to pile into leverage longs, which were quickly punished as price reversed in a liquidation cascade.”

Monday’s Bitcoin liquidation was exacerbated by Tuesday’s announcement that Microsoft’s shareholders had rejected a proposal to add Bitcoin to the company’s balance sheet.

MicroStrategy CEO Michael Saylor presented the proposal to Microsoft’s board last week, explaining why the tech giant should buy Bitcoin. However, Microsoft shareholders rejected the proposal in Tuesday’s voting. The board described Bitcoin investments as “unnecessary risks” that do not align with the company’s strategy.

During the same period, Google’s announcement of its latest quantum chip, ‘Willow,’ sparked concerns about its potential to compromise the integrity of cryptocurrency networks for Bitcoin and crypto encryption.

This event fueled debates over the need for quantum-resistant encryption and underscored the urgency for the crypto community to address vulnerabilities posed by advancing quantum technology.

“Google’s Willow chip, boasting 105 qubits, has showcased unprecedented computational power, solving problems in minutes that would take classical supercomputers billions of years. Despite this breakthrough, experts agree that Willow’s current capabilities pose no immediate threat to Bitcoin’s cryptographic security,” Ryan Lee, Chief Analyst at Bitget Research, told FXStreet.

Bitcoin’s institutional inflow stays robust

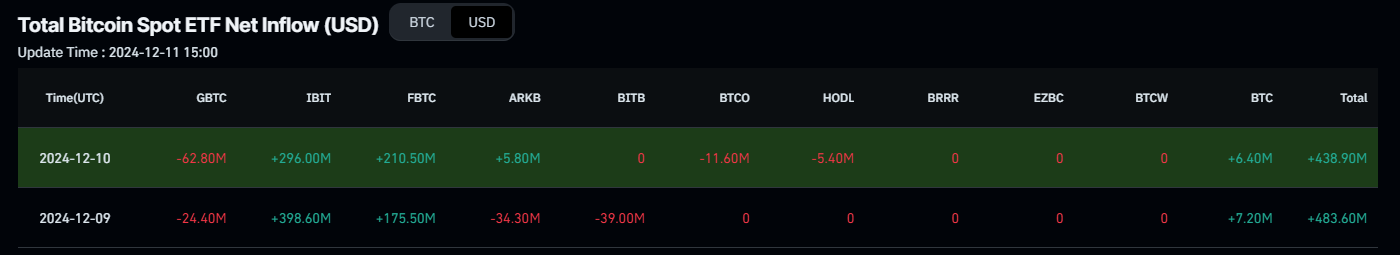

Despite unfavorable events, Bitcoin institutional demand remained strong on Tuesday. According to Coinglass, Bitcoin Spot Exchange Traded Funds (ETFs) saw a second consecutive day of inflows this week, with $438.90 million recorded on Tuesday. This marks consistent positive inflows since November 27. If this magnitude of inflow persists, demand for Bitcoin will increase, leading to a recovery in its price.

Total Bitcoin Spot ETF Net Inflow chart. Source: Coinglass

Moreover, Marathon Digital announced that it had acquired 11,774 BTC worth $1.1 billion in the same period at an average price of $96,000 per Bitcoin. The company currently holds 40,435 BTC, valued at $3.9 billion.

Using the proceeds from its zero-coupon convertible notes offerings, MARA has acquired 11,774 BTC for ~$1.1 billion at ~$96,000 per #bitcoin and has achieved BTC Yield of 12.3% QTD and 47.6% YTD. As of 12/9/2024, we hold 40,435 BTC, currently valued at $3.9 billion based on a… pic.twitter.com/2uvnrhbxaP

— MARA (@MARAHoldings) December 10, 2024

According to Lookonchain data, Riot Platforms acquired 705 BTC worth $68.45 million on Wednesday, following its Monday announcement of a $500 million private offering in convertible senior notes aimed at Bitcoin purchases and general corporate purposes. If the demand for Bitcoin by institutions persists or increases, this could lead to a recovery in its price.

On-chain data shows that Riot Platforms(@RiotPlatforms) has acquired 705 $BTC($68.45M) in the past 3 hours.

— Lookonchain (@lookonchain) December 11, 2024

On Dec 9, Riot announced plans for a private offering of $500 million in convertible senior notes, intended primarily for #Bitcoin acquisitions and general corporate… pic.twitter.com/jkjf9KkP4s

Lastly, Ray Dalio, founder of Bridgewater Associates, endorsed BTC during the Bitcoin MENA and Abu Dhabi Financial Conferences.

“I want to steer away from debt assets and have some hard money like Gold and Bitcoin,”Dalio said,

JUST IN: Billionaire Ray Dalio says, “I want to steer away from debt assets and have some hard money like gold and #Bitcoin” pic.twitter.com/cGepTUrhRl

— Bitcoin Magazine (@BitcoinMagazine) December 11, 2024

Bitcoin Price Forecast: BTC shows signs of weakness

Bitcoin price declined 4.47% so far this week until Tuesday. At the time of writing on Wednesday, it hovers around $98,400.

Traders should be cautious as the Relative Strength Index on the daily chart shows signs of weakness. The recent uptrend in Bitcoin price since mid-November reflects a falling RSI level during the same period, indicating diminishing bullish strength.The RSI hovers around 60. A daily close below the neutral level of 50 would signal that bearish momentum is gaining traction.

If BTC continues its decline and closes below the $90,000 support level, it could extend losses toward the next support level of $85,000.

BTC/USDT daily chart

Conversely, if BTC continues its recovery and closes above $104,088, it could extend the rally toward a new all-time high of $119,510. This level aligns with the 141.4% Fibonacci extension line drawn from the November 4 low of $66,835 to the all-time high of $104,088.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.