Bitcoin related tokens STX, RUNE, LENDS see price gains ahead of BTC halving

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

- Ethereum Price Forecast: ETH faces heavy distribution as price slips below average cost basis of investors

Bitcoin halving anticipation is a likely catalyst for gains in Bitcoin related projects Stacks, THORChain, and Lends.

STX, RUNE, and LENDS prices rallied on Sunday as BTC price inches closer to $70,000.

The Bitcoin-related token narrative sees a resurgence amidst Bitcoin price rally and the upcoming halving in April 2024.

Bitcoin related tokens have seen a resurgence as Bitcoin dominance rises and the largest asset by market capitalization sustains above the $69,000 level. The narrative of BTC-related tokens is likely to stay relevant, driving gains for holders with the upcoming halving.

STX, RUNE, LENDS price climbs alongside Bitcoin

Bitcoin halving is scheduled for April 21, the event is 42 days away. The halving has likely catalyzed gains in Bitcoin-related tokens, Stacks (STX), THORChain (RUNE), and LENDS.

Bitcoin beta plays have emerged as a class of tokens that yield gains for holders, ahead of the Nakamoto Upgrade scheduled for April. STX price climbed nearly 13% on Sunday and yielded 7% weekly gains for holders.

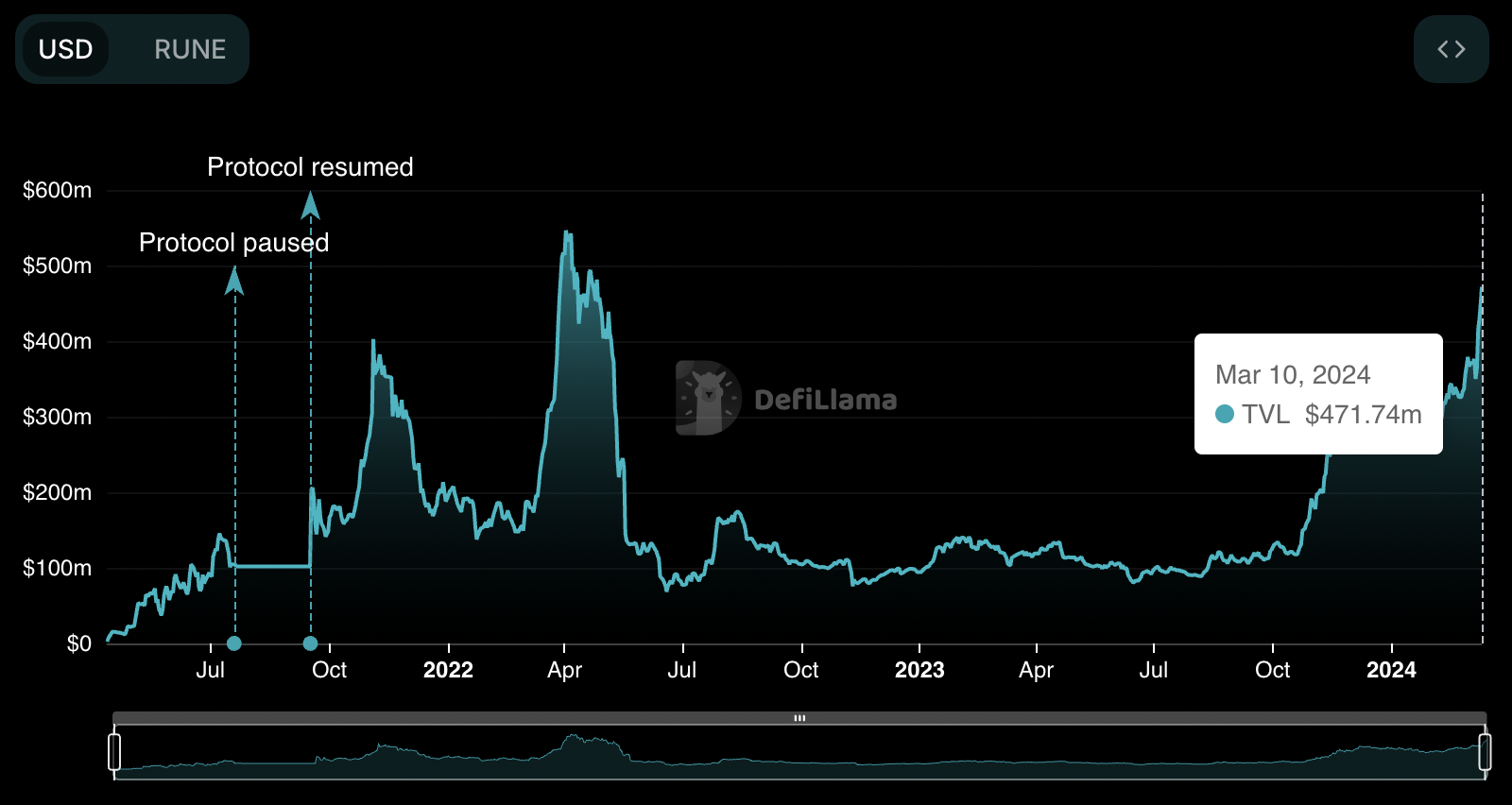

RUNE, the token of a decentralized exchange that enables cross-chain swaps hit a nearly 22-month high in the total value of assets locked (TVL).

RUNE TVL. Source: DeFiLlama

LENDS is likely a RUNE beta play since the token belongs to the THORChain ecosystem. LENDS price climbed nearly 12% today and the token yielded nearly 90% weekly gains to holders.

Bitcoin price is inching closer to $70,000, the asset sustained above the $69,000 level on Sunday. The asset has climbed 2% on the day and yielded nearly 13% weekly gains for BTC holders.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.