Bitcoin price shows strength, Bitget MD cites investors' steadfast optimism toward BTC

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

- Ethereum Price Forecast: ETH faces heavy distribution as price slips below average cost basis of investors

Bitcoin price has reclaimed above $67,000 with clear intention to retake its recent peak above $69,000.

Bitget Exchange CEO cites steadfast optimism and unmatched confidence in BTC among community members.

ETFs remain a key fundamental with BlackRock’s IBIT taking in a record-smashing $788 million on Tuesday.

Bitcoin (BTC) is not done with its upside potential and is on course with a recovery rally only days after detaching from its peak in what could be attributed to massive sell orders. Meanwhile, theories continue to circulate about why the gains are far from over for the pioneer cryptocurrency.

Bitcoin holders are confident: Bitget CEO

According to the Managing Director of Bitget Exchange, Gracy Chen, the surge in Bitcoin price after the recent 16.9% correction is attributed to “steadfast optimism and confidence in BTC”. Chen added, “Based on historical experience, rapid pullbacks often occur during sharp uptrends, constituting a common phenomenon of market deleveraging.”

While Chen ascribes the surge to investor optimism, a report from an economist with Deutsche Bank has detailed five reasons why BTC is trading at a record high and why the rally may not be over yet. Highlights include the BTC exchange-traded funds (ETFs), the halving event, industry regulation and macroeconomic details such as interest rates.

Popular belief is that the BTC halving will kick-start the next bull cycle. Ahead of that, the ETF narrative continues to drive markets with reports indicating that these investment products are continually scooping up hundreds of millions of dollars in BTC daily. For instance, ETF specialist Eric Balchunas recently reported that BlackRock’s IBIT ETF took in a record-smashing $788 million on March 5.

Bitcoin price outlook as BTC attempts to retake $69,000

Bitcoin price continues to push north in clear attempts to reclaim the $69,000 threshold, or in highly bullish cases, clear the $69,324 peak with hopes to nick the $70,000 psychological level.

Buying momentum is rising, as seen with the Relative Strength Index (RSI) that is moving north. The growing bars of the Volume indicator point to a strengthening bullish trend. This accentuates the bullish thesis further.

BTC/USDT 1-day chart, Source: TradingView.

On-chain metrics support bullish outlook for Bitcoin price

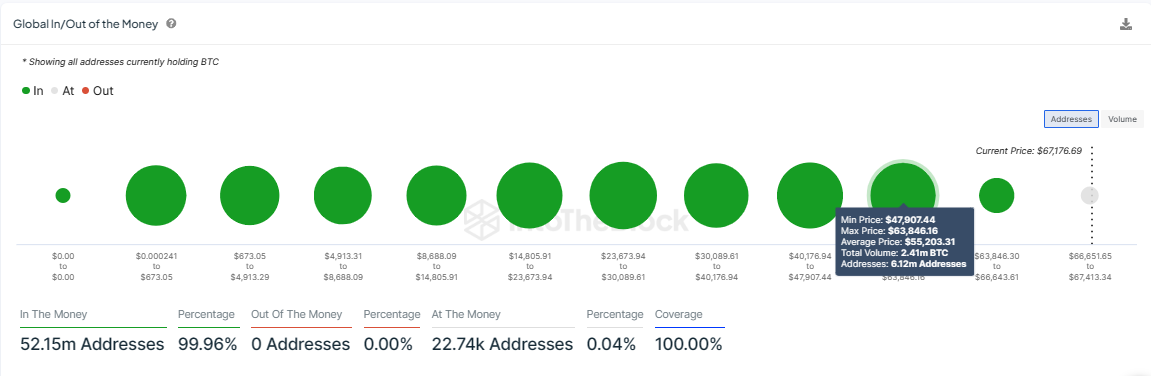

On-chain data from IntoTheBlock’s Global In/Out of the Money (GIOM) metric shows Bitcoin price enjoys strong support downward. The region between $47,907 and $63,846 is particularly of interest as it provides strong support. Efforts to push BTC price below this level will be countered by aggressive buying from approximately 6.12 million addresses that bought nearly 2.41 million BTC at an average price of $55,203.

BTC GIOM

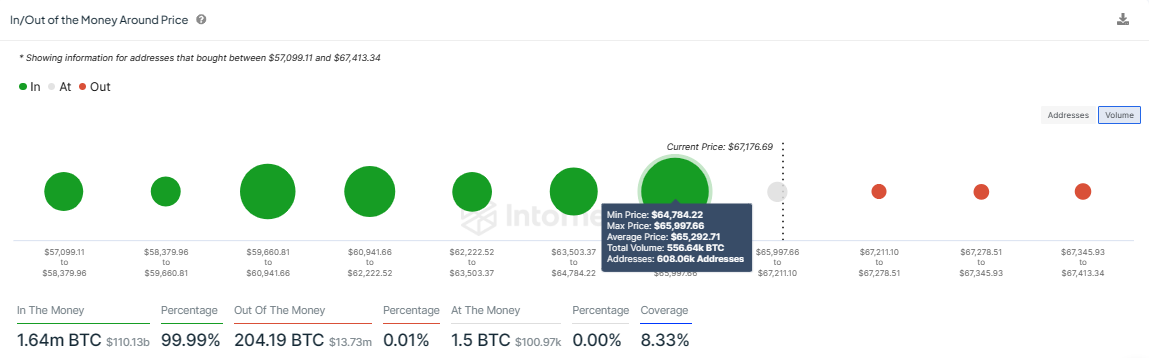

Also, the In/Out of the Money Around Price (IOMAP) metric also corroborates the story, showing that there is a strong area of support between $64,784 and $65,997. Here, approximately 608,060 addresses hold around 556,640 BTC tokens purchased at an average price of $65,292.

BTC IOMAP

For both metrics, it is clear that over 99% of BTC holders are sitting on unrealized profit. With the oncoming halving, the urge to sell is bound to be at a minimum. This adds credence to the bullish thesis.

On the downside, if traders begin to cash in on the gains, Bitcoin price could wipe some of the gains made over the past few days. This could see BTC fall back to $65,000, or in a dire case, descend to the $60,000 psychological level. Such a move would denote a nearly 10% drop below current levels.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.