Bitcoin Nearing ATH, But Social Media FOMO Signals Warning

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

- Ethereum Price Forecast: ETH faces heavy distribution as price slips below average cost basis of investors

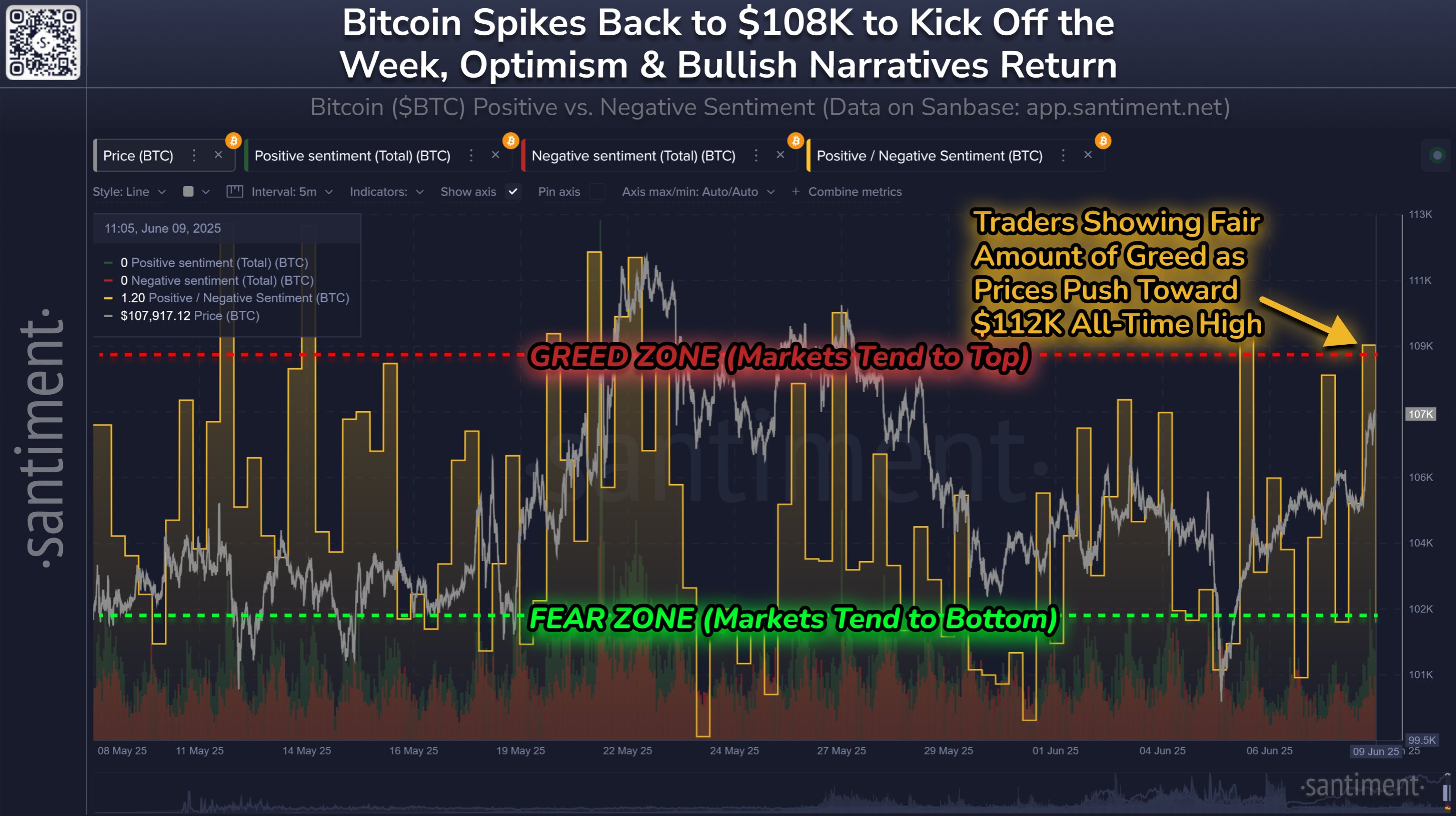

Data shows Bitcoin sentiment on social media may be starting to become overheated, a sign that could end up being a threat to the price rally.

Bitcoin Social Media Sentiment Is Currently Notably Positive

In a new post on X, the analytics firm Santiment has discussed how sentiment around Bitcoin has changed on the major social media platforms after the latest recovery rally.

The indicator of relevance here is the “Positive/Negative Sentiment,” which compares the level of positive sentiment to negative sentiment around a given cryptocurrency on social media.

The metric works by filtering posts/messages/threads containing mentions of the asset and putting them through a machine-learning model that separates between positive and negative comments. The indicator counts up the number of both types of posts and takes their ratio to provide a net representation of social media.

Now, here is the chart shared by Santiment that shows the trend in the Positive/Negative Sentiment for Bitcoin over the past month:

As displayed in the above graph, the Bitcoin Positive/Negative Sentiment has seen a spike in the zone above the 1.0 mark, which suggests a flood of positive posts related to the asset have hit social media platforms. This turn toward a significant positive sentiment has come as the cryptocurrency’s price has been going through a recovery surge.

This isn’t a particularly unusual trend, as excitement tends to rise among traders whenever bullish price action takes place. In the context of the latest surge, especially, an uplift of sentiment isn’t surprising, as it has brought the price close to the all-time high (ATH).

While some hype is to be expected, an excess of it can be something to watch out for. The reason behind this is the fact that Bitcoin and other cryptocurrencies have historically tended to move in the direction that goes contrary to the crowd’s opinion.

This means that a surge of greed in the market is something that can lead to a top for the asset’s price. Similarly, a cooldown in sentiment can imply a bullish reversal instead.

From the chart, it’s apparent that the Positive/Negative Sentiment declined to a relatively low level a few days ago when Bitcoin saw a drawdown toward $100,000. This fear among social media users may have helped the coin reach a bottom.

After the latest spike in the indicator, the situation is now the opposite, with Fear Of Missing Out (FOMO) potentially developing among the investors. It now remains to be seen whether this overexcitement would provide impedance to the price rally or not.

BTC Price

Bitcoin briefly broke above $110,000 during the past day, but the asset has since seen a minor pullback as it’s now back at $109,500.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.