Bitcoin Whales Continuously Selling, But This Cohort Is Buying

- Gold rises to near $5,150 as Trump’s tariffs boost haven demand, US-Iran talks eyed

- Top 3 Price Prediction: BTC breakdown hints at deeper correction as ETH and XRP extend losses

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Gold climbs above $5,200 on geopolitical tensions, trade uncertainty

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Oil prices rise as US and Iran extend talks into next week

On-chain data shows the Bitcoin whales have been distributing for a while, but this investor cohort has been scooping up their coins.

Bitcoin Sharks Have Increased Their Supply Dominance Recently

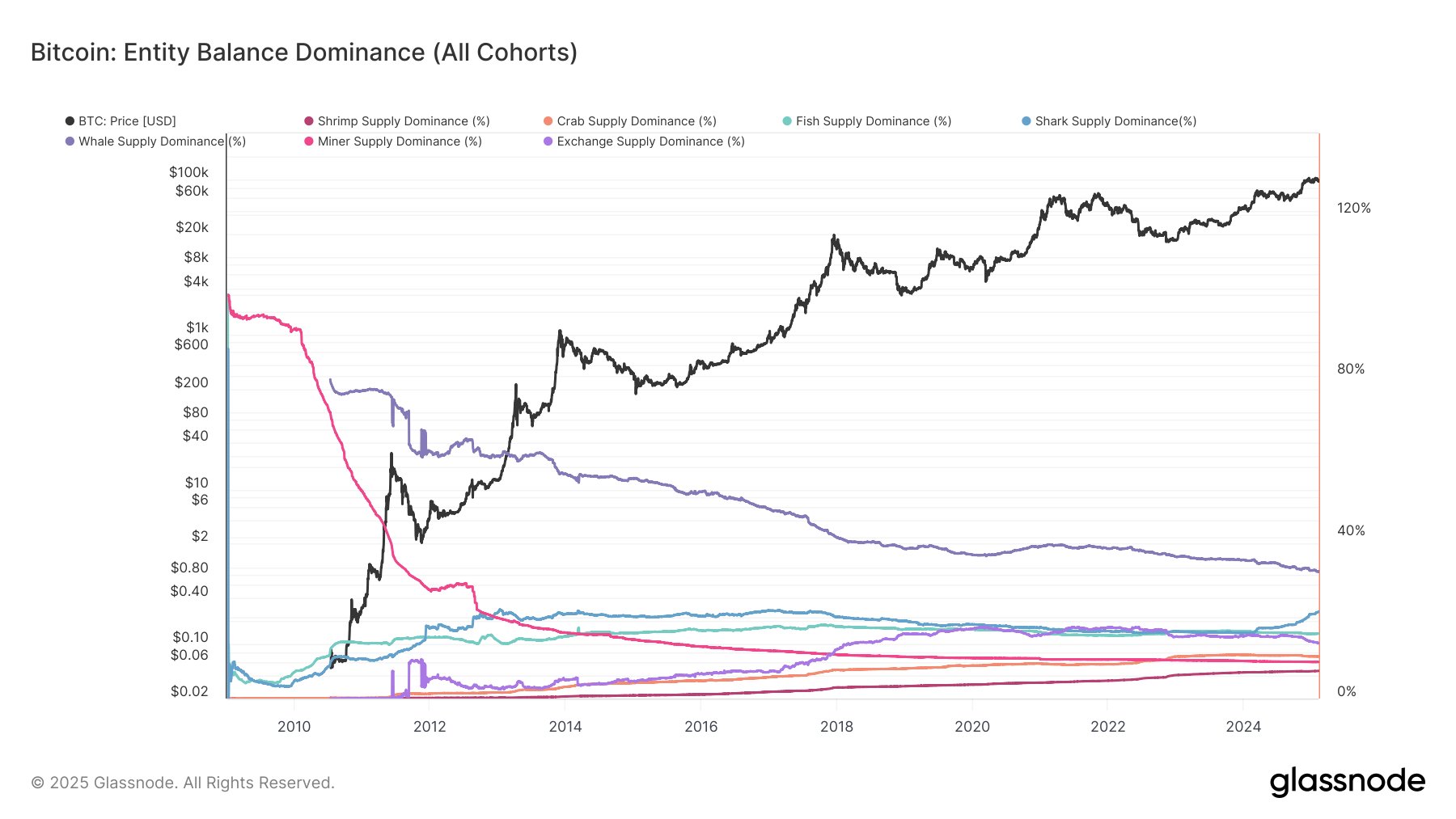

In a new post on X, analyst James Van Straten has discussed about how the Supply Dominance of the various Bitcoin cohorts has recently changed. The “Supply Dominance” here refers to an on-chain metric created by Glassnode that measures the percentage of the total BTC supply in circulation that a given investor group accounts for.

The analytics firm has divided holders into these cohorts based on the balance that they are carrying in their wallets. There are five such groups in total: shrimps (holding less than 1 BTC), crabs (1 to 10 BTC), fish (10 to 100 BTC), sharks (100 to 1,000 BTC), and whales (more than 1,000 BTC).

Besides these, there are also two special groups: miners and exchanges. Miners and exchanges carry a different role in the market from normal self-custodial wallets, so it makes sense to make them into separate categories.

Now, here is the chart shared by the analyst that shows the trend in the Supply Dominance of these seven wallet cohorts over the course of the cryptocurrency’s history:

As displayed in the above graph, the Bitcoin whales have historically held the largest share of the cryptocurrency’s supply, but their Supply Dominance has been trending down over the years.

The metric has been in a particularly pronounced phase of decline for the cohort recently, implying these humongous entities have been busy harvesting profits during the latest bull run. Though, despite the continuous distribution, this group still controls the largest part of the BTC supply.

The crabs, fish, and miners have seen their supply trend more or less sideways recently, meaning they have neither been accumulating nor distributing. The shrimps, the smallest of entities on the network, have constantly been buying, implying new retail interest has been flowing into the market.

These holders are quite small, however, and their buying may not be too relevant in the grand scheme of things. Investors that do stand out in the wider picture are the sharks and they have interestingly been showing some aggressive buying in recent months.

The sharks aren’t quite as influential as the whales, owing to the fact that their holdings are significantly smaller, but they are nonetheless considered a key part of the Bitcoin ecosystem. Thus, this accumulation from the group can be a bullish sign for BTC.

After the latest buying spree, the sharks have raised their Supply Dominance past the 20% mark, gaining a notable gap over all cohorts other than the whales.

BTC Price

Bitcoin has been stuck in consolidation recently as its price is still floating around the $97,200 level.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.