Bitcoin Dominance at Risk as Altcoin Market Cap Targets $1.5 Trillion

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Gold climbs above $5,200 on geopolitical tensions, trade uncertainty

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Oil prices rise as US and Iran extend talks into next week

- Bitcoin Rebounds After Falling to $62,500 Low, Crypto Market Still Extremely Fearful

- Top 3 Price Prediction: Bitcoin, Ethereum, Ripple – BTC, ETH and XRP post cautious recovery amid downside risks

In recent weeks, many altcoins have started to outperform Bitcoin (BTC). This has sparked speculation that the market could be inching toward the anticipated altcoin season. During this period, altcoins tend to deliver higher percentage gains compared to Bitcoin, drawing more investor interest and capital flow into these assets.

While the recent price rallies in key altcoins could signal the early stages of this trend, this analysis examines whether technical patterns are following suit.

Bitcoin Steps Back, Altcoins Break Out of Falling Wedge

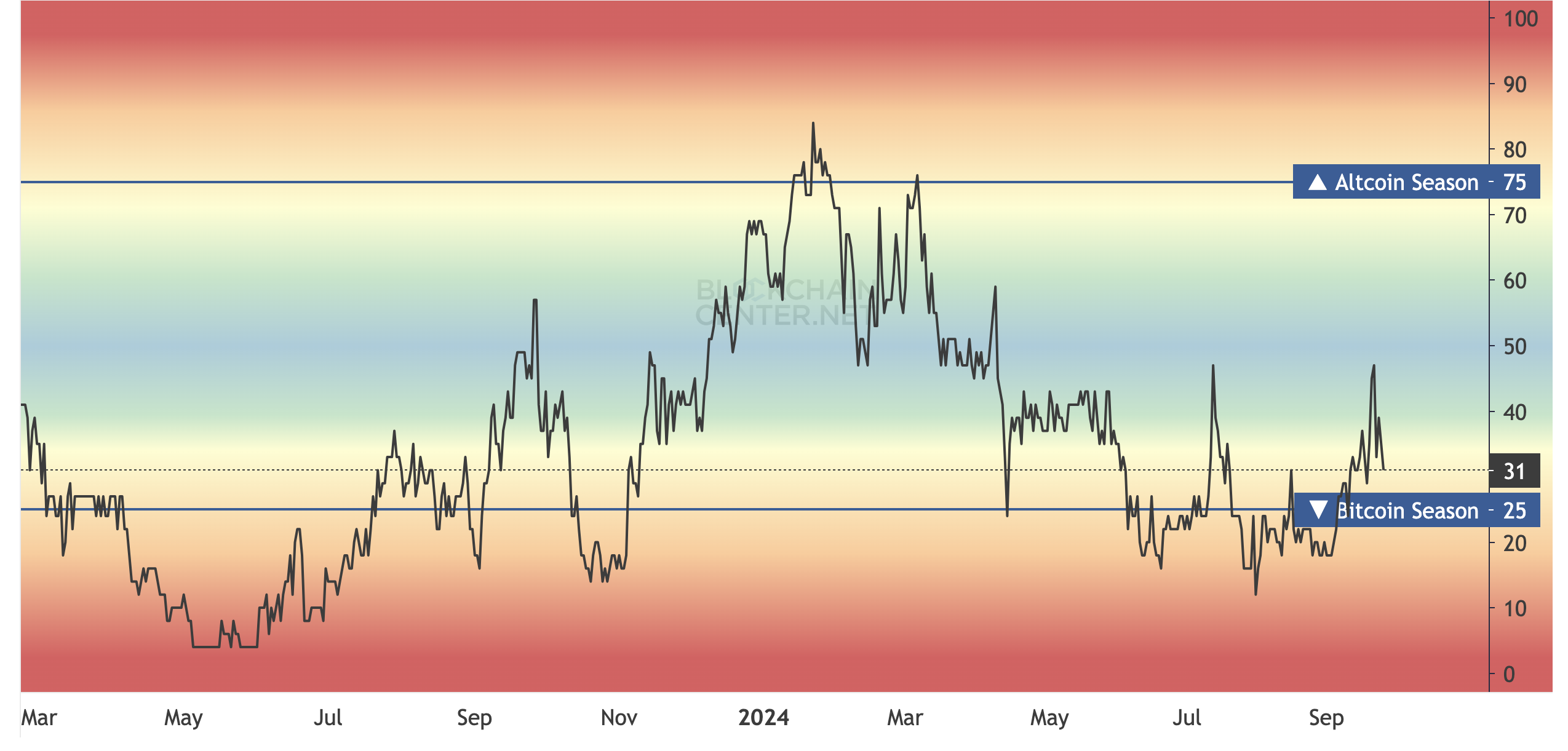

To validate the altcoin season, at least 75% of the top 100 cryptos must outperform the number one coin within 90 days. For the last six months, this has not happened because Bitcoin’s dominance ensured that altcoins played second fiddle to it.

However, according to Blockchaincenter, things are starting to change. The altcoin season index has moved from less than 18 some weeks back to 31. This increase could be connected to the performance of cryptos like Sui (SUI), Bittensor (TAO), Fantom (FTM), and a host of others.

Altcoin Season Index. Source: Blockchaincenter

Altcoin Season Index. Source: Blockchaincenter

Despite the improvement, it is important to note that it is not yet altcoin season. However, based on the daily chart, Bitcoin Dominance (BTC.D) has decreased since September 19.

Furthermore, the TOTAL2 chart, which shows the total crypto market cap excluding BTC, has increased nearly 18% since September 7. This disparity in performance aligns with the notion that Bitcoin might soon step back and allow altcoins to take the lead.

Besides that, BeInCrypto noticed that the TOTAL2 had broken out of a falling wedge. For context, a falling wedge is seen as a bullish signal formed by two descending trendlines. One represents the highs, and the other the lows.

Read more: 10 Best Altcoin Exchanges In 2024

Altcoins Market Cap vs. Bitcoin Dominance. Source: TradingView

Altcoins Market Cap vs. Bitcoin Dominance. Source: TradingView

The breakout from the technical pattern suggests that sellers are starting to lose momentum. In turn, buyers have capitalized on the fatigue. If this trend continues, the altcoin market cap might jump toward $1.3 trillion or as high as $1.5 trillion in some months.

Analysts Predict Altcoin Season Is Near

Following this development, several prominent crypto personalities have agreed that altcoin season is very close. For instance, the Negentropic handle on X, operated by Glassnode and Swissblock founders Jan Happel, Rafael Schultze-Kraft, and Yann Allemann, shares a similar sentiment.

“Swissblock’s Altcoin Signal is at 53: We’re transitioning into an AltSeason! When BTC breaks over 64.4k, Altcoins will fly. Our framework is flagging beta plays. WIF is strong. it’s up 16%+ today with a beta of 3 to BTC. imagine the move once Bitcoin rips towards ATHs,” Negentropic said.

Miles Deutscher is another crypto analyst with such an optimistic view. According to DeDeutscher, the TOTAL3, which is the market cap of altcoins without Ethereum (ETH), could break out if it escapes rejection.

“Altcoins (TOTAL3) are on the verge of a monster breakout. There’s a chance we reject here, but if we break through – expect fireworks,” Deutscher wrote.

Interestingly, BeInCrypto’s analysis of TOTAL3 has increased by almost the same value as TOTAL2. It is also on the verge of breaking above the descending channel on the daily chart.

Read more: 11 Cryptos To Add To Your Portfolio Before Altcoin Season

TOTAL3 Altcoins Daily Analysis. Source: TradingView

TOTAL3 Altcoins Daily Analysis. Source: TradingView

Should this breakout be successful, then altcoin season might accelerate and truly materialize. However, it remains crucial to monitor Bitcoin’s dominance. If BTC.D rebounds and altcoins market cap gets rejected, the projected rally to $1.5 trillion might not come to pass within a short period

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.