Bitcoin (BTC) Price Struggles Put Short-Term Holders at a Disadvantage

- Senate to vote on Trump’s pro-Bitcoin Fed pick as BTC hits four-week high

- Gold slumps below $5,100 as US Dollar gains

- WTI climbs back closer to $72.00 as closure of Strait of Hormuz fuels supply concerns

- US Dollar Index gathers strength to near 99.00 on Middle East tensions, robust US services data

- WTI climbs to $76.00, eyes one-year high amid rising tensions in the Middle East

- How to Survive Bitcoin Winter? Will It Still Fall Below $60,000 in 2026?

In recent months, a cohort of Bitcoin (BTC) holders has been notably affected by the coin’s struggle to stabilize above $70,000. This group comprises short-term holders (STHs) — investors who have held the asset for less than 155 days.

While the rest of the market remains profitable despite BTC’s price troubles, its STHs continue to record losses in their investments.

Bitcoin Short-Term Holders Face Record Losses

In its new report, on-chain data provider Glassnode found that BTC’s STHs continue to sit on more unrealized losses than the rest of the market. Describing them as the “primary cohort at risk,” Glassnode noted that the magnitude of the losses incurred by this category of coin holders has increased over the past few months.

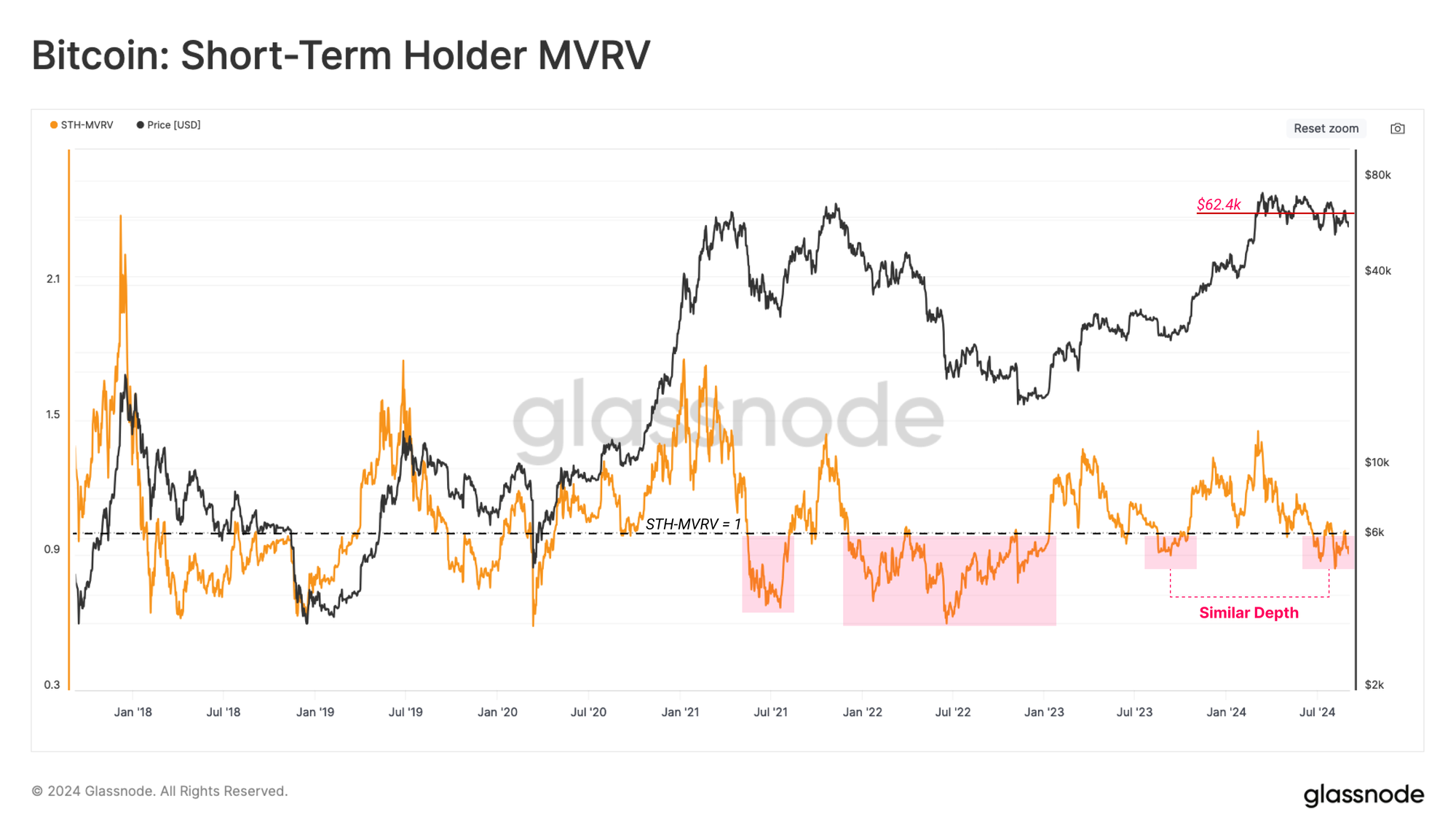

The on-chain analytics firm assessed BTC’s STH market value to realized value (MVRV) ratio. It found that its value has remained below one and is now at “ levels similar to Aug 2023 during the recovery rally after the FTX failure.”

Bitcoin STH Market Value to Realized Value Ratio. Source: Glassnode

Bitcoin STH Market Value to Realized Value Ratio. Source: Glassnode

When an asset’s MVRV ratio is below one, its market value is less than the average price paid to acquire it by holders. Therefore, if they sell, they would incur losses.

“This tells us that the average new investor is holding an unrealized loss. Generally speaking, until the spot price reclaims the STH cost basis of $62.4k, there is an expectation for further market weakness,” Glassnode said.

Due to recent spike in losses, Bitcoin short-term holders (STHs) have adjusted their behavior. According to Glassnode, “the wealth held by new-demand investors has declined over recent months” as these STHs distributed their coins.

Conversely, long-term holders (LTHs) have reduced profit-taking and ramped up accumulation, showing contrasting strategies between the two groups. This pattern is evident amongst BTC whales as well.

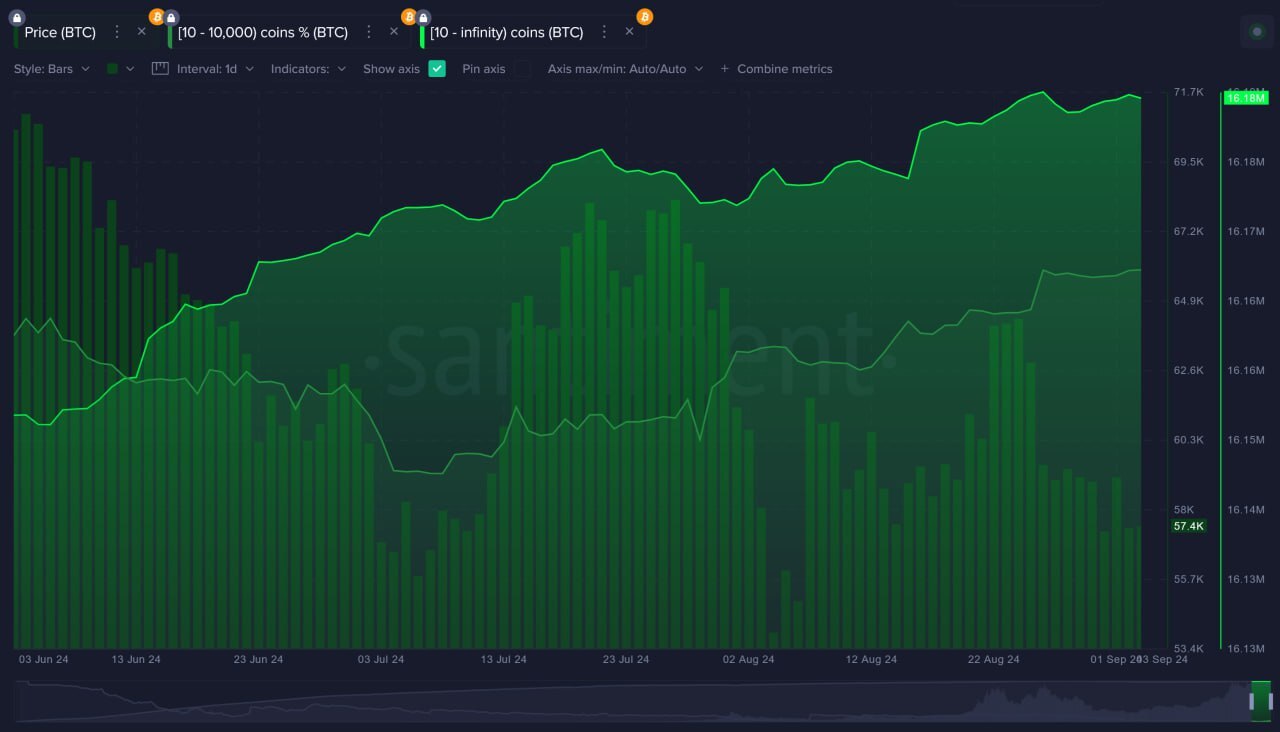

“For Bitcoin, the main chart that continues to look encouraging is this one showing that whales continue to accumulate. Over the past 3 months, 10+ BTC wallets have added a combined 34.2K more coins,” Brian Quinlivan, lead analyst at Santiment, noted in an exclusive interview with BeinCrypto.

Read more: What Happened at the Last Bitcoin Halving? Predictions for 2024

Bitcoin Whale Activity. Source: Santiment

Bitcoin Whale Activity. Source: Santiment

BTC Price Prediction: More Pain Ahead

BTC’s technical setup suggests that the leading coin is poised for a further decline. At press time, its Awesome Oscillator, which measures market momentum, is negative.

At -1,545, BTC’s Awesome Oscillator signals that its short-term price movements are weaker than its longer-term movements, suggesting downward momentum. Additionally, its Chaikin Money Flow (CMF), in a downtrend, signals liquidity exit from the BTC market.

Read more: Bitcoin Halving History: Everything You Need To Know

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingView

If this trend continues, the king coin’s price may fall to $53,968. However, if buying activity outweighs selling pressure, the coin’s value may rally to $57,291.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.