Traders Brace For Impact As Over $4 Billion in Bitcoin and Ethereum Options Expire

- Gold rises to near $5,150 as Trump’s tariffs boost haven demand, US-Iran talks eyed

- Top 3 Price Prediction: BTC breakdown hints at deeper correction as ETH and XRP extend losses

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Gold climbs above $5,200 on geopolitical tensions, trade uncertainty

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Oil prices rise as US and Iran extend talks into next week

The crypto market will witness $4.11 billion in Bitcoin (BTC) and Ethereum (ETH) options contracts expire today. This massive expiration could impact short-term price action, especially as both assets have recently declined.

With Bitcoin options valued at $3.5 billion and Ethereum at $565.13 million, traders are bracing for potential volatility.

High-Stakes Crypto Options Expirations: What Traders Should Watch Today

According to Deribit data, Bitcoin options expiration involves 33,972 contracts, compared to 27,959 contracts last week. Similarly, Ethereum’s expiring options total 224,509 contracts, down from 246,849 contracts the previous week.

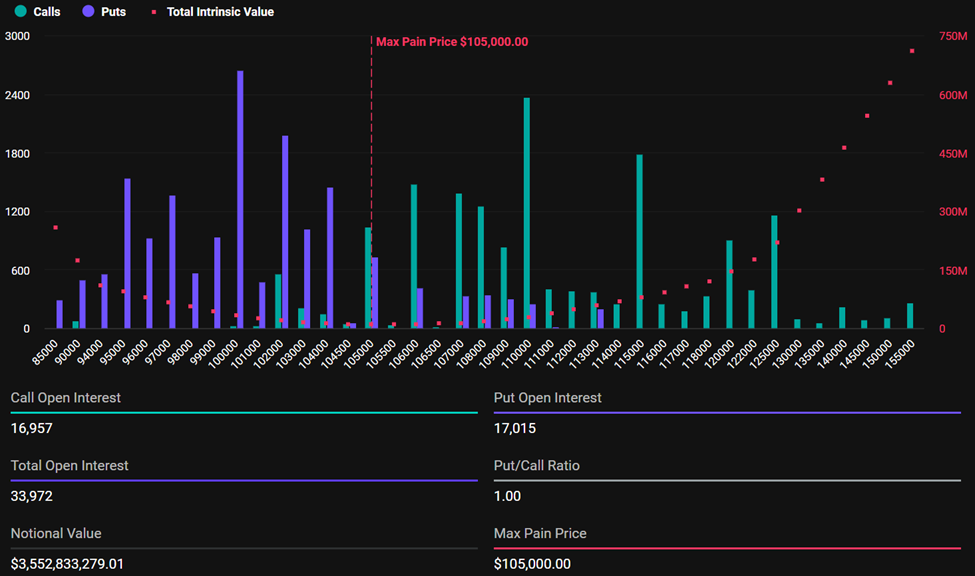

Expiring Bitcoin Options. Source: Deribit

For Bitcoin, the expiring options have a maximum pain price of $105,000 and a put-to-call ratio of 1.00. This indicates traders might be equally divided between bearish (buying puts) and bullish (buying calls) outlooks.

It reflects uncertainty or a consolidation phase in the market, aligning with BeInCrypto’s recent report on Bitcoin’s resilience amid geopolitical tension. The pioneer crypto remains range-bound, with institutional support and low volatility bolstering its position.

Nevertheless, the call and put open interests indicate a slight lean toward puts, hinting at mild bearish sentiment or hedging.

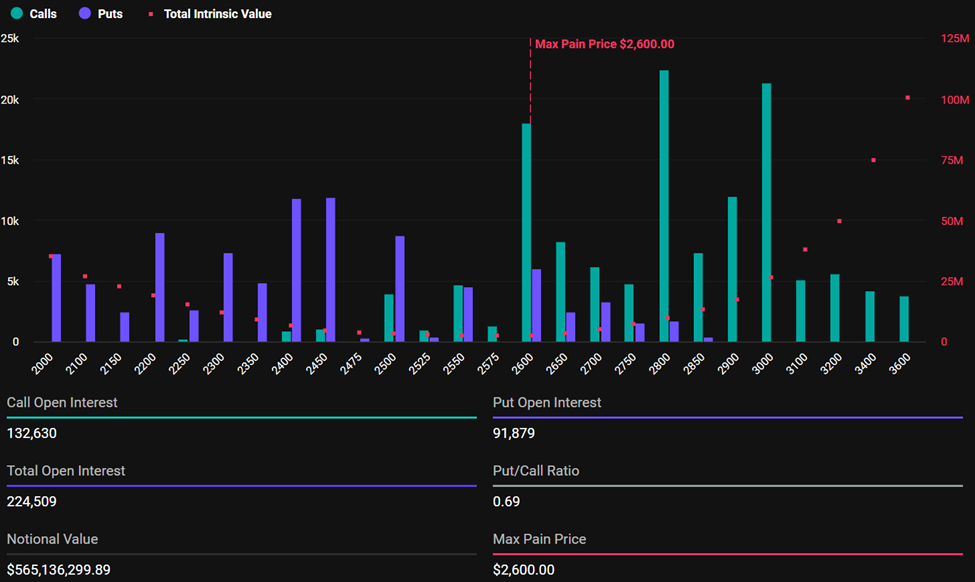

In comparison, their Ethereum counterparts lean bullish with a put-to-call ratio of 0.69 and a maximum pain price of $2,600.

Expiring Ethereum Options. Source: Deribit

The maximum pain point is a crucial metric that often guides market behavior. It represents the price level at which most options expire worthless, inflicting maximum financial “pain” on traders.

Traders and investors should brace for volatility, as options expirations often cause short-term price fluctuations, which create market uncertainty. Based on the Max Pain Theory, asset prices tend to gravitate toward their respective max pain or strike prices.

Ethereum, trading below its max pain level at $2,506 as of this writing, means a bullish outlook and explains the call options as traders bet on price increases. On the other hand, though also below its max pain level, Bitcoin shows more balanced positioning with a put-to-call ratio of 1.0.

“BTC shows more balanced positioning near max pain, while ETH flows tilt bullish with calls dominating up the curve. How will the market respond this time?” analysts at Deribit posed.

However, markets usually stabilize soon after traders adapt to the new price environment. With today’s high-volume expiration, traders and investors can expect a similar outcome, potentially influencing crypto market trends into the weekend.

Geopolitical Risks and Fed Outlook Weigh on Sentiment

Elsewhere, analysts at Greeks.live note that market sentiment among crypto derivatives traders has turned notably bearish in the short term. This comes after the Federal Reserve Chair Jerome Powell’s latest FOMC statement.

The trading group is broadly positioning for downside risk through July, while maintaining long-term optimism into the fourth quarter (Q4).

“Traders are running negative delta for July positions while planning to add positive deltas for Q4,” Greeks.live wrote in a post.

Geopolitical tensions, particularly the rising risk of US involvement in the Middle East, are emerging as the dominant short-term catalyst. Several traders are reportedly positioning long puts ahead of potential US involvement and Iran tensions, hedging against a further market downturn.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.