Bitcoin Slides From $126,000 Peak as Market Eyes Whether Uptober Rally Can Last

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

After reaching a new all-time high of over $126,000 earlier this week, Bitcoin’s (BTC) price has slipped slightly, raising questions about the sustainability of its recent rally.

Despite the slowdown in upward momentum, holder activity suggests the broader bullish phase remains intact. Yet, rising leverage hints at possible short-term turbulence.

ETF Flows and Accumulation Power Bitcoin’s Uptober Momentum

October is historically a strong month for Bitcoin. It saw the coin break through and reach highs over $126,000. Despite facing a correction, BTC has retained most of its gains, which exceed 7%, higher than September’s 5.16% appreciation.

According to the latest data from BeInCrypto Markets, the largest cryptocurrency traded at $122,151, up 0.38% over the past day.

While seasonality has contributed to the positive momentum, Glassnode highlighted that institutional interest played a key role in BTC’s latest milestones. According to Glassnode’s latest report, spot Bitcoin ETFs attracted over $2.2 billion within one week, one of the strongest inflows since April.

“This renewed institutional participation has absorbed available spot supply and strengthened overall market liquidity. Seasonally, Q4 has historically been Bitcoin’s strongest quarter, often coinciding with renewed risk appetite and portfolio rebalancing,” the report read.

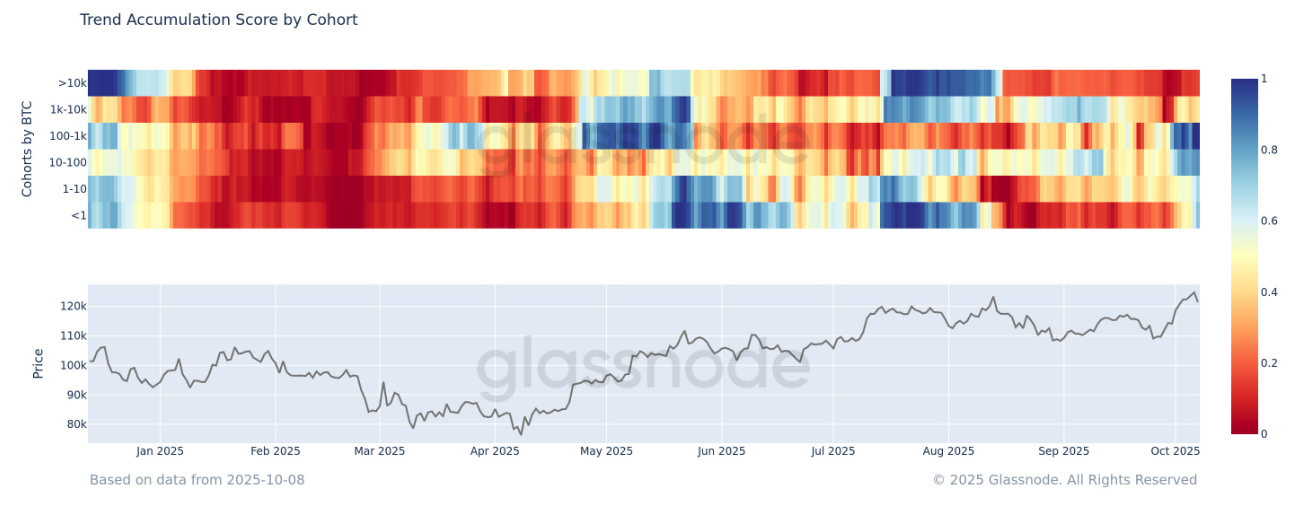

In addition, buying activity was persistent among small and medium wallets (10–1,000 BTC). The Trend Accumulation Score showed accumulation from this cohort over the past few weeks.

“The alignment among mid-tier holders points to a more organic accumulation phase, adding structural depth and resilience to the ongoing rally,” Glassnode added.

The report revealed that daily spot trading volumes have also surged to their highest levels since April, signaling increased market participation and deeper liquidity amid the price breakout.

Notably, Glassnode highlighted that despite 97% of BTC supply being in profit, the slow pace of profit-taking has maintained the uptrend. The firm reported that Bitcoin’s Sell-Side Risk Ratio has risen, though it remains well below levels seen at market tops, indicating controlled selling.

“While rising LTH-to-exchange transfers signal selling pressure, scale and persistence are what matter most. The current increase looks like healthy profit realization within a still-bullish structure. Not euphoria yet,” Bitcoin Vector added.

Can Bitcoin Stay Strong Amid Rising Risks?

Meanwhile, options market data further supports a bullish tilt, with implied volatility rising for end-October expiries and call-heavy flows dominating, reflecting heightened optimism. However, risks remain. Elevated leverage in derivatives markets and crowded positioning could amplify short-term corrections.

“While momentum remains strong and sentiment remains constructive, positioning has become more crowded, suggesting that near-term volatility could remain elevated as markets digest this renewed optimism,” Glassnode stated.

Despite this, the report pointed out that the $117,000 to $120,000 range has emerged as key support. Approximately 190,000 BTC changed hands in this region. Thus, even if BTC drops, the level could attract buyers again. According to Glassnode,

“While price discovery phases inherently carry the risk of exhaustion, a potential pullback into this region could invite renewed demand as recent buyers defend profitable entry zones, marking a key area to watch for stabilization and a resurgence of momentum.”

Overall, Bitcoin’s Q4 setup appears constructive with institutional demand, organic accumulation, and renewed spot participation, but profit-taking and leverage resets may shape short-term volatility before the next leg higher.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.