Michael Saylor Hints at New Bitcoin Purchases As BTC Eyes an All-Time High

- Bitcoin Drops to $70,000. U.S. Government Refuses to Bail Out Market, End of Bull Market or Golden Pit?

- Gold rallies further beyond $5,050 amid flight to safety, dovish Fed expectations

- Bitcoin Bottom Debate: $70,000 or $50,000?

- A Crash After a Surge: Why Silver Lost 40% in a Week?

- Bitcoin Slips Below 75,000 Mark. Will Strategy Change Its Mind and Sell?

- Bitcoin Rout. Bridgewater Founder Dalio Publicly Backs Gold.

Michael Saylor, executive chairman of Strategy (formerly MicroStrategy), has suggested the firm may be preparing for another significant Bitcoin purchase.

His hint comes as Bitcoin gains fresh upward momentum, crossing the $100,000 threshold for the first time in months.

Strategy’s Growing Bitcoin Bet

On May 11, Saylor posted a screenshot of the company’s Bitcoin portfolio tracker on the social media platform X, accompanied by the phrase “connect the dots.”

Although brief, the post follows a familiar pattern of Saylor using cryptic messages ahead of official announcements. These messages typically indicate that the firm is preparing to add more BTC to its balance sheet.

According to the Saylor Tracker platform, Strategy now holds 555,450 BTC, currently valued at more than $58 billion. This makes the firm the largest corporate holder of the top crypto globally.

Strategy’s Bitcoin Purchases. Source: Saylortracker

Meanwhile, Strategy’s bold Bitcoin approach has influenced several other firms to follow suit.

For context, Japan’s Metaplanet, which now holds over 5,000 BTC, has earned comparisons to MicroStrategy in Asia. The firm recently launched a US-based unit to scale its Bitcoin strategy beyond regional borders.

At the same time, competition is intensifying in the US corporate Bitcoin space. Leading banking giant Cantor Fitzgerald, in partnership with stablecoin issuer Tether, has launched a joint $3 billion initiative to build a dedicated Bitcoin treasury firm.

Elsewhere, Vivek Ramaswamy’s Strive has merged with Asset to create another contender in the space.

Bitcoin Crosses $104,000 as Market Optimism Builds

Strategy’s hinted purchase comes amid Bitcoin’s 10% surge during the past week, which pushed it above $100,000 for the first time since February.

As of press time, BTC trades at approximately $104,621, just 4% below its January all-time high of $109,021.

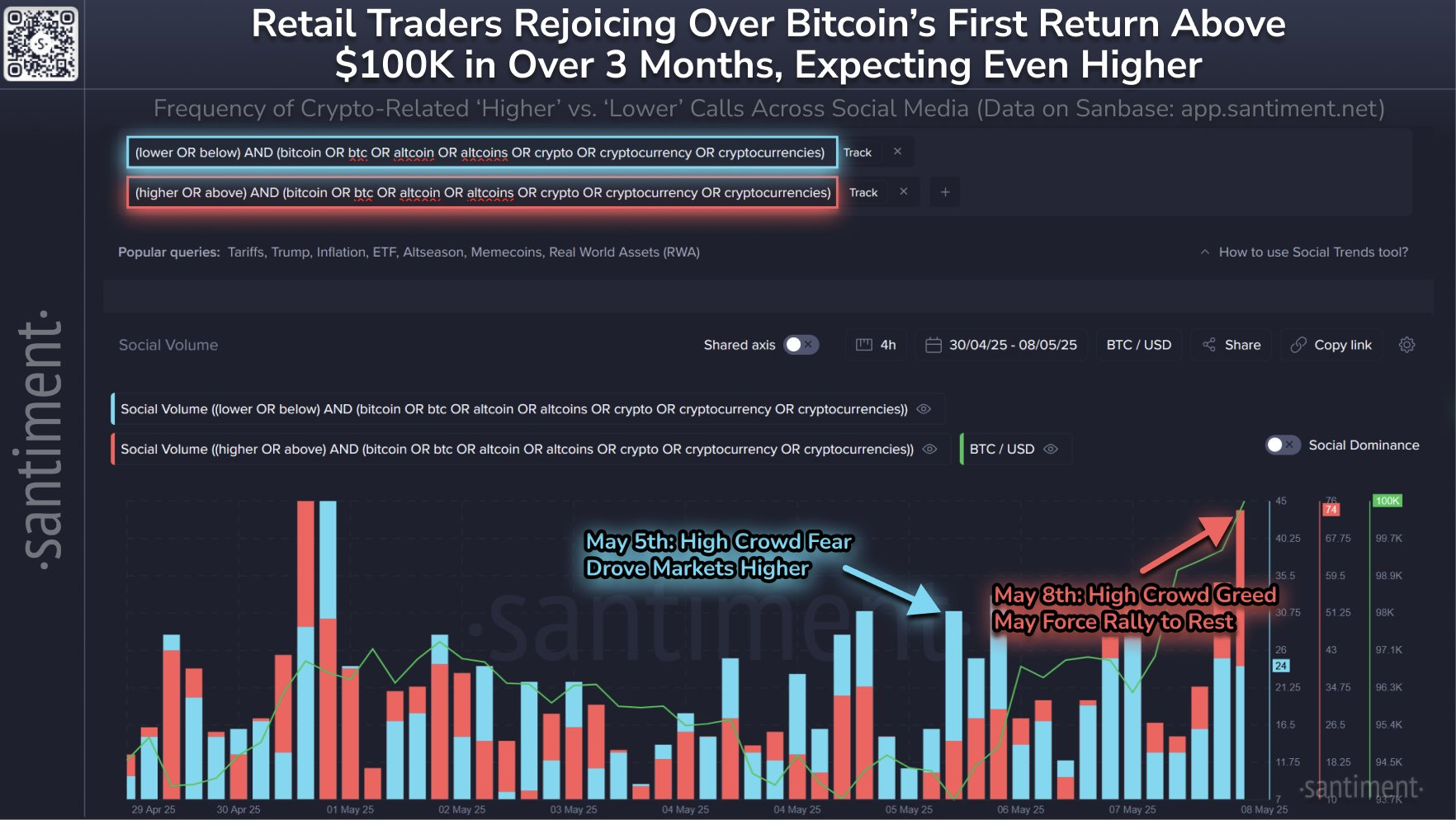

Market analysts at Santiment pointed out that current market sentiment is strongly bullish, which could result in a short-term correction. They note that heavy retail enthusiasm and media hype often coincide with local market tops.

“With Bitcoin breaching the all-important $100K psychological resistance for the first time since Feb. 3rd. Sentiment is quite bullish at the moment, which can be a double-edged sword for upcoming price movement from here,” Santiment noted.

Bitcoin Market Sentiment. Source: Santiment

Still, Saylor remains confident in the top asset’s long-term value. According to him, Bitcoin should already be trading at $150,000 if not for the recent selling pressure, which reflects short-term holders taking profits.

Nevertheless, he expects long-term investors to continue driving the rally forward in the weeks ahead.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.