Bitcoin (BTC) Eyes a Breakout Towards $100,000 as Whale Accumulation Surges

- Gold rises to near $5,150 as Trump’s tariffs boost haven demand, US-Iran talks eyed

- Top 3 Price Prediction: BTC breakdown hints at deeper correction as ETH and XRP extend losses

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Gold climbs above $5,200 on geopolitical tensions, trade uncertainty

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Oil prices rise as US and Iran extend talks into next week

Bitcoin (BTC) is up nearly 5% over ten days and is currently attempting to reclaim the $90,000 level. The recent uptick in whale activity, combined with strong technical indicators, is fueling optimism about a potential breakout.

Bullish patterns across both Ichimoku Cloud and EMA structures suggest the market may be gearing up for a move higher. As momentum builds, traders are watching closely to see if BTC can push toward the $100,000 mark in the coming weeks.

BTC Whales Reached Its Highest Level Since December 15

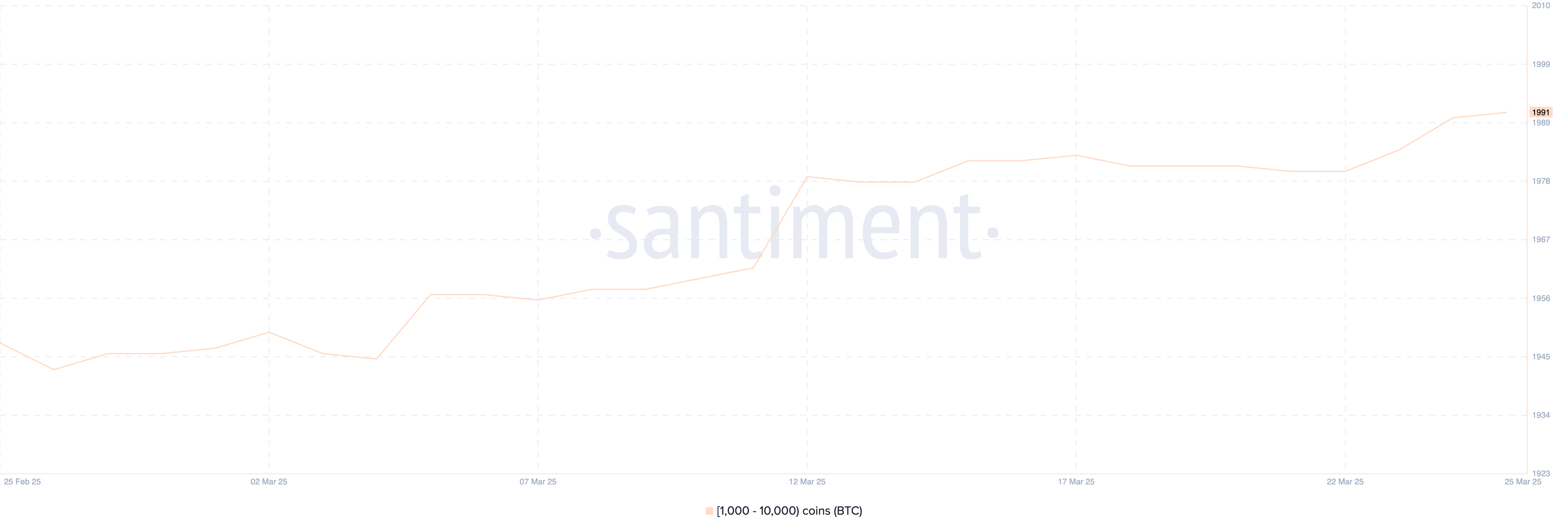

The number of Bitcoin whales—wallets holding between 1,000 and 10,000 BTC—increased from 1,980 on March 22 to 1,991 on March 25, marking the highest count since December 15.

Although modest, this rise is significant as it reflects renewed accumulation by large holders after more than three months of subdued activity.

Tracking whale wallets is crucial because these large players often move markets; their accumulation or distribution patterns can serve as early signals of broader sentiment shifts or major price moves.

Bitcoin Whales. Source: Santiment.

Bitcoin Whales. Source: Santiment.

Whales are typically considered “smart money,” and when their numbers rise, it often suggests increased confidence in the market’s near-term outlook.

Although the growth rate of new whales has slowed in recent days, the fact that their count has reached a multi-month high signals underlying strength.

It could imply that institutional or high-net-worth investors are positioning themselves ahead of a potential bullish move, adding weight to Bitcoin’s current support levels and possibly paving the way for further upside if momentum continues.

Bitcoin Ichimoku Cloud Paints A Good Momentum

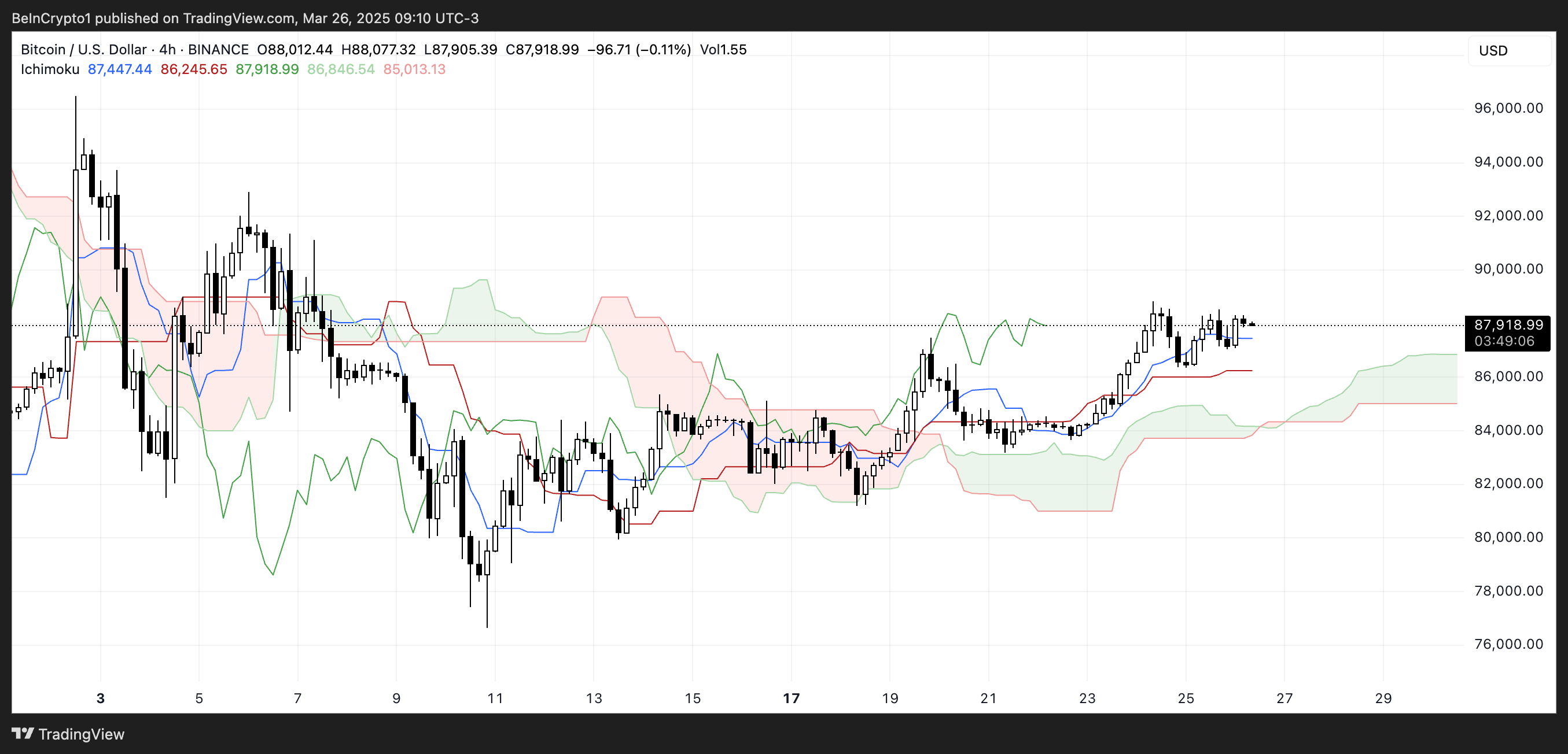

Bitcoin’s Ichimoku Cloud chart is showing a bullish structure, with price action clearly above the cloud and the cloud itself turning green and rising ahead.

The Tenkan-sen (blue) is above the Kijun-sen (red), indicating that short-term bullish momentum is still in play. However, the two lines have started to flatten, suggesting a possible pause or consolidation.

BTC Ichimoku Cloud. Source: TradingView.

BTC Ichimoku Cloud. Source: TradingView.

The future cloud (Kumo) is wide and sloping upward, which signals solid underlying support and growing trend strength. Additionally, the Chikou Span (lagging line) is positioned well above past price action, further confirming bullish sentiment.

While there may be some sideways movement in the short term, the overall Ichimoku setup continues to favor the bulls unless a breakdown below the cloud shifts the outlook.

Will Bitcoin Rise Back To $100,000 In April?

Bitcoin’s EMA lines are aligning for a potential golden cross, which could signal the start of a fresh bullish phase. If this crossover happens and Bitcoin price manages to break the resistance at $88,807, it could trigger a move toward $92,928.

A strong continuation of the uptrend might then send Bitcoin to test $96,503 and $99,472, with a possible breakout above $100,000 if momentum accelerates.

BTC Price Analysis. Source: TradingView.

BTC Price Analysis. Source: TradingView.

On the other hand, if Bitcoin fails to break above $88,807 and faces a trend reversal, it could pull back to test the support at $84,736. A break below that level could lead to further downside toward $81,162.

If selling pressure continues, BTC might even revisit $79,970 and $76,644, potentially falling back below the $80,000 mark.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.