- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Senate to vote on Trump’s pro-Bitcoin Fed pick as BTC hits four-week high

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Oil prices rise as US and Iran extend talks into next week

- WTI Price Forecast: Retreats from seven-month top, still well bid near $71.00 mark

Gold benefits from tailwinds and rallies on the back of tariff headlines.

US yields tick up after a drop in inflation triggers flight to equities.

Traders have to deal with changes in trade wars and knee-jerk reactions.

Gold’s price (XAU/USD) is back on its way to new all-time highs after the United States (US) Consumer Price Index (CPI) data came in softer than expected on Wednesday, which triggered a sigh of relief in US markets with odds for a recession or stagflation being trimmed. This in turn caused an outflow in US bonds and an inflow in US equities, with the sell-off in bonds sparking a boost in yields. The precious metal trades around $2,950 at the time of writing on Thursday.

Meanwhile, traders are still trying to oversee the amount of geopolitical headlines taking place. US President Donald Trump commented on Wednesday that the US will impose reciprocal tariffs on Europe coming into effect on April 2. On the other hand, US diplomats are on their way to Russia to negotiate a ceasefire deal that already got support from Ukraine and bears US military support for the country.

Daily digest market movers: Sigh short-lived

US Consumer Price Index figures for February rose at the slowest pace in four months, and traders are fully pricing in another quarter-point interest-rate cut by the Federal Reserve in June’s meeting. Lower borrowing costs tend to benefit Gold, as the precious metal doesn’t pay interest, Bloomberg reports.

Gold is set to push to a record above $3,100 in the second quarter of 2025 on rising economic uncertainty due to US President Donald Trump’s tariff policies, according to BNP Paribas SA, Reuters reports.

A worsening US budget outlook is signaling inflation could increase, which would benefit Gold as a hedge, according to Macquarie Bank, which calls for a $3,500 level by the third quarter of 2025, Bloomberg reports.

The CME Fedwatch Tool sees a 97.0% chance for no interest rate changes in the upcoming Fed meeting on March 19. The chances of a rate cut at the May 7 meeting currently stand at 39.5%.

Technical Analysis: Gold pushing higher

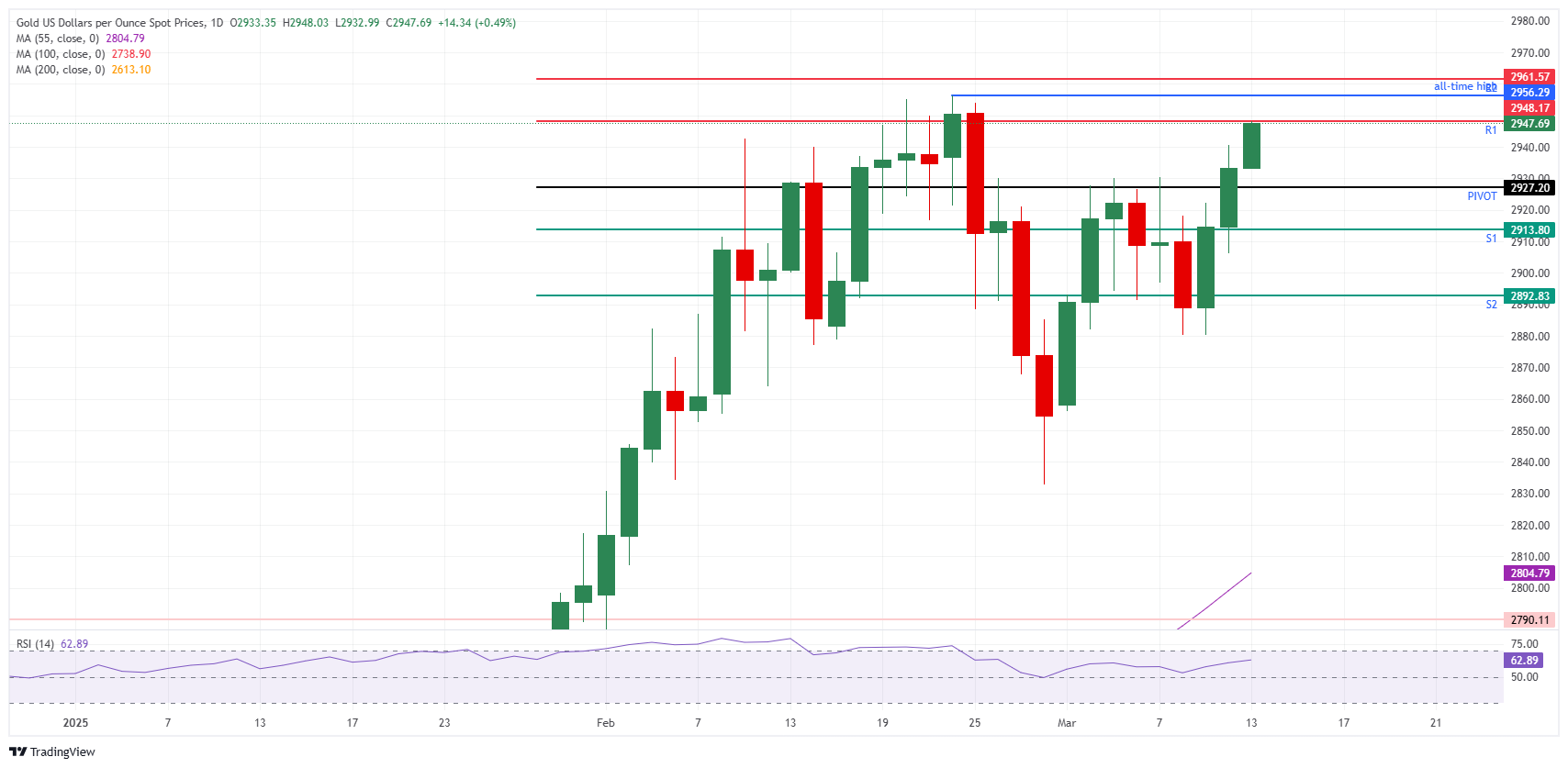

Gold is currently knocking on the door of the intraday R1 resistance level at $2,947 at the time of writing on Thursday. The move comes in a bit contradictory, seeing that US yields rallied higher on Wednesday after a softer US CPI release. The move can be explained by the fact that equities saw inflows from the outflow in US bonds, which pushed yields higher. The sigh of relief is quickly fading on Thursday, with markets focusing again on tariffs, Ukraine, and a possible recession or stagflation in the US.

Gold is heading to $2,950, roughly coinciding with the R1 resistance at $2,947. Once through there, the intraday R2 resistance at $2,961 comes into focus, meaning that the previous all-time high of $2,956 is broken.

On the downside, the daily Pivot Point stands at $2,927. In case that level breaks, look at the S1 support around $2,913. Further down, the S2 support stands at $2,892, though the $2,900 big figure should be strong enough to catch any corrections.

XAU/USD: Daily Chart

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.