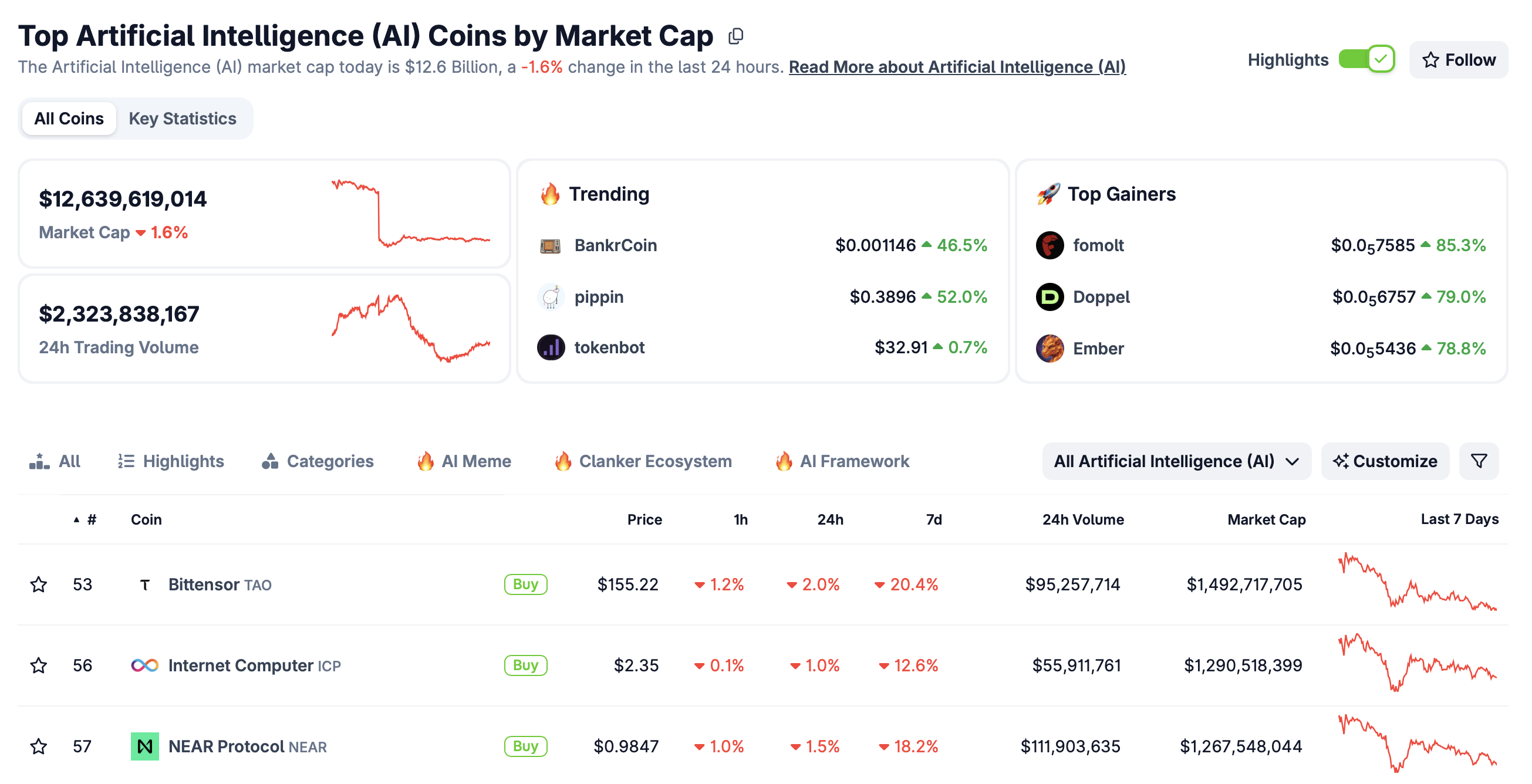

AI Crypto Update: BankrCoin, Pippin surge as sector market cap steadies above $12B

- The AI crypto segment’s market capitalisation stabilises above $12.6 billion amid an extended sell-off.

- BankrCoin is in focus as its price increases in double digits despite lethargic sentiment in the broader crypto market.

- Pippin nears $0.4162 resistance, supported by a robust short-term technical structure.

The Artificial Intelligence (AI) segment is largely on the back foot with major coins such as Bittensor (TAO) and Internet Computer (ICP) extending losses amid a sticky risk-off sentiment.

Meanwhile, little-known coins such as BankrCoin (BNKR) and Pippin (PIPPIN) are in focus as investors expand their scope for emerging opportunities. Pippin is up over 45% and trading at $0.3998 while BNKR holds above $0.00100, up over 22% intraday.

The AI segment’s market capitalisation remains above $12.6 billion, down 1.6% over the past 24 hours. Bittensor, the leading AI coin, hovers at $155, down 20% over the last week. Internet Computer also trades under pressure at $2.35, down over 12% in the past seven days.

BankrCoin eyes higher support as retail interest soars

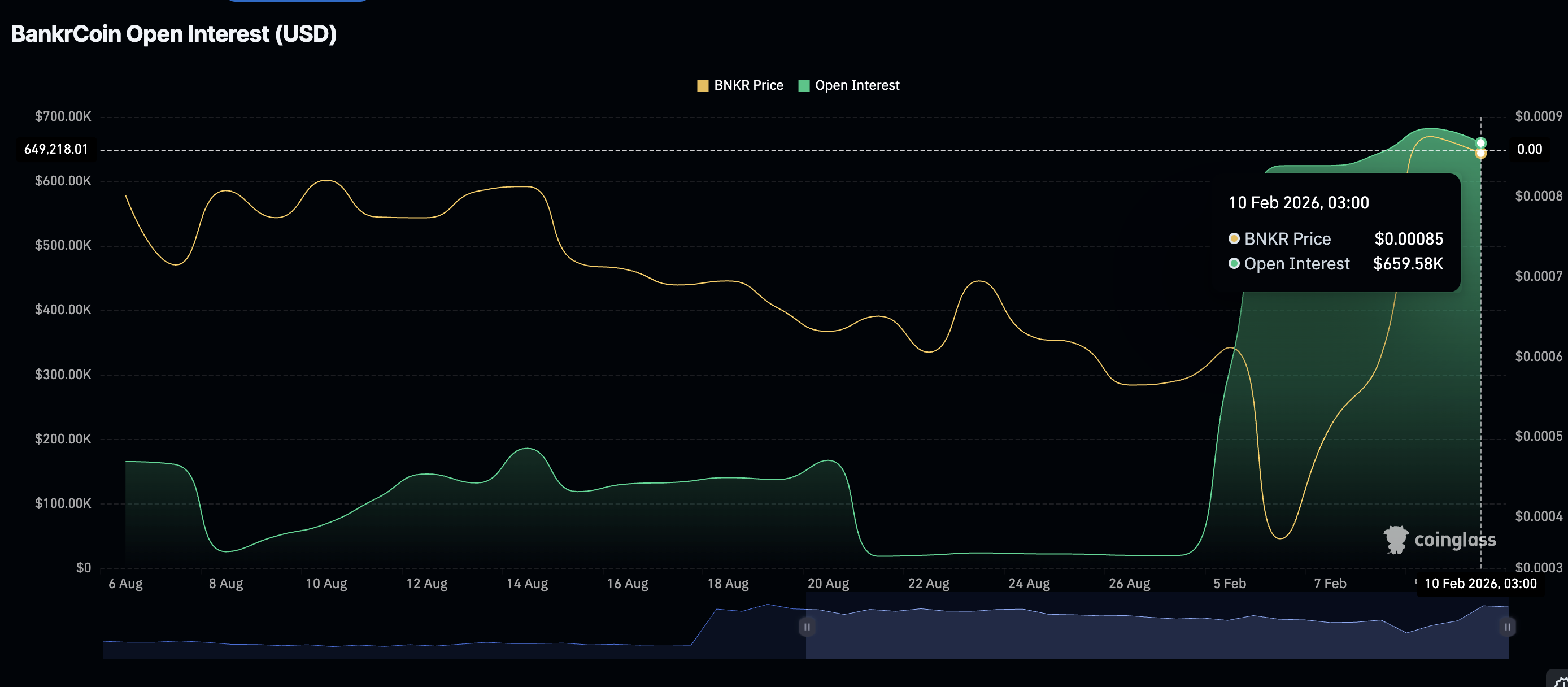

BankrCoin holds above $0.00100 after rising to an intraday high at $0.001233, supported by growing retail interest. The derivatives market reflects the surge in futures Open Interest (OI), which averages $660,000 on Tuesday, slightly below the record $682,000 on Monday.

A further increase in the OI suggests that traders re confidence in BNKR’s ability to sustain the rally, prompting them to increase risk exposure.

Meanwhile, the Moving Average Convergence Divergence (MACD) indicator remains above the signal line, proving supporting for BNKR’s short-term bullish outlook. The expanding green histogram bars suggest that momentum favours the bulls. Key targets include the intraday high at $0.001233 and the price discovery phase beyond the same level.

Still, the Relative Strength Index (RSI) at 70 on the same chart suggests caution for traders, as overbought conditions may indicate that buying pressure is overextended. A correction below the immediate $0.00100 support accelerates BNKR’s correction to $0.00095, last tested earlier in the day.

What's next as Pippin posts double-digit gains

Pippin trades near its intraday high of $0.4024, as bulls tighten their grip. The AI token holds above a descending trendline, highlighting support at $0.3000.

A robust technical structure supports the token’s short-term bullish outlook, starting with the MACD indicator, which remains well above its signal line. The green histogram bars expanding above the zero line prompt traders to lean into risk despite the oversold RSI at 82.5 on the daily chart.

Bulls should seek support above $0.4000 to uphold the bullish thesis and increase the odds of the rally extending above the next hurdle at $0.4162. Other key milestones include $0.4500 and the record high at $0.5535.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.