Bitcoin Weekly Forecast: BTC ends Q2 with 30% gains, Standard Chartered eyes $200K by year-end

- Bitcoin price trades just below $109,000 on Friday after breaking out of a consolidation range.

- BTC wraps up Q2 with nearly 30% quarterly gain and Standard Chartered's predicts Bitcoin at $200,000 by year-end.

- BTC demand remained robust as corporate accumulation rose and spot ETFs recorded a total of $769.60 million until Thursday.

Bitcoin (BTC) closed a strong second quarter (Q2), recording nearly 30% in quarterly gains amid rising corporate and institutional demand and bullish market sentiment. At the time of writing on Friday, BTC trades slightly lower, below $109,000, after breaking out of a consolidation phase earlier in the week. The bullish outlook remains strong, with Standard Chartered reports predicting that Bitcoin could reach $200,000 by year-end. Meanwhile, corporate accumulation and institutional demand remained strong throughout the week, suggesting that BTC could rally toward its record highs.

Bitcoin’s Q2 return was nearly 30%, experts project $200,000 BTC by year-end

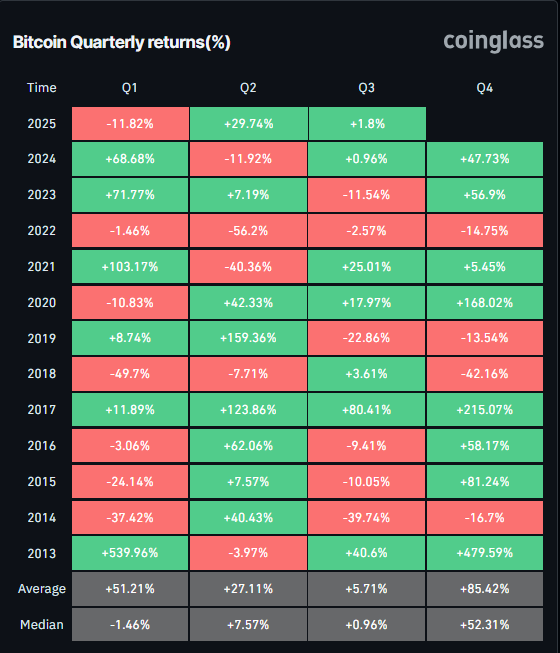

BTC’s Q2 returns were positive, at 29.74%, higher than its average Q2 returns and marking the best second quarter since 2020, fueled by rising demand and favorable risk-on sentiment conditions.

BTC Quarterly returns (%) chart. Source: Coinglass

Standard Chartered's Global Head of Digital Assets Research, Geoffrey Kendrick, predicted that Bitcoin could reach $135,000 by late 2025 and potentially even $200,000 by year-end.

Corporate and institutional demand remains robust

Bitcoin price has been supported by rising corporate and institutional demand this week. At the start of this week, on Monday, Strategy announced that it added 4,980 BTC and is holding a total of 597,325 BTC. On the same day, Japanese investment firm Metaplanet announced that it had purchased an additional 1,005 BTC, bringing the total holding to 13,350 BTC. Moreover, the Blockchain Group confirmed the acquisition of 60 BTC, and the firm holds a total of 1,788 BTC.

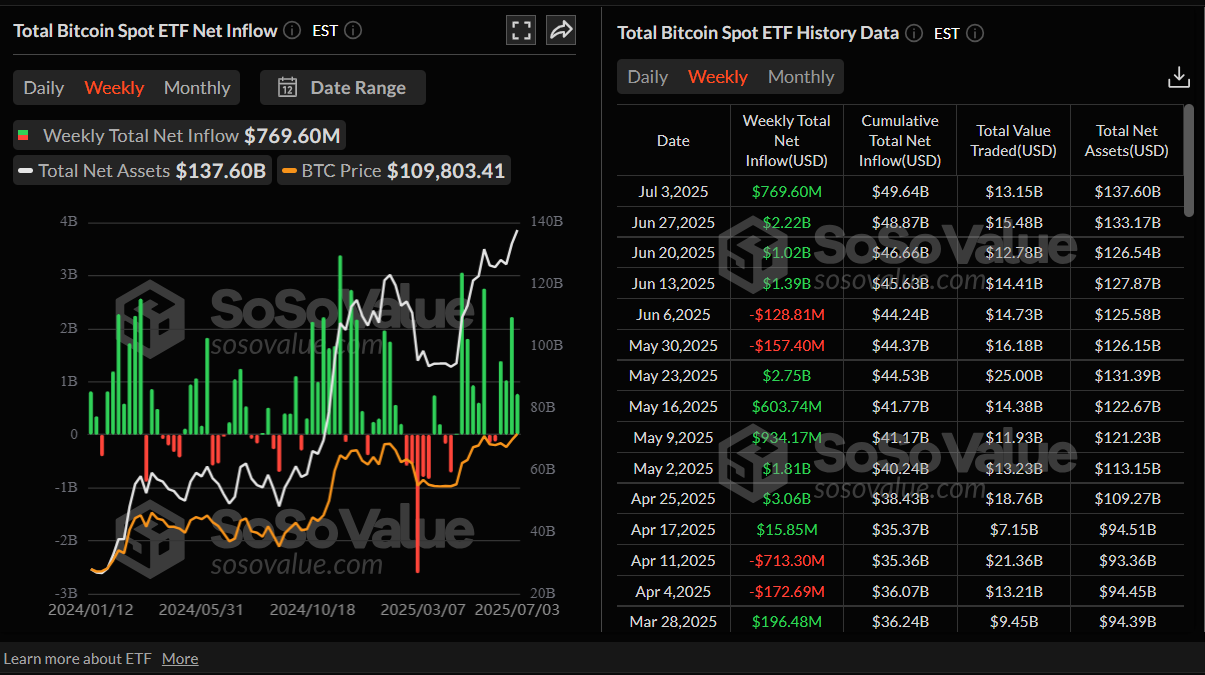

Apart from the robust corporate demand, institutional demand also supported BTC. SoSoValue data shows that spot Bitcoin Exchange Traded Funds (ETFs) have recorded a total of $769.60 million inflows until Thursday, marking the fourth consecutive weekly increase since mid-June.

Total Bitcoin spot ETF net inflow weekly chart. Source: SoSoValue

Trade uncertainty looms over risky assets

US President Donald Trump announced on Wednesday that the United States struck a trade agreement with Vietnam that would ease certain tariffs previously imposed on Vietnamese goods. As part of the deal, a 20% tariff on goods imported from the Southeast Asian nation will be eliminated, and the US will gain tariff-free access to Vietnam’s markets.

Moreover, on Thursday, Bloomberg reported that the Trump administration lifted recent export license requirements for chip design software sales in China as Washington and Beijing implement a trade deal to ease some restrictions on critical technologies for both countries. These easing restrictions and trade deals boosted investors' confidence and supported riskier assets, such as Bitcoin, during the first half of this week.

However, late on Thursday, Trump’s One Big Beautiful Bill (OBBB) cleared its final hurdle in Congress, and President Trump aims to finalize the budget bill by Friday.

Adding to this news, Reuters reported that Trump said, “I will begin sending letters on trade tariffs starting Friday.” He stated that he planned to send letters to 10 countries at a time, outlining proposed tariff rates ranging from 20% to 30%.

Traders should be cautious and keep an eye on the tariff pause, as it is set to expire on July 9 and triggering uncertainty among investors. More countries are pushing to secure a tariff-reducing deal ahead of Trump's July 9 deadline, which could bring volatility spikes in BTC.

Macroeconomic data pauses BTC rally

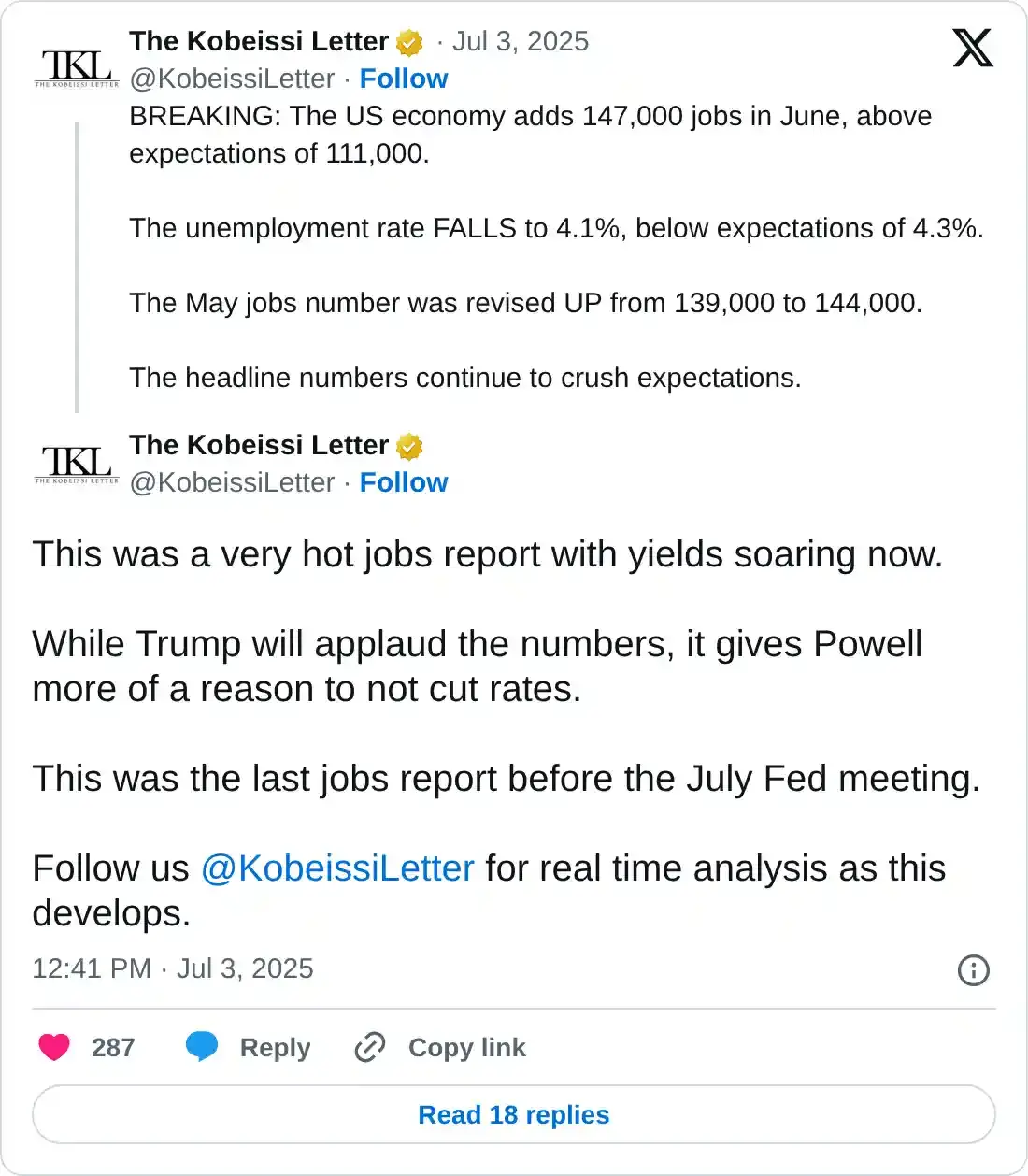

Bitcoin's ongoing rally paused during the second half of the week as the US Bureau of Labor Statistics (BLS) reported on Thursday that the economy added 147,000 new jobs in June, compared to the upwardly revised reading of 144,000 in the previous month and the 110,000 expected.

Moreover, the Unemployment Rate edged lower to 4.1% from 4.2% in May, pointing to a still resilient US labor market.

The Kobeissi Letter reported that “While Trump will applaud the numbers, it gives Powell more of a reason to not cut rates.”

The topline beat gives the Federal Reserve (Fed) space to stick to its wait-and-see approach amid the uncertainty stemming from US President Donald Trump's trade policies. This, in turn, pushed the US Dollar (USD) to a fresh weekly high, triggering a slight bearish sentiment for riskier assets, such as BTC.

Crypto regulation clarity in the upcoming weeks

US Republican House leaders announced on Thursday that the week of July 14 will be “Crypto Week.”

House Finance Committee Chair French Hill, House Agriculture Committee Chair Glenn Thompson and Speaker Mike Johnson would review the CLARITY Act, the Anti-CBDC Surveillance State Act, and the Senate’s GENIUS Act from July 14 to July 18.

“After years of dedicated work in Congress on digital assets, we are advancing landmark legislation to establish a clear regulatory framework for digital assets that safeguards consumers and investors, provides rules for the issuance and operation of dollar-backed payment stablecoins, and permanently blocks the creation of a Central Bank Digital Currency (CBDC) to safeguard Americans’ financial privacy,” said Chairman Hill.

This “Crypto Week” could bring more regulatory clarity to the future of stablecoins and the broader crypto market. Clear and more crypto-friendly regulations in the US could boost the overall cryptocurrency industry.

Will BTC refresh its record highs?

Bitcoin price broke and closed above the upper boundary of a consolidation zone at $108,355 on Wednesday, rallying 3.64% by Thursday. At the time of writing on Friday, it trades slightly lower below $109,000.

If BTC continues its upward momentum and $108,355 holds as support, it could extend the rally toward the May 22 all-time high at $111,980.

The Relative Strength Index (RSI) on the daily chart reads 57 after rebounding from its neutral level of 50 on Tuesday, indicating bullish momentum is gaining traction. The Moving Average Convergence Divergence (MACD) on the daily chart displayed a bullish crossover last week. It also shows rising green histogram bars above its neutral level, suggesting bullish momentum and indicating an upward trend.

BTC/USDT daily chart

However, if BTC faces a correction and closes below its support at $108,355, it could extend the decline to retest the lower boundary of the consolidation zone at $105,333.