Ondo Finance Price Forecast: ONDO fails to extend gains despite a $250 million deal with Pantera Capital

- Ondo Finance has entered into a $250 million deal with Pantera Capital to accelerate the tokenization of real-world assets.

- Open Interest and funding rates surge in Ondo derivatives as optimism sparks.

- The declining daily active address signals a slowdown in Ondo’s network.

Ondo Finance (ONDO) edges lower by over 3% at press time on Friday, reversing from a critical resistance trendline. Ondo announced a $250 million backing from Pantera Capital to support its catalyst initiative, focusing on real-world asset (RWA) tokenization.

Despite the sizable sponsorship, the uplifted sentiment in the derivatives market, as signaled by increased Open Interest, failed to translate into a surge in spot prices. The technical outlook suggests a slightly bearish stance as ONDO fails to break above a near two-month-long resistance trendline.

Pantera commits $250 million to boost RWA tokenization

Ondo Finance announced on Friday that Pantera Capital has committed $250 million to the Ondo Catalyst initiative. Pantera will support tokenizations of RWAs by independently evaluating and investing in projects. Meanwhile, Ondo’s Catalyst actions will help projects onboard their ecosystem.

Paul Veradittakit, the Managing Partner at Pantera Capital, said that “Tokenization of traditional financial assets is the largest shift in infrastructure since electronic trading, and Ondo is at the forefront of it with the right traction and partners.”

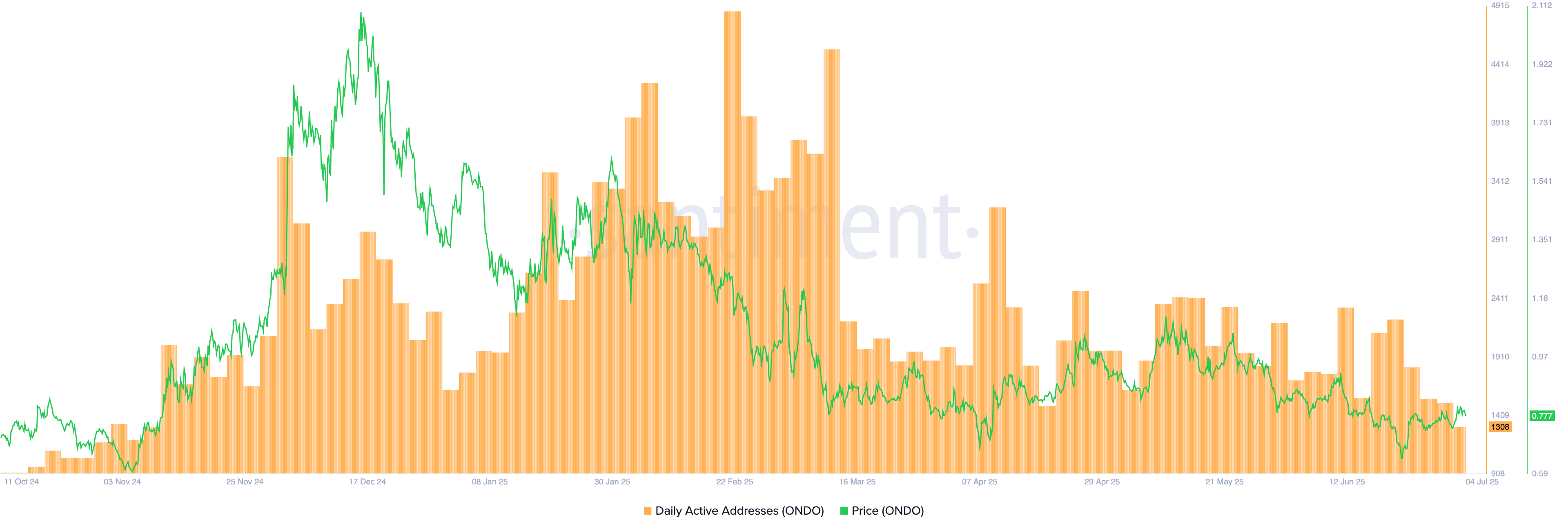

Declining active addresses flash network slowdown warning

The number of daily active addresses (DAA), which refers to unique addresses active on the network, is a key indicator of network strength. A surge in DAA is related to an increase in users on the platform, which could boost the native token’s demand and vice versa.

Santiment’s data shows 1308 DAA on Ondo so far this Friday, down from the 2331 DAA peak in mid-June. With the declining DAA trend, the Ondo network signals a slowdown.

Daily active addresses on ONDO. Source: Santiment

Optimism holds in ONDO derivatives

Coinglass’ data shows a 2.80% increase in the ONDO Open Interest (OI) over the last 24 hours, reaching $319.41 million. Typically, sidelined investors could perceive an OI spike as an optimism surge in the derivatives market due to increased buying activity.

Ondo derivatives data. Source: Coinglass

The OI-weighted funding rate stays positive at 0.0052%, paid by bulls to balance the spot and swap prices.

ONDO fails to surpass a key resistance trendline

Ondo depreciates by over 3% at press time on Friday, undermining the 1.50% growth from Thursday. Price action could complete an evening star pattern, a pattern that foreshadows a bearish reversal after a short-term recovery on the daily chart.

The evening star would form at a critical resistance trendline, obtained by connecting the highs of May 12 and June 11. As buyers fail to exceed the trendline, the declining trend could test the 23.6% Fibonacci retracement level at $0.7165, retraced from near the high of May 14 at $1.1348 to the June 22 low of $0.6216.

The Moving Average Convergence/Divergence (MACD) indicator reflects a hiccup in the uptrend as the intraday green histogram bar rising from the zero line drops slightly. Investors looking out for a sell signal could consider the MACD line crossing below its signal line a potential sign.

The Relative Strength Index (RSI) at 48 struggles to maintain a neutral stand as it reverses from the halfway point. The downtick in RSI signals a bearish tilt in trend momentum.

ONDO/USDT daily price chart.

However, a bullish daily close on Friday, extending gains from the previous day, would mark the breakout of the resistance trendline. In such a case, the uptrend could reach the 50% Fibonacci level at $0.8399.