Dogecoin and Shiba Inu Price Forecast: DOGE and SHIB show early signs of a bullish breakout

- Dogecoin and Shiba Inu hold support at key levels, hinting at a potential recovery.

- On-chain metrics for both meme coins show positive funding rates and dormant activity, reinforcing the bullish sentiment.

- The technical outlook points to possible double-digit gains for both meme coins ahead.

Dogecoin (DOGE) and Shiba Inu (SHIB) show early signs of a potential rally as both meme coins stabilize at key support levels. On-chain metrics for dog-themed meme coins show positive funding rates and dormant activity, reinforcing bullish sentiment. The technical outlook also supports the case for double-digit gains, setting the stage for renewed upward momentum in the dog-themed crypto duo.

Dog-based meme coins show a positive bias

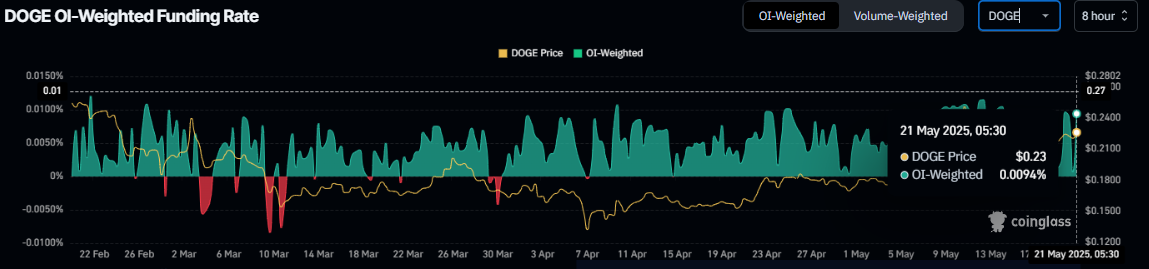

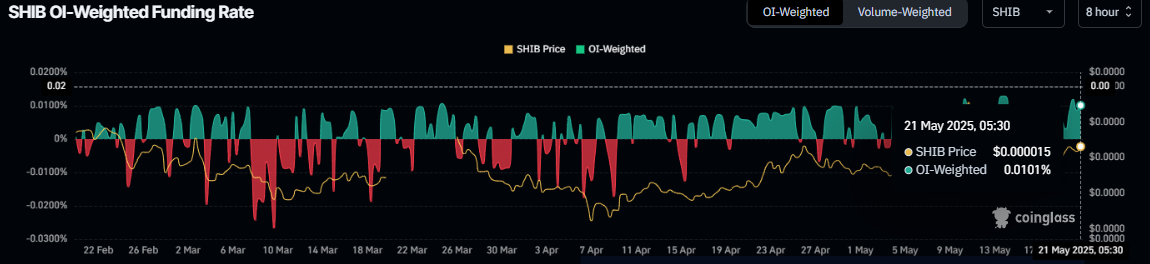

According to Coinglass’s OI-Weighted Funding Rate data, the number of traders betting that the prices of Dogecoin and Shiba Inu meme coins will slide further is lower than that anticipating a price increase.

This index is based on the yields of futures contracts, which are weighted by their Open Interest (OI) rates. Generally, a positive rate (longs pay shorts) indicates bullish sentiment, while negative numbers (shorts pay longs) indicate bearishness.

The metric stands at 0.0094% and 0.0101% for DOGE and SHIB, respectively, reflecting a positive rate and indicating that longs are paying shorts. This scenario often signifies bullish sentiment in the market, suggesting potential upward pressure on DOGE and SHIB prices.

DOGE OI-Weighted Funding Rate chart. Source: Coinglass

SHIB OI-Weighted Funding Rate chart. Source: Coinglass

On-chain data provider Santiment’s Age Consumed index projects a bullish outlook for these dog-themed memecoins. The spikes in this index suggest dormant tokens (tokens stored in wallets for a long time) are in motion, and it can be used to spot short-term local tops or bottoms.

In the case of DOGE and SHIB, history shows that the spikes were followed by a rise in these memecoin prices as holders. The most recent uptick on Tuesday also forecasted that these dog-themed meme coins were ready for an uptrend.

[10-1747805764576.12.26, 21 May, 2025].png)

DOGE Age Consumed chart. Source: Santiment

[10-1747805786086.07.27, 21 May, 2025].png)

SHIB Age Consumed chart. Source: Santiment

Dogecoin Price Forecast: DOGE bulls aim for 20% gains

Dogecoin price has retested multiple times, and support has been found around its 200-day Exponential Moving Average (EMA) at $0.21 since last week. At the time of writing on Wednesday, it trades above this support level at around $0.23.

If the 200-day EMA remains strong, DOGE could extend the rally by 20% from its current trading levels to retest the 50% price retracement level (drawn from the August 2023 low of $0.05 to the December 2024 high of $0.48) at $0.27.

The Relative Strength Index (RSI) on the daily chart reads 61, above its neutral level of 50, indicating bullish momentum.

DOGE/USDT daily chart

However, if DOGE breaks and closes below the 200-day EMA at $0.21, it would extend the correction to retest its next weekly support at $0.18.

Shiba Inu Price Forecast: SHIB aims for a 30% rally

Shiba Inu price has been retested, and support has been found around its 50-day EMA at $0.000013 since Saturday, hovering above it for the next three days. This level roughly coincides with the previously broken descending trendline (drawn by connecting multiple highs since mid-December) at $0.000014, making it a key support zone. At the time of writing on Wednesday, it trades at around $0.000014.

If the 50-day EMA remains strong, SHIB could extend the rally by 30% from its current level to retest its next daily resistance at $0.000019.

The RSI on the daily chart reads 61, above its neutral level of 50, indicating bullish momentum.

SHIB/USDT daily chart

However, if SHIB closes below $0.000013, it could extend the decline to retest its April 16 low of $0.000011.