Ripple Price Forecast: How liquidations, low retail demand, risk-off sentiment could shape XRP trading

- XRP holds $2.22 as bulls push to reclaim key support areas amid heightened volatility.

- XRP remains choppy amid low retail demand and traders piling into short positions, hindering recovery.

- XRP could extend its correction by 15% as a Death Cross pattern beckons.

Ripple (XRP) holds above $2.22 as bulls pare losses on Wednesday, following two consecutive days of declines. Despite bullish attempts to regain control, XRP is facing low retail demand amid deleveraging, liquidations amid risk-off sentiment in the broader cryptocurrency market.

A weak technical structure has made it difficult to hold onto gains, triggering a cascade of losses since XRP reached its record high of $3.66 in mid-July.

XRP remains topside heavy in a weakening derivatives market

The sell-off on Monday and Tuesday has left many investors counting losses, as reflected by the amount of liquidations in the derivatives market. According to CoinGlass data, approximately $29 million in long positions was liquidated on Monday alongside $3 million in shorts.

The selling pressure continued on Tuesday, liquidating over $36 million in long positions and $6 million in shorts. CoinGlass shows liquidations totaling $2 million in long positions and $1.5 million in shorts on Wednesday.

XRP liquidations stats | Source: CoinGlass

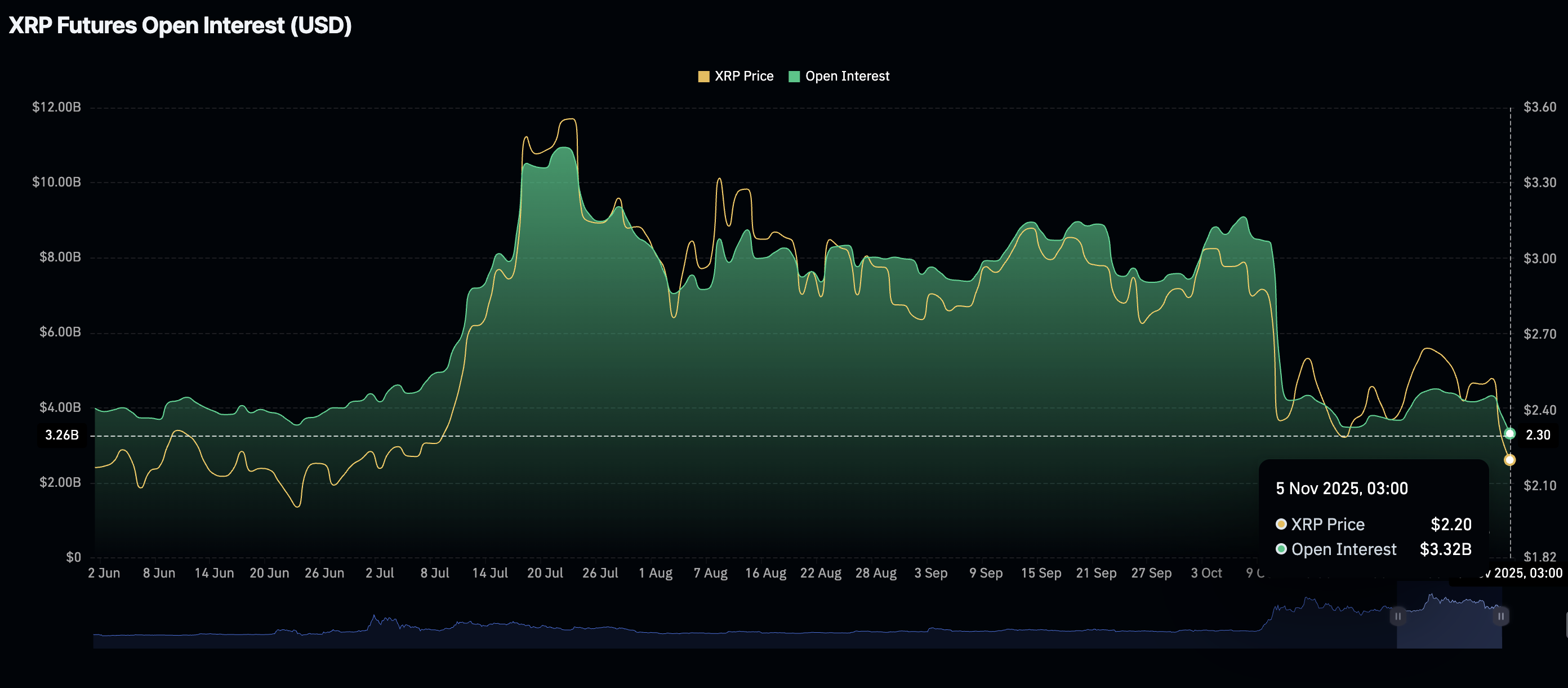

A sharp decline in futures Open Interest (OI) to $3.32 billion on Wednesday, from $4.33 billion on Monday and $9.09 billion on October 7, suggests that risk-off sentiment remains prevalent. Traders are likely staying on the sidelines due to a lack of conviction in XRP's ability to sustain recovery.

XRP Open Interest | Source: CoinGlass

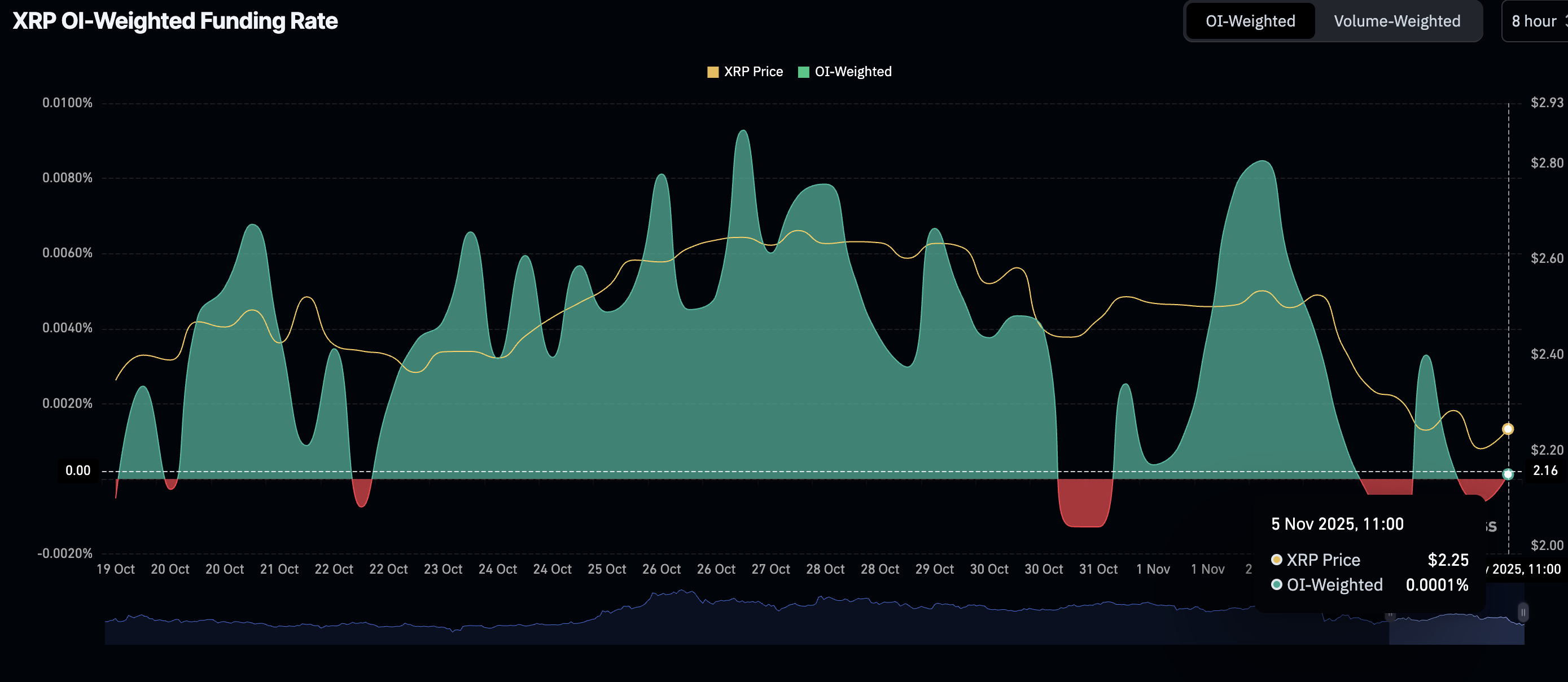

The OI-Weighted Funding Rate metric's erratic movements support the risk-off sentiment narrative. Currently, this metric averages 0.0001%, following a minor recovery from -0.0006 on Tuesday, indicating that traders are piling into short positions, leaving XRP vulnerable to selling pressure.

Technical outlook: XRP signals potential rebound

XRP is trading at around $2.22 at the time of writing on Wednesday, weighed down by headwinds in the broader cryptocurrency market. Traders are watching for a close above the short-term $2.22 support to usher in stability ahead of a potential recovery.

The Relative Strength Index (RSI) has recovered to 33 on the daily chart, signaling that bearish momentum is decreasing. Higher RSI readings indicate that sentiment is shifting from bearish to bullish, increasing the odds of a steady recovery toward the 200-day Exponential Moving Average (EMA) resistance at $2.59.

Still, traders should temper their bullish expectations due to an incoming Death Cross pattern in the same daily time frame. The 50-day EMA is moving toward a downward crossover with the 200-day EMA, which may further reinforce the bearish outlook.

The Moving Average Convergence Divergence (MACD) indicator on the daily chart has maintained a sell signal since Tuesday, encouraging investors to reduce their exposure. Red histogram bars below the mean line suggest overhead pressure remains apparent, and the downtrend could resume, targeting lows below $2.00.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.