Pi Network Price Forecast: PI extends reversal with ISO 20022 rumor resolved

- Pi Network extends the reversal from the 50-day EMA as buying pressure declines.

- A moderator from Pi Network clears up the ISO 20022 compliance as misinformation.

- Social chatter surrounding Pi Network fizzles, suggesting low interest as the broader market remains volatile.

Pi Network (PI) price is down 5% at press time on Monday, extending the reversal from the 50-day Exponential Moving Average (EMA) that occurred last week. The PI token risks further losses as a Pi Network moderator sets the record straight about the ISO 20022 rumor, urging users to wait for official statements from the Pi core team. Meanwhile, social chatter is down from last week’s high, suggesting a decline in interest among traders.

Social interest around PI declines as the ISO 20022 rumor resolves

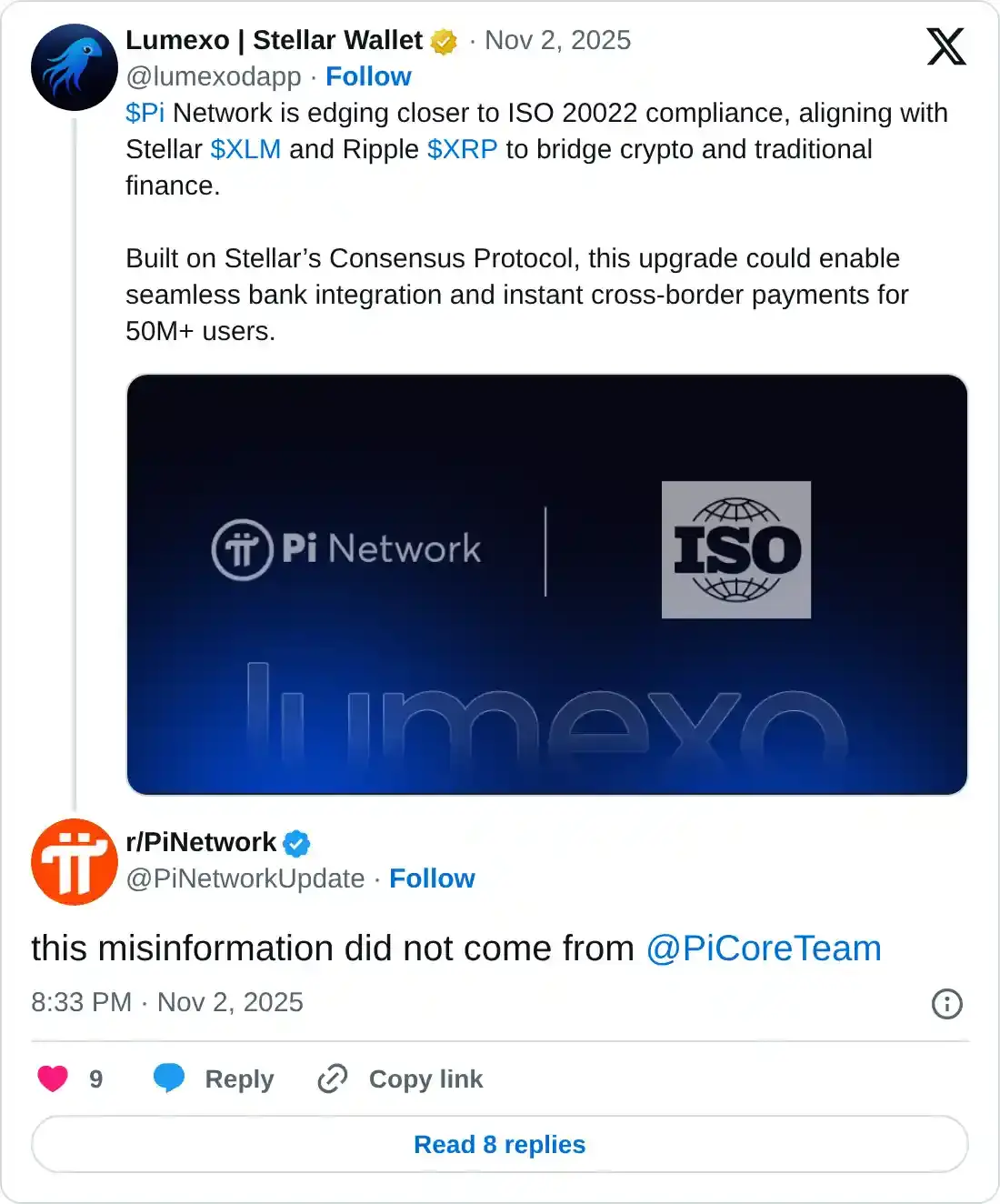

Lumexo, a Stellar-based wallet company, announced on Sunday that the Pi Network is nearing ISO 20022 compliance, an open global standard for financial messaging. The announcement provides an official outlet for the ISO 20022 compliance rumor, competing with blockchain-based cross-border remittance leaders like Ripple’s XRP and Stellar (XLM).

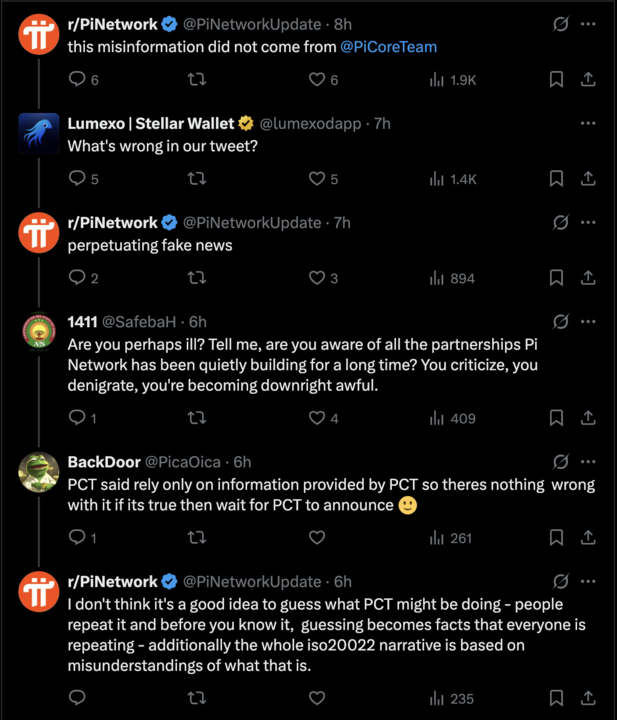

However, r/PiNetwork, a Pi Network moderator, replied in a dismissive tone, saying, “This misinformation did not come from @PiCoreTeam.” For users anticipating an official announcement coming later, the moderator said, “I don't think it's a good idea to guess what PCT might be doing - people repeat it and before you know it, guessing becomes facts that everyone is repeating - additionally the whole ISO 20022 narrative is based on misunderstandings of what that is.”

r/PiNetwork moderator clears up ISO 20022 rumor. Source: X

Still, the ISO 20022 rumor remained a crucial part of the buying pressure last week.

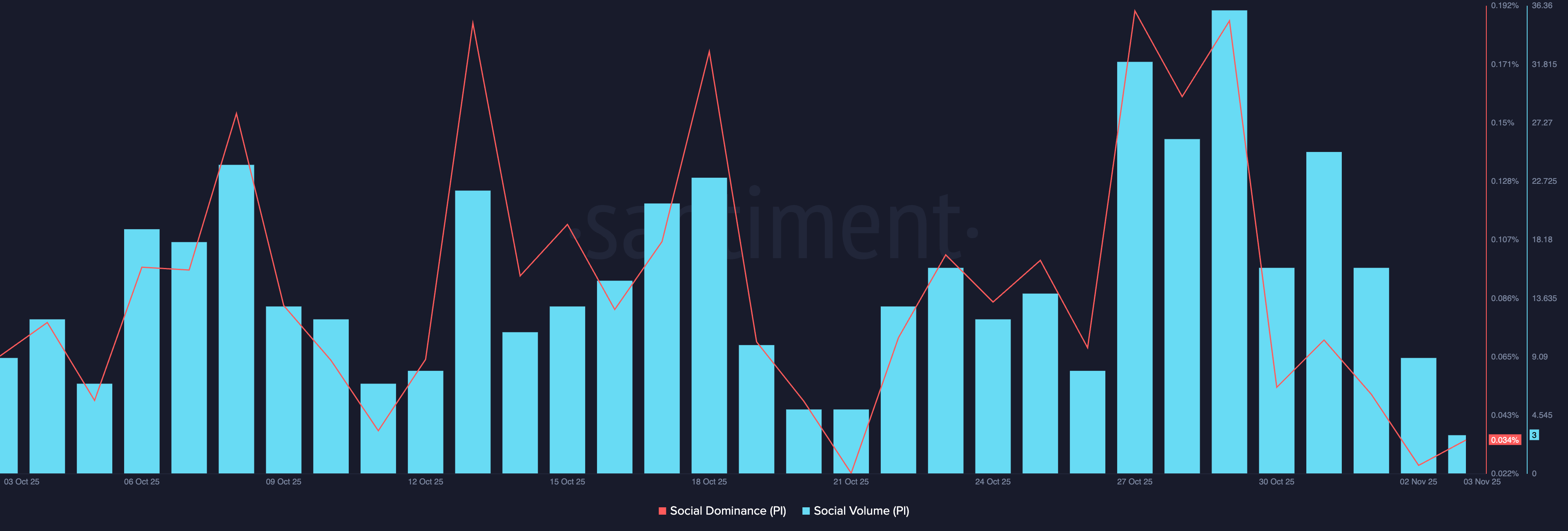

With the moderator trying to silence the rumor, the social chatter surrounding Pi Network is also declining. Santiment data shows that the social dominance and social volume decreased to 0.025% and nine social media messages on Sunday, compared to 0.186% and 36 messages on Wednesday.

Pi Network social interest. Source: Santiment.

In a nutshell, the air clearing around potential ISO 20022 compliance, aligning with low social interest, warns of a possible decline in buying pressure.

Technical outlook: Pi Network’s reversal aims for $0.1919

Pi Network trades below $0.2400 at press time on Monday, risking another correction phase as previously seen after reversing from the 50-day EMA on May 21, June 25, and August 10. The reversal from the average line could test the $0.1919 support level marked by the October 11 low.

If the mobile mining cryptocurrency drops below this level, the $0.1533 low from October 10 would be the last line of defence.

The momentum indicators on the daily chart reflect a decline in buying pressure as the Relative Strength Index (RSI) at 50 reverts to the halfway line from 62 on Wednesday. At the same time, the uptrend in the Moving Average Convergence Divergence (MACD) flattens out as it approaches the zero line, risking a potential cross below the signal line. This crossover would confirm renewed selling pressure.

PI/USDT daily price chart.

Still, a potential rebound above the 50-day EMA at $0.2589 could extend the prevailing trend in the momentum indicators. In such a case, the PI token could test the $0.3220 level, marked by the August 1 low.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.