Trends in Bitcoin treasuries as inflows plunge 99%

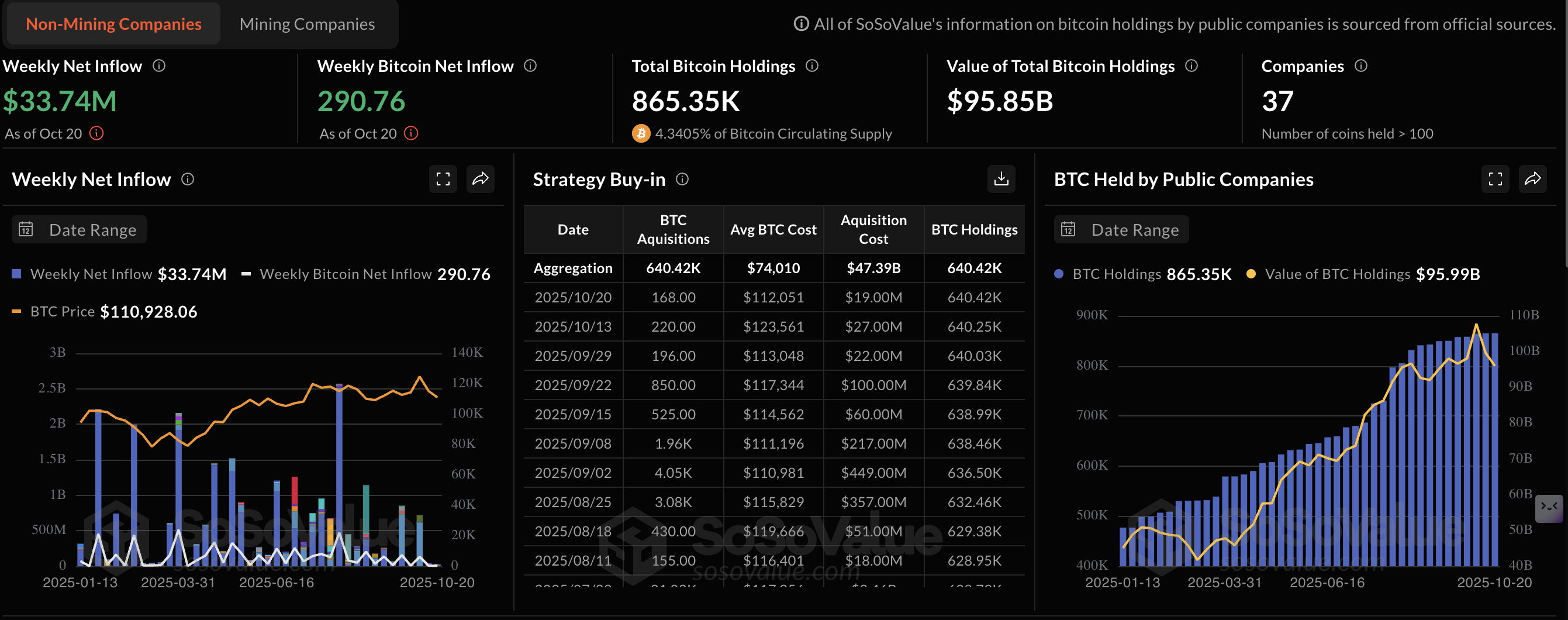

- Bitcoin treasuries inflows grind to $33.74 million per week in mid-October, marking a significant decline from the $2.57 billion peak in early August.

- Bitcoin held by non-mining companies rises to approximately 865,350, valued at $95.85 billion.

- FXStreet interviews key industry experts to get their views on the slowing trend in Bitcoin treasuries inflows.

The corporate asset ownership landscape has continually evolved over the last five years, with Bitcoin (BTC) emerging as a reserve asset both on company balance sheets and in government treasuries. Broader regulatory developments have intentionally inclined toward frameworks that support innovation in digital assets, while protecting stakeholder and customer interests.

This has marked a major turning point for the cryptocurrency industry, whereby Bitcoin is accepted by institutions not just as a speculative asset, but also as an equally valuable strategic element of treasury management.

However, there has been a noticeable decline in the capital inflow into Bitcoin treasuries over the past few months. According to SoSoValue data, weekly net inflows into non-Bitcoin mining companies hit $2.57 billion in early August, but since then, the trend has steadily declined, averaging $33.74 million in the week ending October 20.

Bitcoin weekly net inflow stats | Source: SoSoValue

Bitcoin treasury holdings near $100 billion

Despite the drastic drop in Bitcoin treasury inflows, the total number of BTC holdings has sustained an uptrend, averaging approximately 865,350 BTC valued at $95.85 billion as of writing.

There are 37 non-BTC mining companies operating BTC treasuries led by Michael Saylor's Strategy, which has a total of 640,418 BTC on its balance sheet, valued at $70.94 billion and acquired at a cost basis of $74,010. The second-largest Bitcoin treasury company is XXI, with 43,500 BTC worth approximately $4.82 billion at a cost basis of $87,000, followed by MetaPlanet, with 30,823 BTC valued at $3.41 billion and purchased at an average cost of $107,991.

The other large corporate holders include Bitcoin Standard Treasury Company, with 30,021 BTC valued at $3.33 billion, Bullish, with 24,000 BTC valued at $2.66 billion, and Tesla, with 11,509 BTC worth approximately $1.27 billion.

Non-mining Bitcoin treasury companies | Source: SoSoValue

Strategy has since 2020 pioneered Bitcoin as a corporate strategy asset, citing macroeconomic uncertainty, inflation risks, a weakening US Dollar (USD), recent de-dollarization trends and falling yields on conventional cash holdings.

Michael Saylor, the company's co-founder and executive chairman, perceives Bitcoin as "digital Gold," with its finite supply of 21 million coins. Decentralization and Bitcoin's potential as a hedge asset and a store of value are key elements popularised by Saylor.

"Bitcoin is the greatest company in the history of the world, because it's the greatest store of value, and it's going to absorb all the gold, all the real estate, all the art, all the stocks," Saylor said during a discussion with NYDIG's Ross Stevens in February 2025.

Why are Bitcoin treasury inflows cooling

The decline in Bitcoin treasury inflows from $2.57 billion in August to $33.74 million per week in October represents a 98.69% downward change, "is not a random blip," according to Karim AbdelMawla, a senior digital asset researcher at 21Shares, the world's largest issuer of exchange-traded crypto products with more than $11 billion in assets under management (AUM).

In an exclusive commentary to FXStreet, AbdelMawla said that the downtrend mirrors a shift in how companies approach Bitcoin as a reserve asset. Institutions are juggling several forces, including the increase in the cost of raising capital, regulatory scrutiny with agencies demanding new disclosure rules, and the need to get shareholder approvals.

AbdelMawla added that the fast mover advantage that Strategy and other early adopters of the Bitcoin treasury strategy enjoyed is fading fast, eroding the premium that was once associated with Bitcoin holding corporations.

On the other hand, the spinoff of the downtrend in Bitcoin treasury inflows reflects a growing interest in yield-bearing alternative cryptocurrencies. Altcoins such as Ethereum (ETH), Solana (SOL) and other proof-of-stake (PoS)-based digital assets allow institutions access to yield-generating platforms in the Decentralized Finance (DeFi) sector.

"Taken together, these factors show that the decline is less a temporary pause and more a sign of a maturing market. Companies are no longer piling into Bitcoin blindly but are integrating it more strategically and selectively into balance sheet management," AbdelMawla stated.

When asked whether the 98.69% drop in Bitcoin treasury inflows is a result of profit-taking, smaller budget allocations, broader market volatility, or an intentional pivot toward alternative assets, AbdelMawla said:

"The 98.89% percent drop in treasury buying is driven by a combination of profit-taking, tighter allocation budgets, and a rotation into alternative assets. Many early adopters like Strategy are sitting on massive unrealized gains and are locking in profits to manage accounting risks tied to impairment rules," he explained, "the October flash crash reset corporate risk appetite and forced treasurers to reduce Bitcoin exposure in favor of operational flexibility."

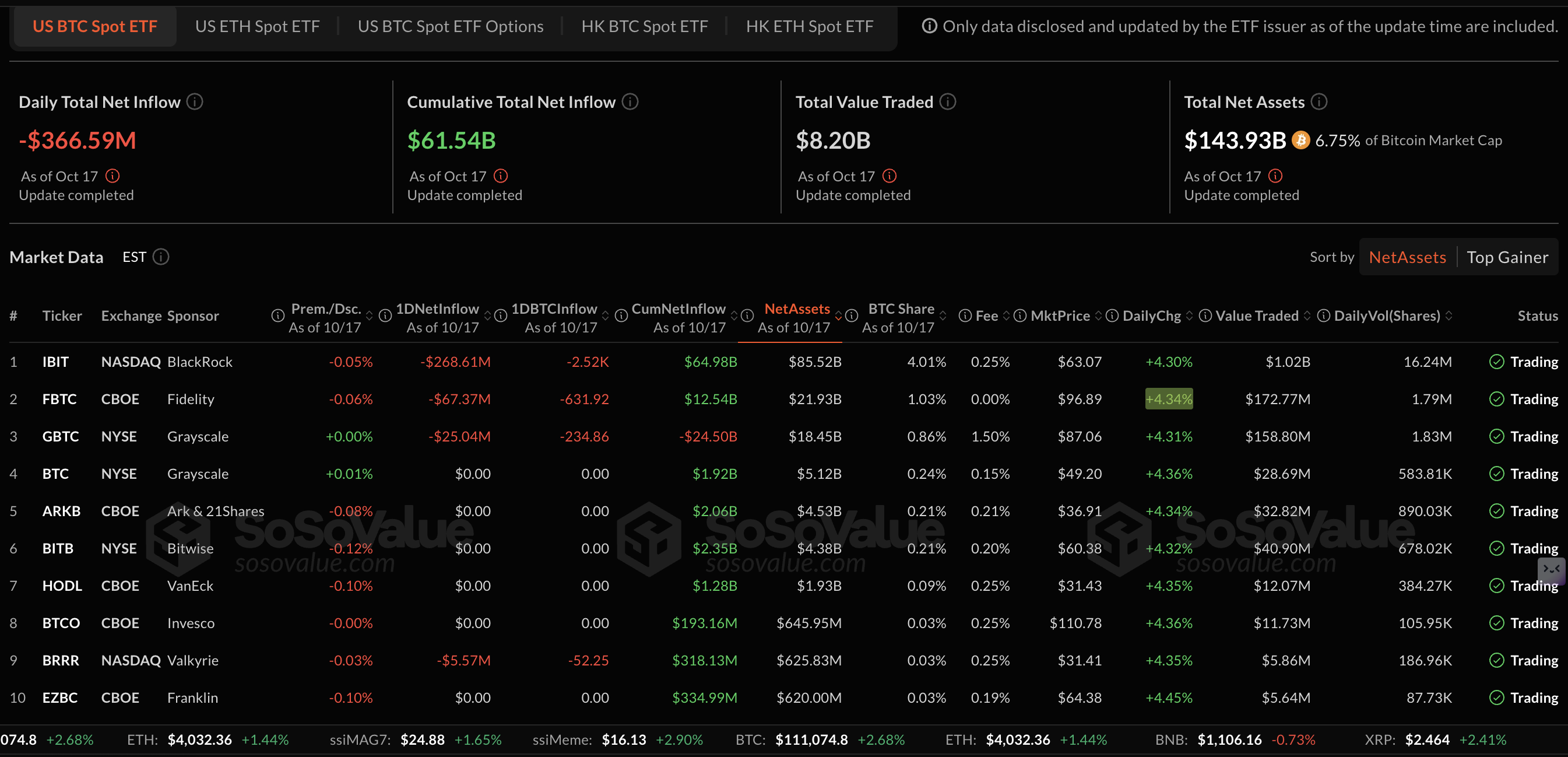

Bitcoin spot Exchange Traded Funds (ETFs), which allow investors to gain exposure to BTC directly on stock exchanges, have amassed a total inflow of $61.54 billion since their approval in January 2024. According to SoSoValue, total net assets average $143.93 billion at the time of writing, underscoring the growing interest in the asset class.

Bitcoin spot ETF stats | Source: SoSoValue

AbdelMawla believes that ETFs are absorbing a lot of the capital that would have otherwise been channelled into Bitcoin treasuries, citing seamless tax reporting while avoiding the requirements and governance huddles associated with operating Bitcoin treasuries.

"The regulated ETFs continue to absorb more capital that might have gone into treasury companies, while some firms are diversifying into assets like gold, Ethereum, and longer tail of assets for yield and risk mitigation," AbdelMawla added.

When asked whether "this trend would persist through Q4 and into 2026, or if a reversal could occur driven by year-end factors, such as renewed ETF inflows or declining volatility, making BTC more comparable to Gold as a hedge asset? AbdelMawla answered:

"Looking forward, treasury buying is likely to remain relatively subdued through the next few weeks until there is more clarity on the macro front and the tariff war settles down, akin to what happened post liberation day. Some of the catalysts that could ignite this trend would be seasonal Q4 strength, historically averaging double-digit returns, accelerating ETF inflows that could reignite institutional FOMO, and the likely interest rate cut expected to happen at the end of October."

Expert insights on Bitcoin treasury trends

To gain further insight, FXStreet interviewed more experts in the cryptocurrency market. Their answers are stated below:

Jamie Elkaleh, Chief Marketing Officer at Bitget Wallet

Q1: What recommendations would you provide to retail and institutional investors during this ongoing pullback? Should they capitalize on it as a buying opportunity ahead of potential Q4 surges (the crypto market has historically performed well in Q4), diversify into ETFs or other cryptos to mitigate risks from macroeconomic catalysts like interest rate shifts or geopolitical tensions?

"For retail and institutional investors, this pullback presents a strategic buying opportunity, particularly given crypto's seasonal Q4 strength, allowing accumulation at more favorable valuations ahead of potential surges driven by holiday liquidity and institutional re-entry. Diversifying into spot Bitcoin ETFs or complementary assets like Ethereum can effectively mitigate risks from macroeconomic shifts, such as interest rate adjustments or geopolitical flare-ups, while maintaining exposure to the sector's upside. By viewing this as a maturation phase, investors can build resilient portfolios that support the ecosystem's growth, emphasizing education and dollar-cost averaging for sustained participation."

Q2: Should retail investors stay on the sidelines, or adopt hedging strategies against further downside from reduced corporate support? How might this interplay with Bitcoin's growing role as a strategic treasury asset impact long-term investment decisions?

"Retail investors should avoid sidelining entirely, but instead adopt measured hedging strategies, such as options or stablecoin allocations, to buffer against short-term downside from waning corporate inflows, while staying attuned to BTC's evolving treasury role as a catalyst for long-term value. This dynamic interplay underscores BTC's transition toward a core reserve asset, akin to digital Gold, which could enhance its appeal and drive renewed accumulation over time. Ultimately, focusing on fundamentals like network security and adoption metrics will guide prudent decisions, promoting a healthier, more inclusive industry trajectory."

Ricardo Santos, Chief Technology Officer at MANSA

Q1: Could you provide insight into the factors influencing the downtrend in inflows?

Also, is this a temporary adjustment or a sign of maturing corporate strategies in viewing BTC as a reserve asset?

"I believe it is a mix of factors that slowed down the pace. Bitcoin dropped 12% from its 2025 highs, which dampened corporate appetite. On-chain data shows the average purchase size fell 86% from earlier peaks. Companies didn't stop buying, but they became more careful about timing and scale.

Spot Bitcoin ETFs pulled in $2.5 billion in September and $56 billion for the year. This created a competing channel that siphoned attention away from corporate treasury stocks. Many of these stocks now trade at or below the value of the Bitcoin they hold. Strategy's premium over net asset value collapsed from 3.4x to 1.2x.

Companies that funded purchases with convertible debt face margin pressure as rates stay high. The treasury space has become crowded too, with over 200 corporations now holding more than 1 million BTC collectively. Bitcoin became common enough that the differentiation value is no longer there.

This looks less like a retreat and more like the market finding its footing. The initial rush gave way to calculated positioning. Companies still look at Bitcoin as a legitimate reserve asset, but they're approaching it with the same deliberation they'd apply to any major balance sheet decision."

Q2: Do you see the 98.89% crash in treasury buying stemming from profit-taking, smaller allocation budgets due to broader market volatility, or a pivot to alternative assets?

Will this trend persist through Q4 and into 2026, or could we witness a reversal driven by year-end factors, such as renewed ETF inflows or declining volatility, making BTC more comparable to Gold as a hedge asset?

"Many firms walked away with profits when Bitcoin hit its all-time high in July. Others pulled back as $280 billion in market liquidations unfolded and Fed policy remained uncertain. Some treasuries moved capital into ETFs or stablecoin yield products instead, as these offered more liquid positions when volatility spiked.

The good thing is that the slowdown may not continue through year-end, given that post-halving cycles historically show strong Q4 performance.

ETF inflows rebounded to $2.7 billion last week, a good indicator that institutional interest hasn't disappeared. If global liquidity improves through rate cuts or China's stimulus measures, demand could return quickly.

Analysts expect a potential rally extending into mid-2026. Some models point to scenarios where Bitcoin reaches $180,000 if capital flows resume at previous levels.

What we're seeing appears to be a pause rather than a permanent shift. Companies recalibrated after an aggressive buying period, but the underlying thesis about Bitcoin as a treasury asset is intact."

Q3: Should retail investors stay on the sidelines, or adopt hedging strategies against further downside from reduced corporate support? How might this interplay with Bitcoin's growing role as a strategic treasury asset impact long-term investment decisions?

"The bigger picture is more important than what happens this quarter. Companies accumulated over 1 million BTC, and those holdings won't flood back into circulation. They might slow down new purchases, but what they've already bought will keep the supply tight.

Retail investors should buy dips, hold through cycles, and keep assets in self-custody. Options or ETF pairs work for hedging if you need downside protection, but don't abandon exposure entirely. Volatility isn't new here, and it doesn't mean you should bail out.

As one analyst on Crypto Twitter put it, ‘Smart money buys when everyone else panics.’ This treasury cooldown might just be their accumulation phase, and positioning alongside them makes more sense than waiting on the sidelines."

Karim AbdelMawla, Senior Digital Asset Researcher at 21Shares

Q1: Should retail investors stay on the sidelines, or adopt hedging strategies against further downside from reduced corporate support? How might this interplay with Bitcoin's growing role as a strategic treasury asset impact long-term investment decisions?

"Retail investors should not remain entirely on the sidelines during this period of reduced corporate support, but they must adapt their expectations and strategies. Bitcoin is transitioning into a more mature phase where returns are likely to be in the 15 to 30 percent range, with periodic 10 to 20 percent drawdowns. Staying invested with clear risk parameters is key. Using strategies like systematic rebalancing, maintaining a diversified portfolio with Gold and fixed income, and exploring income-generating Bitcoin-correlated assets such as mining stocks or crypto service providers that are diversifying into other areas like AI, such as what Galaxy has been doing, can improve resilience."

Q2: What recommendations would you provide to retail and institutional investors during this ongoing pullback?

"Retail and institutional investors should view the current pullback not as a signal to exit the market but as an opportunity to reposition strategically. Retail investors can benefit from dollar-cost averaging into Bitcoin rather than attempting to time the bottom, maintaining allocations around 5 to 10 percent of their portfolios. Using spot ETFs is a prudent choice because they offer transparent exposure without the dilution and governance risks associated with treasury stocks. Diversification remains essential. Balancing Bitcoin exposure with Gold, short-term government bonds, and cash buffers helps mitigate volatility and provides dry powder to deploy during further corrections."

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.