BoE expected to keep interest rate at 4% amid sticky inflation and fiscal woes

- The Bank of England is expected to keep its policy rate at 4%.

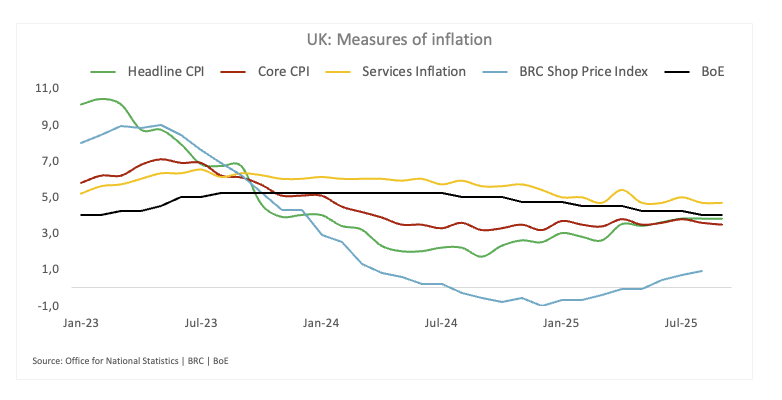

- UK inflation figures remain well above the BoE’s target.

- GBP/USD continues to trade at the lower end of its range, just over 1.3000.

The Bank of England (BoE) will announce its latest policy decision on Thursday, marking its seventh rate meeting of 2025.

Most analysts expect the ‘Old Lady’ to hold fire and keep the base rate at 4%, following the cut delivered back on August 7. Once the announcement lands, the bank will publish the meeting Minutes, offering a closer look at the debate behind the decision.

The market’s base case is for no change, but a 25-basis-point cut isn’t completely off the table. With the UK economy looking increasingly fragile and the fiscal picture continuing to worsen, there’s still a case for the BoE to ease a little further.

Cooling inflation and fiscal woes

The Bank of England kept interest rates on hold at 4% in September, after the Monetary Policy Committee voted 7–2 to stay put. Members Swati Dhingra and Adam Taylor backed a 25-basis-point cut, following the quarter-point reduction delivered in August.

In its latest statement, the BoE stuck to its forecast that inflation will peak around 4% this month before gradually easing back to the 2% target by mid-2027. On growth, the bank staff expect GDP to rise 0.4% in the July-to-September quarter, hardly booming, but still avoiding contraction.

Fresh data from the Office for National Statistics showed headline CPI inflation rising to 3.8% in September, while core inflation (excluding food and energy) eased slightly to 3.5%. Services inflation, often watched closely by the BoE, stayed stubborn at 4.7%, suggesting that underlying price pressures haven’t fully cooled.

Meanwhile, the fiscal picture remains challenging. Chancellor Rachel Reeves warned on Tuesday that broad tax rises could be coming, as she seeks to avoid a return to austerity. She described her upcoming second annual budget as one built on “hard choices”, protecting public services while keeping Britain’s debt in check.

With the budget just three weeks away, Reeves painted a bleak backdrop: pandemic-era debt, weak productivity, and sticky inflation. Her comments hinted she might even break Labour’s election pledge not to raise major taxes: a politically risky move, but one aimed at reassuring investors that the government intends to keep borrowing under control.

In the meantime, recent remarks from BoE policymakers struck a more cautious tone:

- MPC member Megan Greene said a couple of weeks ago that she didn’t see a strong case for the bank to keep cutting rates at the current quarterly pace, though she also noted the easing cycle isn’t finished yet.

- Governor Andrew Bailey, for his part, pointed to the October labour market data as evidence that underlying inflation pressures are continuing to cool. He also flagged that ongoing tariff uncertainty is weighing on business investment decisions, though, for now, it doesn’t seem to be filtering through to prices.

How will the BoE interest rate decision impact GBP/USD?

Investors expect the BoE to retain its reference rate at 4% on Thursday at 12:00 GMT.

While the outcome seems to be fully priced in, attention will focus on the vote split among MPC members, which might be a market mover for the British Pound if it indicates an atypical vote.

In the run-up to the meeting, GBP/USD appears to have met decent contention near the psychological 1.3000 threshold for now.

"Cable came under some strong and persistent downside pressure after hitting monthly tops near 1.3730 on September 17," said Pablo Piovano, senior analyst at FXStreet. He notes that a decisive break below 1.3000 could see the pair slip back to the April valley at 1.2707 (April 7).

On the upside, Piovano identified the key 200-day Simple Moving Average (SMA) at 1.3254 as an important hurdle, ahead of minor resistance levels at the weekly top at 1.3471 (October 17) and the October ceiling at 1.3527 (October 1).

Meanwhile, a technical bounce should not be discarded in the short-term horizon, as the Relative Strength Index (RSI) places a spot in the oversold region at around 24, Piovano concludes.

Central banks FAQs

Central Banks have a key mandate which is making sure that there is price stability in a country or region. Economies are constantly facing inflation or deflation when prices for certain goods and services are fluctuating. Constant rising prices for the same goods means inflation, constant lowered prices for the same goods means deflation. It is the task of the central bank to keep the demand in line by tweaking its policy rate. For the biggest central banks like the US Federal Reserve (Fed), the European Central Bank (ECB) or the Bank of England (BoE), the mandate is to keep inflation close to 2%.

A central bank has one important tool at its disposal to get inflation higher or lower, and that is by tweaking its benchmark policy rate, commonly known as interest rate. On pre-communicated moments, the central bank will issue a statement with its policy rate and provide additional reasoning on why it is either remaining or changing (cutting or hiking) it. Local banks will adjust their savings and lending rates accordingly, which in turn will make it either harder or easier for people to earn on their savings or for companies to take out loans and make investments in their businesses. When the central bank hikes interest rates substantially, this is called monetary tightening. When it is cutting its benchmark rate, it is called monetary easing.

A central bank is often politically independent. Members of the central bank policy board are passing through a series of panels and hearings before being appointed to a policy board seat. Each member in that board often has a certain conviction on how the central bank should control inflation and the subsequent monetary policy. Members that want a very loose monetary policy, with low rates and cheap lending, to boost the economy substantially while being content to see inflation slightly above 2%, are called ‘doves’. Members that rather want to see higher rates to reward savings and want to keep a lit on inflation at all time are called ‘hawks’ and will not rest until inflation is at or just below 2%.

Normally, there is a chairman or president who leads each meeting, needs to create a consensus between the hawks or doves and has his or her final say when it would come down to a vote split to avoid a 50-50 tie on whether the current policy should be adjusted. The chairman will deliver speeches which often can be followed live, where the current monetary stance and outlook is being communicated. A central bank will try to push forward its monetary policy without triggering violent swings in rates, equities, or its currency. All members of the central bank will channel their stance toward the markets in advance of a policy meeting event. A few days before a policy meeting takes place until the new policy has been communicated, members are forbidden to talk publicly. This is called the blackout period.

Economic Indicator

BoE Interest Rate Decision

The Bank of England (BoE) announces its interest rate decision at the end of its eight scheduled meetings per year. If the BoE is hawkish about the inflationary outlook of the economy and raises interest rates it is usually bullish for the Pound Sterling (GBP). Likewise, if the BoE adopts a dovish view on the UK economy and keeps interest rates unchanged, or cuts them, it is seen as bearish for GBP.

Read more.Last release: Thu Sep 18, 2025 11:00

Frequency: Irregular

Actual: 4%

Consensus: 4%

Previous: 4%

Source: Bank of England