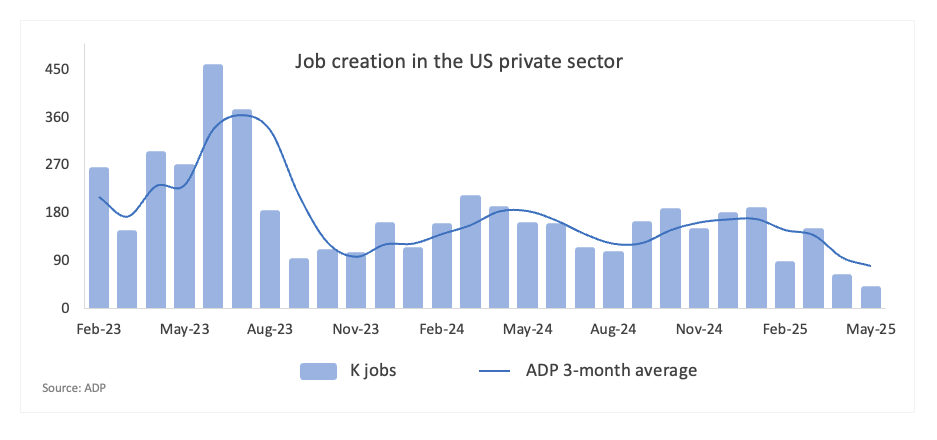

ADP Employment Change projected to show meager US job growth in June

- With the ADP and NFP releases, it will be another key week for the US labour market.

- The US private sector is expected to add 85K new jobs in June.

- The US Dollar Index navigates an area last seen in February 2022.

This week, the US labour market is set to take centre stage, adding to the combo of factors driving market sentiment as of late, namely mitigated geopolitical tensions in the Middle East, rising hopes of further progress on the trade front and prospects of the resurgence of Fed easing in Q3, as well as the renewed animosity from President Donald Trump toward Federal Reserve (Fed) Chair Jerome Powell.

Despite concerns about a potential economic slowdown in the US economy having not dissipated, they seem to have been put on the back burner for the time being.

The ADP Research Institute is poised to release its June Employment Change report on Wednesday, and it will explore the dynamics of private sector job gains.

The ADP survey is typically published a few days prior to the official Nonfarm Payrolls (NFP) data and is frequently viewed as an early indicator of potential trends that may be reflected in the Bureau of Labour Statistics (BLS) jobs report, although the two reports do not always align.

Employment, inflation, and Fed strategy

Employment serves as a fundamental element of the Federal Reserve’s dual mandate, in conjunction with the objective of maintaining price stability.

Recent months have indicated a tentative reduction in inflationary pressure, leading to a shift in focus toward the US labour market. This change follows the Fed’s consistent approach during its June 17–18 meeting and the recent relatively dovish comments made by Chair Powell in Congress.

Currently, market participants anticipate a 50-basis-point easing by the Fed in the latter half of the year, a possibility that could gain additional backing from certain Fed officials.

In light of the recent optimism regarding the White House’s trade strategy, coupled with a resilient economy and declining consumer price pressures, the forthcoming ADP report — especially Friday’s NFP report — has gained increased importance, likely influencing the Fed’s subsequent actions.

When will the ADP report be released, and how could it affect the US Dollar Index?

The ADP Employment Change report for June is set to be released on Wednesday at 12:15 GMT, with projections indicating an increase of 85K new jobs following May’s disappointing gain of 37K. The US Dollar Index (DXY) is currently adopting quite a negative position as it navigates multi-year troughs amid somewhat better conditions in trade and ongoing speculation regarding a potentially more accommodative Fed in the medium-term horizon.

If the ADP figures surpass expectations, they may alleviate some concerns regarding a potential economic slowdown, thereby supporting the Fed’s cautious approach. On the other hand, if the figures do not meet expectations, it could heighten concerns regarding the economy's momentum, which may lead the Fed to reevaluate the timing of its easing cycle's resumption.

Pablo Piovano, Senior Analyst at FXStreet, argued that when the multi-year trough at 96.37 (July 1) is broken, the index has the potential to reach the February 2022 floor of 95.13 (February 4), which is somewhat higher than the 2022 bottom of 94.62 (January 14).

“On the upside, we could expect to encounter some early resistance around the June ceiling of 99.42 (June 23), which is supported by the proximity of the provisional 55-day Simple Moving Average (SMA). Further up emerges the weekly top of 100.54 (May 29), which precedes the monthly high of 101.97 (May 12),” Piovano added.

He also highlights that as long as the index stays below its 200-day SMA at 103.78 and the 200-week SMA at 102.99, it is likely to continue its decline.

“Plus, momentum indicators are still leaning toward the negative side: the Relative Strength Index (RSI) has dropped to the oversold region around 28, and the Average Directional Index (ADX) is hovering above 17, so the trend isn't exactly blazing with intensity,” Piovano concludes.

Employment FAQs

Labor market conditions are a key element to assess the health of an economy and thus a key driver for currency valuation. High employment, or low unemployment, has positive implications for consumer spending and thus economic growth, boosting the value of the local currency. Moreover, a very tight labor market – a situation in which there is a shortage of workers to fill open positions – can also have implications on inflation levels and thus monetary policy as low labor supply and high demand leads to higher wages.

The pace at which salaries are growing in an economy is key for policymakers. High wage growth means that households have more money to spend, usually leading to price increases in consumer goods. In contrast to more volatile sources of inflation such as energy prices, wage growth is seen as a key component of underlying and persisting inflation as salary increases are unlikely to be undone. Central banks around the world pay close attention to wage growth data when deciding on monetary policy.

The weight that each central bank assigns to labor market conditions depends on its objectives. Some central banks explicitly have mandates related to the labor market beyond controlling inflation levels. The US Federal Reserve (Fed), for example, has the dual mandate of promoting maximum employment and stable prices. Meanwhile, the European Central Bank’s (ECB) sole mandate is to keep inflation under control. Still, and despite whatever mandates they have, labor market conditions are an important factor for policymakers given its significance as a gauge of the health of the economy and their direct relationship to inflation.

Economic Indicator

ADP Employment Change

The ADP Employment Change is a gauge of employment in the private sector released by the largest payroll processor in the US, Automatic Data Processing Inc. It measures the change in the number of people privately employed in the US. Generally speaking, a rise in the indicator has positive implications for consumer spending and is stimulative of economic growth. So a high reading is traditionally seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Last release: Wed Jun 04, 2025 12:15

Frequency: Monthly

Actual: 37K

Consensus: 115K

Previous: 62K

Source: ADP Research Institute

Traders often consider employment figures from ADP, America’s largest payrolls provider, report as the harbinger of the Bureau of Labor Statistics release on Nonfarm Payrolls (usually published two days later), because of the correlation between the two. The overlaying of both series is quite high, but on individual months, the discrepancy can be substantial. Another reason FX traders follow this report is the same as with the NFP – a persistent vigorous growth in employment figures increases inflationary pressures, and with it, the likelihood that the Fed will raise interest rates. Actual figures beating consensus tend to be USD bullish.