Fed Minutes set to reveal details of hawkish stance amid Trump’s tariffs

- The Minutes of the Fed’s May 6-7 gathering are due on Wednesday.

- The Federal Reserve kept the benchmark interest rate on hold, as expected.

- The US Dollar is at risk of piercing its 2025 low amid tariff-related concerns.

The Federal Open Market Committee (FOMC) will release the Minutes of its May 6-7 meeting on Wednesday. Back then, policymakers decided to keep the Fed Funds Target Range (FFTR) unchanged at 4.25%-4.50%, as widely anticipated by market participants.

The Federal Reserve (Fed) adopted a more hawkish stance at the beginning of the year, amid concerns about United States (US) President Donald Trump's tariffs' potential impact on economic progress and inflation.

Not only did officials decide to keep the benchmark interest rate on hold, but they also gave no hints on future rate cuts, maintaining the wait-and-see stance adopted in March.

The Fed is concerned about risks lying ahead

Fed officials noted, “Uncertainty around the economic outlook has increased. The Committee is attentive to the risks to both sides of its dual mandate,” according to the statement released alongside the decision.

Later in the press conference, Chairman Jerome Powell stated, "We are comfortable with our policy stance." "We think that right now, the appropriate thing to do is to wait and see how things evolve. There's so much uncertainty," he added.

Additionally, the Fed slowed the pace of decline of its securities holdings. The central bank has been allowing up to $25 billion in Treasuries to mature every month, and reduced the roll-off to just $5 billion starting in April. Shrinking the balance sheet is another tool the Fed uses to control inflationary pressures.

President Trump’s massive tariffs have been the main reason behind the latest Fed’s hawkish stance. Despite his usual caution, Chairman Powell finally acknowledged that tariffs are “a good part” of their increased expectations for higher inflation. He added it would be “very difficult” to assess how much of the inflation is coming from tariffs.

"Looking ahead, the new Administration is in the process of implementing significant policy changes in four distinct areas: trade, immigration, fiscal policy, and regulation. It is the net effect of these policy changes that will matter for the economy and for the path of monetary policy," Powell said.

When will FOMC Minutes be released and how could it affect the US Dollar?

The FOMC is set to release the Minutes from its May 6-7 policy meeting at 18:00 GMT on Wednesday, and market players hope the document will shed some light on the future of monetary policy.

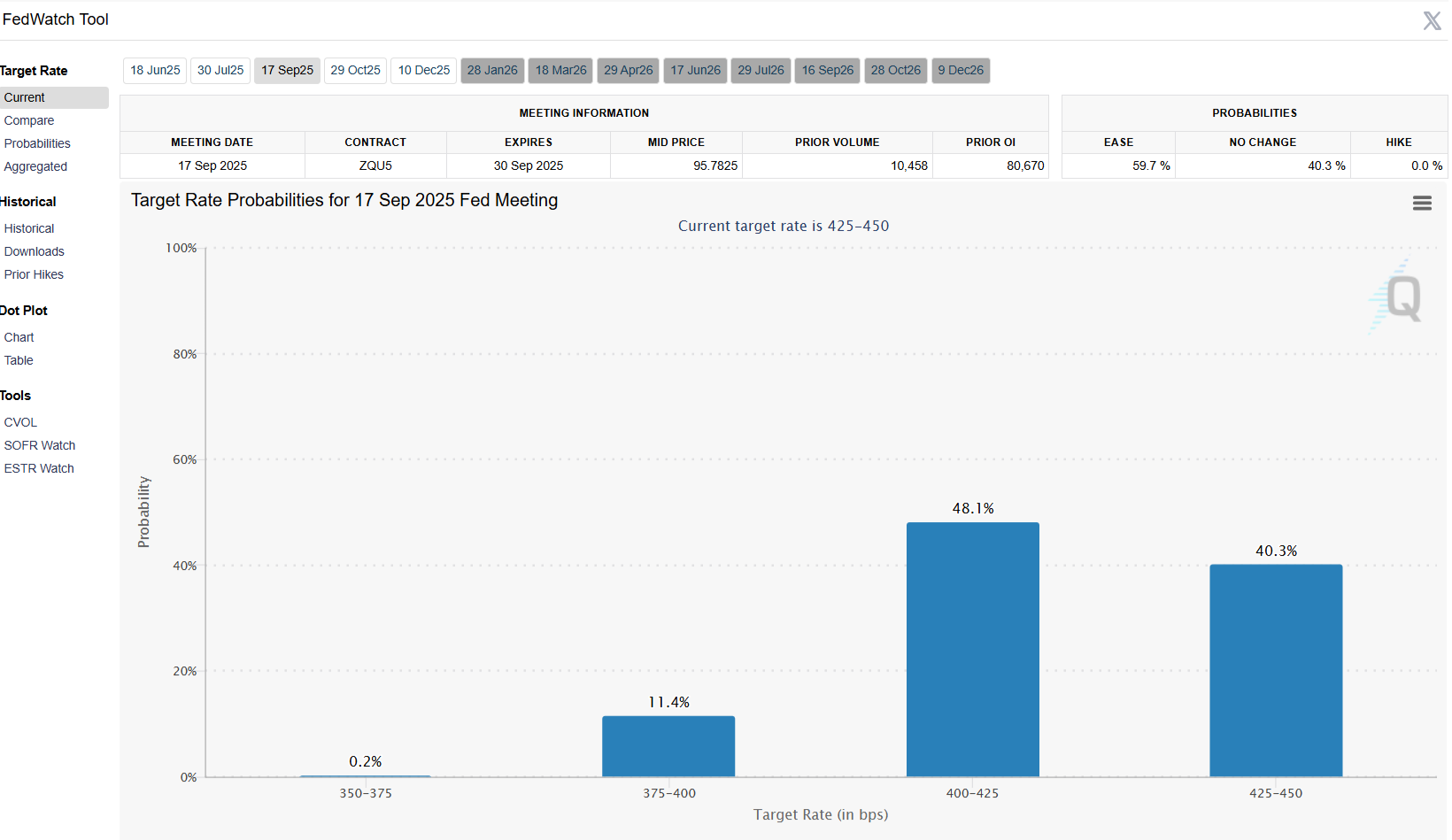

Ahead of the release, the CME FedWatch Tool shows speculative interest does not expect interest rate cuts in June or July, with the odds for a 25 basis-point (bps) cut standing at around 48% in September.

The US Dollar is under selling pressure ahead of the event, with the US Dollar Index (DXY) comfortably below the 100.00 mark. The Fed is not expected to adopt a dovish stance, meaning that most of what they could reveal is aligned with what the market already knows. The FOMC Minutes should then have a limited impact on the DXY.

Valeria Bednarik, Chief Analyst at FXStreet, says: “The DXY trades not far above the multi-month bottom posted in April at 97.91, and the risk skews to the downside, according to technical readings in the daily chart. The index develops below all its moving averages, with a flat 20 Simple Moving Average (SMA) providing resistance at around 100.20. Gains beyond the latter expose the 101.00 area, ahead of the May peak at 101.98. Still, such an advance seems out of the picture, given limited buying interest. Technical indicators in the mentioned time frame advanced, but remain well below their midlines, falling short of supporting a steady advance.”

Bednarik adds: “On the other hand, relevant support comes at 98.70, May monthly low. A bearish breakout exposes the mentioned April low, followed by the 97.50 region.”

Economic Indicator

FOMC Minutes

FOMC stands for The Federal Open Market Committee that organizes 8 meetings in a year and reviews economic and financial conditions, determines the appropriate stance of monetary policy and assesses the risks to its long-run goals of price stability and sustainable economic growth. FOMC Minutes are released by the Board of Governors of the Federal Reserve and are a clear guide to the future US interest rate policy.

Next release: Wed May 28, 2025 18:00

Frequency: Irregular

Consensus: -

Previous: -

Source: Federal Reserve

Minutes of the Federal Open Market Committee (FOMC) is usually published three weeks after the day of the policy decision. Investors look for clues regarding the policy outlook in this publication alongside the vote split. A bullish tone is likely to provide a boost to the greenback while a dovish stance is seen as USD-negative. It needs to be noted that the market reaction to FOMC Minutes could be delayed as news outlets don’t have access to the publication before the release, unlike the FOMC’s Policy Statement.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.