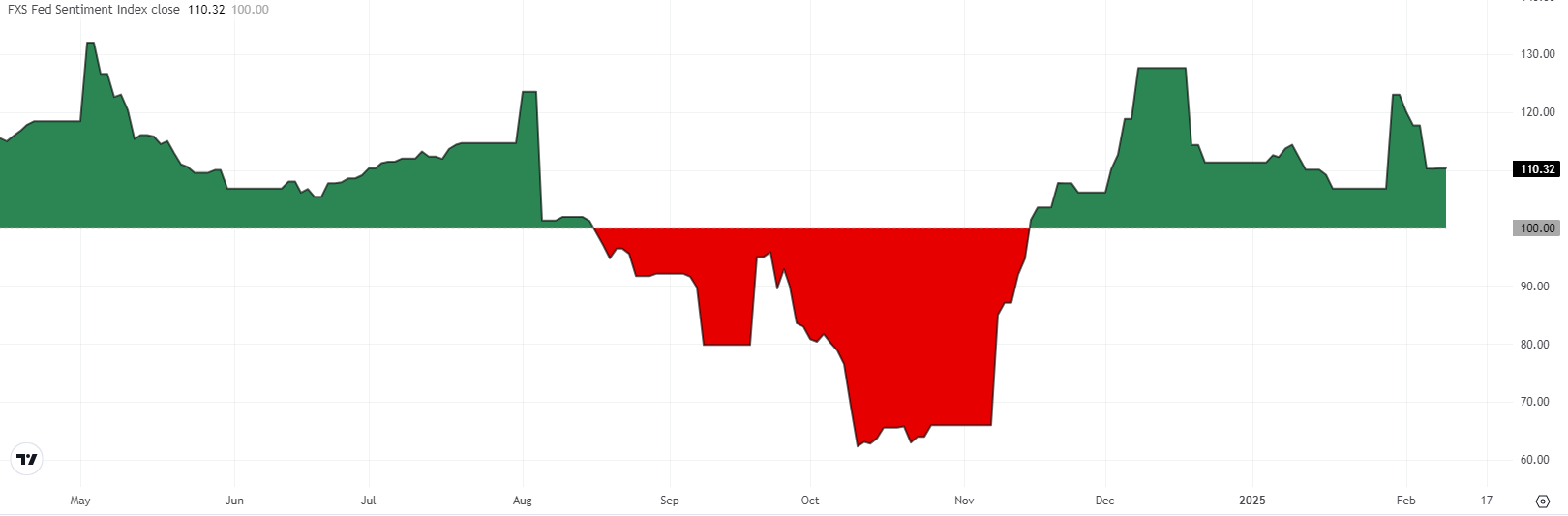

FXS Fed Sentiment Index retreats but remains in hawkish territory ahead of Powell testimony

Federal Reserve (Fed) Chairman Jerome Powell will testify on the semiannual Monetary Policy Report before the Senate Banking, Housing and Urban Affairs Committee at 15:00 GMT on Tuesday.

In the Monetary Policy Report published on Friday, February 7, the Fed reiterated that policymakers will weigh incoming data, the evolving outlook and the balance of risks when they consider future policy moves. In the meantime, 67 of 101 economists that took part in a recently-conducted Reuters survey said that they expect the US central bank to lower the policy rate by at least once by end-June. According to the CME FedWatch Tool, markets are currently pricing in a less-than-10% probability of the Fed lowering the policy rate by 25 basis points (bps) in March.

Following the January policy decisions, FXStreet (FXS) Fed Sentiment Index climbed above 120, reflecting a hawkish sentiment. Since then, however, the Fed Sentiment Index retreated to 110 as some policymakers adopted a relatively less hawkish language. Although this decline suggests that the Fed is softening its tone, it is yet to signal a dovish shift.

In an interview with Bloomberg on Wednesday, February 5, Richmond Fed President Thomas Barkin noted that he was still leaning towards additional rate cuts this year and said that he expects 12-month inflation numbers to "come down nicely." On a more neutral note, "the Fed needs to be mindful of overheating and deterioration, but things are largely going well," Chicago Fed President Austan Goolsbee said and added that he is hopeful that tariffs end up not being a big impediment to trade, based on what they saw recently.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.