Fed Minutes Preview: Details on decision to trim rates by 50 bps in September take centre stage

- The Minutes of the Fed’s September 17-18 policy meeting will be published on Wednesday.

- Details of Jerome Powell and co’s decision to trim interest rates by 50 basis points taking centre stage.

- The US Dollar Index may correct lower with the news, but the bullish path is right around the corner.

The Minutes of the US Federal Reserve’s (Fed) September 17-18 monetary policy meeting will be published on Wednesday at 18:00 GMT. Policymakers loosened the monetary policy for the first time in over four years and surprised market players with a 50 basis points (bps) interest rate cut. The decision spurred speculation officials were concerned about the economic progress and hinted at more aggressive trims.

Jerome Powell and co decided to cut rates in the September meeting

The Federal Open Market Committee (FOMC) took action after acknowledging progress towards its inflation goal. “In light of the progress on inflation and the balance of risks, the Committee decided to lower the target range for the federal funds rate by 1/2 percentage point to 4-3/4 to 5 percent,” the statement reads. However, officials also noted that “job gains have slowed, and the unemployment rate has moved up but remains low.”

The announcement was not a complete surprise, given that Powell and co somehow anticipated the decision to start trimming interest rates. What came as a surprise was the larger-than-anticipated trim, given that market participants were mostly anticipating a 25 bps cut, with only Fed Governor Michelle Bowman calling for a quarter-point cut instead.

As usual, policymakers repeated that future decisions will be made meeting by meeting based on macroeconomic data.

Meanwhile, Fed Chair Jerome Powell poured cold water on speculation the large cut came amid concerns about economic progress. In the press conference that followed the announcement, Powell said he does not see anything in the economy suggesting the likelihood of a downturn, adding that the growth rate is solid, inflation is coming down, and the labor market is “still at very solid levels.”

“We’re trying to achieve a situation where we restore price stability without the kind of painful increase in unemployment that has come sometimes with disinflation,” Powell added.

As a result, the focus shifted to employment. Tepid data released throughout September fueled speculation that the central bank would deliver another 50 bps cut when it meets in November. The US Dollar (USD) came under persistent selling pressure while stock markets cheered cheaper money.

Things changed in the first days of October. The September Nonfarm Payrolls (NFP) report released by the Bureau of Labor Statistics (BLS) showed the economy added a whopping 254,000 new jobs in the month, while the Unemployment Rate unexpectedly eased to 4.1% from 4.2% in August. Those figures clearly indicate a strong labor market, reducing concerns about it.

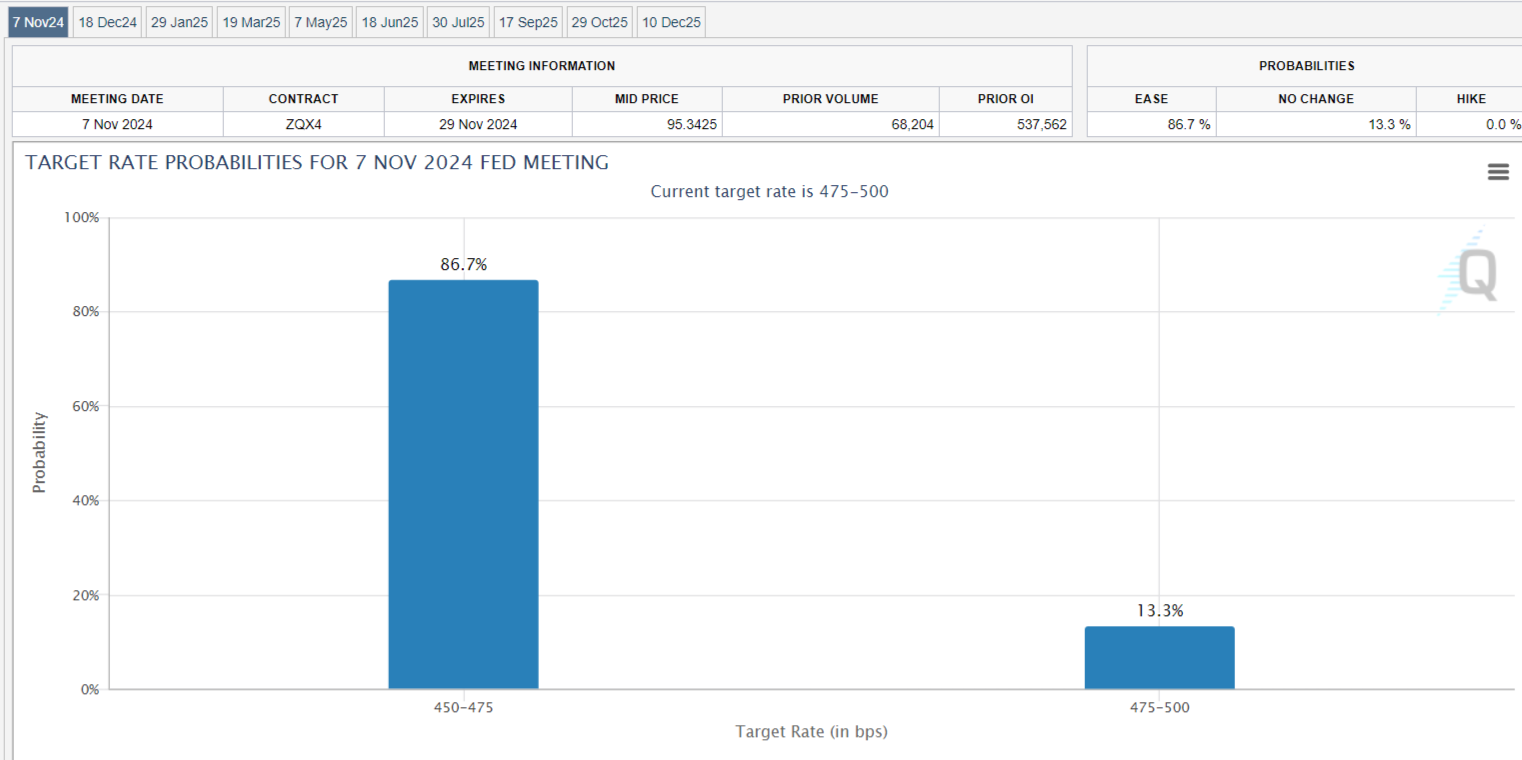

As a result, market players dropped bets of a 50 bps cut in November, with the odds for a 25 bps currently standing at around 85%, according to the CME FedWatch Toll.

When will FOMC Minutes be released, and how could it affect the US Dollar?

The FOMC will release the minutes of the September 17-18 policy meeting at 18:00 GMT on Wednesday. The document may explain the decision and hint at future action, but at this point, it may be old news. The NFP report indeed overshadowed any pre-release speculation about the state of the labor market.

With inflation coming down, economic growth, and solid employment-related data, it seems that the United States (US) is in the right spot to allow the Fed to reduce rates at a maybe slower but steady pace.

The Minutes will likely show that policymakers are willing to reduce the interest rate further in November, although the extent of such a cut will depend on upcoming macroeconomic data.

In fact, the US will publish the September Consumer Price Index (CPI) on Thursday, and the figures will probably have a broader impact on future Fed decisions, and hence the USD, rather than the FOMC Minutes.

Generally speaking, the more dovish the document, the more pressure there would be on the Greenback, while hawkish words should support the USD.

From a technical perspective, Valeria Bednarik, Chief Analyst at FXStreet, notes: “The US Dollar Index (DXY) seems comfortable above the 102.00 mark after flirting with the 100.00 mark in September. The overall technical stance is bullish, although another leg north is needed to confirm a sustained advance in time.”

“From a technical point of view, the DXY may correct towards 102.00 ahead of the announcement, with near-term support in the 101.90 region. Nevertheless, the daily chart shows that technical indicators hold well into positive territory, with the Momentum indicator still heading firmly north, reflecting buyers’ interest. At the same time, the DXY has overcome its 20 Simple Moving Average (SMA), which gains upward traction at around 101.20, a key dynamic support area. Finally, the 100 and 200 SMAs hold well above 103.00, limiting the mid-term bullish potential.”

Bednarik adds: “The DXY needs to conquer the 103.00 mark to extend gains at a solid pace, with the next resistance area at around 103.80. Once beyond the latter, an unlikely scenario post-FOMC Minutes, the index will enter a clearer bullish path.”

Economic Indicator

FOMC Minutes

FOMC stands for The Federal Open Market Committee that organizes 8 meetings in a year and reviews economic and financial conditions, determines the appropriate stance of monetary policy and assesses the risks to its long-run goals of price stability and sustainable economic growth. FOMC Minutes are released by the Board of Governors of the Federal Reserve and are a clear guide to the future US interest rate policy.

Read more.Next release: Wed Oct 09, 2024 18:00

Frequency: Irregular

Consensus: -

Previous: -

Source: Federal Reserve

Minutes of the Federal Open Market Committee (FOMC) is usually published three weeks after the day of the policy decision. Investors look for clues regarding the policy outlook in this publication alongside the vote split. A bullish tone is likely to provide a boost to the greenback while a dovish stance is seen as USD-negative. It needs to be noted that the market reaction to FOMC Minutes could be delayed as news outlets don’t have access to the publication before the release, unlike the FOMC’s Policy Statement.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.