Bitcoin Price Forecast: BTC trades within recent range as ETF flows stay weak

- Bitcoin price has been trading sideways between $85,500 and $90,000 for nearly three weeks, signaling indecision in the market.

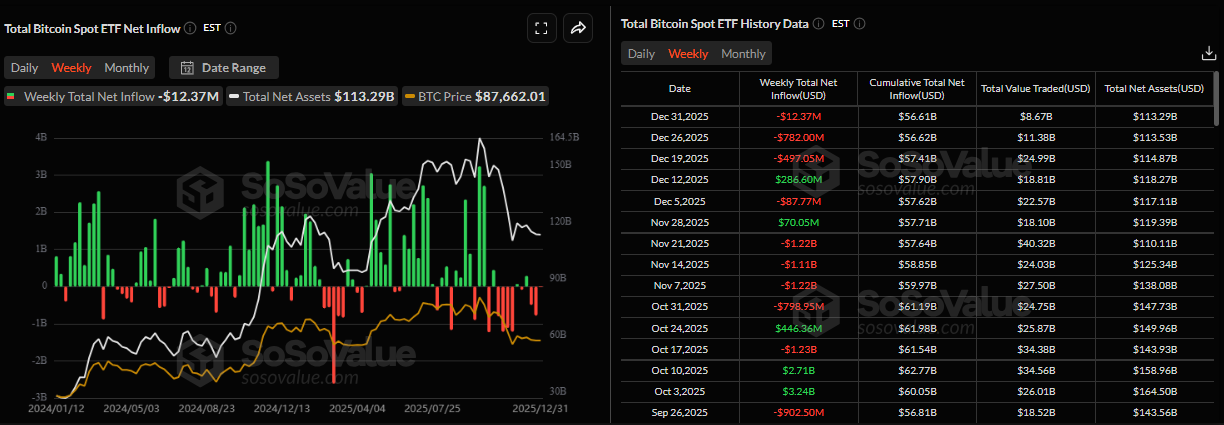

- Institutional demand weakens as spot Bitcoin ETFs record a mild outflow of $12.37 million by Thursday, extending their third consecutive weekly streak of withdrawals.

- Record year-end borrowing of $74.6 billion from the New York Fed’s SRF eased short-term funding stress, supporting a mild risk-on tone in markets.

Bitcoin (BTC) price trades around $89,000 on Friday, extending its sideways price action for nearly three weeks as market participants remain indecisive. Institutional demand continues to soften, with spot Bitcoin Exchange Traded Funds (ETFs) recording mild net outflows for a third consecutive week. Meanwhile, easing year-end liquidity conditions have helped stabilize broader risk sentiment, keeping BTC confined within a narrow trading range for now.

Institutional demand continues to soften

Institutional demand for Bitcoin continues to weaken this week. SoSoValue data show that Spot Bitcoin ETFs recorded a net total outflow of $12.37 million by Thursday, marking the third weekly outflow since mid-December. If these outflows intensify, the Bitcoin price could see a correction.

Some signs of optimism

Reuters reported on Thursday that the Federal Reserve Bank of New York’s Standing Repo Facility (SRF) loaned a record $74.6 billion to financial firms on the final trading day of 2025, surpassing the previous peak of $50.35 billion.

The New York Fed also reported that, through its reverse repo facility, money funds and other eligible firms parked $106 billion at the Fed, the largest amount since early August. The substantial use of both reverse repos and the SRF is to some degree related: lenders often pull back at year-end and seek the safety of investing cash risk-free at the Fed, which dries up lendable funds, in turn driving up direct borrowing from the central bank. This move helps stabilize markets, eases short-term funding stress, and supports a mild risk-on tone.

Meanwhile, the Federal Reserve began buying $40 billion of Treasury bills per month on December 12 to alleviate short-term funding stress. This wave of net liquidity injection into financial markets will make borrowing cheaper and encourage risk-on sentiment, particularly in assets such as stocks and cryptocurrencies, providing near-term support for BTC.

Bitcoin Price Forecast: BTC lacks direction as consolidation extends

Bitcoin price has been consolidating between $85,500 and $90,000 for nearly three weeks, indicating indecision in the market. As of Friday, BTC hovers around $89,000.

If BTC breaks and closes above $90,000 on a daily basis, it could extend the rally toward the next resistance at $94,253, which aligns with the 61.8% Fibonacci retracement level drawn from the April low of $74,508 to October's all-time high of $126,199.

The Relative Strength Index (RSI) on the daily chart reads 51, above the neutral 50 level, indicating fading bearish momentum. For the bullish momentum to be sustained, the RSI must hold above the neutral level. Meanwhile, the Moving Average Convergence Divergence (MACD) indicator showed a bullish crossover on December 20, which remains intact, supporting a slightly bullish view.

However, if BTC corrects, it could extend the decline toward the lower consolidation boundary at around $85,500.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.