Altcoin Season Beckoning: What's behind Sui, Stacks and Fartcoin price rallies?

- The cryptocurrency market sparkles with altcoins like Sui, Stacks and Fartcoin extending gains on Monday.

- Sui breaks above a critical descending trendline, but the 100-day EMA crossing below the 200-day EMA signals potential bearish hurdles.

- Stacks surges more than 10% on the day and sits above the 50-day EMA after validating an inverse head-and-shoulders pattern.

- Fartcoin renews its uptrend following a cup and handle pattern breakout, aiming for $1.00.

The cryptocurrency market gains strength on Monday, led by select altcoins like Sui, Stacks (STX) and Fartcoin, following another round of instability in United States (US) markets caused by President Trump's administration's plan to shake up the Federal Reserve (Fed), and possibly fire Fed Chair Jerome Powell. The US dollar (USD) tumbles, with the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, hitting a three-year low, with markets interpreting the White House's direct attack on Powell as threatening the central bank's independence, FXStreet reported earlier today.

As the implied instability rattles currency markets, Bitcoin (BTC) strengthens its bullish outlook, breaking above $87,500 during the Asian session on Monday. Major altcoins, including Ethereum (ETH), Ripple (XRP), and Solana (SOL), followed in BTC's footsteps, posting significant gains.

Altcoin season breakout, or fakeout?

In an altcoin season, alternative cryptocurrencies break out, outperforming Bitcoin by gaining significant market share and momentum. Increased investor interest, market trends, or project developments often drive the widespread gains.

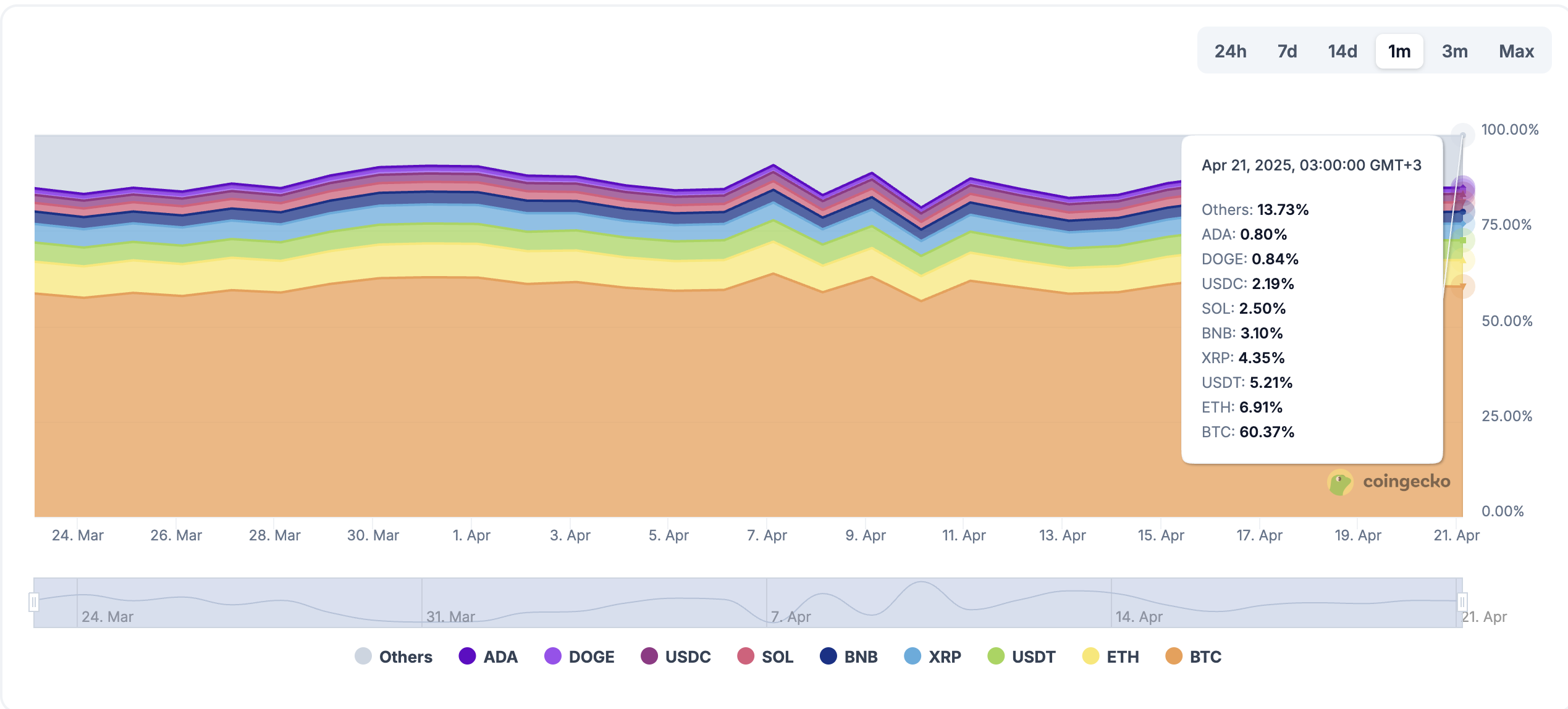

Since the launch of Exchange Traded Funds (ETFs) in January 2024, Bitcoin has outperformed altcoins, with its market share steadily above 60%. Per CoinGecko, Bitcoin's dominance currently holds at 60.37%, implying that altcoins share the remaining 39.63% of the pie.

Bitcoin dominance | Source: CoinGecko

Historically, altcoin seasons have culminated in Bitcoin losing market share as retail investors reduce exposure to BTC in favor of other tokens, like Sui, Stacks and Fartcoin. Nevertheless, the launch of Bitcoin ETFs changed the dynamics so that institutional and retail investors now prefer to hold BTC while reducing exposure to altcoins.

As crypto prices recover in the second half of April and in the months to come, the focus will be on how altcoins respond, whether they could gain an edge over Bitcoin, and whether they reward holders who continue to deal with unrealized losses.

Can Sui's price sustain a bullish breakout?

Sui's price gains more than 7% on the day and dodders at $2.26 at the time of writing. The Layer 1 token has, since the lows traded at $1.72 on April 7, pushed to escape the extended downtrend from its all-time high of $5.36, achieved on January 4.

The path with the least resistance gradually shifts upwards, thanks to SUI sitting above the descending trendline. Key signals backing the uptrend include a bullish outlook from the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI) indicator's upward direction.

The MACD reveals a buy signal on the daily chart while inching closer to the center line. Green histograms also indicate the potential for more gains ahead. The RSI indicator's position above the midline, pointing upwards, reinforces positive sentiment among investors.

SUI/USDT daily chart

Traders buying SUI should prepare for all outcomes, including the possibility of hurdles challenging the uptrend at the 50, 100, and 200-day Exponential Moving Averages (EMA) at $2.41 and $2.74, respectively. The 100-day EMA crossing below the 200-day EMA is another bearish signal to consider before going all in on SUI. In a reversal below the descending trendline, key areas for support are $1.80 (green in the chart) and $1.50, a level tested in September.

Stacks price validates inverse head and shoulders

Stacks price regains strength, rising to trade at $0.70 at the time of writing on Monday. The breakout comes amid a generally bullish outlook across the crypto market, but most importantly, the validation of an inverse head and shoulders pattern. This pattern signals a potential bullish reversal after a downtrend, characterized by three troughs: a lower "head" flanked by two higher "shoulders."

STX/USDT 4-hour chart

Traders would place buy orders slightly above the neckline resistance at $0.65, while the stop losses would go marginally below the same level. As volume increases, Stacks is expected to rise 27% to $0.83, a distance equal to the pattern's height extrapolated above the breakout point. With STX holding above the 50, 100 and 200 EMAs on the 4-hour chart, bulls could likely tag $0.83 in the coming days.

However, the RSI indicator's position in the overbought region indicates the possibility of bearish momentum building and clawing back the accrued gains.

Fartcoin price relentlessly battles to reclaim the $1 level

Fartcoin's price has recovered above the pivotal $0.90 to exchange hands at $0.91 at the time of writing. The meme coin slipped to support at $0.71 on Saturday, possibly due to rampant profit-taking activities.

However, more traders bought the dip, providing Fartcoin with bullish momentum, targeting a move past the psychological resistance at $1.00.

FARTCOIN/USDT 12-hour chart

Fartcoin's bullish structure shows a cup and handle pattern formation, which bulls validated with a breakout on April 9. Holding support above $0.90 would encourage more traders to buy the meme coin, increasing demand and movement past the much-awaited $1.00. Traders should tread carefully, considering potential drawdowns as meme coins are highly volatile.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.