US Dollar on track to lose around 2% of value this week

- The US Dollar retreats on all fronts and against all major peers.

- US President Trump commented that tariffs on China might not finally be imposed.

- The US Dollar Index (DXY) sinks below 108.00 and hits a key moving average.

The US Dollar Index (DXY), which tracks the performance of the US Dollar against six different major currencies, sinks below 107.50 at the time of writing on Friday after US President Donald Trump left surprised with comments the previous day casting doubts on the application of tariffs on China. The comments came after Trump had a phone call with China’s President Xi Jinping. Meanwhile, the Bank of Japan (BoJ) hiked interest rates by 25 basis points, which triggered substantial losses for the US Dollar (USD) against the Japanese Yen (JPY).

In the economic data front, Markit has already released Germany’s Purchasing Managers Index (PMI) preliminary readings for January, with some strong upbeat numbers, fueling more Euro (EUR) strength against the US Dollar (USD). Later this Friday, the US will receive its S&P Global PMI preliminary readings for the same month. The University of Michigan will close off the day with the final reading of its Consumer Sentiment Index for January.

Daily digest market movers: Messy to say the least

- US President Donald Trump released comments about his phone call with Chinese President Xi Jinping. He surprised markets by saying he does not want to impose tariffs on China, Bloomberg reported.

- US President Trump commented on the Federal Reserve and US rates, affirming that he would demand an immediate cut in US interest rates, Bloomberg reports.

- Germany saw its preliminary Services PMI jump to 52.5 in January, beating the 51.0 estimate and above the previous 51.2. The Composite PMI was able to head out of contraction, reaching 50.1 and beating the expected 48.2 and the previous 48.0.

- At 14:45 GMT, the US will receive its PMI preliminary reading for January from S&P Global:

- Services are expected to soften to 56.5, coming from 56.8 in December’s final reading.

- Manufacturing is expected to remain in contraction at 49.6, coming from 49.4.

- At 15:00 GMT, the University of Michigan’s final reading for its Consumer Sentiment Index for January is expected to remain stable at 73.2. The 5-year inflation expectation component is also set to remain unchanged at 3.3%.

- Equities are mixed, with China and Europe in positive territory as markets tune down Trump’s tariffs risk. However, after that same headline, US equities face a setback and are trading negatively.

- The CME FedWatch tool projects a 52.2% chance that interest rates will remain unchanged at current levels in the May meeting, suggesting a rate cut in June. Expectations are that the Federal Reserve (Fed) will remain data-dependent with uncertainties that could influence inflation during US President Donald Trump’s term.

- The US 10-year yield is trading around 4.631%, off its poor performance seen earlier this week at 4.528% and still has a long way to go back to the more-than-one-year high from last week at 4.807%.

US Dollar Index Technical Analysis: Sigh of relief

The US Dollar Index (DXY) is taking some punches and heading lower, hand in hand with US yields. Although US President Trump might suddenly soften his stance on tariffs, it is still early in his term to rule out any tariff implementation on China and other countries. Tail risks are forming, with markets starting to downplay the actual stance, which might still see the US Dollar rally if Trump slaps tariffs on China.

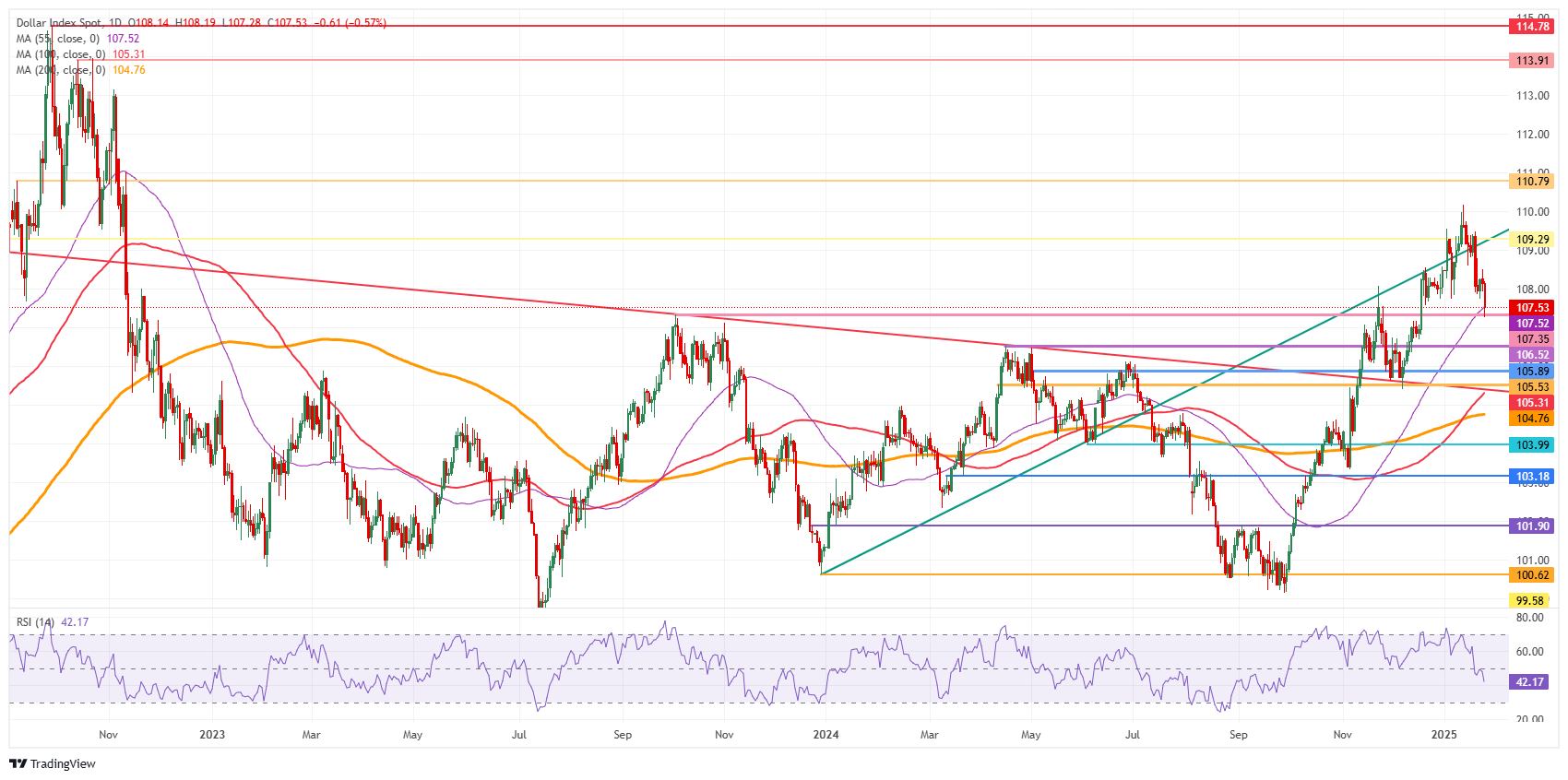

The DXY has its work cut out to recover to levels seen at the start of this week. First, the big psychological level at 108.00 needs to be recovered. From there, 109.29 (July 14, 2022, high and rising trendline) is next to pare back incurred losses from this week. Further up, the next upside level to hit before advancing further remains at 110.79 (September 7, 2022, high).

On the downside, the convergence of the high of October 3, 2023 and the 55-day Simple Moving Average (SMA) around 107.50 should act as a double safety feature to support the DXY price. For now, that looks to be holding, though the Relative Strength Index (RSI) still has some room left to the downside. Hence, rather look for 106.52 or even 105.89 as better levels for US Dollar bulls to engage and trigger a reversal.

US Dollar Index: Daily Chart

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.