Bitcoin Price Forecast: BTC nears all-time high as ETF inflows extend 12-day streak

- Bitcoin price extends its winning streak to a fourth day on Thursday, trading 4% away from its all-time high.

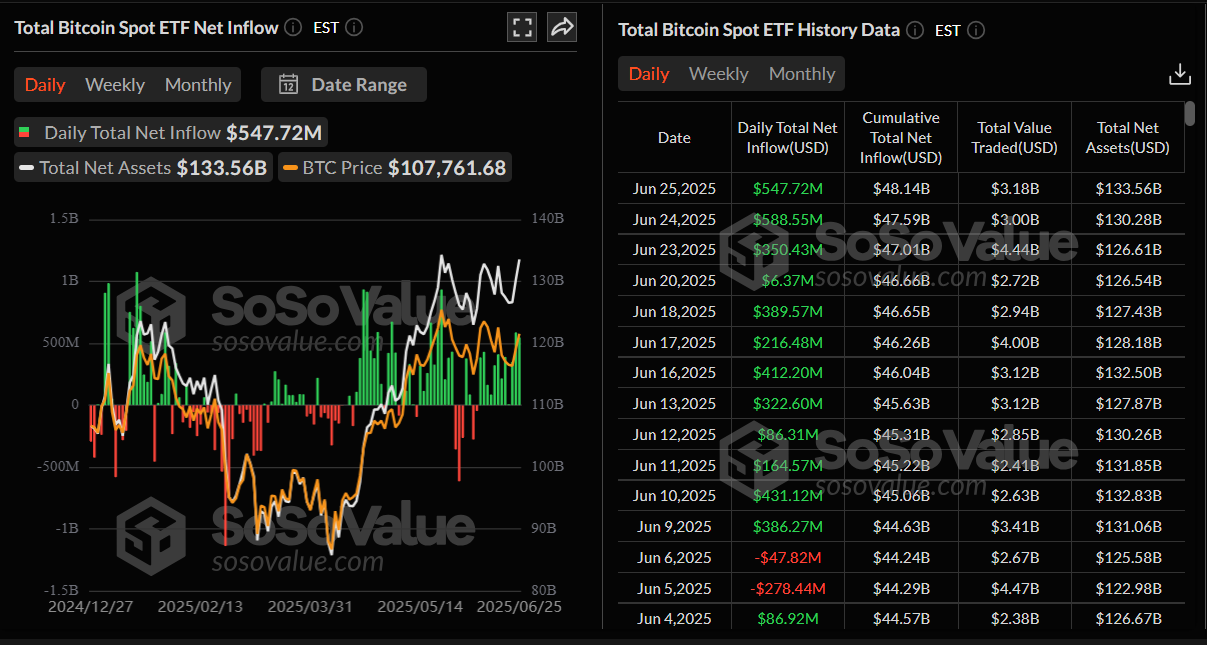

- US-listed spot BTC ETFs recorded more than $547 million in inflows on Wednesday, continuing a 12-day streak since June 9.

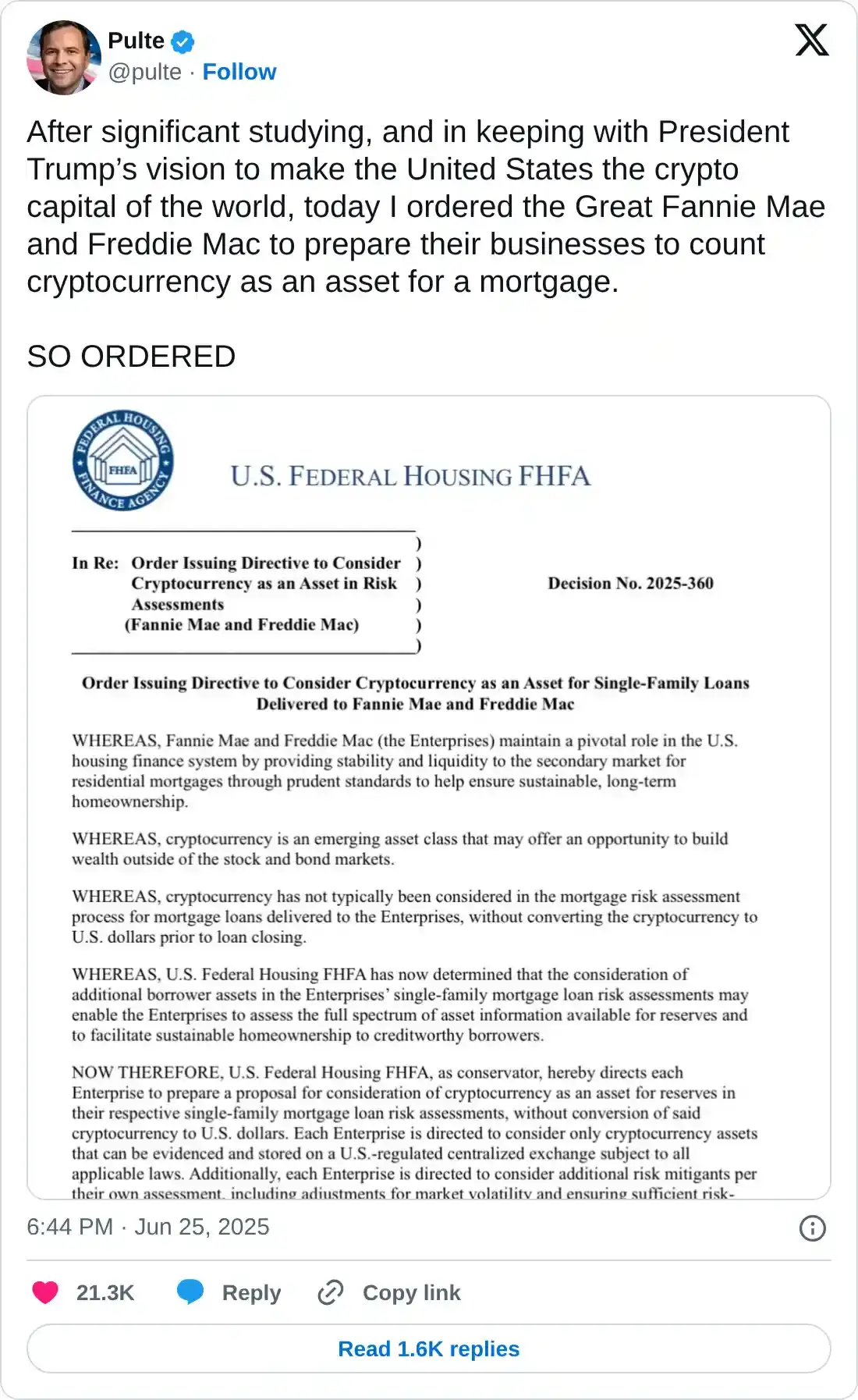

- The US Federal Housing Finance Agency directs Fannie Mae and Freddie Mac to recognize cryptocurrency as an asset for mortgage eligibility.

Bitcoin (BTC) extends its fourth day of gains, trading above $107,000 at the time of writing on Thursday, just 4% shy of its all-time high. BTC spot Exchange Traded Funds (ETFs) support the ongoing rally, recording over $547 million in inflows on Wednesday and continuing its 12-day streak since June 9. Apart from the robust institutional and corporate demand, the US Federal Housing Finance Agency directs agencies to recognize cryptocurrency as an asset for mortgage eligibility.

Bitcoin’s soaring institutional demand pushes BTC within reach of record highs

Bitcoin institutional demand supports BTC gains so far this week. According to SoSoValue data, the spot BTC ETFs recorded an inflow of $547.72 million on Wednesday. The weekly flow has reached $1.49 billion as of Wednesday, levels not seen since the end of May when BTC reached its new all-time high (ATH) at $111,980. If the inflow continues and intensifies, BTC could reach or even surpass its ATH.

Total Bitcoin spot ETF net inflow daily chart. Source: SoSoValue

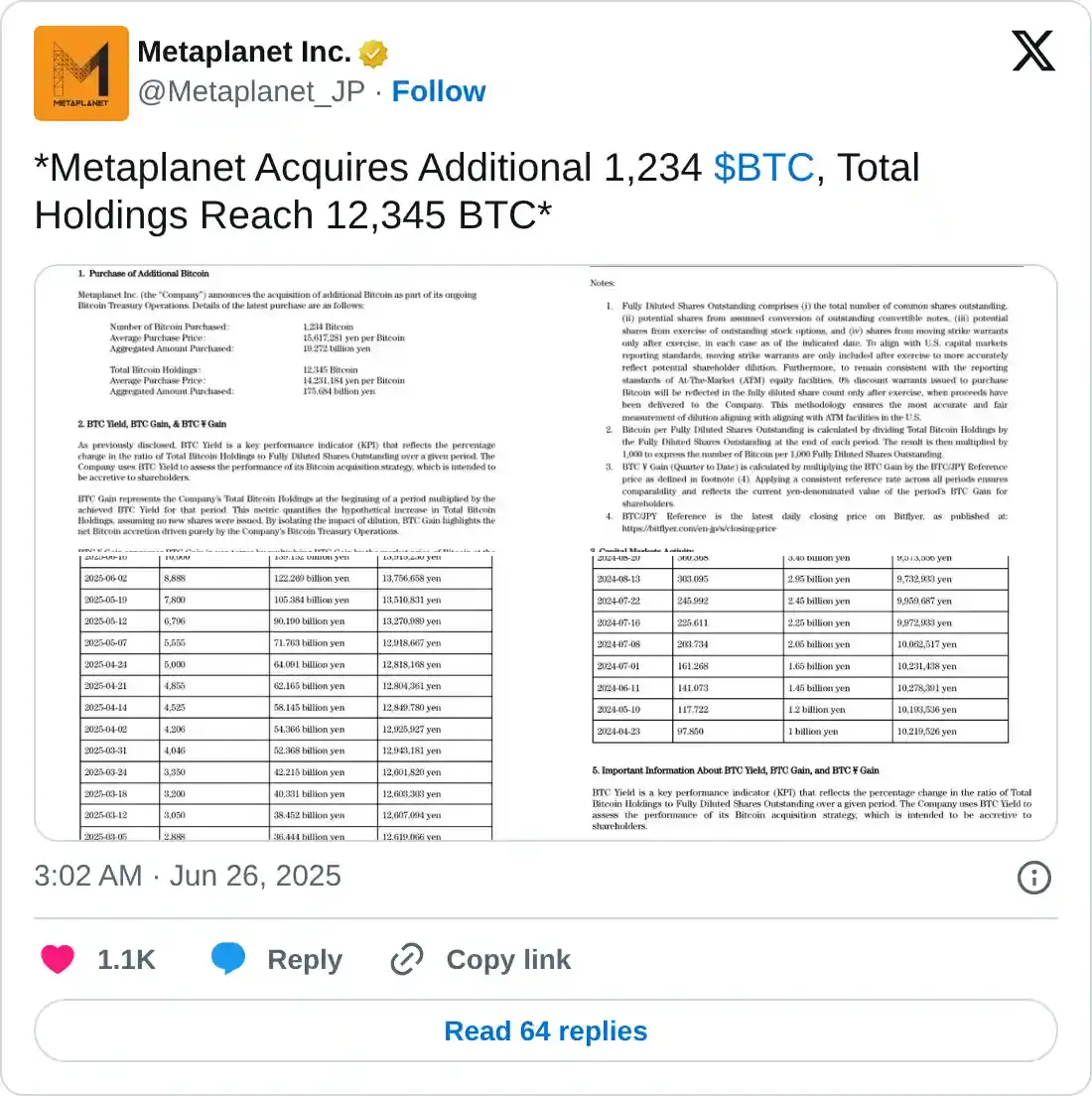

Apart from the continuous institutional inflows, the corporate companies also added BTC to their treasury reserves. Japanese investment firm Metaplanet added another 1,234 BTC on Thursday after adding 1,111 BTC at the start of this week. The firm currently holds 12,345 BTC.

Anthony Pompliano’s ProCap BTC also purchased an additional 1,208 BTC on Wednesday, following its earlier purchase on Tuesday, and now holds a total of 4,932 BTC. So far this week, corporate companies have added a total of 7,597 BTC, supporting robust demand for BTC.

Will BTC serve as collateral for a mortgage?

William Pulte, Director of the Federal Housing Finance Agency (FHFA), announced on his official X account on Wednesday that he has directed Fannie Mae and Freddie Mac to prepare their businesses to recognize cryptocurrency as an asset for mortgage purposes.

Pulte said, “After significant studying, and in keeping with President Trump’s vision to make the United States the crypto capital of the world, today I ordered the Great Fannie Mae and Freddie Mac to prepare their businesses to count cryptocurrency as an asset for a mortgage.”

This announcement could reshape mortgage markets, potentially increasing access to homeownership for crypto holders.

However, investors should keep a watchful eye on FHFA’s proposal details, regulatory clarity and market reaction in the upcoming days.

Bitcoin Price Forecast: BTC inches away from all-time highs

Bitcoin price declined, reaching a daily low of $98,200 on Sunday, but avoided a daily close below the $100,000 psychological level. BTC recovered sharply on Monday and continued its recovery over the next two days, closing above $107,000 on Wednesday. At the time of writing on Thursday, it trades around at $107,400.

If BTC continues its upward trend, it could extend the rally toward its May 22 all-time high at $111,980. A successful close above this level could extend additional gains to set a new all-time high at $120,000.

The Relative Strength Index (RSI) on the daily chart reads 56, above its neutral level of 50, indicating bullish momentum. The Moving Average Convergence Divergence (MACD) indicator is showing a bullish crossover on Thursday, and a daily confirmation would give a buy signal and favor the upward trend.

BTC/USDT daily chart

However, if BTC faces a correction, it could extend the decline to retest the 50-day Exponential Moving Average (EMA) at $103,543.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.