Crypto Today: Bitcoin, Ethereum, XRP consolidate gains after Israel-Iran ceasefire

- Bitcoin holds above $105,000 in sentiment-driven recovery following the announcement of a ceasefire between Israel and Iran.

- Institutional interest in Bitcoin and Ethereum remains elevated with steady spot ETF inflows.

- XRP extends gains backed by short-term technical buy signals and support above the 4-hour 100-period EMA.

Tensions in the Middle East have taken the backseat after United States (US) President Donald Trump announced a ceasefire between Israel and Iran on Monday. Global markets, including cryptocurrencies, ticked up, boosting Bitcoin’s (BTC) recovery above $105,000 at the time of writing on Tuesday.

Leading altcoins, including Ethereum (ETH) and Ripple (XRP), also responded positively to the improving sentiment, reclaiming key support levels at $2,400 and $2.15, respectively. Interest in digital assets, particularly in BTC, ETH, and XRP, has remained relatively high as investors seek to hedge against uncertainty.

Market overview: Israel-Iran ceasefire upholds investor interest in Bitcoin, Ethereum and XRP

Following President Trump’s high-stakes strikes on Iranian nuclear sites over the weekend, Iran responded on Monday, striking a US airbase in Qatar. Iran’s strike on Al Udeid airbase caused no injuries, paving the way for a ceasefire announced by President Trump.

The price swings seen in the last few days “demonstrate that, while crypto is decentralized in structure, it remains deeply influenced by global politics and investor psychology,” Andrejs Balans, risk manager at YouHodler, told FXStreet in a statement.

As the uncertainty surrounding the ceasefire agreement is still high, it is plausible that Bitcoin, Ethereum, and XRP will continue to dance between risk-on and risk-off sentiment in the coming days.

Data spotlight: Bitcoin, Ethereum boast steady ETF inflows

Interest in Bitcoin and Ethereum spot Exchange Traded Funds (ETFs) remains stable despite geopolitical tensions. BTC spot ETFs extended the bullish streak with over $350 million in net inflow volume on Monday, following a major drop to $6.4 million recorded on Friday. The cumulative total net inflow volume stands at $47 billion, with total net assets at $127 billion, according to SoSoValue data.

Bitcoin spot ETF data | SoSoValue

Investors resumed inflows into Ethereum spot ETFs on Monday, with SoSOValue recording slightly more than $100 million, swinging from outflows of around $11 million on Friday. To date, the cumulative total net inflow stands at $4 billion, with net assets at approximately $9.3 billion.

Ethereum spot ETF data | SoSoValue

Chart of the day: Bitcoin bulls regain control

Bitcoin’s price holds above key short-term support levels provided by the 4-hour 100-period Exponential Moving Average (EMA) at around $104,631, the 200-period EMA at $104,382, and the 50-period EMA at $103,865.

The path of least resistance appears to be up, buoyed by a buy signal flashed by the Moving Average Convergence Divergence (MACD) indicator on Monday when the blue MACD line crossed above the red signal line in the 4-hour chart. The expanding green histogram bars above the mean line indicate a bullish technical bias that is likely to support BTC’s recovery.

BTC/USD 4-hour chart

Prices closing above a higher support, preferably above $105,000, would affirm the bullish grip. Traders eye the extension of the uptrend to reach $106,500 (the resistance tested on Friday), and the seller congestion at $108,934, last tested on June 17.

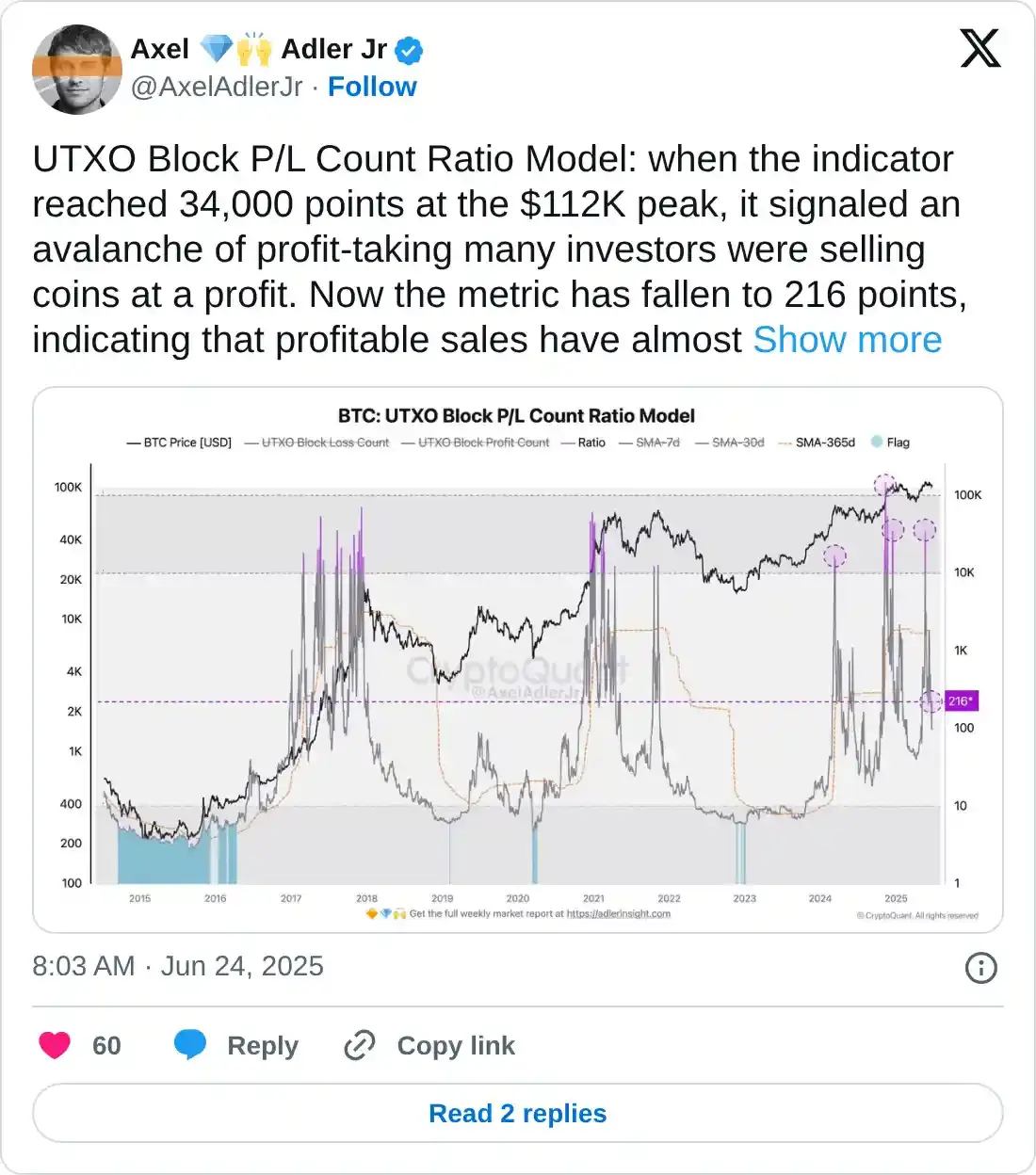

On-chain and macro analyst Axel Adler Jr. said on X that profit-taking-driven sell-side pressure had subsided, with sellers stepping aside and paving the way for investors to buy Bitcoin at lower levels. This has the potential to significantly push Bitcoin’s price higher while reducing the likelihood of sharp declines.

Altcoins update: Ethereum, XRP uphold gains

Ethereum is currently trading at around $2,416 at the time of writing as bulls push to extend gains after the weekend's drop to $2,110. Higher support is anticipated from the 4-hour 50-period EMA at $2,415, which could help boost the recovery and aim for highs above the resistance at $2,570 tested on Friday.

The technical structure remains relatively robust, with the MACD flaunting a buy signal, while the Relative Strength Index (RSI) on the 4-hour chart hovers above the 50 midline.

Traders should pay attention to the confluence resistance at around $2,475 established by the converging 100-period EMA and the 200-period EMA, which could delay the uptrend due to potential selling pressure as traders take profit.

ETH/USDT 4-hour chart

Meanwhile, XRP has risen 1.2% on the day, trading at $2.18 at the time of writing. The cross-border money remittance token confirmed two key support levels following its reversal from support tested at $1.90 on Sunday. These key anchor levels include the pivotal $2.00 and the 100-period EMA at $2.15.

XRP/USDT 4-hour chart

A break above the 200-period EMA at $2.19 could follow the steady uptrend in upcoming sessions. Positive sentiment in the broader crypto market, a buy signal from the MACD, and the RSI's upward movement at 63 also add to the bullish outlook. Key targets on the upside include a break above the descending trendline resistance and the seller congestion at $2.33, which was tested on June 17.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.