Ripple Price Forecast: XRP nears technical breakout as whales uphold risk-on sentiment

- XRP is poised for a breakout from a descending channel, bolstered by renewed risk-on sentiment.

- Large-volume holders and institutional investors continue to show interest in XRP despite fluctuations in price and geopolitical tensions.

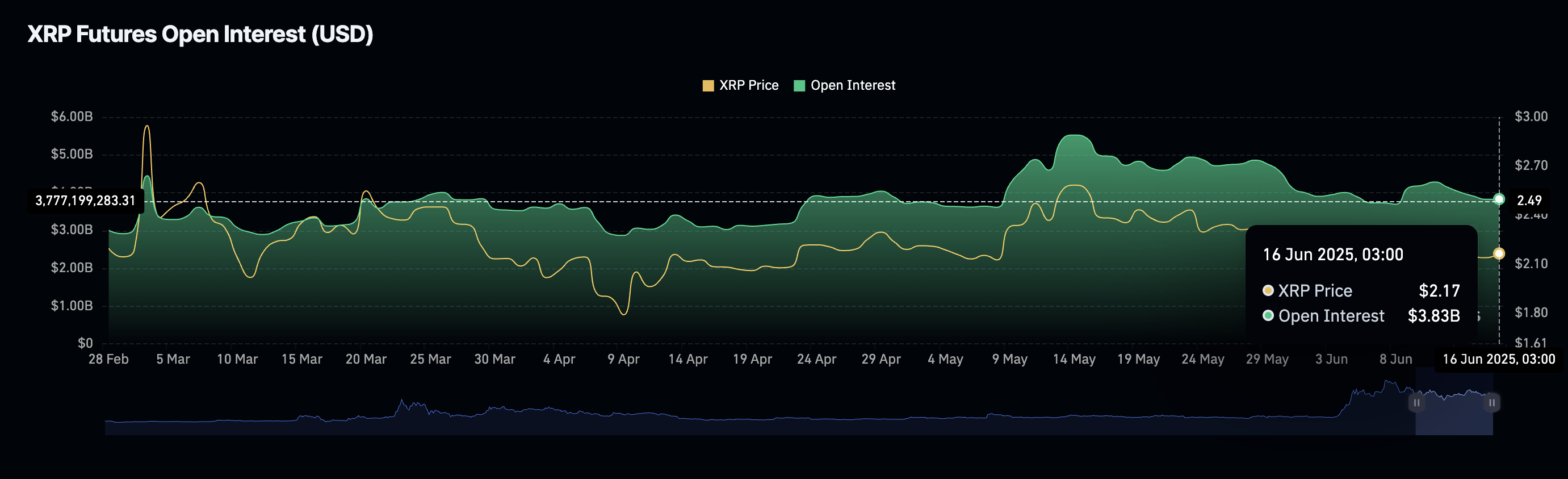

- XRP futures open interest remains steady at $3.83 billion, largely maintaining a downtrend outlook that is likely to hinder interest in the token.

Ripple (XRP) flaunts a short-term bullish outlook as part of the recovery from the sell-off encountered last week after Israel launched attacks on Iran, escalating geopolitical tensions in the Middle East.

The international money transfer token hovers at around $2.28 at the time of writing on Monday, rising by over 5% on the day. Other major assets, including Bitcoin (BTC) and Ethereum (ETH), offer bullish signals amid optimism for a ceasefire between Israel and Iran.

XRP extends gains amid steady risk appetite

Interest in XRP is growing despite heightened volatility due to tensions between Israel and Iran. Large volume holders, with between 1 million and 10 million XRP, continued to buy XRP despite macroeconomic and geopolitical tensions.

According to Santiment, this investor cohort currently holds 9.9% of XRP’s total supply, up from 9.5% on May 1 and 8.24% recorded on January 1.

[16-1750085336436.21.21, 16 Jun, 2025].png)

XRP Supply Distribution metric | Source: Santiment

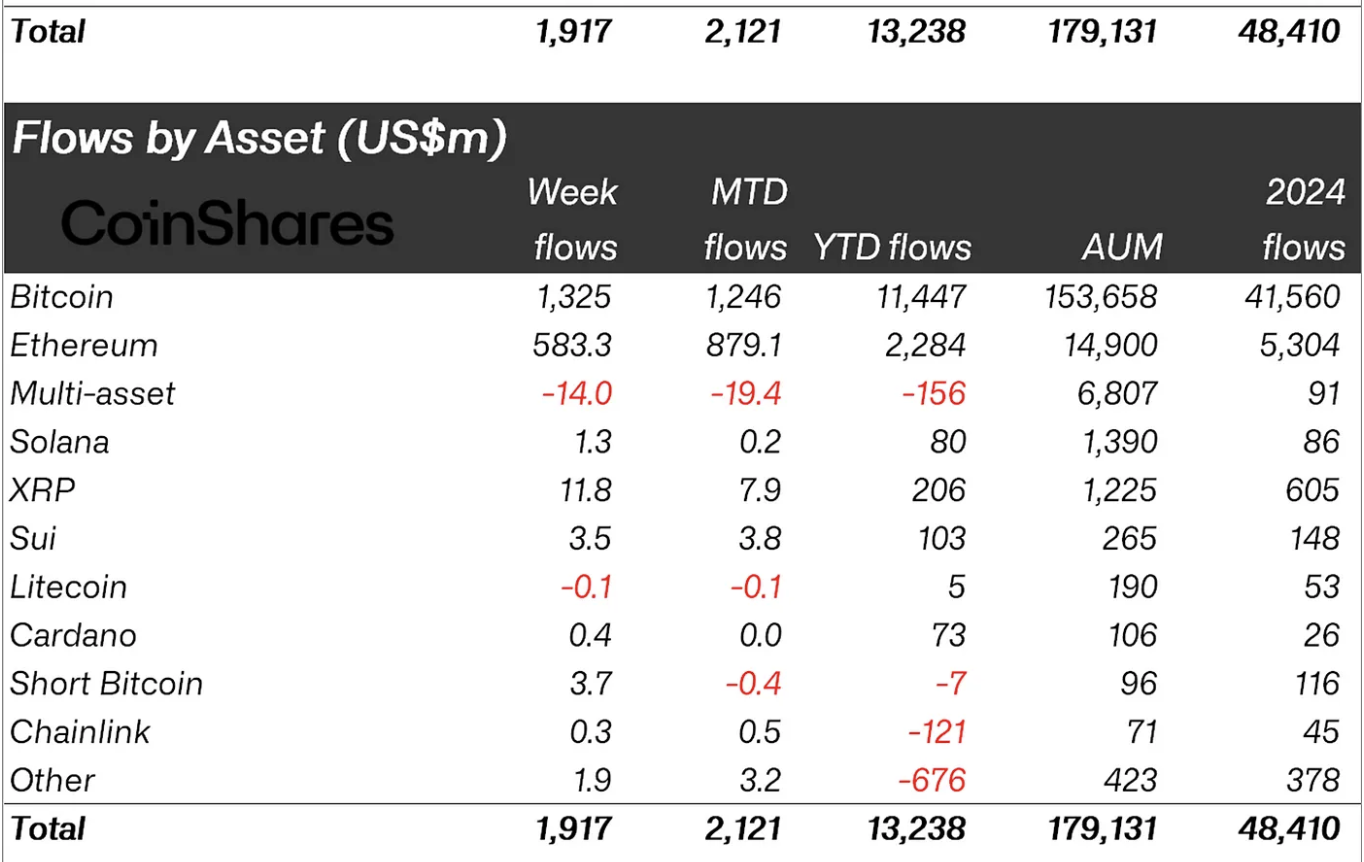

The persistent increase in risk-on sentiment among large volume holders mirrors CoinShares’ weekly digital investment report, which highlights inflows of approximately $11.8 million in XRP-related financial products last week.

“Regional sentiment was positive, led by the US (US$1.9bn), while altcoins like XRP (US$11.8m) and Sui (US$3.5m) also saw renewed investor interest,” CoinShares weekly report highlights.

Weekly digital asset inflows | Source: CoinShares

Meanwhile, interest within the microenvironment is showing signs of consolidation, with the XRP futures Open Interest (OI) steady at around $3.83 billion. From the chart below, OI is sideways but upholds a general downtrend from the recent peak at $5.52 billion, reached in mid-May.

OI refers to the number of futures and options contracts that have yet to be settled or closed. Steady OI suggests that interest in XRP is growing, with traders likely betting on potential price increases in the future.

XRP futures open interest | Source: CoinGlass

Technical outlook: XRP is on the cusp of breakout

XRP’s price rises, hovering around $2.28 at the time of writing. The upswing follows the establishment of support at $2.09, bolstered by the 200-day Exponential Moving Average (EMA).

Key indicators, including the Relative Strength Index (RSI) and the Moving Average Convergence/Divergence (MACD), provide bullish technical signals. The RSI’s return above the 50 midline implies bullish momentum, likely to keep the price of XRP steady in upcoming sessions.

The MACD indicator will likely validate a buy signal if the blue MACD line crosses above the red signal line. Traders can also monitor the indicator’s movement, with recovery toward the mean line alongside the expansion of green histogram bars, potentially triggering a breakout from the descending channel, as illustrated on the daily chart.

XRP/USDT daily chart

A convergence of the 50-day EMA and the 100-day EMA at $2.25 serves as short-term support. Traders would look for a daily close above this level to validate the strength of the uptrend. Meanwhile, breaking above the descending channel resistance could boost momentum as volume surges.

Key areas of interest going forward will include $2.65, a seller congestion 17% above the current level, and the elusive target at $3.00, representing a 32% move above the prevailing market value.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.