Bitcoin Weekly Forecast: BTC dips as profit-taking surges, but institutional demand holds strong

- Bitcoin price stabilizes around $106,000 on Friday after falling near 3% so far this week.

- On-chain data shows that BTC’s profit-taking activity has reached a three-month high, signaling growing selling pressure.

- Corporate and institutional demand remains robust as Strategy, GameStop adds BTC, and spot Bitcoin ETFs record net positive inflow until Thursday.

Bitcoin (BTC) is stabilizing around $106,000 on Friday, following three consecutive days of correction that have resulted in a near 3% decline so far this week. The correction in BTC prices was further supported by the profit-taking activity of its holders, which has reached a three-month high.

Despite the short-term selling pressure, institutional demand remains robust. Firms like Strategy, former MicroStrategy, and GameStop have added Bitcoin to their balance sheets, and spot Bitcoin Exchange Traded Funds (ETFs) continue to record inflows, highlighting ongoing confidence in the largest cryptocurrency by market capitalization and its long-term potential.

Some holders realized profits, increasing the downward pressure

Santiments’ Network Realized Profit/Loss (NPL) metric indicates that some BTC holders are realizing gains.

As shown in the graph below, the NPL experienced a significant spike on Tuesday, marking the highest profit booking activity since February 5. Later on Friday, a similar spike of lesser intensity was also seen. These spikes indicate that holders are, on average, selling their bags at a significant profit and increasing the selling pressure.

[10-1748585592553.27.22, 30 May, 2025].png)

BTC NPL chart. Source: Santiment

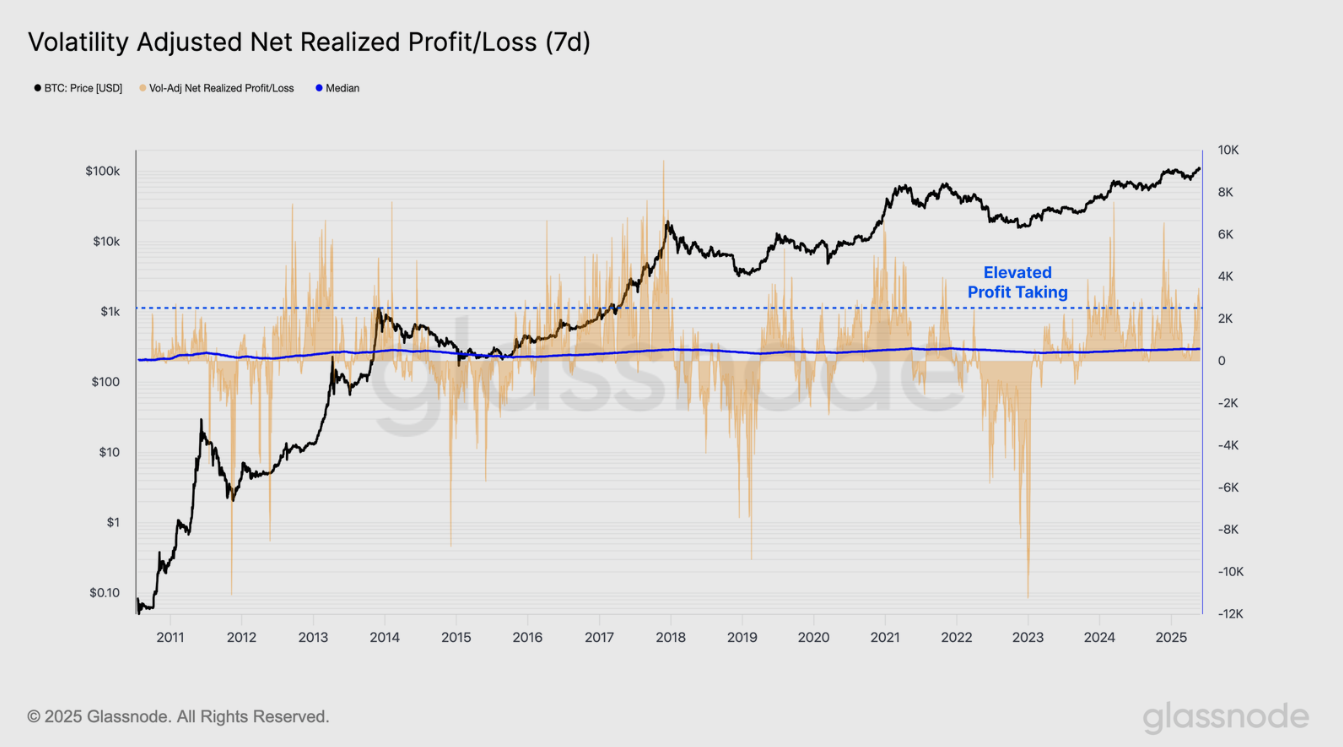

The Glassnode's weekly report highlights that investor profitability and spending behavior have both increased notably, and current levels remain below the extremes reached prior bull market peaks.

The Volatility-Adjusted Net Realized Profit/Loss metric, as shown below, measures realized profit and loss in BTC terms, which normalizes it relative to Bitcoin’s growing market cap across cycles. It is further refined by adjusting for 7-day realized volatility to account for Bitcoin’s diminishing returns and slower growth rate as the asset matures.

As the BTC price rallied through its previous all-time high, a notable uptick in profit-taking was recorded, with only 14.4% of days recording higher values. This suggests profit-taking has increased but has not yet reached extreme levels.

BTC Volatility-Adjusted Net Realized Profit/Loss (7-day) chart. Source: Glassnode

Corporate and institutional demand remains robust

Bitcoin’s corporate and institutional interest and demand continued to strengthen despite its mild correction so far this week.

The week started with Strategy adding 4,020 BTC for $427.1 million on Monday, bringing its total BTC holdings to 580,250 BTC. Later on Wednesday, US video game retailer GameStop made its first Bitcoin purchase after acquiring 4,710 BTC. The acquisition follows GameStop’s $1.3 billion convertible note offering, issued in March, as part of its plan to include Bitcoin as a treasury asset. Later on Thursday, Japanese investment firm Metaplanet announced that it has issued $21 million in Ordinary Bonds to purchase more BTC; the firm currently holds 7,800 BTC in its treasury.

The corporate companies’ interest in Bitcoin indicates a growing acceptance of BTC as a strategic asset, boosting its legitimacy and potentially driving long-term adoption.

Looking at institutional demand, SoSoValue data show that US spot Bitcoin ETFs recorded a total inflow of $458.82 million until Thursday, continuing its seven-week streak of weekly inflows since mid-April. Additionally, the monthly ETF inflow reached $5.85 billion in May, the highest level since December and surpassing the levels seen after US President Donald Trump’s inauguration in January. If this institutional inflow continues or intensifies, the BTC price could recover and head toward its all-time high of $111,980.

Total Bitcoin spot ETFs weekly chart. Source: SoSoValue

Total Bitcoin spot ETFs monthly chart. Source: SoSoValue

Bitcoin price fails to recover despite easing tariff fears

Bitcoin started the week on a positive note as US President Donald Trump announced on Monday on his Truth Social account that he agreed to extend the implementation date for the 50% tariff on EU goods from June 1 to July 9. This news followed last Friday’s announcement to impose 50% tariffs on imports from the European Union, as Trump said that negotiations in Brussels were going nowhere. Friday’s announcement triggered a risk-off sentiment in the market as Bitcoin fell 3.9% that day.

This delay in the EU tariff slightly boosted investor sentiment and triggered a mild rise in risk-on sentiment. The overall market reacted positively to this news, and Bitcoin recovered slightly, closing above $109,000 that day.

This week, the US took an unexpected move regarding its tariffs. The US Court of International Trade announced on Wednesday that it had blocked Trump’s reciprocal tariffs that were announced on the so-called “Liberation Day.” The court ruled that the president overstepped his authority by imposing across-the-board duties on imports from US trading partners.

The three-judge panel issued a permanent injunction on the blanket tariff orders issued by Trump since January and ordered the issuance of new orders reflecting the permanent injunction within ten days. The Trump administration has appealed the decision.

Overall, markets reacted positively to this news, with the US dollar (USD) strengthening and global equities rising due to optimism surrounding reduced trade frictions. However, risky assets such as Bitcoin failed to recover and dipped slightly on Wednesday, closing below $105,600 the next day after reaching a new all-time high of $111,980 the previous week.

Macroeconomics development

US macroeconomic data releases this week fail to support the risk-on sentiment. The Minutes of the Federal Reserve’s (Fed) May monetary policy meeting, released on Wednesday, showed that officials perceived elevated uncertainty about the economic outlook.

“Participants noted they may face difficult trade-offs if inflation proved more persistent while outlooks for growth and employment weakened,” the publication noted.

The risk-on sentiment continued to fade on Thursday as the US Pending Home Sales fell to a one-year low of -6.3%, while Initial Jobless Claims rose more than expected to 240K on a week-on-week basis. Additionally, Q1 Gross Domestic Product (GDP) contracted 0.2% on an annualized basis.

“US data broadly came in poor to mixed on Thursday,” reports Joshua Gibson, FXStreet’s analyst.

Gibson continued that the US Personal Consumption Expenditures Price Index (PCE) inflation for April is due on Friday and will be a key reading for investors. As the Fed favored measure of inflation, PCE price growth has a direct link to when the central bank will move interest rates and by how much.

Bitcoin technical outlook shows fading bullish momentum

Bitcoin price dipped and closed below its daily level of $106,406 on Thursday, following its ongoing correction over the previous two days. At the time of writing on Friday, it hovers and trades below $106,000.

If BTC continues its correction, it could extend the decline to revisit the psychologically important level of $100,000.

The Relative Strength Index (RSI) reads 54 in the daily chart, pointing downward toward its neutral level of 50, indicating fading bullish momentum. Additionally, the Moving Average Convergence Divergence (MACD) indicator also showed a bearish crossover. It also shows rising red histogram bars below its neutral level, indicating a correction ahead.

BTC/USDT daily chart

However, if BTC recovers and closes above its all-time high, it could extend the rally toward the key psychological level of $120,000.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.