Bitcoin Price Forecast: BTC fails to reach all-time high despite building institutional and state support

- Bitcoin price stabilizes around $105,200 on Tuesday, just 4% shy of its all-time high at $109,588.

- JPMorgan CEO Jamie Dimon says the bank will let clients buy Bitcoin.

- The Texas House is set to conduct a second reading of a bill that, if passed, would establish a Bitcoin Reserve.

Bitcoin (BTC) price stabilizes at around $105,200 at the time of writing on Tuesday, just 4% shy of its record peak. The positive narrative builds as JPMorgan CEO Jamie Dimon said the bank will let clients buy Bitcoin on Monday. Meanwhile, the Texas House is set to conduct a second reading of Senate Bill 21 on Tuesday; if passed, the bill would establish a Bitcoin Reserve.

JPMorgan CEO Jamie Dimon says the bank will let clients buy Bitcoin

CNBC reported on Monday that JPMorgan Chase would allow clients to buy Bitcoin, marking a significant step for the largest US bank, even as CEO Jamie Dimon remains a vocal critic.

“We are going to allow you to buy it,” Dimon said on Monday at the bank’s annual investor day. While clients can purchase Bitcoin, JPMorgan will not custody the asset; the bank will reflect the holdings in client statements.

Despite the move, Jamie Dimon reaffirmed his disapproval of Bitcoin, citing its association with illicit activities such as money laundering, terrorism, and sex trafficking, reports CNBC.

“I don’t think you should smoke, but I defend your right to smoke,” Dimon said. “I defend your right to buy bitcoin.”

JPMorgan’s move adds to growing Wall Street acceptance of Bitcoin, following Morgan Stanley’s decision to offer access to spot Bitcoin ETFs to eligible clients since August 2024. These signals indicate a positive outlook for Bitcoin. Moreover, the US has rolled back anti-crypto policies under the pro-crypto Trump administration. The accounting rule SAB 121 has also been repealed, allowing banks to custody crypto assets.

Texas House to review Bitcoin Reserve Bill

The Texas House of Representatives is set to conduct a second reading of Senate Bill 21 (SB21), known as the Texas Bitcoin Reserve Bill, on Tuesday.

If passed, the bill would establish a Texas Strategic Bitcoin Reserve, allowing the state comptroller to manage a fund outside the state treasury to hold Bitcoin and potentially other digital assets. Only digital assets with a market capitalization of over $500 billion would qualify for inclusion. Currently, only Bitcoin meets that threshold.

The bill must pass out of the House Public Health Committee by Saturday to proceed to a final floor vote before the legislature adjourns in early June.

Texas would become the third US state to establish such a reserve, following New Hampshire and Arizona, while similar initiatives in Florida, Wyoming, Montana and Pennsylvania have failed this year.

Bitcoin institutional demand remains strong

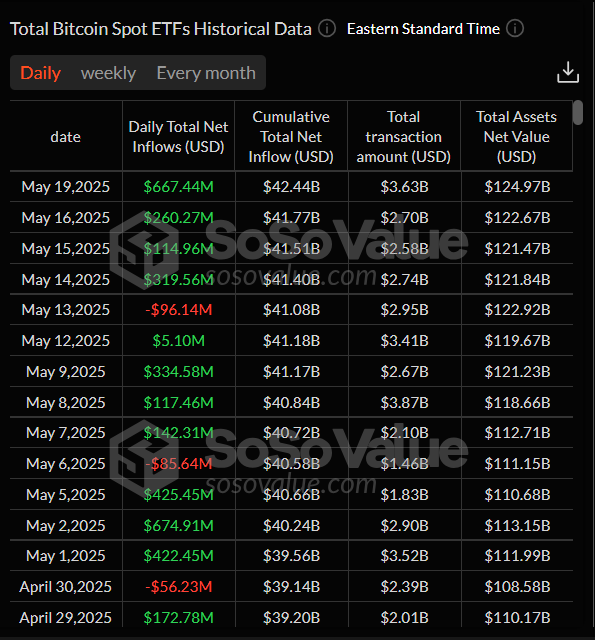

Bitcoin’s institutional demand started the week positively, continuing its four-day streak on inflow since May 14. According to SoSoValue data, US spot Bitcoin Exchange Traded Funds (ETFs) recorded an inflow of $667.44 on Monday. The Bitcoin price should benefit if institutional inflows continue and intensify, targeting its all-time high level of $109,508.

Total Bitcoin Spot ETFs daily chart. Source: SoSoValue

Another bullish narrative for Bitcoin is the Stablecoin legislation, the GENIUS Act, which overcame a procedural blockade on Monday night in the US Senate, marking a major victory for the crypto industry. During the same period, US President Donald Trump announced via a Truth Social post the possibility of a ceasefire between Russia and Ukraine. As discussed in the previous report, this narrative could fuel BTC to its all-time highs.

Bitcoin Price Forecast: BTC shows early signs of weakness in momentum indicators

Bitcoin price rallied 3.23%, breaking above its key resistance level at $105,000 on Sunday. However, on Monday, BTC erased all its gains during the Asian session but recovered slightly by the end of the New York session, closing above $105,500. At the time of writing on Tuesday, it continues to trade down at around $105,000.

The momentum indicators on the daily chart show early signs of weakness. The Relative Strength Index (RSI) reads 67 and points downward after being rejected from its overbought levels of 70 on Sunday, indicating fading bullish momentum.

The Moving Average Convergence Divergence (MACD) also showed a bearish crossover on Sunday, with the MACD line crossing below the signal line, giving a sell signal and indicating the potential start of a downward trend.

If BTC continues its pullback, it could extend the decline to retest the psychological support level at $100,000.

BTC/USDT daily chart

Another possibility is that if BTC holds strong around the $105,000 support level, it could extend the rally toward the all-time high of $109,588 set on January 20.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.