Bitcoin Price Forecast: BTC slips below $103,000 as traders lock in profits ahead of US CPI

- Bitcoin extends its decline on Tuesday, slipping below $103,000.

- Santiment data shows traders are taking profits ahead of the US CPI release.

- Bitfinex analysts suggest that if macro conditions stay favorable, short-term dips may be quickly absorbed, keeping BTC’s bullish outlook intact.

Bitcoin (BTC) extends its decline on Tuesday, slipping below $103,000 at the time of writing as traders book profits following last week’s over 10% rally. The move comes ahead of the release of the US Consumer Price Index (CPI) data for April, which could bring volatility into risky assets like BTC. Despite the short-term decline, a report from Bitfinex analysts suggests that if macro conditions stay favorable, short-term dips may be quickly absorbed, keeping BTC’s bullish outlook intact.

Some BTC holders realize profits ahead of the US CPI

Bitcoin began this week on a positive note, climbing during the Asian session on Monday, as news came in that the US and China had agreed to a tariff reduction for 90 days. However, those gains were largely erased during the New York session as the largest cryptocurrency by market capitalization dropped sharply below $103,000, hitting an intraday low near $100,700. At the time of writing on Tuesday, it is trading in the red at around $102,600 during the early European trading session.

Santiments’ Network Realized Profit/Loss (NPL) metric shows BTC holders are booking some profits after a massive gain of over 10% in the previous week. This metric computes a daily network-level Return On Investment (ROI) based on the coin’s on-chain transaction volume. Strong spikes in a coin’s NPL indicate that its holders are, on average, selling their bags at a significant profit. On the other hand, strong dips imply that the coin’s holders are, on average, realizing losses, suggesting panic sell-offs and investor capitulation.

As shown in the chart below, the metric showed a strong spike on Tuesday, indicating that holders are, on average, selling their bags at a significant profit and increasing the selling pressure.

[12-1747125255850.24.28, 13 May, 2025].png)

BTC NPL chart. Source: Santiment

The short-term profit booking activity comes ahead of the highly anticipated release of the US April CPI data on Tuesday, which could inject fresh volatility into the market, and traders should watch for it.

FXStreet reports that, as measured by the CPI, inflation in the US is forecast to rise at an annual rate of 2.4% year-over-year (YoY) in April, at the same pace as in March. The core CPI inflation, which excludes the volatile food and energy categories, is expected to stay at 2.8% YoY in the reported period, as against a 2.8% growth in the previous month. On a monthly basis, the CPI and the core CPI are projected to rise by 0.3% each.

A surprise uptick in the annual headline CPI inflation print could affirm bets that the Fed will hold the monetary policy in June. In this case, the USD (US Dollar) could see another leg higher in an immediate reaction, triggering risk-off sentiment in the market that would cause a fall in the prices of risky assets like Bitcoin.

Conversely, a softer-than-expected reading could revive the USD downtrend on renewed dovish Fed expectations, often boosting investor confidence across risk markets, leading to rallies in BTC.

Bitcoin price dips are likely to be absorbed quickly, says Bitfinex report

On Monday, Bitfinex's ‘Alpha’ report highlights that as long as macro conditions remain supportive, short-term dips will likely be absorbed quickly, reinforcing the upside bias and leaving BTC well-positioned for a potential new leg toward fresh highs.

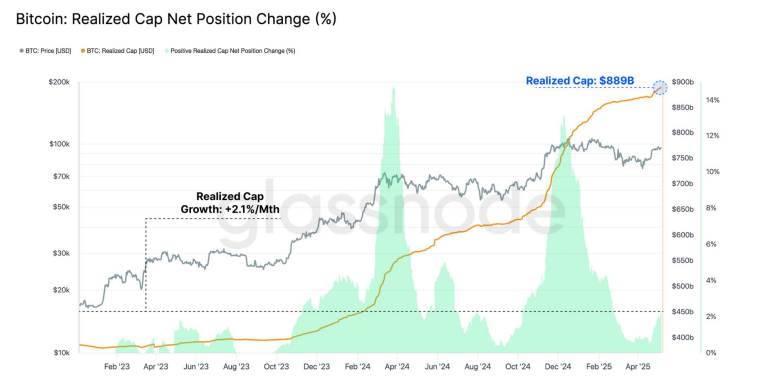

The report explains that capital rotation into Bitcoin appears sustained, as shown in the graph below, the Realised Cap Net Position Change reaching a new all-time high of $889 billion, reflecting growing investor conviction and capital inflow.

Bitcoin realised capitalisation net position change chart. Source: Glassnode

Moreover, the Bitcoin spot Exchange Traded Funds (ETFs) inflows have exceeded $920 million over the past two weeks. There is also a significant drop in coins held at a loss, with over 3 million BTC returning to profit, according to a Bitfinex analyst.

Bitcoin supply in loss in correlation to price chart. Source: CryptoQuant

In an exclusive interview, a Bitfinex analyst told FXStreet about Bitcoin's short-term, medium-term, and long-term outlook.

Short-Term (Next 1–2 Weeks):

Bitcoin is holding above $100K with steady spot volume and neutral funding—suggesting trend continuation is likely, but not guaranteed. However, we have potentially market-moving events this week, including the latest CPI report and Fed Chair Jerome Powell’s speech on Thursday.

With ETF flows back and no major macro risks imminent, the short-term outlook is constructive. However, volatility is expected on any news around trade deals. Key support lies at $98.5K; resistance near $104K–$106 K. A breakout above this range opens up quick upside to $110K, and beyond to the current all-time high. However, BTC has moved up sharply in the past few weeks, and we expect a period of consolidation - meaning a new ATH could be delayed to June as supply/demand stabilises above 100k.

Medium-Term (Next 1–3 Months):

The medium-term setup remains bullish. FOMC statements are currently favourable, ETF inflows are consistent, and Bitcoin has shown relative strength over equities and altcoins. Risks include sudden macro shocks (e.g. CPI surprise, regulation headlines) or breakdown in ETF momentum.

Long-Term (6–12 Months+):

Bitcoin’s long-term outlook is the strongest it has ever been. With sovereign and institutional adoption advancing, ETF rails expanding globally, and the US framing crypto policy more positively, BTC is evolving into a global macro reserve asset. Cycle targets towards $150K–$180K are still in play for 2025–2026. Barring systemic liquidity shocks, structural supply constraints and programmable demand.

Bitcoin Price Forecast: BTC faces rejection from $105,000

Bitcoin faced resistance at around the $105,000 level on Sunday, declining by 2% until the next day. At the time of writing on Tuesday, it hovers at around $102,300.

Signs of bullish exhaustion are emerging on momentum indicators. The Relative Strength Index (RSI) on the daily chart reads 67, slipping below its overbought level of 70 and pointing downwards, indicating a weakening bullish momentum. If the RSI continues to decline and moves below the neutral level of 50, it would lead to a sharp fall in Bitcoin prices.

If BTC continues its pullback, it could extend the decline to retest the psychological support level at $100,000.

BTC/USDT daily chart

However, if BTC recovers and closes above the $ 105,000 resistance level, it could open the door for a rally toward the all-time high of $109,588 set on January 20.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.