Crypto Today: BTC price hits $100K as Trump announces UK trade deal, boosting Ethereum, PEPE and Chainlink

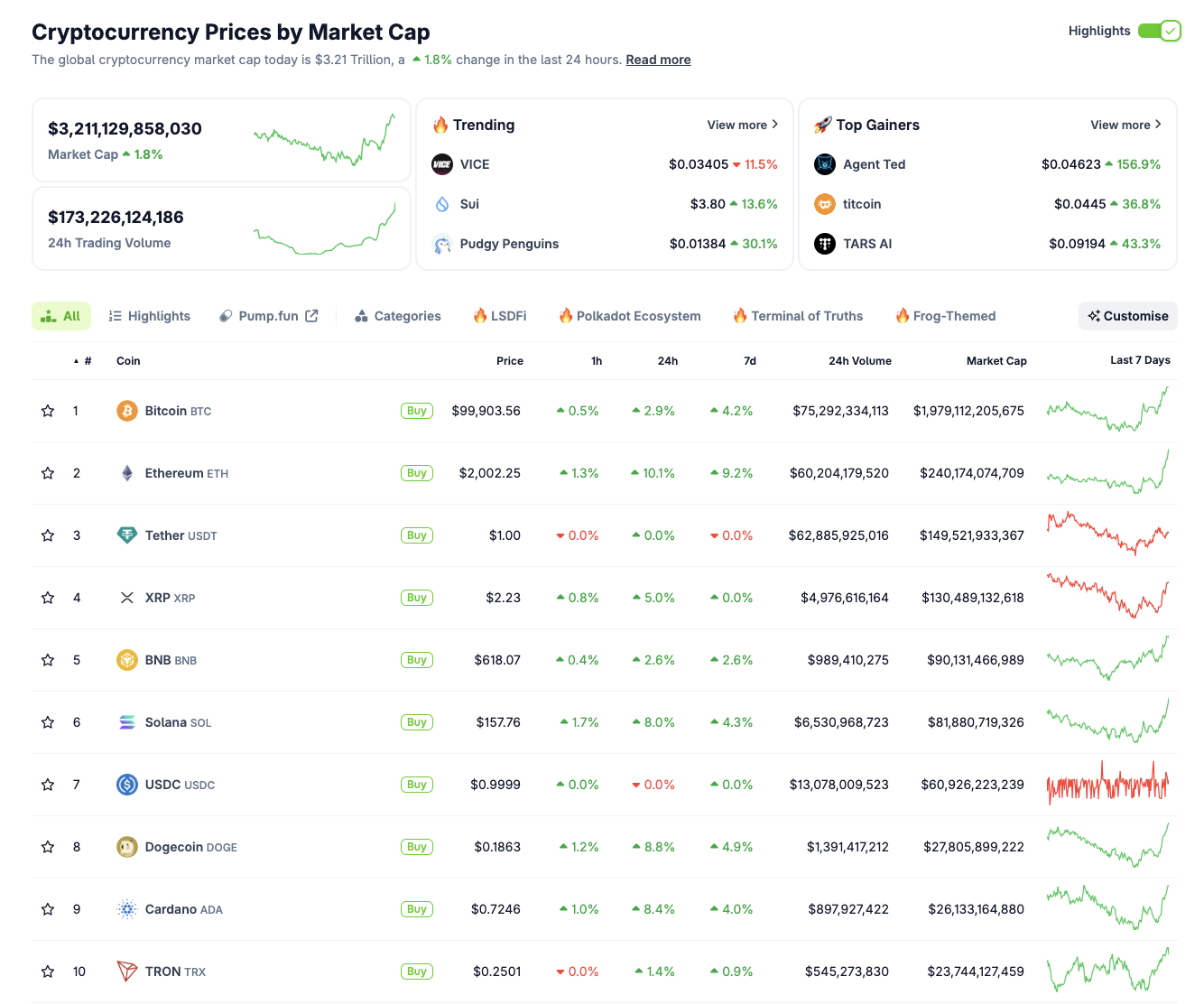

- Cryptocurrency sector valuation holds above $3.1 trillion on Thursday as global financial markets react to bullish macro pointers.

- US President Donald Trump announced a trade deal with the UK, hinting at more deals in the works.

- Ethereum-hosted assets are attracting unusually high-demand with ETH, PEPE and Chainlink price gains accompanied by rising trading volumes.

- SUI, Virtuals Protocol and the official TRUMP token are also among the standout performers, driven by distinct catalysts.

The cryptocurrency sector valuation crossed the $3.1 trillion market on Thursday, as markets reacted to bullish macro pointers.

Why is the crypto market up today?

United States (US) President Donald Trump announced a trade deal with the United Kingdom (UK) on Thursday morning. Markets had priced in the move before its announcement, with top-ranked assets, including BTC and ETH, breaking multi-month resistance levels at $2,000 and $100,000, respectively.

Trump announces trade deal with UK, May 8, 2025 | TruthSocial

With Trump’s post hinting at more trade deals in the works and Chinese authorities confirming talks to discuss existing tariffs, the crypto market is expected to witness more capital inflows as the US day-trading session unfolds.

Bitcoin market updates

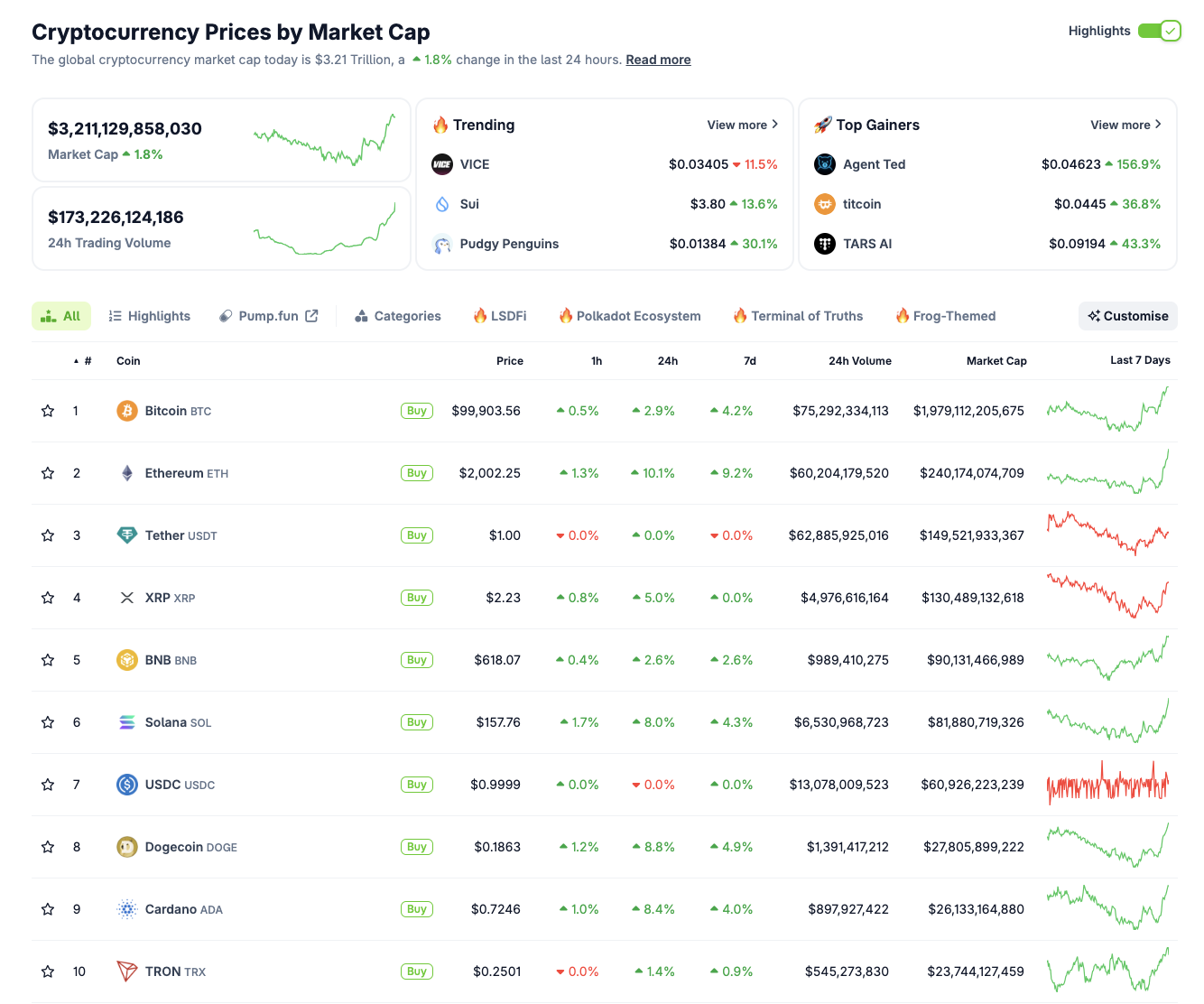

For the first time since February, Bitcoin price tested the $100,000 resistance on Thursday, trading as high as $101,525 according to TradingView data.

Bitcoin price action | Coingecko

More so, BTC’s 24-hour trading volume has more than doubled, rising from $35 billion at the close of Wednesday to hit $76 billion at press time. Rising trading volumes during a rally often signal more bullish action ahead, as the asset continues to find buyers at its current high prices.

Altcoin market updates: Ethereum-hosted projects in high demand as macro pointers align with Pectra upgrade

Investors are pouring into Ethereum and its ecosystem tokens as macro and internal bullish tailwinds converge.

The recent Ethereum Pectra upgrade, executed successfully on Wednesday, came amid a favorable macro backdrop, including renewed optimism from Trump-led trade deals and the Federal Reserve's third consecutive rate pause decision.

A technical quirk further accelerated the Ethereum price rally. During the Pectra rollout, major exchanges like Coinbase temporarily paused ETH withdrawals.

This led to artificially low sell pressure just as markets turned bullish, enabling Ethereum to post a strong 13% daily performance.

ETH surged to $2,002.25 at press time, outpacing Bitcoin, which is gaining 4% after breaching the $100,000 milestone.

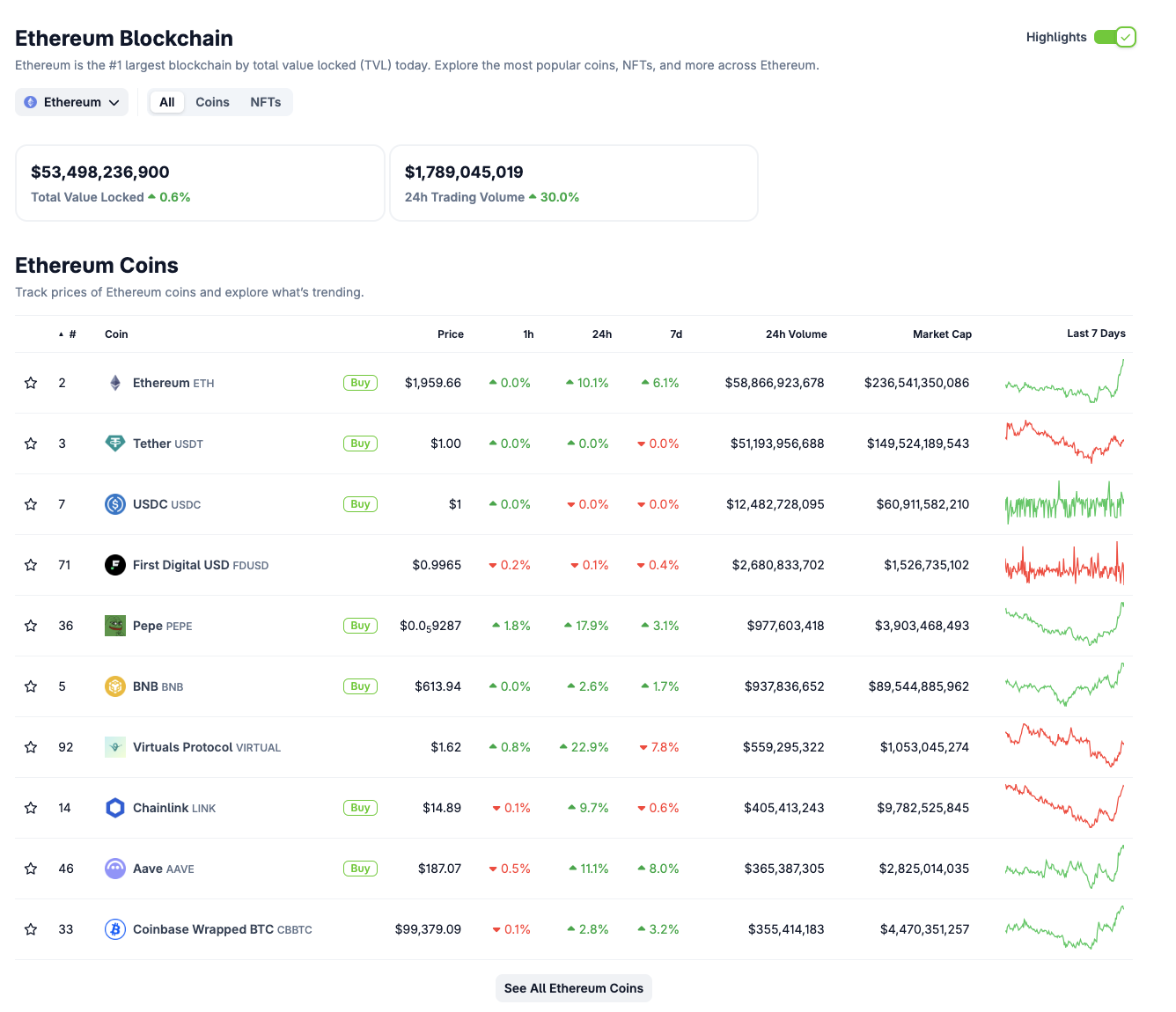

Chart of the day: Ethereum ecosystem trading volumes surge 30% in 24 hours

Ethereum ecosystem aggregate market cap surges to $53.5 billion with its trading volumes rising 30% within the last 24 hours. This aligns with the narrative that investors are increasingly leaning into Ethereum-hosted projects to capitalize on improved sentiment from the Pectra upgrade.

Ethereum Ecosystem Performance, May 8 2025 | Source: Coingecko

Among Ethereum-native tokens, the top performers in the last 24 hours include:

- PEPE price gained 17.0% to $0.00006, riding memecoin momentum and renewed whale interests.

- Virtuals Protocol (VIRTUAL) price up 21.0% to trade at $1.62, benefiting from speculative flows into new DeFi infrastructure.

- Chainlink (LINK) price posts 9.4% gains at it nears $15, driven by growing cross-chain integration narratives and close affiliation to Trump as one of the tokens held by Trump-back Word Liberty Financial (WLFI).

- AAVE price is also up by 10.6% as it crossed $187, reflecting renewed interest in Ethereum-based lending and borrowing platforms.

Top-ranked layer-1 altcoin performance:

- Ripple (XRP): XRP rose 4.7% to $2.23 as bulls push higher despite unresolved legal headwinds. Rising daily volumes suggest renewed momentum.

- Cardano (ADA): ADA surged 8.1% to $0.7246, riding Layer 1 optimism. A break above $0.75 is needed to confirm trend continuation.

Top 10 cryptocurrencies performance May 8, 2025 | Source: Coingecko

- Dogecoin (DOGE): DOGE jumped 8.3% to $0.1863, nearing overbought RSI levels. Social buzz remains the key driver of short-term gains.

- Solana (SOL): SOL climbed 8.0% to $157.76, with increased network activity offsetting adverse volatility from memecoin speculation.

In summary, the global cryptocurrency market cap now stands at $3.21 trillion, with a 24-hour trading volume of $173.2 billion, aligning strong inflows across global risk assets markets.

Ethereum's post-upgrade strength and the spillover into its ecosystem projects may signal the start of a major altseason rotation theme, especially if Bitcoin continues to stall below key levels, as often seen during periods of increased investor risk appetite.

Crypto news updates:

US OCC approves national banks to trade crypto on behalf of customers

The Office of the Comptroller of the Currency (OCC) has granted national banks the authority to buy and sell cryptocurrencies on behalf of their clients. Banks are also permitted to outsource custody and trade execution services to third-party providers under this directive.

The ruling emphasizes a risk-managed framework, requiring institutions to demonstrate the ability to handle operational and security challenges.

Ethereum Foundation allocates $32 million in Q1 2025 grants for ecosystem growth

The Ethereum Foundation has announced the allocation of $32 million in grants for the first quarter of 2025.

The funding is directed toward bolstering the Ethereum ecosystem through investments in community programs, developer tooling, cryptographic research, and core infrastructure enhancements.

According to the Foundation, the grants will support a wide range of initiatives, including improvements to the developer experience, expansion of educational programs, advancements in zero-knowledge proof technologies, and continued development of the execution layer.