Crypto Today: Bitcoin taps 45-day peak as US Dollar jittery sparks demand for altcoins and Gold

- Cryptocurrency market capitalization crossed the $2.8 trillion mark on Monday, rising 0.9% after stagnating at $2.7 trillion last week.

- Bitcoin price hit $87,600, its highest level in 45 days, dating back to March.

- BTC’s 4% gain outperforms top altcoins like BNB, XRP and Solana, while Tron trades in the red, signaling the rally is still in early stages.

The cryptocurrency market capitalization rises 0.9% on Monday, breaking after stagnating at $2.7 trillion last week. Global news insights suggest that crypto has benefited from capital displaced as investor confidence in USD-denominated assets wobbles.

On Friday, the White House confirmed President Donald Trump is considering replacing US Federal Reserve (Fed) Chair Jerome Powell, raising concerns about central bank independence. As investors exit US-denominated instruments, alternative assets find new buyers, driving prices to significant peaks.

Bitcoin markets update:

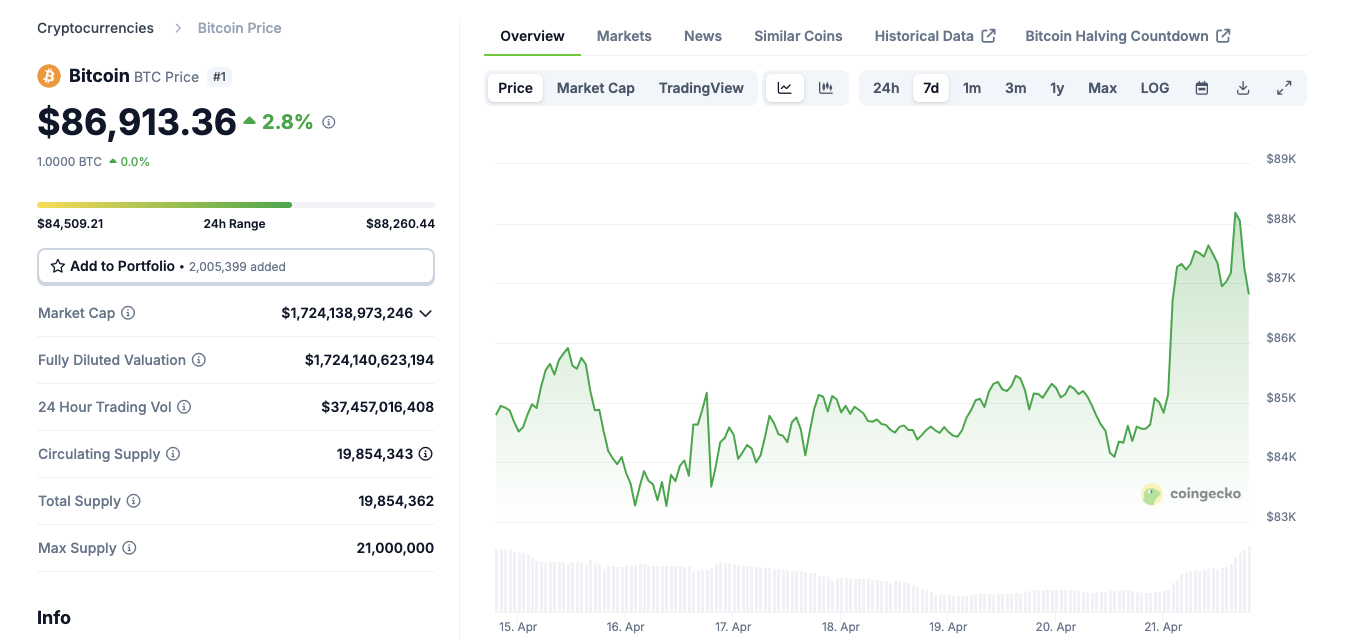

- Bitcoin price rose to a 45-day peak of $88,260 on Monday as investors turned towards alternative assets, with USD losing value in global markets.

Bitcoin price action today | Source: Coingecko

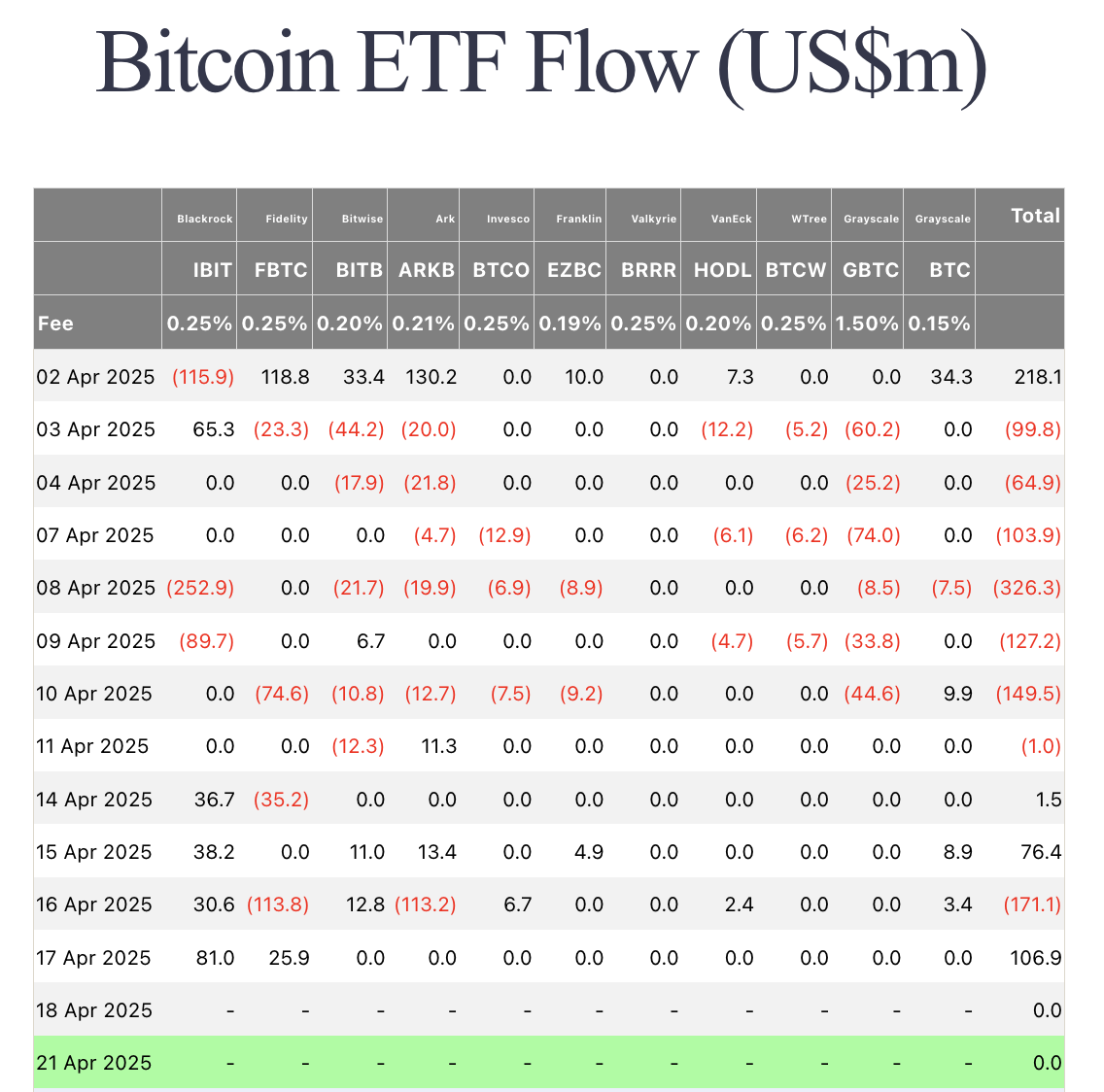

- With institutional capital flowing into BTC, Bitcoin ETFs are expected to start the week in buying mode.

Bitcoin ETFs Flows | Source: Farside

As of the current data, Bitcoin ETFs currently hold a total of $35.4 billion, having added another $106.9 million on Friday.

Altcoin market update: BTC price skips ahead

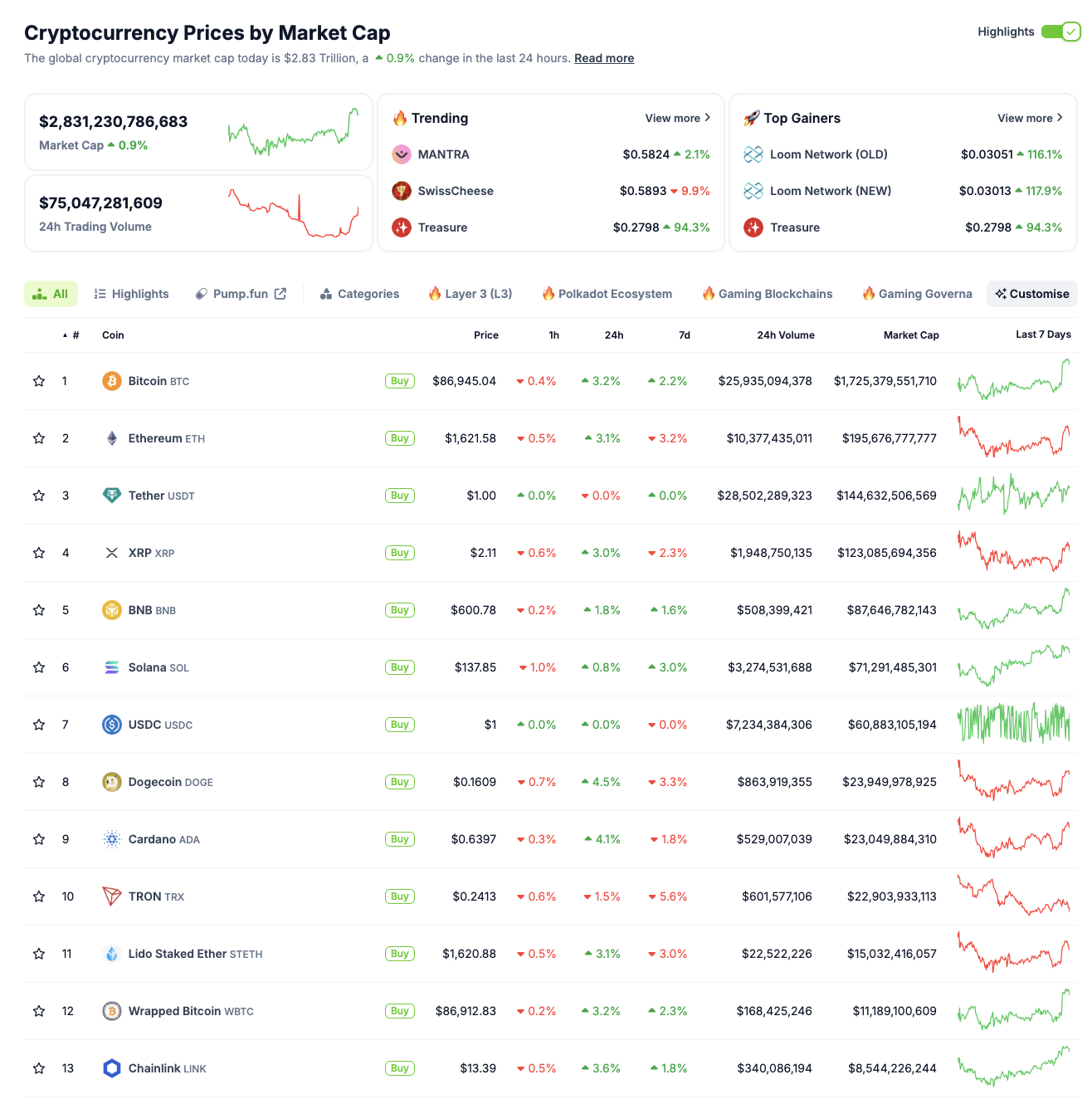

Bitcoin's 4% weekly gain to $86,945 positions it well ahead of major altcoins like BNB 1.6%, XRP is down 2.3%, while Solana only gains 3%.

The total crypto market cap now stands at $2.83 trillion, up 0.9% in the past 24 hours, while daily trading volume remains relatively light at $75 billion, a sign that broader retail and institutional participation hasn't peaked yet.

The outperformance of Bitcoin over key altcoins typically reflects cautious optimism, with investors favoring BTC as a “safer” first move before rotating into riskier assets. Meanwhile, TRON’s 5.6% weekly decline stands out.

Altcoin market performance, April 18 | Coingecko

As a network heavily used for stablecoin transactions, TRON’s slump hints at weakening stablecoin demand, often a precursor to higher volatility and market rotation.

Dogecoin 4.5% and Chainlink 3.86% are among the few notable altcoin gainers, showing early signs of bullish interest returning.

However, Ethereum’s 3.2% weekly drop and ADA’s mild loss suggest that many top alts are still struggling for clear direction.

Overall, Bitcoin’s leadership and muted altcoin performance suggest the rally may just be warming up, with more intense bullish altcoin momentum likely to follow.

Oregon attorney general to sue Coinbase over securities violations

Oregon Attorney General Dan Rayfield is preparing to file a securities enforcement lawsuit against Coinbase, according to a statement from the company's Chief Legal Officer, Paul Grewal. The pending action follows earlier federal charges brought by the US Securities and Exchange Commission (SEC), which were dismissed earlier this year.

The announcement adds to Coinbase’s ongoing regulatory challenges in the US as state and federal agencies take differing approaches to crypto enforcement. The lawsuit comes amid broader uncertainty surrounding cryptocurrency regulation, with Congress still debating comprehensive national legislation.

Singapore exchange to offer Bitcoin perpetual futures in 2025

Singapore Exchange (SGX) will launch Bitcoin perpetual futures in the second half of 2025, targeting professional and institutional investors. The move positions SGX among a growing number of traditional exchanges expanding into crypto derivatives amid rising demand for regulated investment products.

Unlike traditional futures contracts, perpetual futures do not have an expiry date and allow continuous trading based on Bitcoin price movements. SGX reported positive feedback from both decentralized and traditional finance sectors ahead of the launch.

Metaplanet adds 330 BTC to holdings despite global market pressures

Japanese investment firm Metaplanet has purchased an additional 330 bitcoins valued at approximately $28.2 million. The acquisition comes amid ongoing market uncertainty tied to recent US tariff measures. Bitcoin's price has continued to rise, recently surpassing the $87,000 mark.

Following the latest purchase, Metaplanet’s total bitcoin holdings stand at 4,855 BTC, securing its status as the largest corporate bitcoin holder in Asia and the tenth largest globally. The company remains committed to its goal of reaching 10,000 BTC by the end of 2025, mirroring the accumulation strategy popularized by Michael Saylor.