Crypto Today: Trump criticizes Powell, SOL and ADA lead DeFi gains as Bitcoin price nears $85K

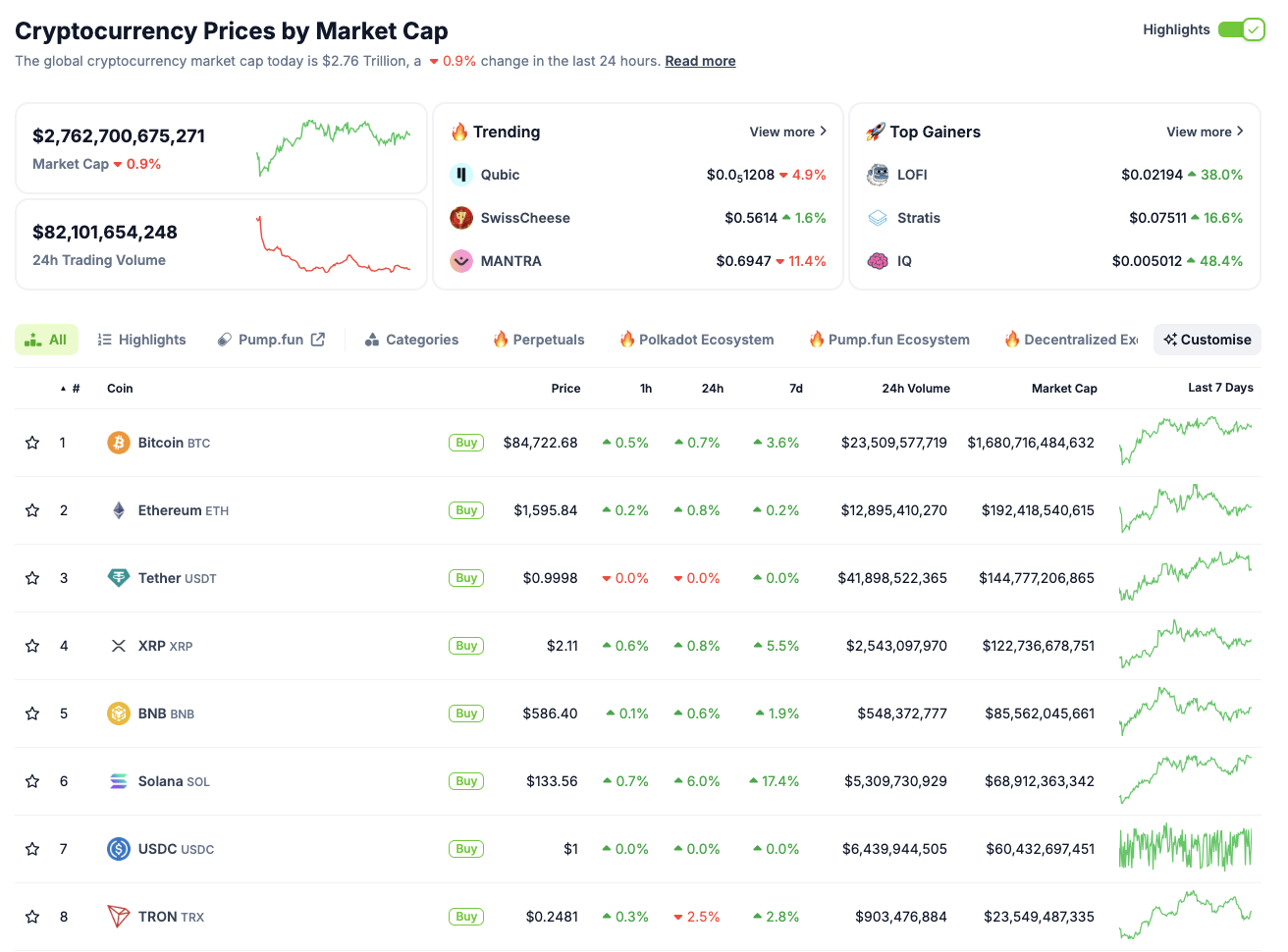

- Cryptocurrency market valuation hovers around the $2.7 trillion mark on Thursday.

- Solana, Cardano and Dogecoin are the biggest gainers among the top-ten crypto assets in the last 24 hours.

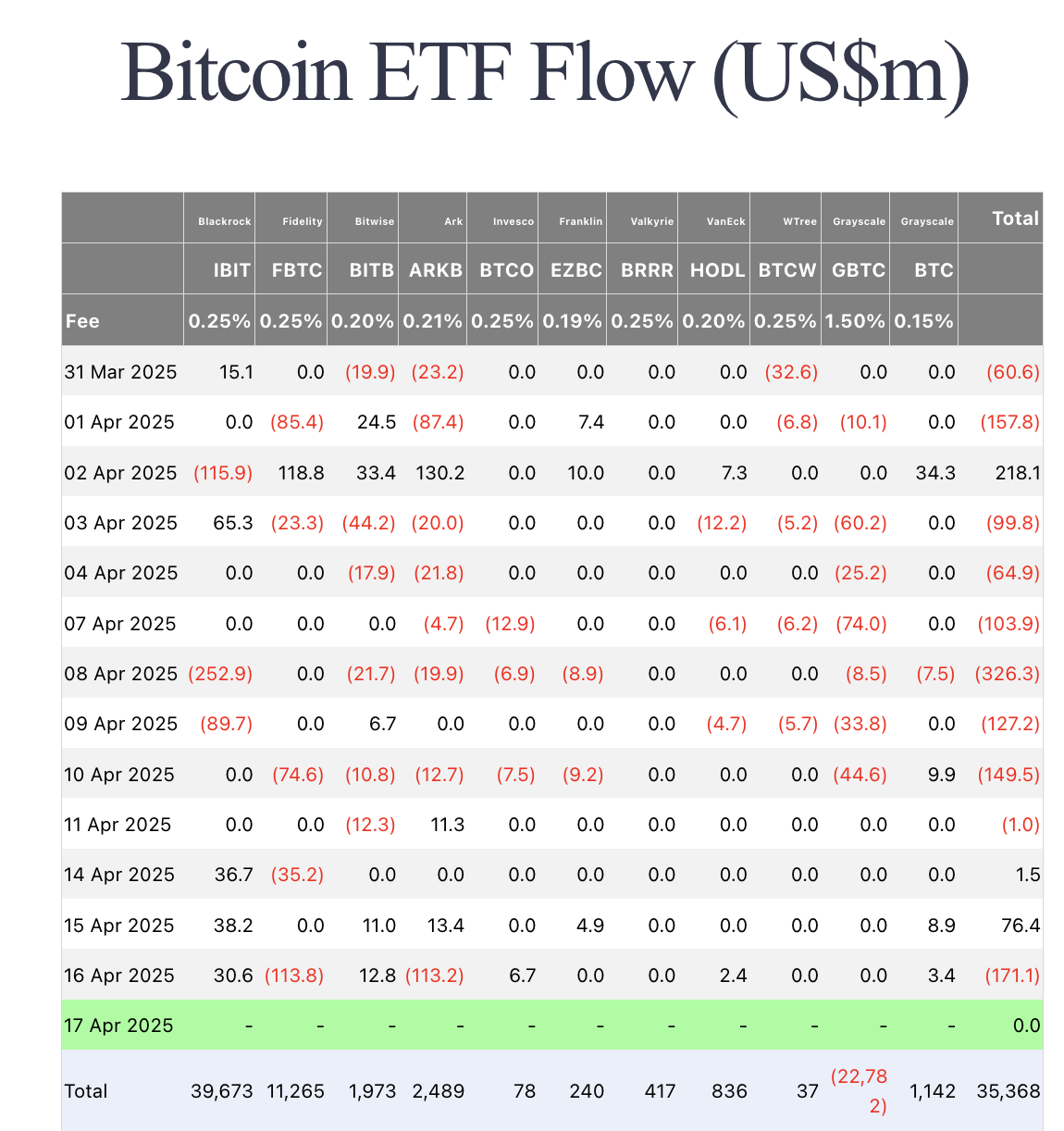

- Spot Bitcoin ETFs posted $171 million outflows on Wednesday, snapping a two-day buying streak.

The cryptocurrency sector valuation is hovering around the $2.7 trillion mark on Thursday. While Bitcoin price clings to the $85,000 level, DeFi protocols and layer-1 altcoins appear to be attracting the most traction on the day

Bitcoin market updates:

- Bitcoin price continues to hover around the $85,000 level, as investors lean towards altcoins to skim volatility gains.

Chart of the day: Bitcoin ETF spotted selling into market rally

- BTC stagnation coincides with a $171 million sell-off from Bitcoin ETFs on Wednesday.

According to Farside data, the sell-off on Wednesday has effectively ended the positive start to the week that saw Bitcoin ETFs acquire $1.5 million and $76.4 million on Monday and Tuesday, respectively.

Bitcoin ETF Flows, April 17, 2025 | Sources: Farside

Based on recent trends, Bitcoin ETF sell-offs during price rallies have often preceded major downswings. Notably, most of the BTC outflows came from BlackRock’s IBIT fund and Ark Invest’s ARKB ETF, both shedding over $113 million.

If the sophisticated US-based institutional investors’ sell-off continues on Thursday, strategic retail and mid-size traders may be hesitant to enter high-volume bullish positions. This may explain why BTC stagnates around $84,600 at press time while top altcoins like Solana have booked larger gains over the last 24 hours.

Altcoins: Solana leads DeFi gains as Ethereum’s laggard performance persists

Bearish headwinds from the US-China tariff trade war remain active this week as the diplomatic de-escalation efforts falter. However, crypto markets appear to be benefiting from displaced capital this week, as US stock traders intensified sell-offs after Nvidia confirmed a $5.5 billion charge due to tariffs.

Crypto market performance today | Coingecko

CoinGecko data shows a modest 0.9% dip in overall crypto market cap to $2.76 trillion, which is accompanied by a sharp drop in 24-hour trading volume to $82.1 billion, signaling consolidation and rotation.

Among the top-ranked assets, Solana leads the top gainers with a 6% daily rise, while Cardano and Dogecoin also post strong upside. Meanwhile, Ethereum’s muted performance below the $1,600 resistance persists, raising concerns over its long-term market share prospects.

Crypto news updates:

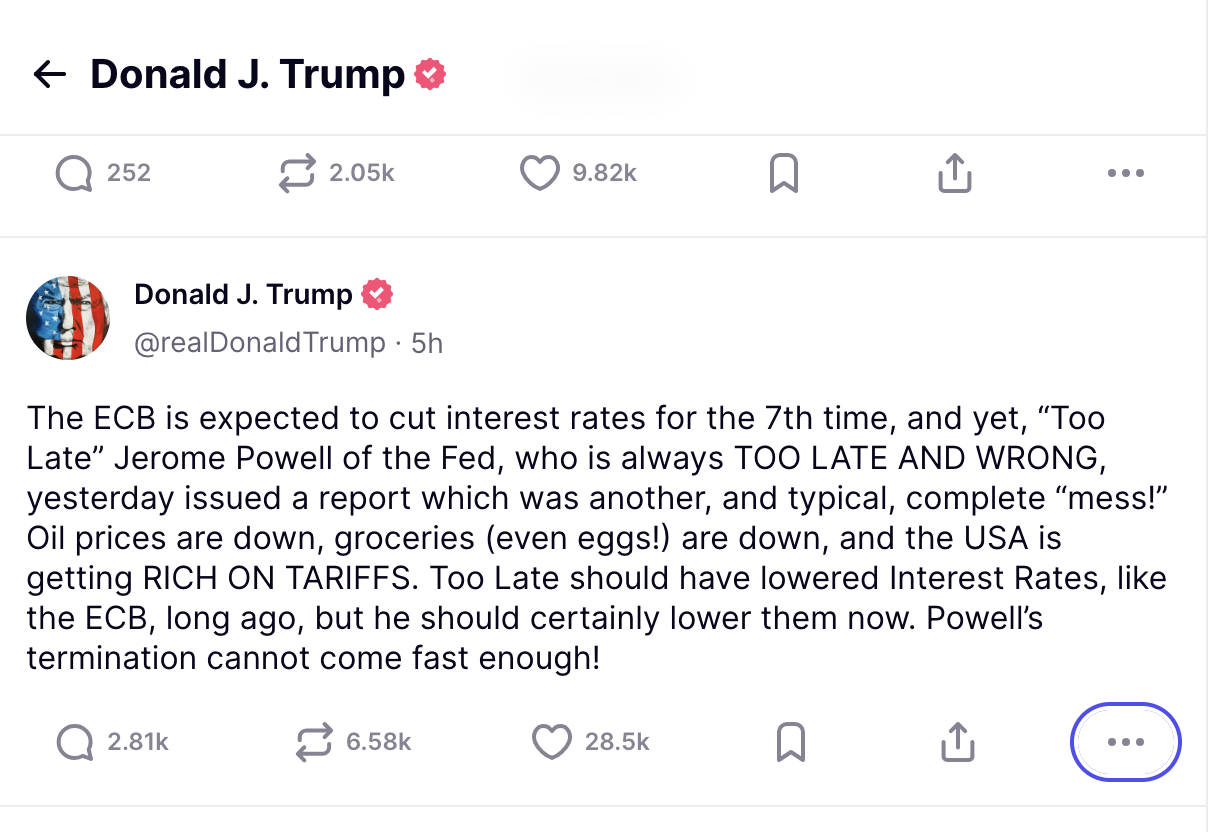

Trump criticizes Powell, questions Fed leadership amid interest rate dispute

President Donald Trump escalated his criticism of Federal Reserve (Fed) Chair Jerome Powell, suggesting he could seek Powell’s removal following a speech in which the central bank chief reaffirmed the Fed’s legal independence.

Speaking at the Economic Club of Chicago, Powell had stated that he cannot be dismissed without cause, citing statutory protections and broad bipartisan support for the central bank's autonomy.

Trump responds with a post on Truth Social, condemning the Fed’s current stance on interest rates, calling Powell’s approach “a complete mess.”

He pointed to expected rate cuts by the European Central Bank as justification for immediate action by the Fed, and claimed inflation was under control. Treasury Secretary Scott Bessent is expected to begin interviewing candidates to potentially succeed Powell later this year.

Binance advises governments on crypto policy despite past legal setbacks

Despite recent legal challenges in the United States, Binance is actively providing advisory services to governments on cryptocurrency regulation and digital asset strategy. CEO Richard Teng emphasized the exchange’s consultancy efforts, citing growing global interest and a more receptive stance toward crypto regulation under President Donald Trump’s administration.

Following a guilty plea for money laundering and sanctions violations, Binance has paid significant fines and implemented stronger compliance measures. Teng stated that 25% of the company’s workforce now focuses on regulatory adherence. Countries including Pakistan and Kyrgyzstan are currently working with Binance, signaling continued confidence in the firm's expertise.

Bhutan taps hydropowered crypto to boost economy and retain talent

Bhutan is turning to green cryptocurrency mining as a strategic tool to drive economic growth and create jobs, while addressing the nation’s ongoing brain drain. By leveraging its abundant hydropower resources, Bhutan has been mining digital assets since 2019, using the proceeds to fund government operations and public sector salaries.

These efforts are managed by Druk Holding and Investments, the country’s sovereign wealth fund, which is also investing in blockchain and AI training programs to prepare citizens for digital economy roles. Plans are underway to expand the nation’s hydropower infrastructure to support future growth in the cryptocurrency sector.