Crypto Today: ETH and Bitcoin stabilize as market digest Trump’s 25% auto tariff

- Cryptocurrencies market capitalization surges by $14 billion on Thursday, hitting the $2.83 trillion mark.

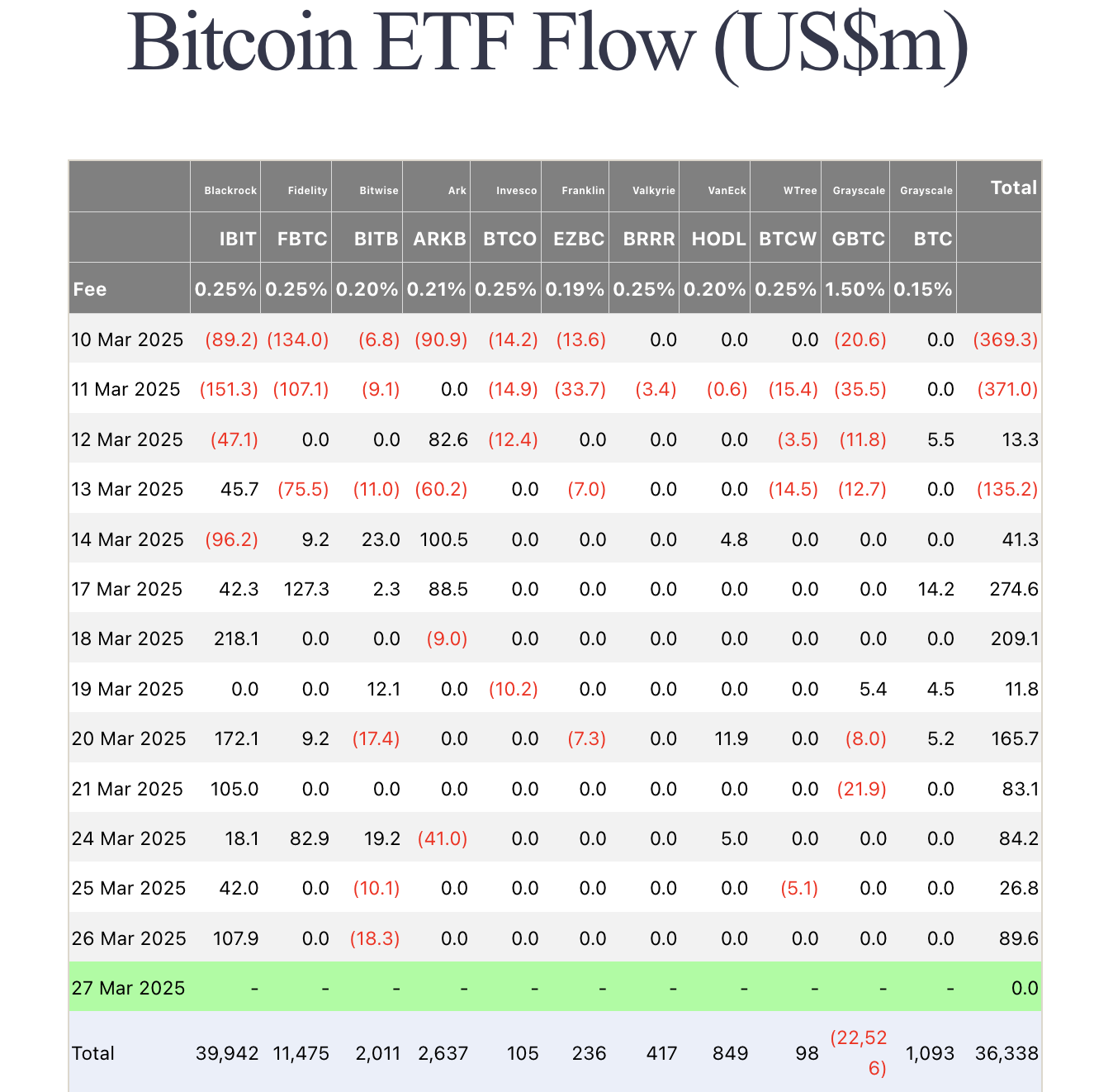

- Bitcoin ETFs brought in another $89.6 million, reaching nine successive days of net inflows, according to Farside data.

- Crypto VC Foresight Ventures’ latest report highlights yield opportunities as a key growth driver as the global stablecoin market cap crosses $211 billion.

Bitcoin market updates:

- Bitcoin price rose 4% in the early hours of Thursday, trading as high as $88,000 on Binance before retracing towards $87,000 at press time.

- Bitcoin ETFs recorded $89.6 million inflows on Wednesday per Farside data.

Bitcoin ETF Flows | Source: Fairside

Bitcoin ETF Flows | Source: Fairside

- BTC holds above the $85,000 mark for the fourth consecutive day, with Ethereum also establishing steady support above $2,000. This signals that most traders could now be pining for another leg up towards $90,000.

Why did Bitcoin price rise earlier today?

Bitcoin’s early rally on Thursday is linked to United States (US) President Donald Trump confirming 25% tariffs to be imposed on auto imports from April 3. In reaction, investors rapidly shifted capital out from US stocks likely to be impacted by the auto tariffs.

S&P 500 performance March, 26 2025 | Source: NASDAQ/TradingView

S&P 500 performance March, 26 2025 | Source: NASDAQ/TradingView

Within 24 hours of President Trump’s latest announcement, Elon Musk’s Tesla stock (TSLA) price declined 5%, with the S&P 500 shedding 65 points in a 1.12% dip.

This confirms that BTC’s rally on Thursday is linked to traders’ shifting funds from US stocks into the crypto markets, which are viewed as resistant to Trump’s trade policy pressures.

Altcoin market updates: Toncoin, SUI and PI coin emerge top gainers amid market shuffle

The global crypto market capitalization consolidates within a tight 2% range around the $3 trillion mark on Thursday. Trading volumes remain relatively high at $94 billion. However, minimal directional change in aggregate market valuation signals that investors are rotating funds within the market rather than injecting or withdrawing capital.

This trend is evident in the Coingecko data above, which shows high-cap layer-1 projects, including XRP (-4.6%), Solana (-4.3%), and Cardano (-4.5%), experiencing notable losses over the past 24 hours, while capital is shifting towards selective mid-cap altcoins and stablecoin-related networks.

Crypto Gainers Today

Tron (TRX) price rises 2%, gaining momentum following renewed discussions around stablecoin launches. With Trump-backed World Liberty Financia (WLFI), the State of Wyoming, and Fidelity all making strategic moves toward stablecoin issuance, TRON's low-cost, high-speed network is attracting more activity.

- Dogecoin (DOGE) price is up 4.2%, outperforming most of the top-10 cryptocurrencies and climbing 12.8% over the past week as memecoins gain traction.

- SUI price gains 5%. Ethereum’s recent underperformance and fee hikes during periods of intense market activity have led to increased inflows into layer-2 tokens like SUI. Additionally, growing speculation around a potential SUI Exchange Traded Fund (ETF) has contributed to its recent price surge.

Chart of the day: Foresight Ventures highlights Yield impact as stablecoin market cap tops $211 billion

Stablecoins have emerged as one of the most dominant themes in crypto media this week with several US-based corporate entities announcing plans to launch USD-backed tokens.

Following a shift in regulatory stance after President Trump’s inauguration, the US Securities and Exchange Commission (SEC) recently dropped charges against top crypto firms, and corporate entities have deepened their adoption of cryptocurrencies.

This week alone, Trump-backed WLFI, the State of Wyoming, and Fidelity all announced strategic moves toward stablecoin issuance.

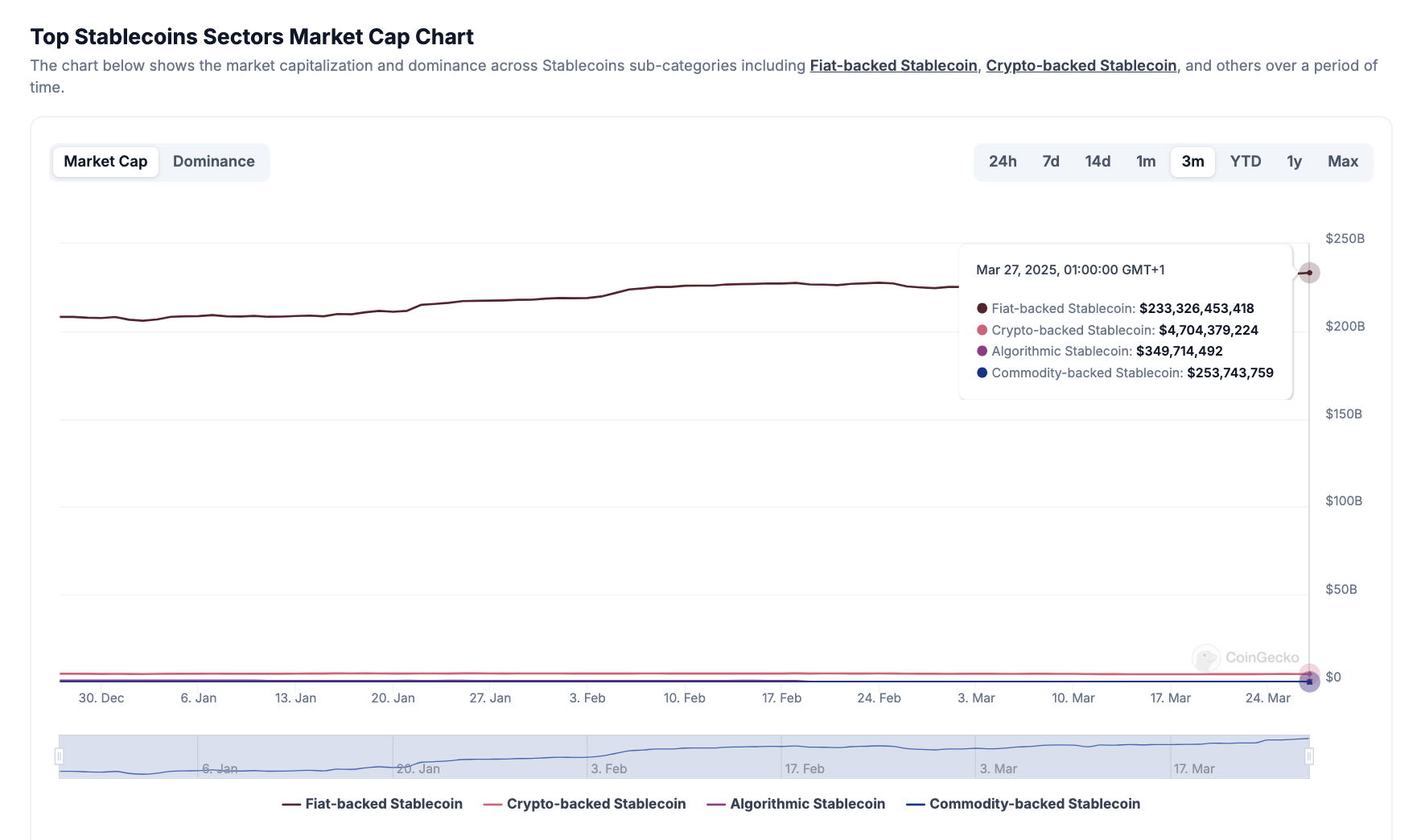

Stablecoin market capitalization as of March 27, 2025 | Source: Coingecko

Stablecoin market capitalization as of March 27, 2025 | Source: Coingecko

According to Coingecko data, the total stablecoin market capitalization has crossed the $211 billion mark, adding another $8 billion in March alone.

However, Crypto VC Foresight Ventures has published a report showing that increased intestinal participation in the stablecoin sector extends beyond improvement in regulatory stance.

According to the report:

“The ability to earn yield on digital dollars is another compelling value proposition of stablecoins, a feature that remains largely untapped by traditional finance.

Historically, accessing DeFi yields required technical expertise, self-custody, and interaction with complex protocols. Now, regulated platforms are abstracting away these complexities, offering intuitive interfaces that enable users to earn yield on stablecoin holdings without needing deep crypto knowledge.

Unlike traditional stablecoins that act solely as a medium of exchange, Mountain’s USDM distributes yield directly to its token holders on a daily basis by

default. Its current 4.70% APY is generated from short-term, low-risk U.S. Treasuries, making it an attractive alternative to both traditional bank deposits and DeFi staking mechanisms.

- Foresight Ventures Stablecoin Report, March 2025

Crypto news updates:

- ICE partners with Circle to explore new digital asset solutions

Intercontinental Exchange (ICE) and Circle, a peer-to-peer payments technology company, have signed a memorandum of understanding to explore new financial products utilizing Circle’s USDC stablecoin and US Yield Coin (USYC). The collaboration aims to integrate these digital assets into ICE’s market infrastructure, including derivative exchanges, clearinghouses, and data services. By leveraging Circle’s blockchain technology and ICE’s global network, the partnership seeks to expand the use of tokenized assets in capital markets.

- GameStop to raise $1.3 billion for Bitcoin treasury strategy through note offering

GameStop has unveiled plans for a $1.3 billion private offering of convertible senior notes, set to mature in 2030, targeting institutional investors. The funds will be used to acquire Bitcoin as part of the company’s new treasury asset strategy. This move aligns with its revised investment policy, which was outlined alongside its fourth-quarter earnings report. GameStop posted a net income of $131.3 million and reported $4.75 billion in cash reserves, positioning itself for a strategic shift toward digital assets.

- Senate votes to repeal IRS crypto reporting rule imposed by Biden administration

The US Senate has voted to repeal an Internal Revenue Service (IRS) regulation that required decentralized finance (DeFi) platforms to operate as traditional securities brokers. The rule mandated that DeFi participants collect user trading data, issue tax forms, and report transactions to the IRS. Lawmakers argued that these requirements excessively burdened the industry and raised concerns about user privacy.

With the measure receiving bipartisan support, President Donald Trump is expected to sign the repeal, officially overturning the rule introduced in the final days of the previous administration.