Bitcoin Price Forecast: BTC hovers above $85,500 as Trump calls the Fed to lower interest rates

- Bitcoin price edges lower around $85,500 on Thursday after gaining nearly 5% the previous day.

- US President Trump called on the Fed to lower interest rates as tariffs start to hurt the economy.

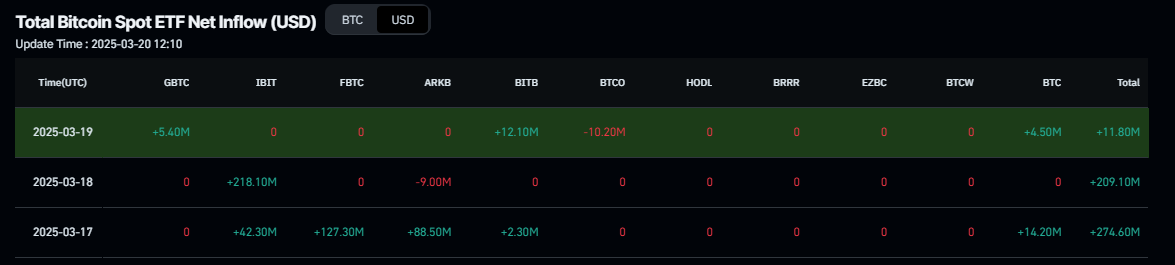

- US spot ETF recorded the third straight day of inflows so far this week.

- The Blockworks Digital Asset Summit on Thursday marks a historic first for a sitting US president to speak at a crypto conference.

Bitcoin (BTC) edges lower, trading around $85,500 at the time of writing on Thursday, after recovering nearly 5% the previous day following the Federal Reserve's (Fed) decision to keep interest rates unchanged and maintain its rate cut forecast for the year. Additionally, United States (US) President Donald Trump posted on the Truth Social platform on Wednesday, calling on the Fed to lower interest rates as tariffs start to hurt the economy. The US spot Bitcoin Exchange Traded Funds (ETFs) have recorded inflows for the third consecutive day this week, signaling a reduction in sell-side pressure.

On Thursday, US President Trump’s address at the Blockworks Digital Asset Summit marks a historic event as it's the first time a sitting president speaks at a crypto conference, suggesting growing recognition of the industry at the highest levels.

Talks on Russia-Ukraine war boost crypto investors' confidence

US President Donald Trump and Russian President Vladimir Putin agreed on Tuesday for an immediate pause in strikes against energy infrastructure in the Ukraine war.

Moreover, Ukrainian President Volodymyr Zelenskiy and Trump agreed to work together to end the protracted Russia-Ukraine war, further boosting investors' confidence toward risky assets like Bitcoin.

However, traders should also keep an eye on the rising tension in Gaza. The Israeli military said that it launched a limited ground incursion into Gaza a day after an aerial bombardment of the Strip that shattered the two-month-old ceasefire with Hamas. Moreover, Israeli Prime Minister Benjamin Netanyahu warned of fierce war expansion, which could hinder investors' confidence and lead to a risk-off sentiment in the crypto market.

Trump calls Fed for a rate cut

Bitcoin's price recovered nearly 5% on Wednesday, reaching a high of $87,000, bolstered by the Federal Reserve's decision to keep interest rates unchanged and maintain its rate cut forecast for the year.

Haresh Menghani, analyst at FXStreet, posted, “As was widely expected, the US central bank held interest rates steady for the second straight meeting and signaled that it would deliver two 25 basis points rate cuts by the end of this year.”

However, Fed officials trimmed their growth forecast for the year amid the growing uncertainty over the impact of the Trump administration's aggressive trade policies on economic activity. Since February, Trump has imposed a flat 25% duty on steel and aluminum and threatened to impose reciprocal and sectoral tariffs, fueling worries about a global trade war.

On Wednesday, Donald Trump posted on the Truth Social platform, calling on the Fed to lower interest rates as tariffs start to hurt the economy.

Trump posted: “ The Fed would be MUCH better off CUTTING RATES as U.S.Tariffs start to transition (ease!) their way into the economy. Do the right thing. April 2nd is Liberation Day in America!!!”

Trump to address Digital Asset Summit in New York

On Thursday, President Trump’s address at the Blockworks Digital Asset Summit 2025 marks a historic event as it's the first time a sitting president speaks at a crypto conference, suggesting growing recognition of the industry at the highest levels.

This event follows Trump's recent executive order to create a strategic Bitcoin reserve, using seized Bitcoin, as part of his administration's push to position the US as the "crypto capital of the world."

The summit, hosted in New York City, features discussions on the future of digital assets, involving key figures from the crypto industry and policymakers, reflecting the administration’s rapid moves to support and regulate the sector.

FXStreet interviewed some experts in the crypto markets regarding the Digital Asset Summit. Their answers are stated below:

Tracy Jin, COO of MEXC

Q: What impact do you think President Trump's upcoming address at the Digital Asset Summit (DAS) in New York will have on Bitcoin’s market sentiment and the future of cryptocurrency regulations?

The sitting president’s speech at a cryptocurrency conference in New York is a major event for the entire market, and its impact is already being felt — Bitcoin has settled at $85,000. If this level doesn’t hold, a short-term sell-off could follow, bringing prices back to the $81,000–$83,000 range.

Donald Trump’s remarks could bring surprises. A statement in support of the industry and a pledge to ease regulatory pressure would likely trigger a positive market reaction and push Bitcoin’s price higher. A return to early February levels of $103,000, or even a new all-time high, is entirely possible. What will Trump say? What will Elon Musk post? Will Trump Jr. show his support? These factors will determine how significant price fluctuations might be.

If Trump takes a stricter stance, emphasizing the need for tighter control over the crypto sector, a short-term dip in Bitcoin’s price is likely. However, given the already bearish market sentiment, a drop below $80,000 remains an unlikely scenario.

Investors are looking for clarity — bold statements followed by real action. Even hints at regulatory easing could drive renewed interest and increased participation from institutional players. For months, the market has been driven by speculation and news, making it uncertain just how strong the reaction will be this time."

James Toledano, COO of Unity Wallet

His upcoming address at the Digital Asset Summit (DAS) in New York could be pivotal for DeFi, as it’s the first time a sitting U.S. president has spoken at such an event. It’s also a chance for him to clarify his administration’s stance on the strategic reserve and broader regulations. Bitcoin has rebounded past $86,000 in recent days. If the price surges after his address, that will be a strong signal."

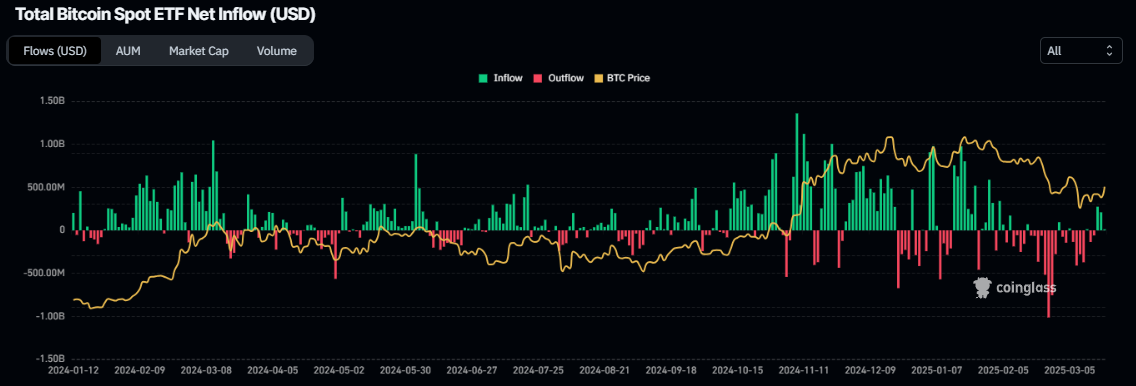

Bitcoin sees a slight boost in institutional demand

Bitcoin institutional investors have shown slight signs of improvement this week. According to Coinglass data, the Bitcoin spot ETF recorded a third straight day of net inflow of $11.80 million on Wednesday, after a net inflow of $483.7 million in the previous two days. Bitcoin's price could recover further if this inflow continues and intensifies, indicating a reduction in sell-side pressure.

Total Bitcoin spot ETF net inflow chart. Source: Coinglass

Bitcoin Price Forecast: BTC bulls aim for $90,000 if 200-day EMA holds

Bitcoin's price broke and closed above its 200-day Exponential Moving Average (EMA) on Wednesday, reaching a high of $87,000 that day. At the time of writing on Thursday, it trades slightly down, retesting its 200-day EMA at $85,540.

If BTC finds support and bounces off the 200-day EMA, it could extend the rally to retest its key psychological level of $90,000.

The Relative Strength Index (RSI) on the daily chart reads 48 after being rejected from its neutral level of 50 on Wednesday, indicating slight bearish momentum. The RSI must move above its neutral level of 50 for the recovery rally to be sustained.

The Moving Average Convergence Divergence (MACD) indicator showed a bullish crossover on the daily chart last week, giving a buy signal and suggesting a bullish trend ahead. Additionally, it shows rising green histogram levels above its neutral level of zero, indicating strength in upward momentum.

BTC/USDT daily chart

However, if BTC fails to find support around the 200-day EMA at $85,540, it could extend the decline to retest its next support level at $78,258.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.