Crypto Today: Bitcoin retakes $95K, Binance lists ChainGPT, Kenya moves to legalize digital assets

- The cryptocurrency market snapped its three-day losing streak on Friday, gaining 3% as it reached $3.2 trillion valuation.

- Bitcoin price struggled to retake the $95,000 support level as ETF outflows dampened momentum.

- Binance listed Chain GPT token of Friday, sparking a rally across AI-related tokens.

- The Kenyan government is reportedly drafting legislation to legalize crypto trading within its borders.

Bitcoin Market Updates: BTC fails $96K breakout test

- Bitcoin (BTC) rose 3% on Friday to hit $95,800 ending a three-day losing streak.

- While major altcoins like Cardano (ADA) and SUI scored excess of 5% gains, BTC rally stagnated below the $96,000 level as bulls struggled to mop up excess supply from Bitcoin ETF’s rapid outflows this week.

Altcoin market updates: AI tokens see green as Binance lists ChainGPT

The global crypto market cap grew by $87 billion on Friday. Major altcoins flourished despite Bitcoin recovery topping out at the $96,000 mark.

Binance exchange listed Chain GPT, a crypto AI project built on the BNB chain ecosystem.

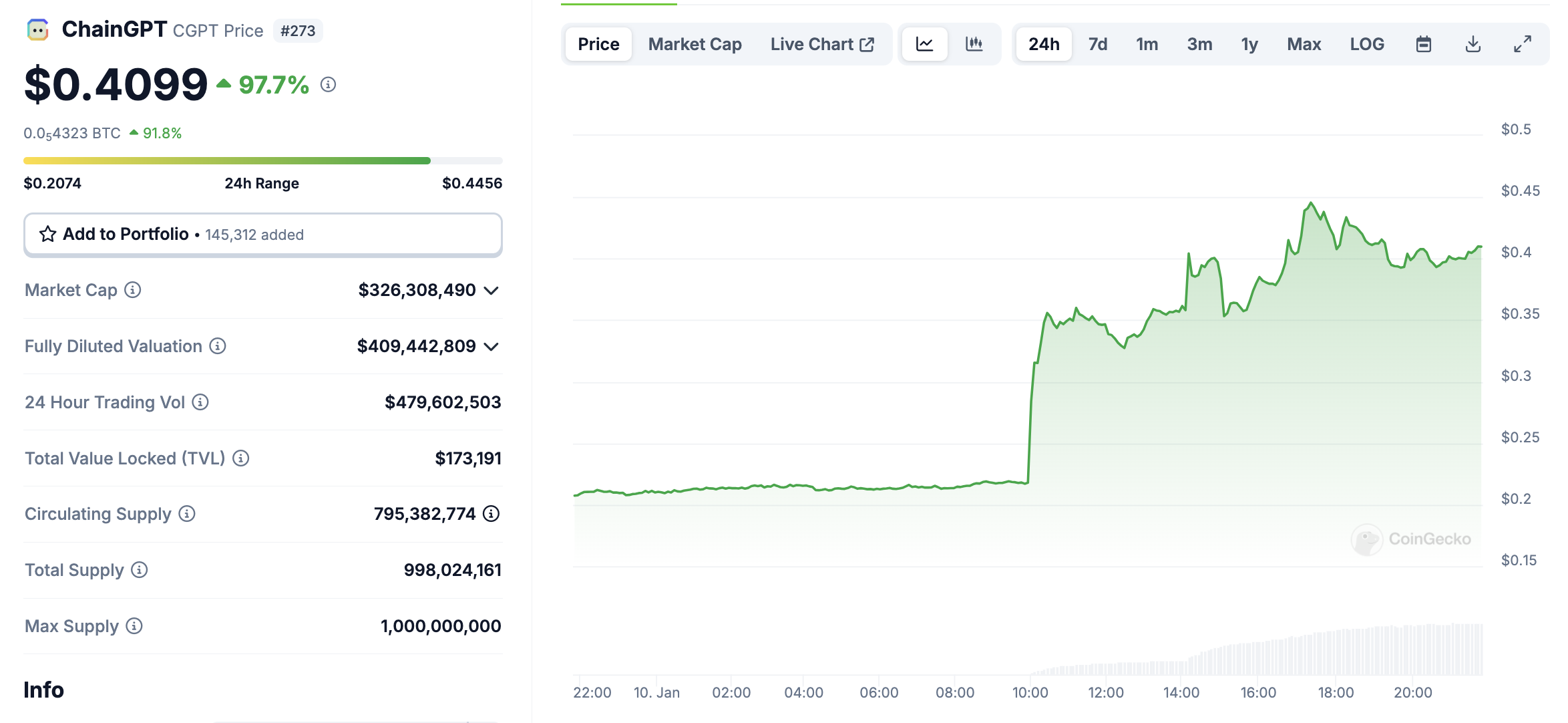

ChainGPT Price action, January 10, 2025 | Source: CoinGecko

ChainGPT Price action, January 10, 2025 | Source: CoinGecko

ChainGPT price broke above $0.40 at press time as the listing sparked a 97% surge, pushing its market cap above the $320 million mark.

Notably, the bullish tailwinds spilled over to other AI-related tokens. Render (RNDR) price surged 4%, Ai16z increased by 3.6%, while Near Protocol (NEAR) also saw 2% gains.

Key Altcoin Price Movements

- SUI

SUI emerged the top performer among the top 50 ranked crypto assets on Friday, driven by growing adoption of its scalable blockchain and strategic partnerships fueling ecosystem development.

- Uniswap (UNI)

Uniswap price 6% on Friday resurgent market activity boosted demand for exchange-native tokens.

Alongside UNI, centralized exchange tokens like Binance Coin (BNB) and Bitget Token (BGB) also recorded substantial gains, hinting at a potential market bottom formation.

- Bitcoin Cash (BCH)

Bitcoin Cash price soared 7% on Friday, reaching $450, outperforming Bitcoin.

XLM and Litecoin also skipped ahead of Bitcoin on the day, signalling that strategic traders diversify toward alternative privacy-preserving assets amid the looming liquidation of $6.5 billion worth of BTC by the US Department of Justice.

Chart of the day: Whales spent $514M buying BTC amid market dip

Bitcoin price stabilized above $95,000 on Friday, halting a steep sell-off across the cryptocurrency market.

The downturn, fueled by hawkish Federal Reserve sentiment and the US Department of Justice’s imminent $6.5 billion crypto liquidation, triggered widespread liquidations, rattling investor sentiment.

During the turbulence, Bitcoin plunged to a 40-day low of $91,200 on January 9, before rebounding 3% on Friday to reclaim the $95,800 level.

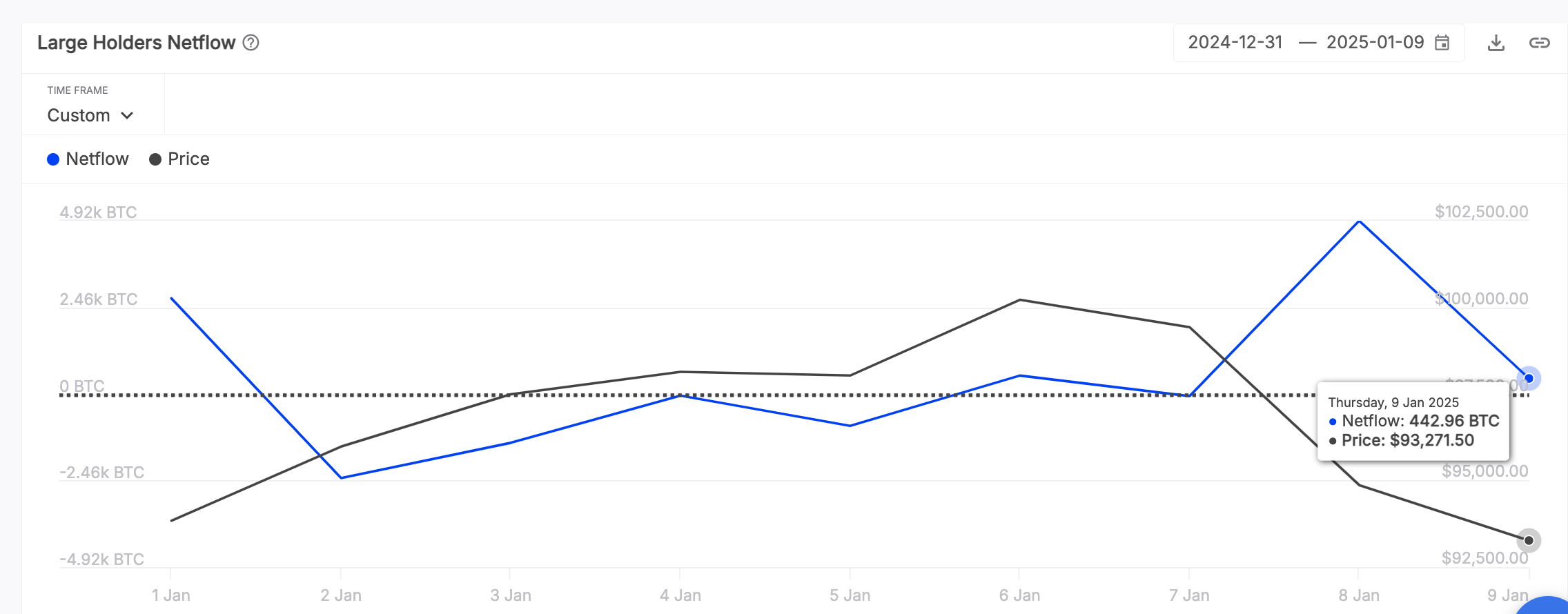

Interestingly, on-chain data highlights opportunistic accumulation by whale investors during the downturn.

IntoTheBlock’s Large Holder Netflow chart below shows that wallets holding at least 0.1% of Bitcoin’s total circulating supply, equivalent to 19,300 BTC (~$2 billion), significantly increased their holdings.

Bitcoin Large Holder Netflows | Source: IntoTheBlock

Bitcoin Large Holder Netflows | Source: IntoTheBlock

The chart above shows how the whale wallets strategically acquired 4,920 BTC on Wednesday and another 442 BTC on Thursday, while BTC prices traded at 40-day lows.

Despite this wave of accumulation, Bitcoin remains under pressure with the $100,000 level still some distance away. The $95,000 support remains pivotal as traders await further market clarity.

With Trump’s inauguration now just ten days away, the coming weeks will test whether bullish momentum can prevail amid an uncertain macroeconomic landscape.

Crypto news updates:

- Kenya Set to Legalize Crypto, Says Finance Minister John Mbadi

Kenya is poised to legalize cryptocurrencies, marking a significant shift from its earlier ban.

Treasury Cabinet Secretary John Mbadi announced this development on January 10, emphasizing the country’s acknowledgment of the widespread use and potential benefits of digital assets.

The proposed legislation aims to create a regulated market for cryptocurrencies and Virtual Asset Service Providers (VASPs) while addressing risks such as money laundering and fraud.

- Russian Authorities Liquidate 1 Billion Rubles in Bitcoin Amid Historic Bribery Case

Russian authorities have begun liquidating 1,032 Bitcoin, valued at over one billion rubles, confiscated from Marat Tambiev, a former senior investigator convicted in a landmark crypto bribery scandal.

Tambiev accepted the bribe from the Infraud Organization, a hacking group, in exchange for shielding their illicit assets from seizure.

The Bitcoin, stored on a hardware wallet seized during a raid on Tambiev's Moscow apartment, was transferred to state revenue following a 2023 court ruling.

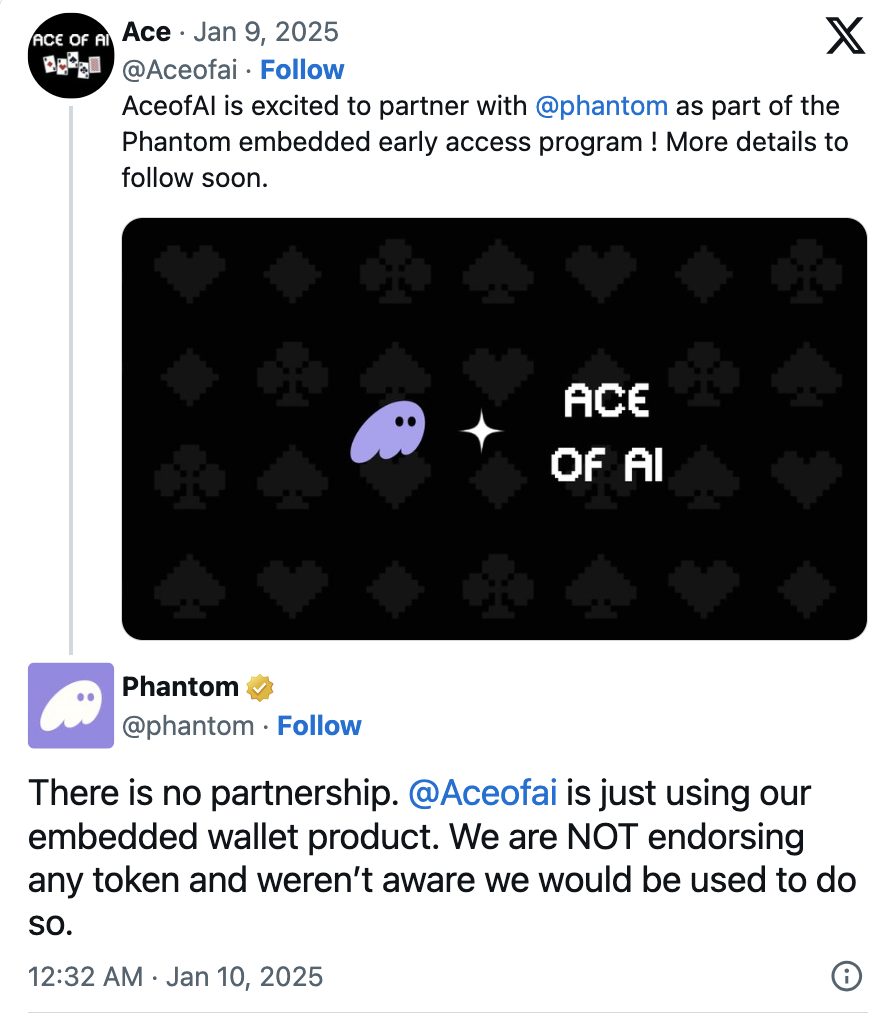

- Phantom faces Backlash over Misinterpreted Ace of AI Partnership

Phantom, a leading multi-chain crypto wallet provider, faced public criticism after a tweet exchange with Ace of AI led investors to believe the two projects had formed a partnership.

On January 9, Ace of AI announced an alleged collaboration under Phantom's embedded early access program, prompting a sharp rise in the value of its ACE token.

Phantom denies partnership claims from ACE of AI | Soruce: X.com/Phantom

Phantom denies partnership claims from ACE of AI | Soruce: X.com/Phantom

Phantom’s emoji-laden reply further fueled speculation, causing the token to spike to $0.017 before the company issued a clarification.

Phantom later deleted its response, stating that Ace of AI was merely using its embedded wallet service and that no formal partnership existed.

The clarification caused a sharp decline in ACE’s value, leaving many investors dissatisfied.