Bitcoin Price Annual Forecast: 2025 outlook brightens on expectations of US pro-crypto policy

- Bitcoin’s price has surged more than 140% in 2024, reaching the $100K milestone.

- The rally was driven by the launch of Bitcoin Spot ETFs and the reduced supply following the fourth halving event in 2024.

- The US presidential election victory of crypto-friendly candidate Donald Trump has further bolstered market sentiment for 2025.

- Technical analysis and expert insights within the crypto space support a bullish outlook for BTC, with price targets exceeding $200K by 2025.

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

The beginning of the interest-rate cutting cycle by the US Federal Reserve (Fed) in September, followed by the victory of crypto-friendly candidate Donald Trump in the US presidential election in November, added further momentum. Technical analysis and expert insights within the crypto space support a bullish outlook for BTC, with price targets exceeding $200K by 2025.

Bitcoin in 2024: The year of the landmark $100K

Bitcoin price grew over 140% in 2024, reaching a new all-time high (ATH) of $108,353 in mid-December. This remarkable increase above the $100K threshold and surpassing a $2 trillion market capitalization was significant for Bitcoin and the entire crypto markets.

Bitcoin’s institutional adoption: Rise of ETFs and corporations

2024 was a defining year for Bitcoin’s institutional adoption, driven by the launch of Bitcoin spot ETFs in January. These ETFs have created a regulated and accessible avenue for institutional and retail investors to gain exposure to Bitcoin without the complexities of direct ownership.

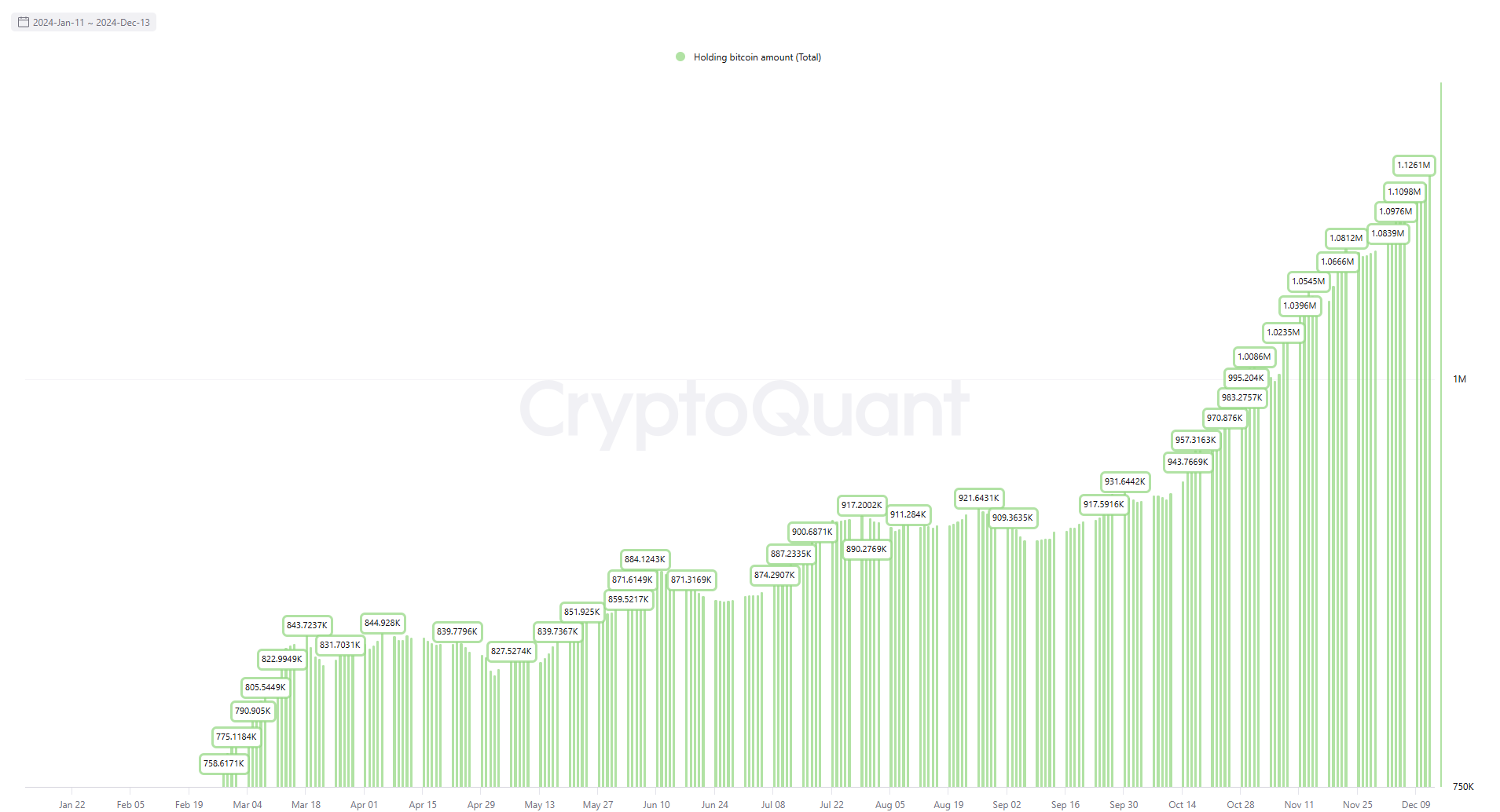

By year-end, the combined 11 BTC spot ETFs held over 1 million Bitcoin out of the 19.79 million BTC circulated supply, meaning 5% of the circulating supply and 4.7% of the total supply of 21 million BTC. This showcases robust institutional demand and solidifies Bitcoin’s position in traditional finance.

“I have never been more bullish on Bitcoin,” Darius Sit, Founder & Chief Investment Officer of QCP Singapore’s digital assets firm, told FXStreet in an exclusive interview.

In his opinion, Bitcoin is increasingly being brought into traditional markets, with a particular focus on debt financing. “Equity financing is starting to impact how individuals, corporations, and countries think about their future and how they raise money,” Sit said.

Total Bitcoin ETFs Holding chart. Source: CryptoQuant

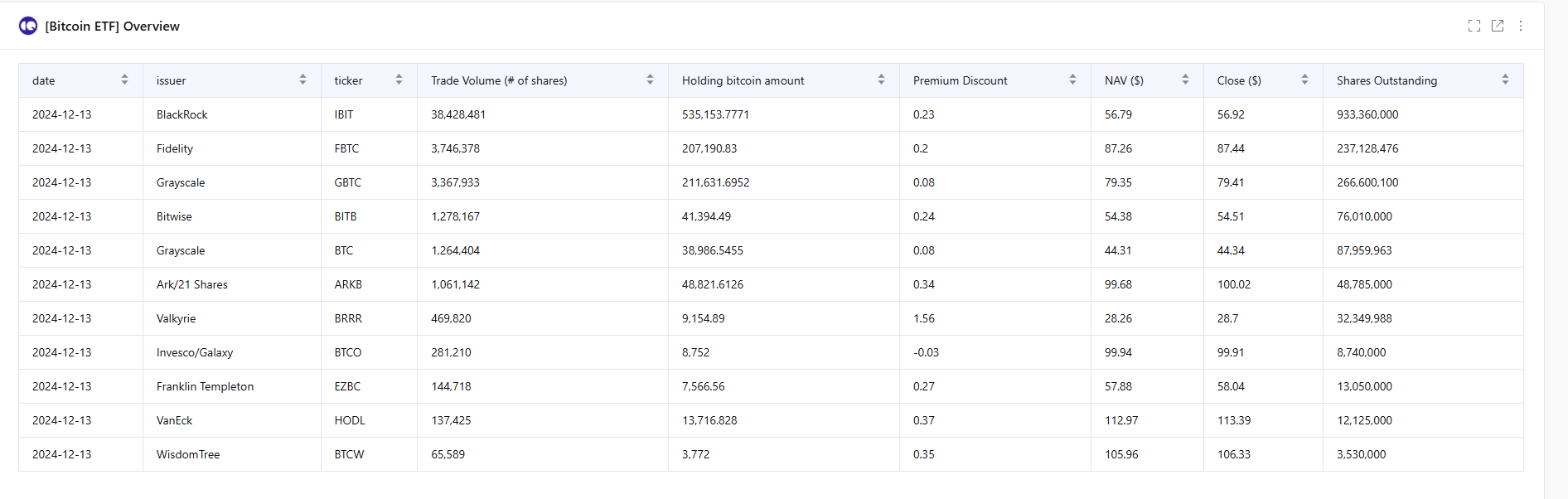

Bitcoin ETF Overview chart. Source: CryptoQuant

Apart from institutional interest in Bitcoin, corporate accumulation also surged in 2024. MicroStrategy (MSTR), an AI-powered cloud analytics company, solidified its position as the largest corporate holder of Bitcoin, increasing its holdings from 189,000 BTC at the start of the year to 423,650 BTC.

MicroStrategy BTC Holding chart. Source: CryptoQuant

This trend signals a growing corporate interest in Bitcoin, which encouraged additional companies to follow MicroStrategy’s footsteps, like Marathon Digital (MARA), Galaxy Digital Holdings (GLXY), Tesla (TSLA), Riot Platforms (RIOT), and others to adopt similar Bitcoin accumulation strategies. The move was based on the assumption of viewing the asset as a hedge against macroeconomic uncertainty and a long-term value store.

These institutional demands and the army of corporates cushioned big sellers such as the US government, the German government, and the defunct exchange Mt. Gox.

“The ETFs are kind of buying on any dip, so that should help cushion any sell-offs,” Geoff Kendrick, Global Head of Digital Assets Research at Standard Chartered, told FXStreet.

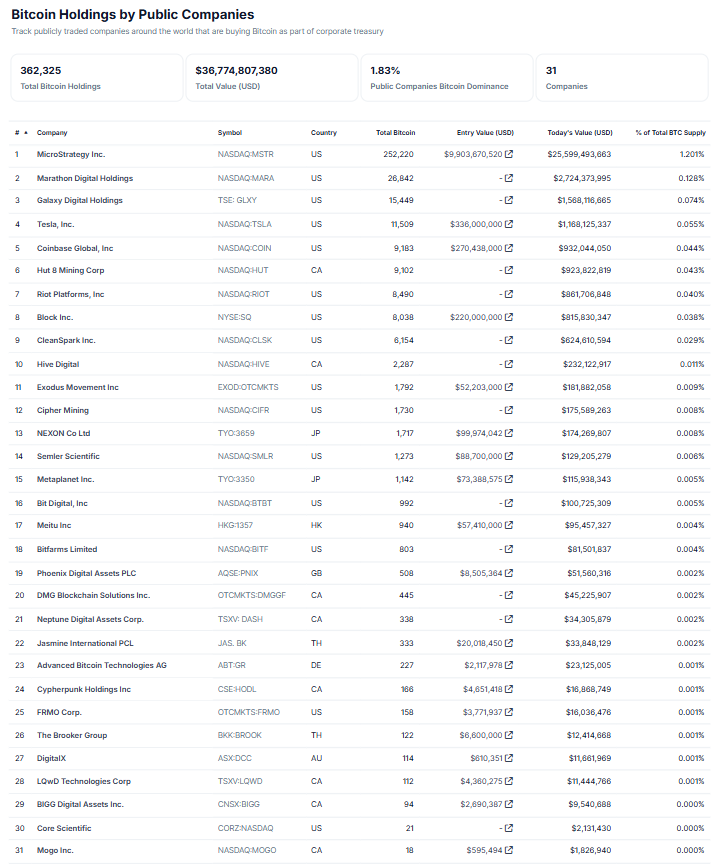

Bitcoin Holdings by Pubic Companies chart. Source: CoinGecko

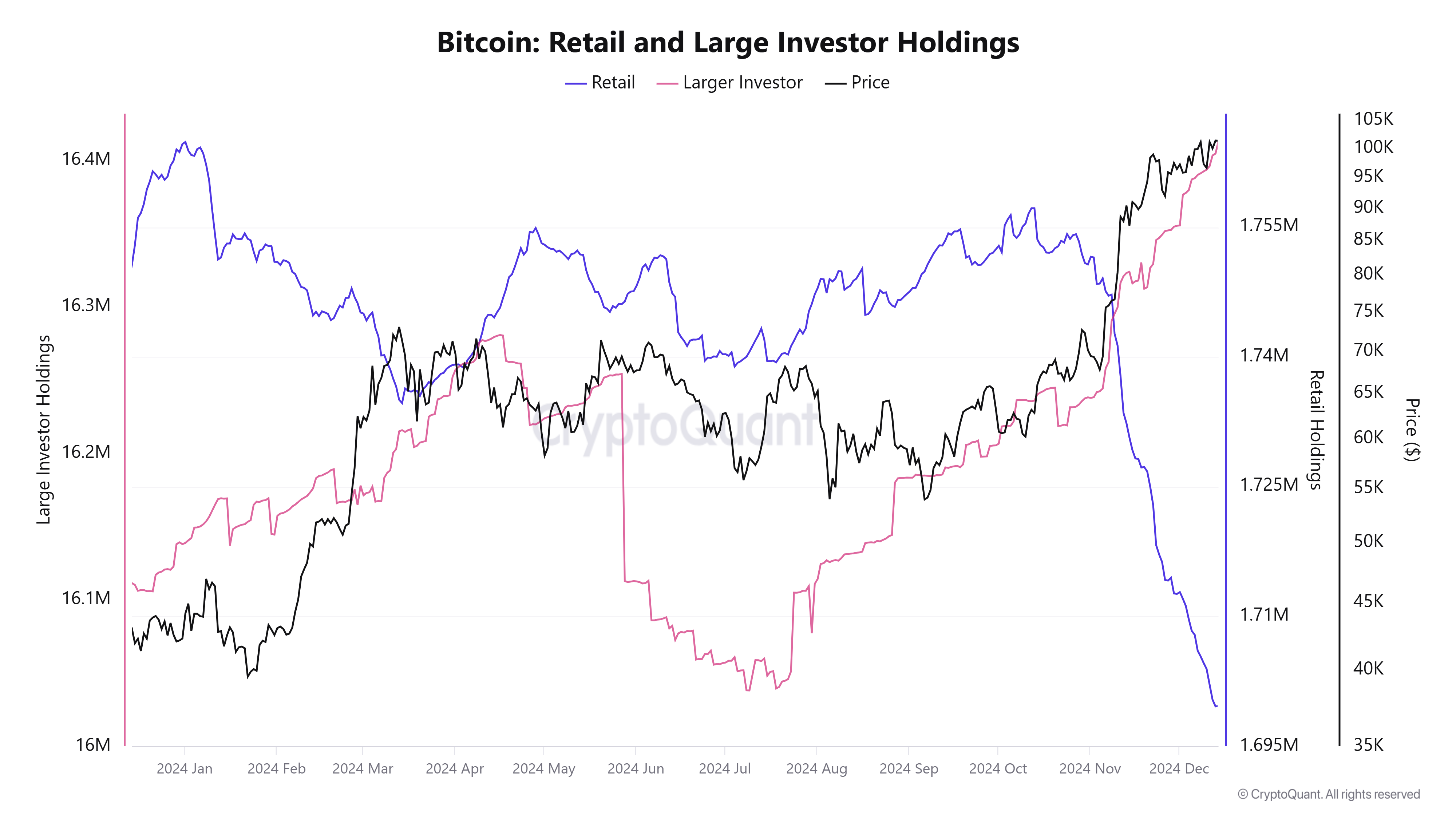

Indeed, this year’s Bitcoin price rally has been driven by large investors’ buying, reflecting growing interest from asset managers and hedge funds. CryptoQuant data shows that large Bitcoin investors increased their holdings by a net 275,000 Bitcoin so far in 2024, reaching a record high of 16.4 million BTC. Meanwhile, retail investors reduced their net holdings by 53,000 BTC over the same period. This influx of institutional activity enhanced Bitcoin’s liquidity, stability, and credibility, positioning 2024 as a milestone year for its integration into global financial systems.

Bitcoin Retail and Large Investor Holdings chart. Source: CryptoQuant

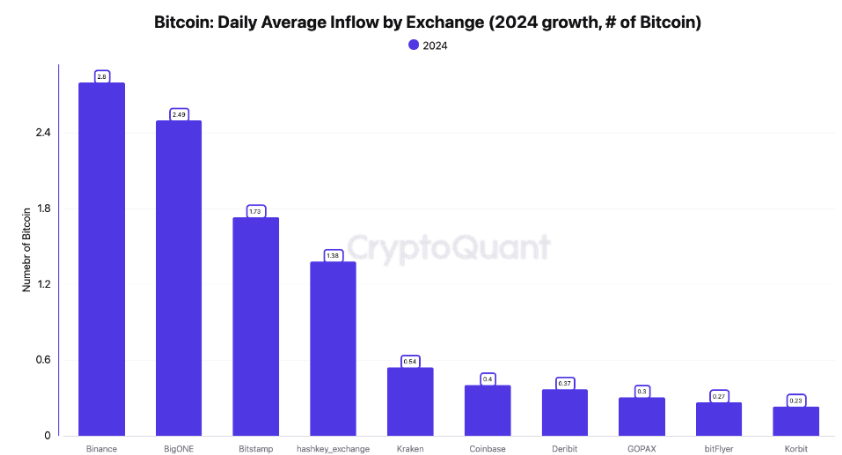

Additionally, 2024 has marked a shift in the cryptocurrency industry, with exchanges reporting sharp increases in average BTC and USDT deposits, signaling rising institutional participation, according to the Cryptoquant report.

The average Bitcoin deposits across all exchanges rose from 0.36 BTC in 2023 to 1.65 BTC, while USDT deposits surged from $19,600 to $230,000. These larger deposits reflect growing interest from professional and corporate investors, distinguishing institutional activity from retail trading.

Bitcoin: Daily Average Inflow by Exchange (2024 growth) chart. Source: CryptoQuant

Bitcoin’s fourth halving event

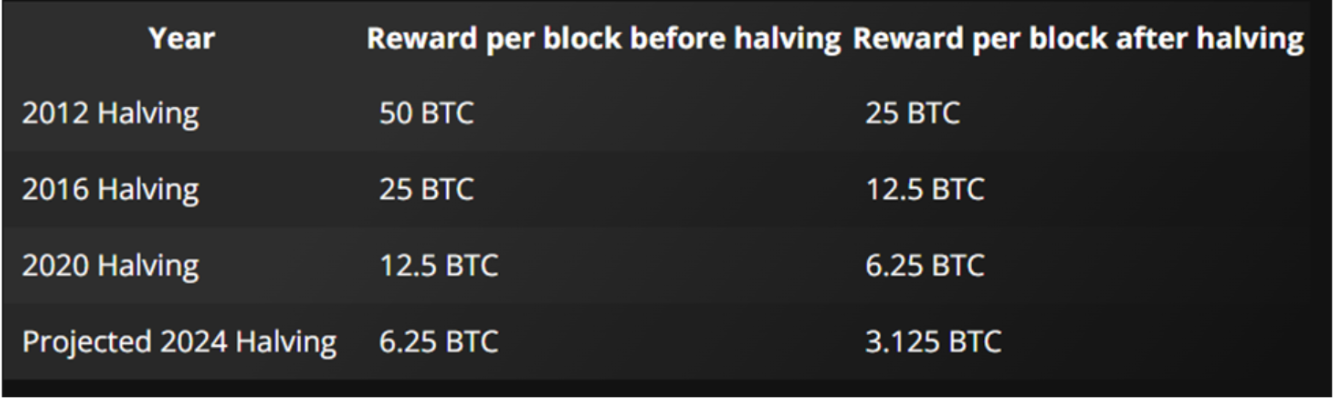

Bitcoin’s fourth halving event occurred in April 2024, leading to a 50% reduction in supply inflation and an inherent increase in issuance scarcity. The halving reduced block rewards from 6.25 BTC to 3.125 BTC, constraining new supply and fueling demand.

Bitcoin Halving Year and Reward chart

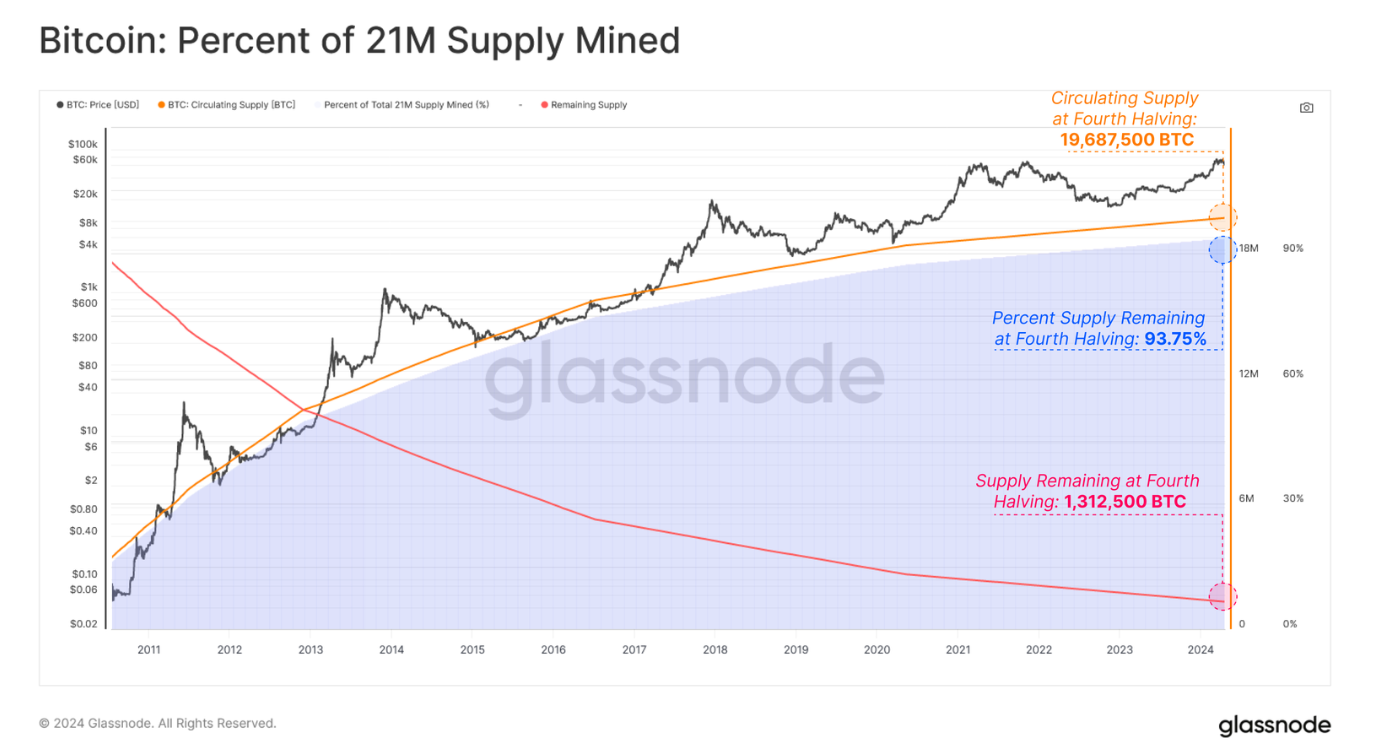

According to a Glassnode report, 19,687,500 BTC have been mined and issued in the Fourth Epoch, accounting for 93.75% of the terminal supply of 21 million BTC. Thus, there are only 1,312,500 BTC to be issued during the next 126 years, with 656,600 (3.125%) issued during our present Epoch. The report explains that each halving represents a point where:

- The percent of supply remaining equals the new block subsidy (3.125 BTC/block vs 3.125% remaining).

- 50% of the remaining supply (1.3125M BTC) will be mined between the fourth and fifth halving.

Bitcoin: Percent of 21 Million Supply Mined chart. Source: Glassnode

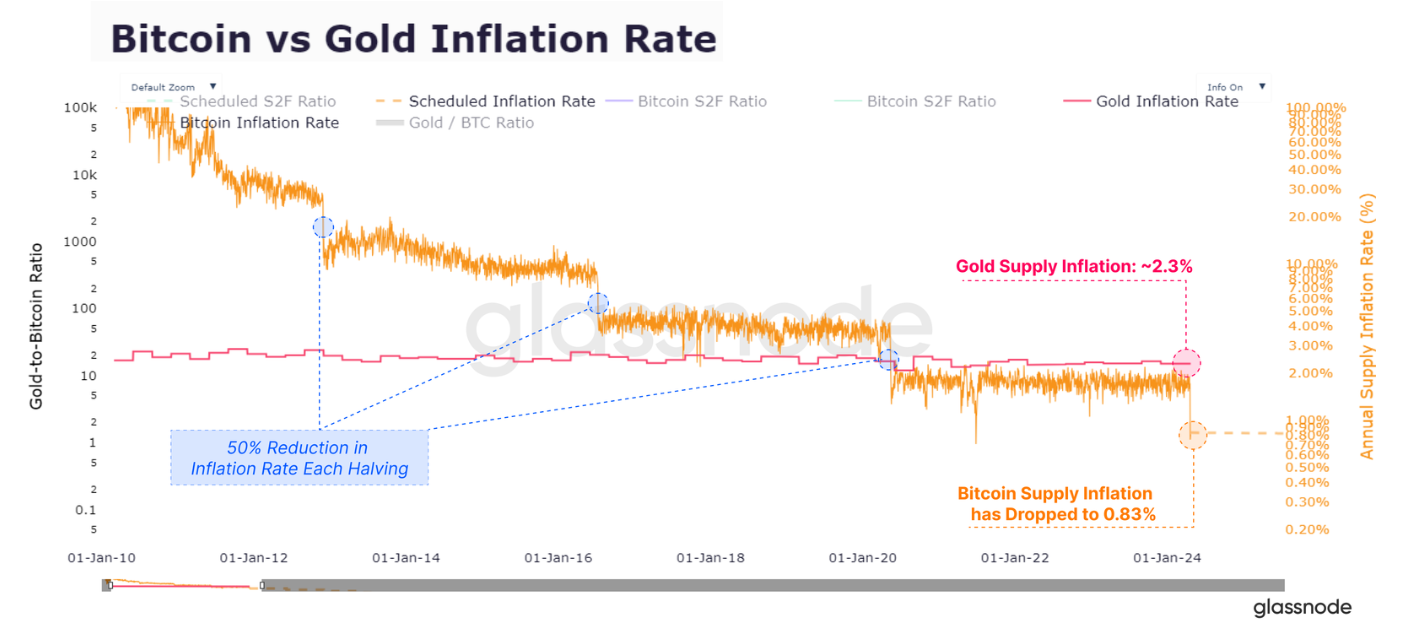

Moreover, the block subsidy is halved every 210,000 blocks, and the inflation rate is also halved roughly every four years. This puts the new annualized inflation rate of the Bitcoin supply at a value of 0.85%, down from 1.7% in the prior Epoch.

The fourth halving also marks a significant milestone in comparing Bitcoin to Gold as, for the first time in history, Bitcoin’s steady-state issuance rate (0.83%) became lower than Gold (~2.3%), marking a historic handover in the title of the scarcest asset.

Bitcoin vs. Gold Inflation Rate chart. Source: Glassnode

In an exclusive interview with FXStreet, market-making firm Auros Managing Director Le Shi said that, based on past trends, Bitcoin is “still relatively early on” in the bullish cycle compared to other years in which there has been a halving event.

“I can’t predict that timing, but there are plenty of reasons to be very bullish for the remainder of this year – the three weeks remaining – as well as going into 2025,” Le said.

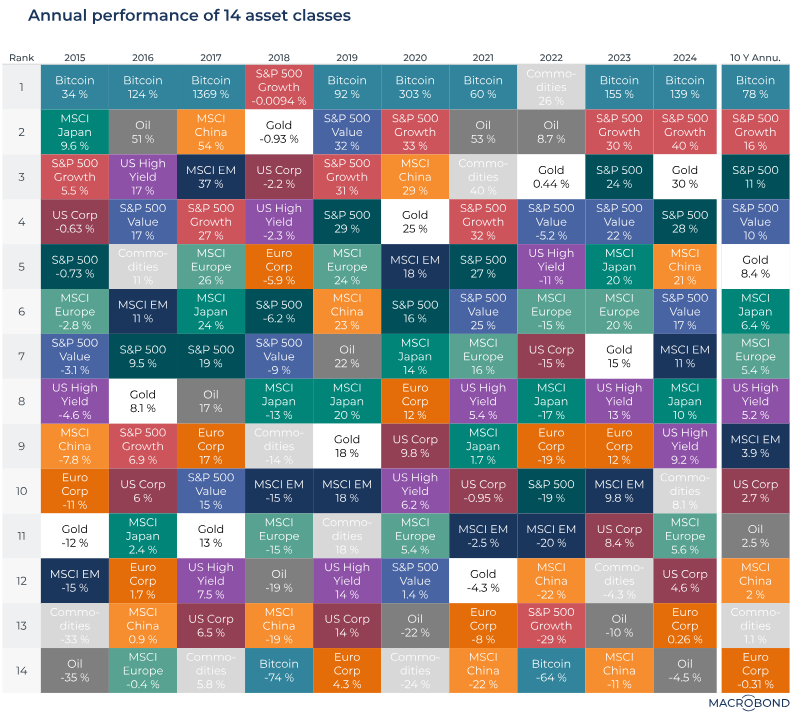

Bitcoin becomes the best-performing asset of 2024

Bitcoin has emerged as a standout performer in 2024, overshadowing traditional asset classes such as Gold, equities, real estate, and bonds. The world’s most renowned cryptocurrency has extended prior year gains, boasting a 139% surge in 2024, contributing a substantial $2.1 trillion to its market capitalization.

Assets Class Total Returns chart. Source: Macrobond

Donald Trump’s victory in the US election

The US presidential election in 2024 was one of the most significant events in the world. The influence of the country’s political decisions, policies, and economic approaches can significantly impact crypto and global markets.

The victory of a crypto-friendly candidate, Donald Trump, was seen as more favorable for crypto markets due to his pro-crypto stances, which led Bitcoin prices to a new all-time high this year.

Trump’s stance regarding Bitcoin and other cryptocurrencies shifted dramatically during this presidential election, which could be seen during his campaign earlier this year.

He proposed creating a strategic national Bitcoin stockpile to position the US as a leader in cryptocurrency adoption and announced plans to establish a Bitcoin and crypto presidential advisory council for clearer regulatory guidelines.

Moreover, after his victory, the current US Securities and Exchange Commission (SEC) Chair, Gary Gensler, announced that he would resign from the agency on January 20, 2025. This news is considered positive for the Bitcoin and overall crypto markets as investors anticipate an end to the SEC’s stringent “regulation by enforcement” approach, which has heavily impacted the broader crypto sector.

Additionally, in 2024, Trump’s sons, Donald Trump Jr. and Eric Trump, launched World Liberty Financial (WLFI), a cryptocurrency exchange, signaling the family’s growing involvement in the industry.

“President-elect Trump’s pro-crypto stance, including key regulatory appointments and his broader plans to foster a U.S.-led Bitcoin market, could have a meaningful impact once his administration begins implementing these policies,” Bobby Zagotta, CEO of Bitstamp US, told FXStreet.

Lastly, in 2024, Staff Accounting Bulletin (SAB) 121, which had imposed strict accounting requirements for crypto custodians, was revoked by the US Congress.

Financial institutions were prevented from providing crypto services by SAB 121, which compelled businesses that held cryptocurrency assets for clients to record them as liabilities on their balance sheets. This resulted in a considerable increase in compliance expenses.

Reversing SAB 121 was celebrated as a victory for the cryptocurrency sector, indicating bipartisan legislative support for digital assets and promoting increased institutional participation. These changes enable the wider integration of cryptocurrencies into conventional finance and public policy and indicate a rising shift in the political and regulatory landscape in the United States.

Macroeconomics factors and use case for Bitcoin

US macroeconomics also supported risky assets like Bitcoin in 2024. The US Federal Reserve announced a 50 basis point (bps) cut in interest rates in September, lowering borrowing costs for the first time in over four years (COVID-19 times). This big rate cut is considered a bullish sign for cryptocurrencies, stocks, and global risk markets.

Lower borrowing costs generally provide more purchasing power for investors, who would invest their money in assets rather than keep it in the bank. Thus, since the September rate cut, Bitcoin has rallied from $55K to more than $100K.

“Rate cuts are generally pretty good for the risk assets.[...]Trump is coming. Elon Musk is joining Trump in forming the government, so 2025 could be the year of crypto and we are witnessing history,” Arjun Vijay, Chief Operating Officer and founder at Indian crypto exchange Giottus, told FXStreet.

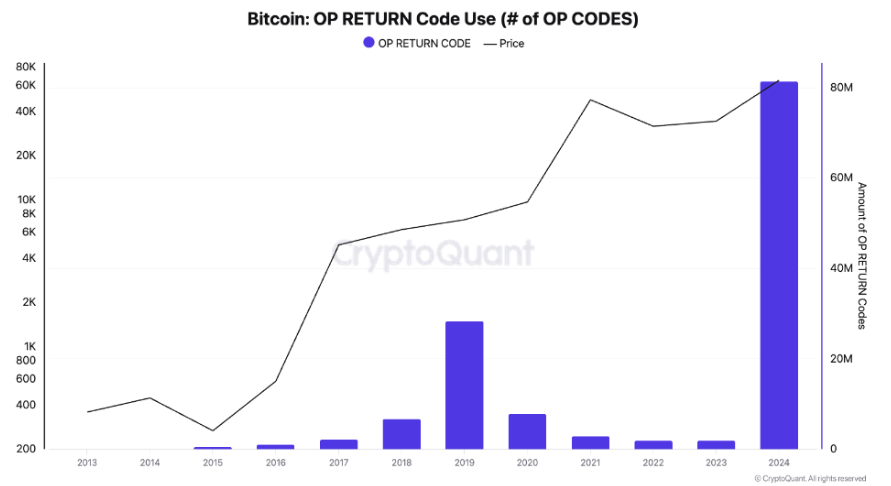

Additionally, this year, the Bitcoin network discovered a new use case with the introduction of the RUNES protocol, enabling the minting of tokens directly on the Bitcoin blockchain. By leveraging the OP_RETURN opcode to inscribe RUNES, the protocol unlocked a wave of innovation, resulting in an unprecedented surge in the use of OP_RETURN, with 81 million recorded throughout the year.

Bitcoin: OP Return Code Use chart. Source: CryptoQuant

Bitcoin outlook for 2025: What to expect with a crypto-friendly US president

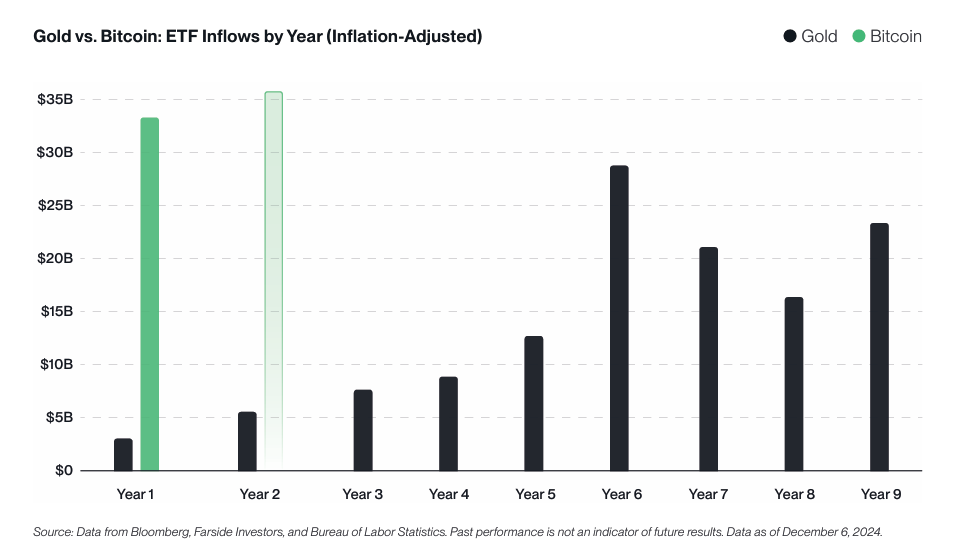

The year-ahead report by Bitwise highlights Bitcoin predictions for 2025. The report explains that Bitcoin ETF demand will reach a new high.

“Combine that demand with the reduction in new supply thanks to the April 2024 halving, plus new buying from corporations and governments and … well, we’ve seen this play before. (Note: If the US government follows through on proposals to establish a 1 million Bitcoin strategic reserve, $200,000 becomes $500,000 or more,” says the report.

The report further explains that after the ETFs launched in January 2024, ETF experts forecasted the Bitcoin group to see $5 billion to $15 billion of inflows in their first year. They passed the higher end of that range within the first six months. Since its launch, the record-setting ETFs have gathered $33.6 billion in inflows.

Bitwise’s report says, “We expect 2025’s inflows to top that.”

Three reasons for this rise in inflow are given below:

First, year one for ETFs is generally the slowest. The best historical analogy is comparing Gold ETFs in 2004 with Bitcoin ETFs in 2024. In the first year, Gold saw a total inflow of $2.6 billion, followed by $5.5 billion, $7.6 billion, $8.7 billion, $16.8 billion and $28.9 billion, respectively, in the subsequent years. It would align with Gold’s example for Year 2’s flows to top Year 1’s. Flows petering out would be unusual.

Gold vs. Bitcoin ETF Inlfow by Year chart. Source: Bitwise

Secondly, the major wirehouses will come online in 2025. Regarding Bitcoin ETFs, the largest wirehouses in the world – from Morgan Stanley and Merrill Merrill Lynch to Bank of America and Wells Fargo – have yet to unleash their army of wealth managers, who have largely been prevented from accessing the products. Bitwise analysts believe this will change in 2025, and the trillions of dollars these firms manage will start flowing into Bitcoin ETFs.

Lastly, Bitwise has seen a distinct pattern over the seven years of helping investment professionals access crypto. Most investors start with a small allocation and then build on it over time. It is suspected that most investors who bought bitcoin ETFs in 2024 will double down in 2025.

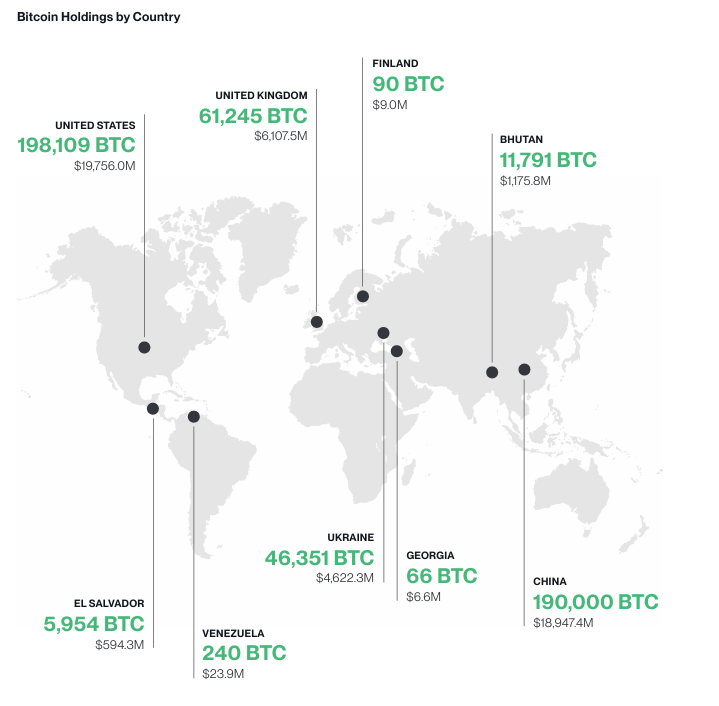

The report also predicts that the number of countries holding Bitcoin will double in 2025. The fact that the US is actively considering building a strategic Bitcoin reserve will kick off a race worldwide for governments to buy Bitcoin.

This is already seen with legislators from Poland to Brazil introducing bills pushing for strategic Bitcoin reserves in their countries. According to BitcoinTreasuries.net, nine countries currently have Bitcoin holdings (led by the United States).

Bitcoin Holdings by Country chart. Source: Bitwise

Technical analysis: Bitcoin could exceed $240K

Looking at Bitcoin’s monthly chart below, Bitcoin’s price peaked between 518 and 549 days after each previous halving cycle. This is seen after the 2016 and 2020 halving, respectively. Assuming that history repeats, the next Bitcoin peak would likely occur after 518 days (September 2025) or 549 days (October 2025).

Moreover, when considering the peak of the previous halving, it is 3.51 times the other one: the 2021 peak was 3.51 times the 2017 peak. Assuming this theory plays out, the peak in 2025 would be 3.51 times that of 2021, which would give a price target of $242,190.

BTC/USD monthly chart

Another price projection would be given by CryptoQuant Bitcoin realized price bands, which is the average price at which all the Bitcoin in circulation has been transferred for the last time.

Historically, the price of Bitcoin has marketed a cycle top at ~4 times the realized price; this level represents the upper band (red dashed line). As of now, Bitcoin’s top price target is at $156K.

-638701935717553686.png)

Bitcoin: Realized Price Bands chart. Source: CryptoQuant

Lastly, FXStreet interviewed several experts and renowned people in the crypto communities. Their views about Bitcoin price projection for the end of 2024 and 2025 are given below:

| Experts | End of 2024 | End of 2025 |

| Geoff Kendrick, Global Head of Digital Assets Research at Standard Chartered | $125,000 | $200,000 |

| Dr. Sean Dawson, Head of Research, Derive.xyz | $90,000 | $200,000 |

| Arjun Vijay, Chief Operating Officer and founder at Indian crypto exchange Giottus | $90,000 | $250,000 |

| Max Keiser, American-Salvadoran broadcaster and filmmaker, Bitcoin maximalist | $220,000 | $180,000 |

| Tim Draper, American venture capital investor | $120,000 | $250,000 |

| Tom Lee, Cofounder, Fundstrat Global Advisors | $150,000 | $250,000 |

Conclusion

Bitcoin surged above the $100K milestone this year for the first time, a historic event for the overall crypto industry. Just a few years back, the entire industry was shaken by the collapse of foundational institutions, such as Genesis, FTX, BlockFi, Celsius, Three Arrows, and Voyager, as well as the LUNA/UST digital assets, casting doubts over the future of the crypto industry.

However, the launch of spot Bitcoin ETFs in the US in January 2024 gave an accessible avenue for institutional and retail investors to gain exposure to Bitcoin without the complexities of direct ownership. This was followed by corporate accumulation led by MicroStrategy, Marathon Digital, Galaxy Digital Holdings, Tesla, Riot Platforms and others, leading to the surge in demand for Bitcoin.

Bitcoin’s fourth halving event fueled the ongoing rally, leading to a 50% reduction in supply inflation and an inherent increase in issuance scarcity. Political developments further shaped the industry with the victory of a crypto-friendly candidate Donald Trump, the resignation by SEC chair Gary Gensler, expectations of favorable regulations and looser monetary policy in the US and other large economies pushed BTC to a new highs.

With many of these factors expected to extend into 2025, technical analysis and expert insights support a bullish outlook for BTC, with price targets exceeding $200K by the end of next year.