Pi Network Price Forecast: PI bulls resurface at a crucial support level

- Pi Network holds steady above $0.1350 on Friday after rising over 2% the previous day from a crucial support level.

- PI-supporting CEXs record net withdrawals over 24 hours as Pi Foundation outflows slow, suggesting increased buying pressure.

- The technical outlook for PI highlights a potential double-bottom reversal at a crucial support level.

Pi Network (PI) is up almost 1% at press time on Friday, extending the 2% gains from the previous day. Renewed buying pressure, evidenced by increased withdrawals from exchanges supporting the PI token, and reduced outflows from the Pi Foundation, adds tailwinds. The technical outlook for PI is bullish in the short term, driven by the likelihood of a double-bottom reversal at a key support level.

On-chain data points to reduced headwinds

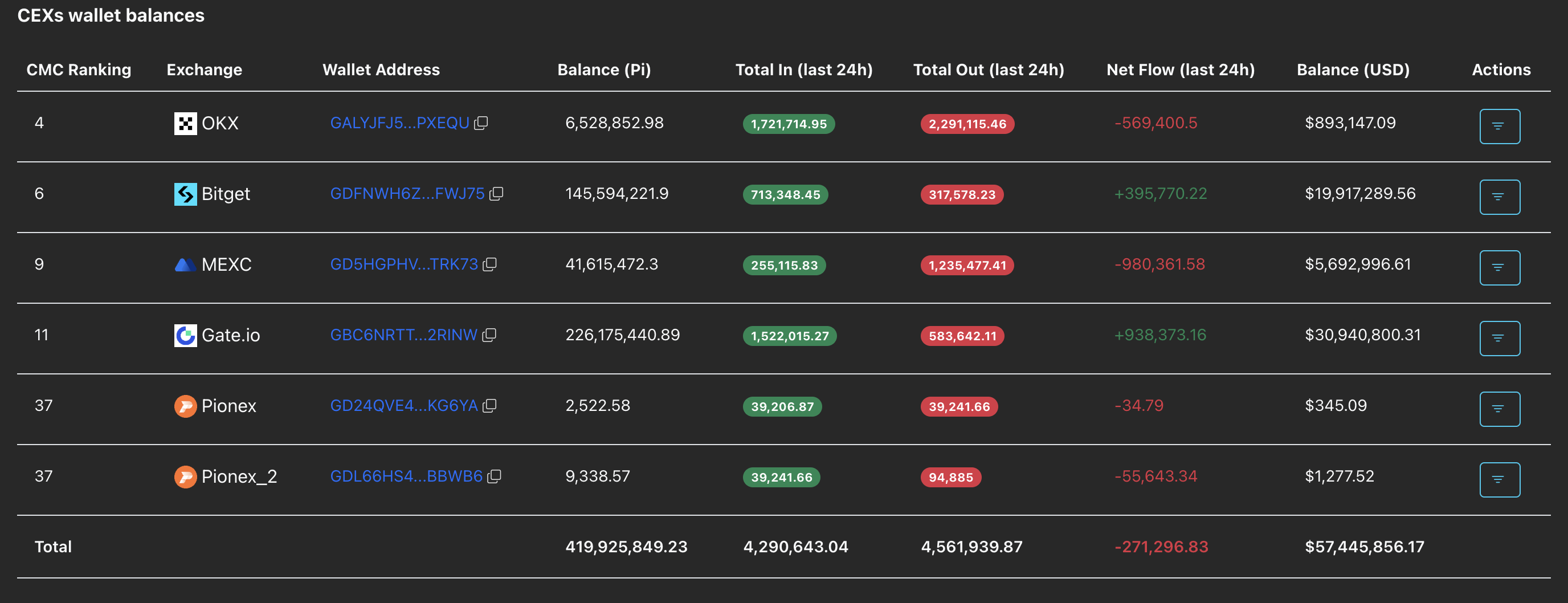

PI scan data shows that Centralized Exchanges (CEXs) have recorded a net outflow of 271,296 PI tokens over the last 24 hours, suggesting renewed buying pressure as investor confidence rebuilds.

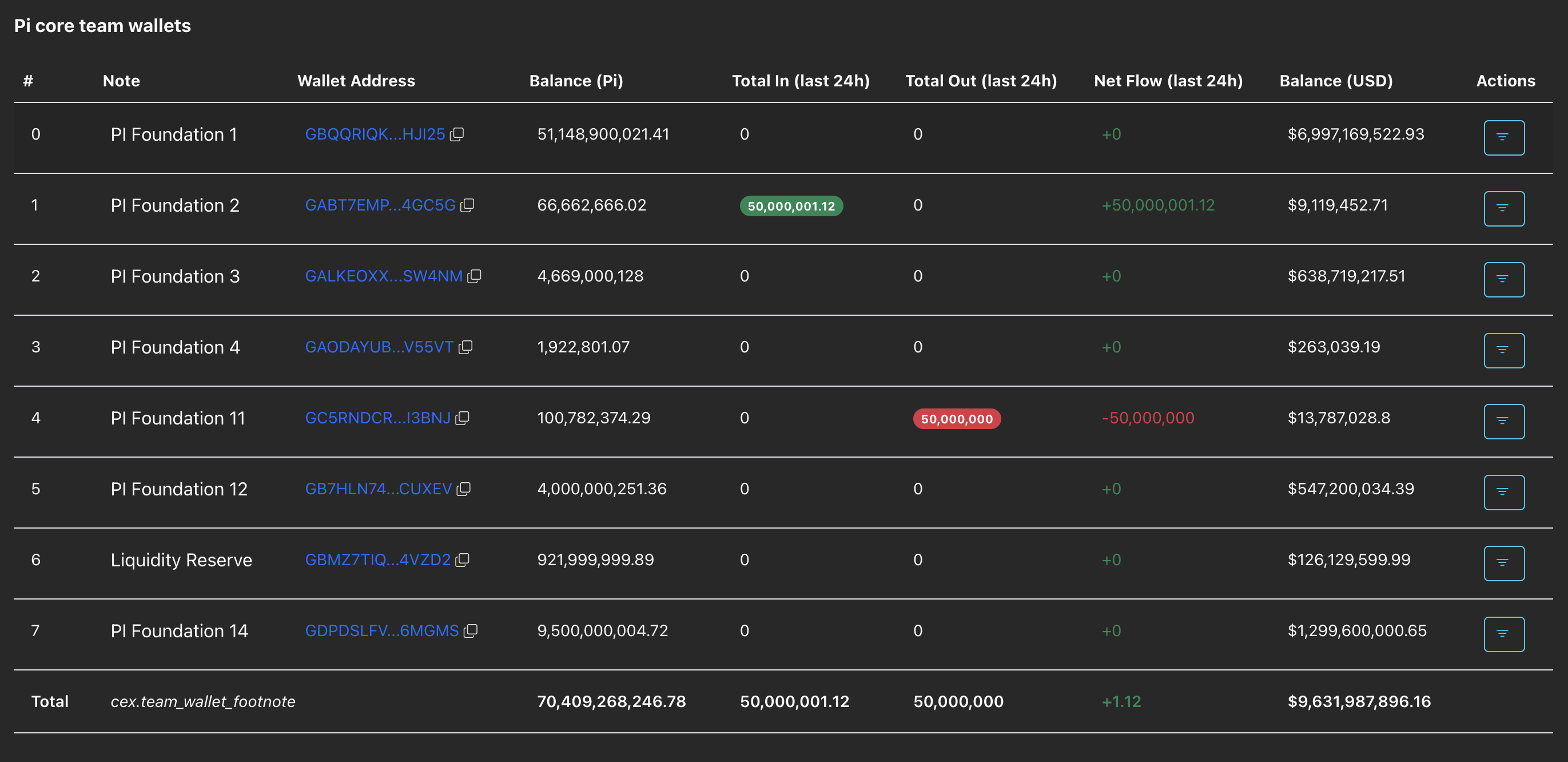

The Pi core team wallets, which have previously recorded major outflows, made a strategic shift of 50 million PI tokens, without any significant outflows in the last 24 hours. This signals reduced outflow from PI Foundation, which limits the downside pressure. If the trend continues, a limited supply dump and steady CEXs outflows could support the short-term recovery in PI token.

Pi Network prepares for a rebound from key support

PI token is approaching the $0.1400 round figure after bouncing off the S1 pivot point at $0.1327 the previous day. The sudden recovery suggests a double-bottom reversal, as the support was previously tested by the February 6 low at $0.1300.

The immediate resistance for the PI token is at $0.1533, aligning with the October 10 low. A steady close above this level could target the 50-day Exponential Moving Average at $0.1763.

However, the downward-sloping 50- and 200-day EMAs reaffirm the prevailing bearish bias and are likely to cap gains in an extended recovery.

The technical indicators on the daily chart back the short-term rebound thesis despite prevailing downside pressure. The Relative Strength Index (RSI) is at 26, remaining in the oversold zone and suggesting a potential rebound, typically seen at saturated levels of selling pressure.

At the same time, the Moving Average Convergence Divergence (MACD) converges with the signal line as negative histogram bars recede, suggesting a bullish crossover as bearish momentum wanes.

However, if the PI token slips below the S1 pivot point at $0.1327 on a daily close, it could extend the decline to the S2 pivot point at $0.1046.