Privacy coins set to take the lead in 2026 as regulation accelerates demand for on-chain anonymity

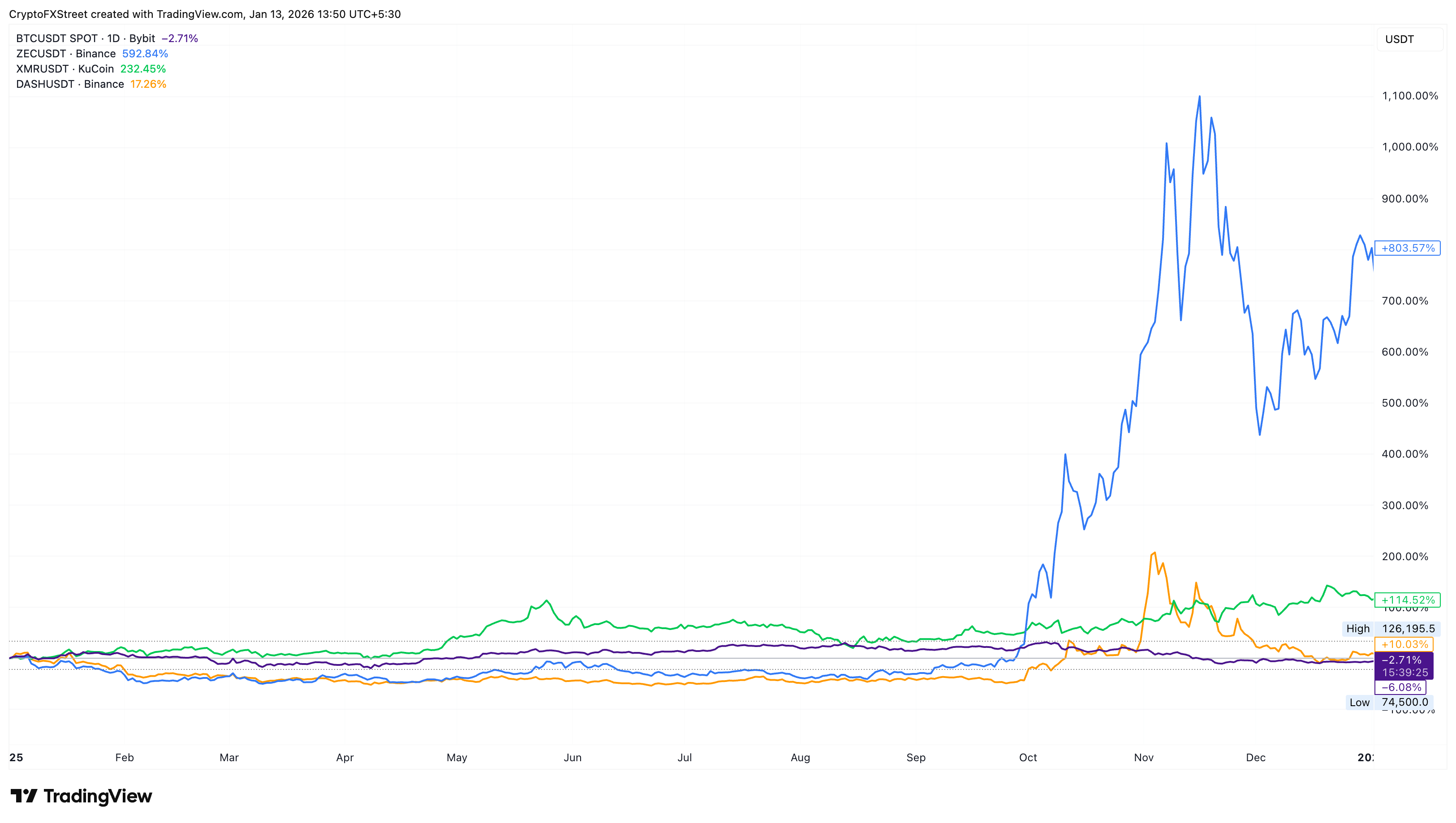

- The segment of privacy coins outperforms the broader cryptocurrency market, with a roughly 290% rise in 2025.

- The rising user count on the cryptocurrency tumbler Tornado Cash amid regulatory pushes, such as the 2025 GENIUS Act, reflects a surge in demand for privacy.

- Andreessen Horowitz anticipates narratives such as “secrets-as-a-service” and “spec is law” could make privacy the strongest moat for crypto in 2026.

Privacy coins have outperformed the broader cryptocurrency market in 2025, with gains of nearly 290%. The growing user base, pool size, and monthly withdrawals on the cryptocurrency tumbler Tornado Cash reflect a surge in demand for on-chain anonymity amid regulatory pushes, such as the 2025 US GENIUS Act, and the Markets in Crypto-Assets Regulation (MiCA) in the European Union (EU). Additionally, the increasing number of wrench attacks, which are real-world assaults to steal digital assets, risks the social identity of holders worldwide.

Experts, including venture capital firm Andreessen Horowitz (a16z), expect privacy coins rally to extend in 2026, driven by narratives such as “secrets-as-a-service” and “spec is law.”

Privacy coins take the lead

Privacy coins outperformed the broader cryptocurrency market segment, delivering 288% returns in 2025, while the exchange tokens segment recorded a 22% rise. This massive margin difference between the two segments reflects the broader market's surge in demand for privacy.

Zcash (ZEC) and Monero (XMR) recorded annual returns of around 800% and 115%, respectively, outperforming Bitcoin (BTC), which posted a negative return of 2.7% in 2025. ZEC and XMR advanced on a rally in late September and gained further traction during the US government shutdown from October 1 to November 12. Zcash jumped 580%, and Dash (DASH) rebounded by more than 400% during the same period, while Monero surged nearly 50% in October and November.

On the regulatory side, the US GENIUS Act (Guaranteeing Essential National Infrastructure in US-Stablecoins), signed by the US President Donald Trump on July 18, focuses on stablecoin regulations, and the US CLARITY Act, still pending Senate approval, would focus on a regulatory framework and transparency on crypto exchanges. Such regulations ease financial surveillance, which could boost demand for privacy coins in the long term.

Tornado Cash reveals a surge in on-chain anonymity demand

Tornado Cash, a cryptocurrency tumbler, is typically used to anonymize transactions by blurring the on-chain trail through a shared funding pool. The increasing demand for Tornado Cash suggests market activity is focused on financial privacy. However, this could also suggest heightened money-laundering and capital-evasion activities.

The active users trend saw a steady rise in 2025, peaking at 3,900 monthly users in December. This trend extends into 2026, with 6,000 active monthly users so far in January.

The outflows from Tornado Cash follow a similar rising trend, extending a streak of five consecutive rising monthly withdrawals, reaching 5,828 withdrawals in December with 531 transactions of over 10 ETH. Additionally, the ETH deposited on the Tornado Cash pool remains above 300 million ETH, suggesting high liquidity on the platform and corroborating demand.

Here’s why the privacy coins narrative could take the lead in 2026

Andreessen Horowitz, a venture capital firm commonly known as a16z, expects the privacy coin segment to remain the most important moat in the cryptocurrency market. According to the company, private systems lock in real value and provide a hedge against shutdowns, coercion, and government control.

Additionally, the “secrets-as-a-service” narrative could build a core infrastructure to transform data access control and key management, advancing from Multi-Party Computation (MPC) and multi-signature wallets.

Finally, a shift from “code is law” to “spec is law,” would mean the system behaves according to the specification rather than whatever the code executes. This shift could include reversal transactions, more regulations, and compliant systems to override the “code is law” behavior.

Apart from the technicals, a real-world threat arises as anonymity fades in the cryptocurrency market. As per Jameson Lopp, the Chief Security Officer at CasaHODL, nearly four wrench attacks have occurred so far in 2026 in France, after over 70 physical attacks in 2025 on digital asset holders to steal their savings.

On the mainstream adoption side, Solana, the high-speed blockchain ecosystem, initiated a hackathon focused on building private transactions, a launchpad, and open traction.

Technical outlook: Could Zcash, Monero and Dash extend the rally in 2026?

Zcash trades around $400 at press time on January 13, breaking below the 50-day Exponential Moving Average (EMA) at $443 after a 24% decline last week. The ZEC token is signaling a bearish breakout from a symmetrical triangle pattern on the daily chart, potentially targeting the $300 psychological support level.

The momentum indicators on the daily chart suggest a sell-side bias, as the Relative Strength Index (RSI) is at 41, hovering near the oversold zone, and the Moving Average Convergence Divergence (MACD) remains below the signal and zero lines.

Looking up, if ZEC resurfaces above the resistance trendline connecting the November 15 and December 29 highs, near $500, it could extend the rally toward the November 7 high at $750.

Meanwhile, Monero continues its bullish trend in 2026, with 55% gains so far in January. At the time of writing, XMR is up 6% on Tuesday, marking its fourth consecutive day of rally and recording an all-time high of $690 so far.

The XMR rally targets the R4 Pivot Point at $711. A decisive close above could lead to the R5 Pivot Point at $782.

The momentum indicators on the daily chart signal intense bullish pressure, as the RSI at 85 rises into the overbought zone, while MACD and the signal line rise nearly vertically.

On the flip side, if XMR slips below $600, it could test the R2 Pivot Point at $569.

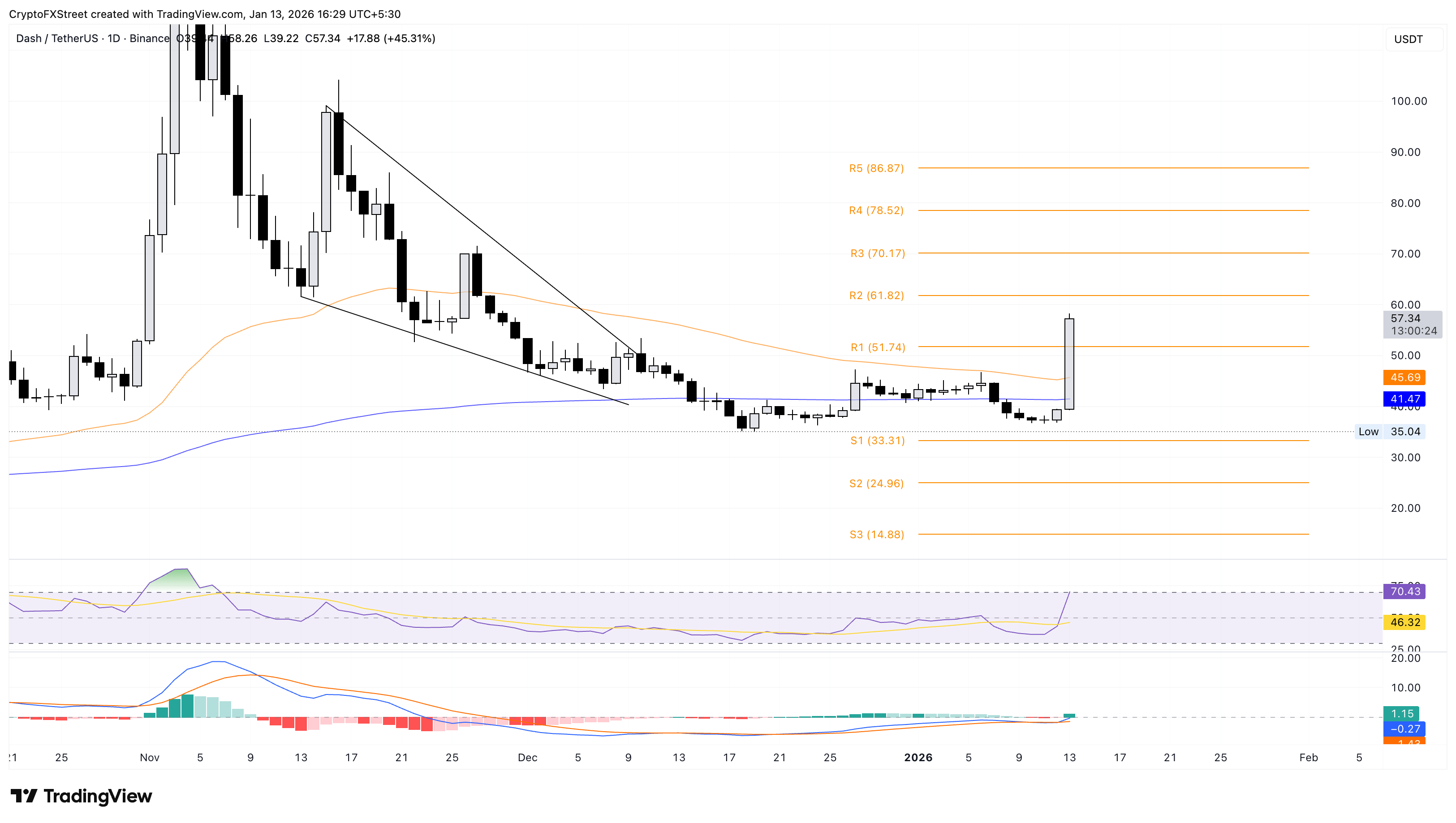

Finally, Dash records 44% gains by press time on Tuesday, surpassing the $50 mark. The DASH token aims for the R2 and R3 Pivot Points at $61 and $70, respectively.

The MACD indicator flashes a buy signal as it crosses above the signal line on the daily chart. At the same time, a vertical surge in RSI hits 70, reaching the overbought boundary, suggesting a rise in buying pressure.

If DASH drops below $50, it could test the 50-day EMA at $45.