Ripple Price Forecast: XRP struggles despite surge in on-chain activity

- XRP edges lower, targeting Monday’s low amid mixed signals from technical indicators.

- The XRP Ledger records a sharp increase in economic activity and on-chain transactions.

- Institutional demand for XRP ETFs steadies with inflows extending their positive streak to 13 consecutive days.

Ripple (XRP) is trading under pressure at the time of writing on Thursday, after bulls failed to break the short-term resistance at $2.22. The reversal may extend toward Monday’s low of $1.98, especially if risk-off sentiment persists in the broader cryptocurrency market.

XRP Ledger records highest on-chain activity in 2025

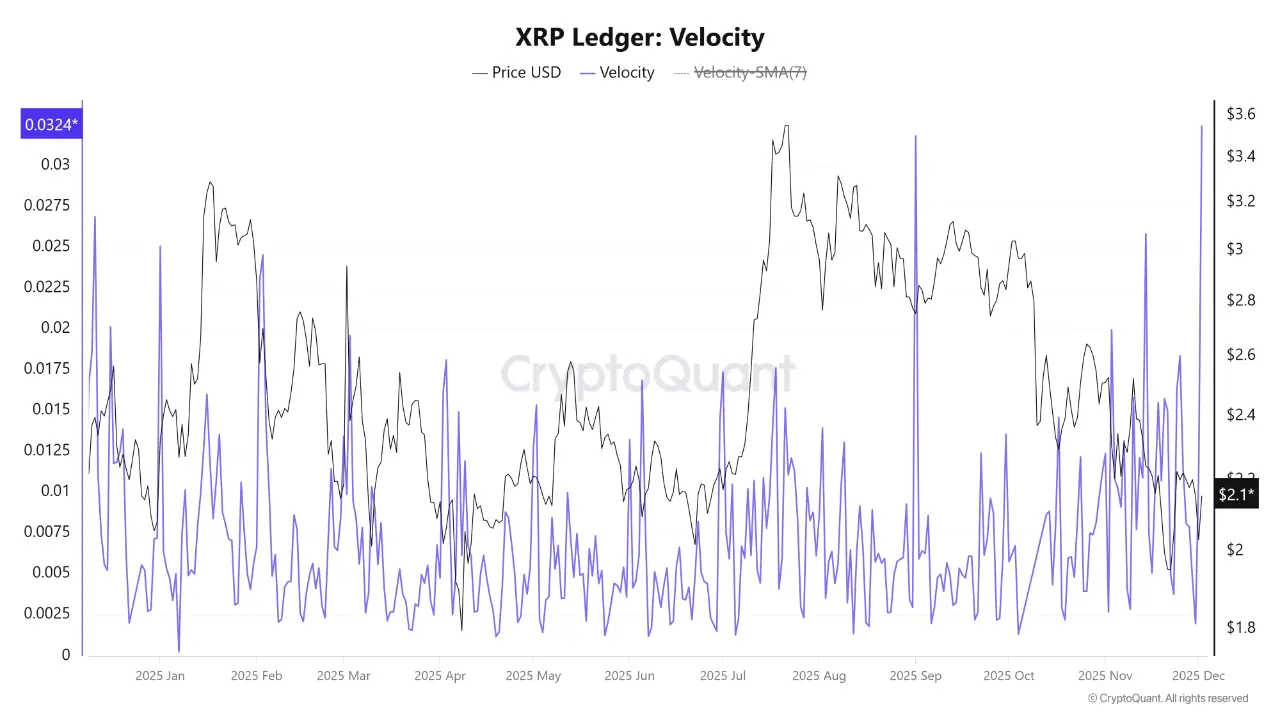

The XRP Ledger (XRPL) Velocity indicator shows that the blockchain recorded a significant spike in on-chain activity, with the index reaching a yearly high of 0.0324 on Tuesday.

According to CryptoQuant data, the Velocity metric, which tracks the frequency of an asset’s movement across the network, saw a sharp increase in economic activity and on-chain transactions.

“This level of circulation velocity suggests that instead of remaining dormant in cold wallets or being held for the long term (HODL), XRP coins are rapidly changing hands among market participants,” CryptoOnchain analyst stated on CryptoQuant's Quicktake section.

The XRPL on-chain data shows that the network is experiencing a significant surge in user engagement, regardless of market direction.

The XRP derivatives market also saw a minor increase in retail demand, with futures Open Interest (OI) averaging $3.85 billion on Thursday, up from $3.75 billion on the previous day. OI, which measures the notional value of outstanding futures contracts, had declined to $3.19 billion on November 22, the lowest level since April 22.

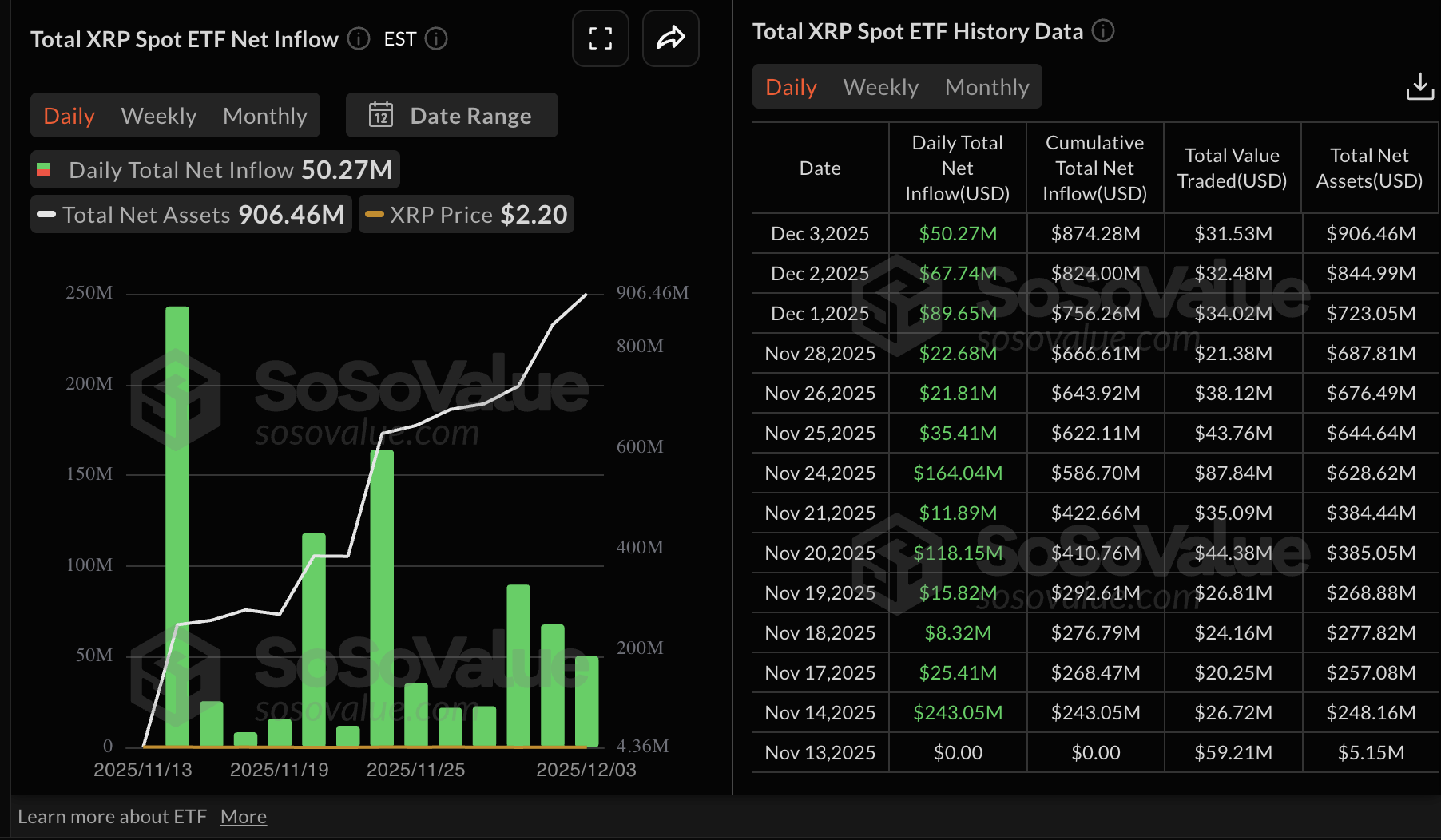

Institutional interest in XRP spot Exchange Traded Funds (ETFs) has also remained steady since their debut on November 13. SoSoValue data shows that US-listed XRP ETFs recorded approximately $50 million in inflows on Wednesday, bringing cumulative inflows to $874 million and net assets to $906 million.

Steady ETF inflows support positive sentiment, encouraging investors to increase exposure and anticipate a sustained uptrend.

Technical outlook: XRP recovery falters amid mixed signals

XRP is sitting above Monday’s low of $1.98 at the time of writing on Thursday. The cross-border remittance token also holds below the descending 50-day Exponential Moving Average (EMA) at $2.31, the 100-day EMA at $2.47, and the 200-day EMA at $2.49, all of which point to a bearish bias.

The Relative Strength Index (RSI) at 46 remains in bearish territory on the daily chart, as bullish momentum wobbles. If the RSI dips further toward the oversold region, it will signal increasing bearish momentum.

Still, the Moving Average Convergence Divergence (MACD) indicator on the same chart has maintained a buy signal since November 25. XRP would repair its bullish outlook if the blue MACD line remains above the red signal line, while the green histogram bars expand.

To invalidate the bearish thesis, the 50-day EMA at $2.31 should flip into support, while a break above the descending trendline could boost XRP’s recovery potential toward $3.00.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.