EUR/USD slips below 1.1650 as resilient US labor data backs Dollar

- EUR/USD slips as resilient US labor data offsets cooling inflation, delaying near-term Fed easing expectations.

- Markets trim Fed cut odds despite CPI undershoot, citing strong employment and stable economic momentum.

- Attention shifts to Eurozone officials and US PPI, Retail Sales for clearer policy signals.

EUR/USD trades with losses on Tuesday even though the latest inflation in the United States was benign, hinting that the Federal Reserve could indeed reduce interest rates as priced in by the financial markets. At the time of writing, the pair trades at 1.1642, down by over 0.20%.

Euro weakens despite benign US inflation, as firm jobs data and Fed rhetoric boost the Dollar

The Greenback recovered some ground after the December Consumer Price Index (CPI) in the US was mostly aligned with estimates, with underlying inflation ticking a tenth lower on the annual print. This would justify rate cuts by the Federal Reserve, but last Friday’s solid Nonfarm Payrolls report, the tick lower in the Unemployment Rate and a goodish ADP Employment Change 4-week average report, indicates a resilient labor market.

Last year, the three rate cuts by the Fed were triggered by labor market weakness even though inflation remains high. Now, the labor market remains solid and prices, while closer to 3% than 2%, remained stable.

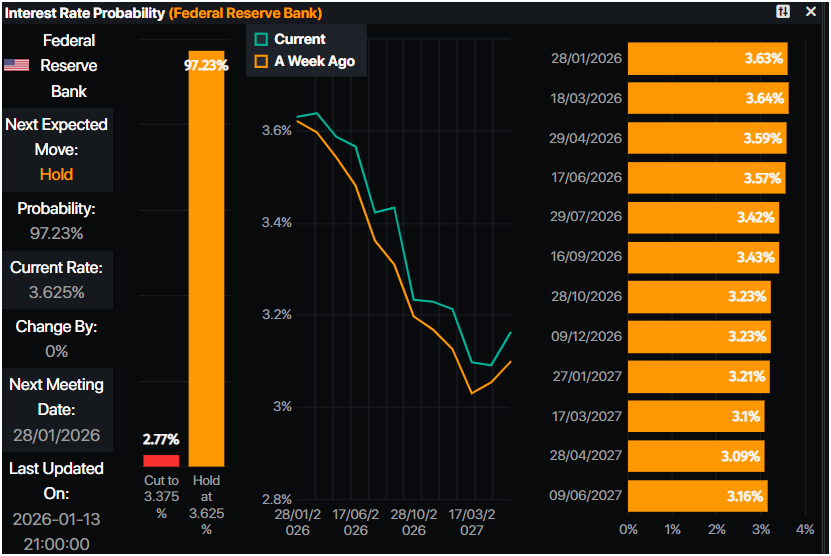

Money market had trimmed the odds for a 25-basis point rate cut by the Fed, revealed the Interest Rate Probability tool by Prime Market Terminal. Traders see the Fed funds rate finishing at 3.23% so far, implying 52 basis points of cuts.

After the US CPI report, US President Donald Trump, slammed the Fed Chair Jerome Powell once more, He posted in his Truth Social Network “Inflation numbers for the USA. That means that Jerome “Too Late” Powell should cut interest rates, MEANINGFULLY!!! If he doesn’t he will just continue to be, “TOO LATE!” ALSO OUT, GREAT GROWTH NUMBERS. Thank you MISTER TARIFF! President DJT.”

Earlier, the ST Louis Fed President Alberto Musalem was neutral hawkish, said that the economy is likely to grow at or above its potential in 2026.

On Wednesday, the Eurozone economic docket will feature a speech by the European Central Bank Vice-President Luis De Guindos. In the US, traders’ focus will be on releases of the Producer Price Index (PPI) for October and November, Retail Sales for November and a flurry of Fed officials.

Daily digest market movers: Euro tumbles amid soft US inflation report

- US CPI came in largely aligned with forecasts. Headline CPI was unchanged at 0.3% MoM, matching November’s pace, while annual inflation held steady at 2.7%, exactly as projected. Core CPI showed signs of modest easing, slowing to 0.2% MoM from 0.3%, as expected. On a yearly basis, core inflation stood at 2.6%, unchanged from November but slightly below market estimates, pointing to gradual disinflation.

- Meanwhile jobs market data was solid. ADP’s Employment Change four-week average ticked higher, improving from 11K to 11.75K, suggesting a mild stabilization in private-sector hiring momentum.

- October’s New Home Sales edged 0.1% lower MoM slipping from 738K to 737K. However, U.S. Department of Commerce data showed a sharp increase on an annual basis, suggesting that easing mortgage rates and lower home prices are beginning to support to on the housing market.

Technical outlook: EUR/USD slumps as sellers pile in, pushing the pair below 1.1650

EUR/USD continues to consolidate after failing to clear key resistance at the 20-day Simple Moving Average (SMA) at 1.1716, which sent the pair sliding past 1.1700 and the 1.1650 figure. Momentum as measured by the Relative Strength Index (RSI) shows that sellers are in charge, as the RSI stills below its neutral level.

That said, if EUR/USD slides below 1.1600, this could expose the 200-day SMA at 1.1575. A breach of the latter clears the way to challenge 1.1500 and the August 1 low of 1.1391. On the other hand, if buyers regain the 50 and 100-day SMAs, each at 1.1647 and 1.1663, then up next lies 1.1700. If surpassed, traders could target the 20-day SMA at 1.1716.

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.