GBP/USD falls towards 1.3100 as UK political tensions weighs on Sterling

- Reports of possible leadership challenge to PM Starmer spark political jitters ahead of UK fiscal budget.

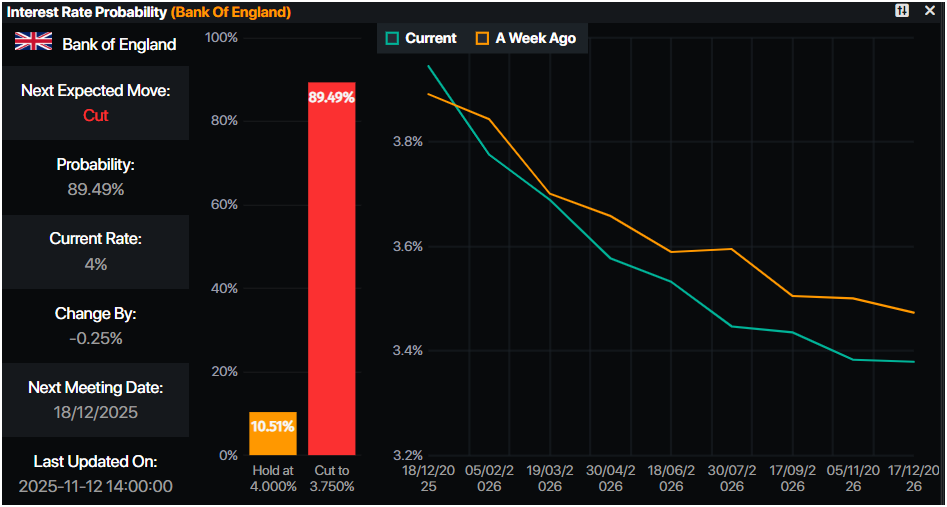

- UK jobs data showing 5% unemployment and slower wage growth lift odds of December BoE rate cut to 90%.

- DXY steady at 99.58 as markets await House vote to end US government shutdown.

The Pound Sterling tumbles during the North American session on Wednesday as reports emerged that Prime Minister Keir Starmer’s leadership was questioned, ahead of the release of UK’s fiscal budget. The GBP/USD tumbles over 0.34% at 1.3105.

Pound slides 0.34% as Starmer faces leadership rumors and traders price in a near-certain BoE rate cut next month

UK newspapers cited some allies of the Prime Minister on a feared plot, but the PM distanced from a briefing by unnamed allies that he would fight any leadership bid, according to Reuters.

Health minister Wes Streeting who was mentioned to challenge Starmer, denied the plot and said to Sky News “I'm not going to demand the prime minister's resignation.”

In addition to that, a weaker jobs report revealed on Tuesday increased the chances for a Bank of England (BoE) rate cut in December. In the last meeting, BoE’s Governor Andrew Bailey sided with the hawks, on a 5-4 vote split. However, the jump of the Unemployment Rate to 5%, and wages growth easing, prompted traders to discount 25 basis points rate cut by the BoE at the December meeting, with odds standing near 90%, revealed Prime Market Terminal data.

Across the pond, a Wall Street Journal headline reading “Hopes the government shutdown will end as soon as Wednesday,” keeping the US Dollar bid as depicted by the US Dollar Index (DXY).

The DXY, which measures the buck’s performance versus six currencies, bounced off Tuesday’s lows and traded at 99.58, up 0.13%.

Nevertheless, the Dollar’s recovery could be questioned as Reuters revealed that 80% of the economists polled estimate the Fed will lower rates by 25 bps next month.

Meanwhile, the US House of Representatives is expected to vote the bill to end the government shutdown around 19:00 ET, said Rep. Scalise on CNBC.

The government reopening could release an avalanche of US economic data pending to be unveiled, from October 1, when federal offices closed.

GBP/USD Price Forecast: Technical outlook

The GBP/USD technical picture remains biased downward, though sellers need to drag the exchange rate below 1.3100, to challenge the latest cycle low of 1.3010, hit on November 5. A breach of those two levels could expose the April 7 low of 1.2707.

Conversely, a daily close above 1.3100, could set the tone to remain subdued at around 1.3100-1.3150 amid the lack of catalysts, with a light UK economic docket, and the US government shutdown.

Pound Sterling Price This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.22% | 0.23% | 0.57% | -0.29% | -0.68% | -0.63% | -1.03% | |

| EUR | 0.22% | 0.44% | 0.82% | -0.10% | -0.48% | -0.44% | -0.83% | |

| GBP | -0.23% | -0.44% | 0.47% | -0.54% | -0.92% | -0.88% | -1.27% | |

| JPY | -0.57% | -0.82% | -0.47% | -0.92% | -1.30% | -1.25% | -1.68% | |

| CAD | 0.29% | 0.10% | 0.54% | 0.92% | -0.30% | -0.35% | -0.80% | |

| AUD | 0.68% | 0.48% | 0.92% | 1.30% | 0.30% | 0.04% | -0.36% | |

| NZD | 0.63% | 0.44% | 0.88% | 1.25% | 0.35% | -0.04% | -0.40% | |

| CHF | 1.03% | 0.83% | 1.27% | 1.68% | 0.80% | 0.36% | 0.40% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).