- Gold jumps over 2% toward $5,400 after US, Israel attack Iran

- Strait of Hormuz Blockade: JPM Warns Crude Production May Halt After 25 Days. How Will US-Iran Conflict Trajectory Affect Global Oil Prices?

- Gold rises to near $5,200 amid US tariff uncertainty, US PPI data in focus

- Gold climbs above $5,200 on geopolitical tensions, trade uncertainty

- Gold gains above $5,150 as US tariff uncertainty drive demand, eyes on US-Iran talks

- Oil prices rise as US and Iran extend talks into next week

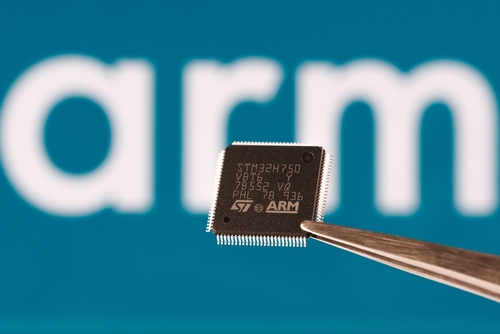

Shares of Arm Holdings (NASDAQ: ARM) were moving higher after the chip-design company posted better-than-expected results for the fiscal second quarter and reaffirmed its guidance for the full year.

As of 2:25 p.m. ET, the stock was up 4.1% on the news.

Image source: Getty Images.

Artificial intelligence demand continues to grow

Arm's growth decelerated from the fiscal first quarter, but that was expected as it rolled off a large licensing deal from the quarter a year ago.

In the second quarter, which ended Sept. 30, revenue rose 5% to $844 million, which was ahead of the company's own guidance at $780 million to $830 million and the analyst consensus at $808.4 million.

Arm makes money from licensing chip designs and collecting royalties on those designs so it has two segments, licensing and royalties.

Royalty revenue, the larger of its two segments, rose 23% in the period to $514 million, due to an increase in Armv9, its latest CPU architecture. It said Armv9 now makes up about 25% of its royalty revenue, up from 10% a year ago.

License revenue, on the other hand, was down 15% to $330 million as expected, though it said Q2 bookings were strong. Annualized contract value, an underlying measure of license growth, was up 13% to $1.25 billion, and remaining performance obligations, a proxy for backlog, were up 10% to $2.39 billion.

On the bottom line, adjusted earnings per share fell from $0.36 to $0.30, due in part to the decline in license revenue as spending on research and development (R&D) and sales and marketing increased after backing out share-based compensation.

In a letter to shareholders, CEO Rene Haas said, "Demand for AI everywhere is increasing the need for more compute and in turn driving our partners to make long-term commitments to more, and more powerful, energy-efficient Arm technology."

What's next for Arm

Management reiterated its guidance for the fiscal year, calling for $3.8 billion to $4.1 billion and adjusted earnings per share of $1.45 to $1.65.

For the third quarter, the company expects revenue of $920 million to $970 million, and adjusted earnings per share of $0.32 to $0.36, which were in line with estimates.

Overall, the company remains on track to capitalize on continued artificial intelligence demand, despite the modest revenue growth in the quarter.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.