US Inflation Difficult to Ease, Will Non-Farm Payroll Data Exceed Expectations Again?

Market Review

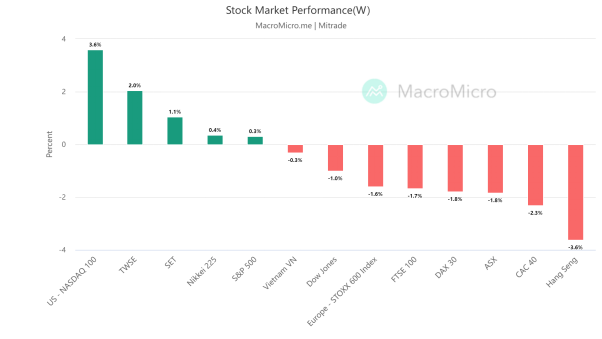

Last week, the US stock market showed mixed performance with the NASDAQ 100 index rising 3.6%, the S&P 500 index rising 0.3%, and the Dow Jones Industrial Average falling 1.0%. In Europe, the STOXX 600 index fell 1.6% in the stock market.

【Source:MacroMicro 2023/5/22-2023/5/26】

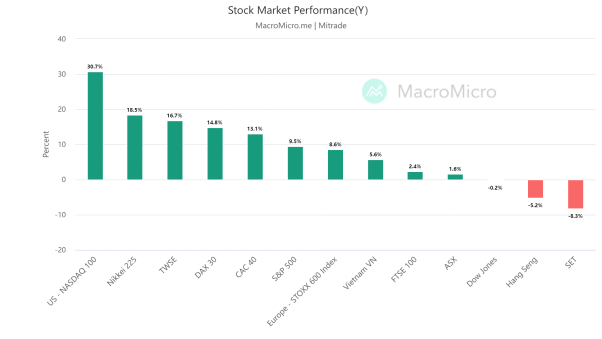

【Source:MacroMicro 2023/1/1-2023/5/26】

1. Persistent High Inflation, Rising Expectations of Interest Rate Hike

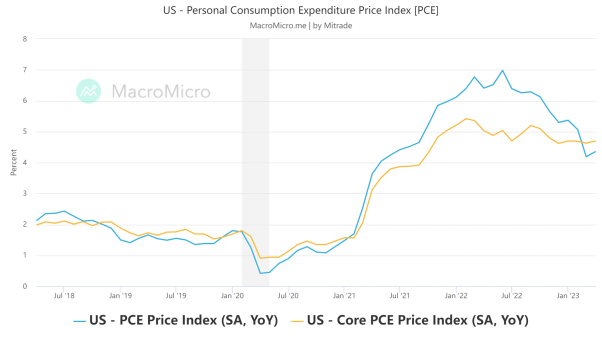

On May 26th, according to data from the U.S. Department of Commerce, the U.S. Personal Consumption Expenditures (PCE) Price Index for April showed a year-on-year increase of 4.4%, surpassing the expected value of 4.3%. The core PCE Price Index, which excludes food and energy, also saw a year-on-year growth of 4.7%, exceeding the forecasted 4.6%. On a month-on-month basis, it rose by 0.4%, once again surpassing the expected value of 0.3%. This growth rate represents a new high since January 2023.

【Source:MacroMicro 】

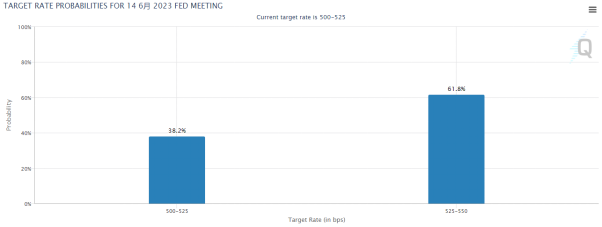

The persistent high inflation has fueled an increase in expectations for interest rate hikes. Currently, the market predicts that there is a probability of over 60% for the Federal Reserve to raise interest rates in June. This represents a significant increase of 40% compared to the previous week.

【Source:CME Fedwatch】

The labor market is a key factor considered by the Federal Reserve, and this Friday the US will release the nonfarm payroll data for May. The market is anticipating an addition of 188,000 jobs in May, which is lower than the 253,000 jobs added in the previous month.

Mitrade Analyst:

Recent data suggests that inflation in the United States remains stubborn, and there is a key focus on whether the nonfarm payroll data this Friday will show a cooling as expected. If the nonfarm data exceeds expectations once again, it will further reinforce the market's anticipation of a rate hike in June.

2. Principle Agreement Reached on US Debt, Focus on Wednesday's Voting

The countdown begins for the US debt ceiling negotiations. On the evening of May 27th, local time, US President Biden and Republican Congressional leader McCarthy reached a preliminary agreement on raising the federal government's debt ceiling of $31.4 trillion. McCarthy stated that it will be submitted for a vote in both the Senate and the House on Wednesday.

It is worth noting that the "X-date" has been postponed, and US Treasury Secretary Yellen stated that the new X-date is June 5th.

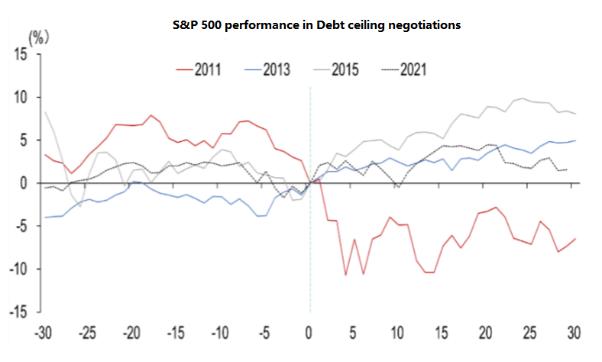

The current negotiation process aligns with the general market expectations, and although there have been twists and turns, it is expected that the two parties will ultimately reach an agreement to avoid a substantial default. However, market volatility still needs to be monitored as the S&P downgraded its rating in 2011 even after an agreement was reached, causing market tremors.

【Source:Bloomberg】

Mitrade Analyst:

The market performance has already anticipated the outcome of reaching the debt ceiling, so it is crucial to pay more attention to the potential adverse effects rather than the positive ones.

3. AI Helps Nasdaq Index Soar, Can the Trend Continue?

Last week, NVIDIA released better-than-expected financial results, causing its stock to surge more than 20% in a single day and reigniting the AI frenzy. The Nasdaq 100 index recorded a weekly gain of 3.6%, reaching a nine-month high.

【Source:TradingView】

Since the beginning of this year, technology giants like Microsoft, Google and NVIDIA have seen significant gains due to the booming AI sector, driving the Nasdaq 100 index up by over 30%. However, even considering the potential growth of AI, the current valuation of the Nasdaq 100 index remains excessively expensive.

According to Bloomberg data, the price-to-earnings ratio of the Nasdaq 100 index has reached 30 times, exceeding more than 85% of its historical valuation.

Mitrade Analyst:

The current fundamentals of technology companies may not justify such high valuations. In the early stages, the contribution of AI to company revenues is relatively small, and the market has overpriced future growth expectations. Considering that the US interest rate cycle has not yet ended, the risks at this level outweigh the opportunities.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.